Georgia Demand for Collateral by Creditor

Description

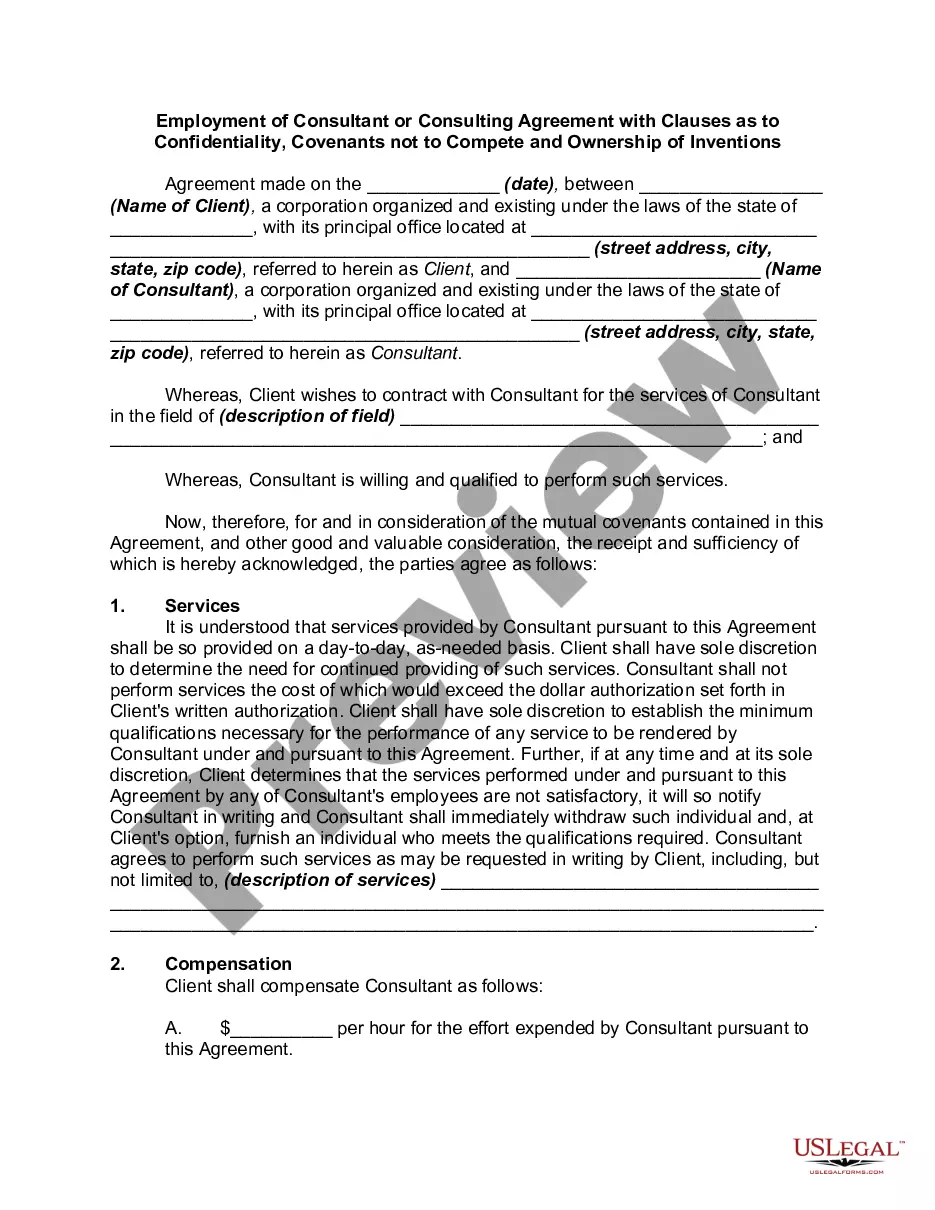

How to fill out Demand For Collateral By Creditor?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a vast selection of legal document templates that you can download or create.

By using the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Georgia Demand for Collateral by Creditor in a matter of minutes.

If you already possess a subscription, Log In and obtain the Georgia Demand for Collateral by Creditor from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms within the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form onto your device. Edit. Fill out, revise and print and sign the downloaded Georgia Demand for Collateral by Creditor. Each template you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply access the My documents section and click on the form you require. Access the Georgia Demand for Collateral by Creditor with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs.

- Ensure you have chosen the correct form for your city/county.

- Click the Preview button to review the content of the form.

- Check the form description to confirm you have selected the right form.

- If the form does not meet your requirements, use the Search section at the top of the screen to find one that does.

- If you are satisfied with the form, validate your choice by clicking the Buy Now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Secured creditors possess several rights, including the right to repossess collateral upon default. This repossession can happen without court intervention, provided the process follows legal routes set by local laws. Understanding these rights is vital during a Georgia Demand for Collateral by Creditor, as it forms the basis of debt collection. Moreover, these rights enable creditors to secure their financial interests effectively.

One critical requirement for a creditor to have an enforceable security interest is the execution of a security agreement. This agreement must clearly define the collateral and be signed by the debtor to confirm their acknowledgment. In a Georgia Demand for Collateral by Creditor, having this crucial documentation is instrumental. It serves as protection for the creditor's interests throughout the process.

To maintain an enforceable security interest, you need a security agreement, the debtor’s rights in the collateral, and the creditor's interest must be attached. These elements ensure the creditor has a legal claim on the specified collateral. For those dealing with a Georgia Demand for Collateral by Creditor, understanding these requirements is fundamental to safeguarding your investment. An optimized approach ensures compliance with state regulations.

A right granted to a creditor for securing a debt is the ability to claim collateral if the debtor defaults. This right is established through a security interest that specifies what property can be taken to satisfy the obligation. In the realm of Georgia Demand for Collateral by Creditor, this right plays a pivotal role in debt recovery. A well-crafted security agreement bolsters these rights.

To enforce a security interest, a creditor must follow specific legal procedures that often involve notifying the debtor of default and taking possession of the collateral. In Georgia, the creditor should also consider filing a financing statement to perfect the security interest. Using a Georgia Demand for Collateral by Creditor can guide you through this enforcement process. Legal assistance may also help expedite this phase.

A debtor has rights in collateral through ownership or an agreement with the creditor. This ownership entitles the debtor to use the collateral unless specified otherwise in the security agreement. Understanding these rights is vital during a Georgia Demand for Collateral by Creditor, as it affects the overall ability to repay the debt. Clear communication between the debtor and creditor can prevent disputes.

To create a valid security interest, the creditor must have a security agreement, the collateral must be identifiable, and the debtor must have rights to the collateral. This process is crucial for ensuring enforceability under a Georgia Demand for Collateral by Creditor. Additionally, proper attachment of the interest enhances the creditor's position. Each step must be compliant with state laws to ensure the interest is valid.

A valid security agreement gives the creditor enforceability over the collateral. This agreement must describe the collateral and be signed by the debtor. In the context of a Georgia Demand for Collateral by Creditor, clarity and documentation are essential. When properly executed, this agreement serves as a foundation for the creditor's claims.

The first to file or perfect rule is a legal principle that dictates priority among creditors regarding perfected security interests. Essentially, this rule states that the first creditor to file a lien or perfect a security interest will have the highest claim to the collateral in the event of a default. For those involved in a Georgia Demand for Collateral by Creditor, understanding this rule is vital to protect your rights. Ensuring timely filing can enhance your ability to recover owed debts efficiently.

The process by which a security interest in the collateral becomes enforceable typically involves attachment and perfection. Attachment occurs when the security agreement is executed, and the debtor receives value. Perfection, on the other hand, often involves filing the appropriate documentation to publicly declare the creditor's interest in the collateral. In Georgia, adhering to these processes is critical when issuing a demand for collateral by creditor, as it ensures stronger legal rights.