Georgia Deferred Compensation Agreement - Short Form

Description

How to fill out Deferred Compensation Agreement - Short Form?

If you need to finish, download, or print legitimate document templates, utilize US Legal Forms, the most significant selection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to locate the documents you require.

Different templates for business and personal purposes are categorized by types and states, or keywords.

Every legal document template you purchase is your own forever. You have access to every form you saved in your account. Select the My documents section and choose a form to print or download again.

Complete and download, and print the Georgia Deferred Compensation Agreement - Short Form with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the Georgia Deferred Compensation Agreement - Short Form with just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Acquire button to find the Georgia Deferred Compensation Agreement - Short Form.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

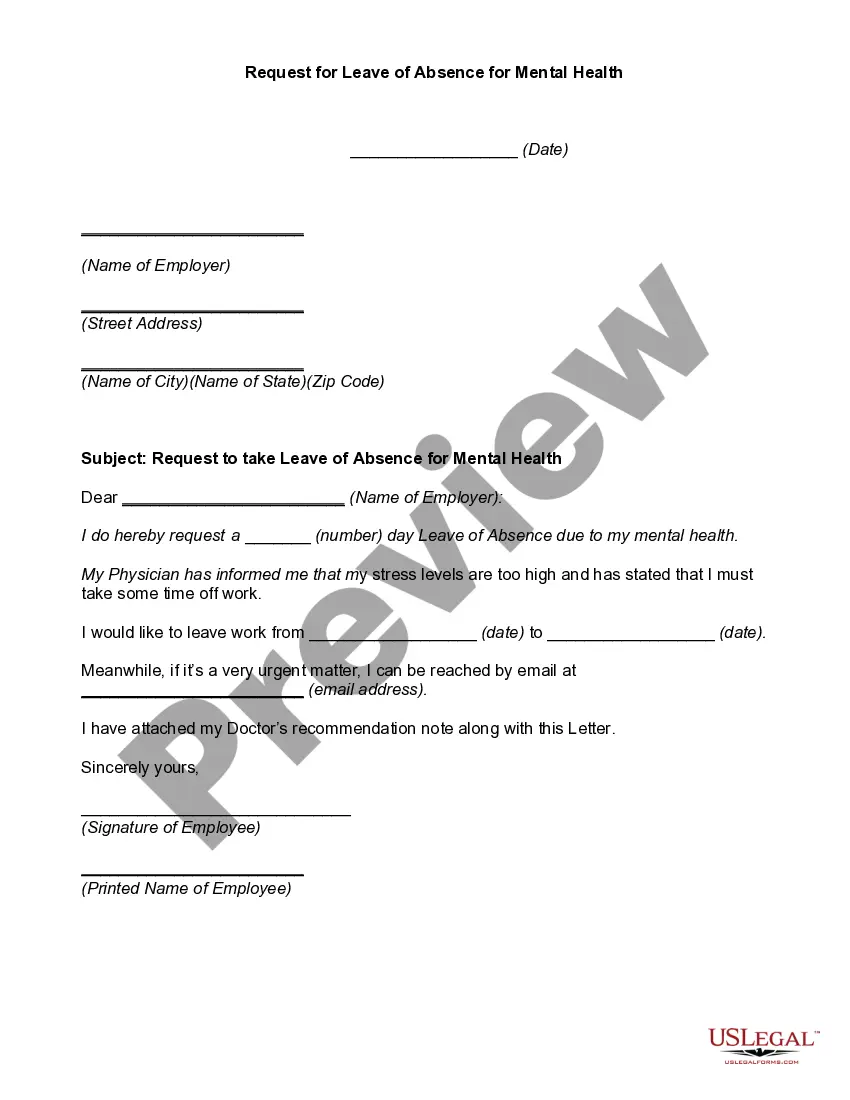

- Step 2. Use the Preview option to review the form's contents. Make sure to review the details.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Acquire now button. Select the pricing plan you prefer and provide your details to sign up for the account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Georgia Deferred Compensation Agreement - Short Form.

Form popularity

FAQ

A Georgia Deferred Compensation Agreement - Short Form can impact your future Social Security benefits in specific ways. While contributions to a deferred compensation plan are generally not included in your Social Security earnings, the total amount you receive during retirement could still influence your benefits. Careful planning is essential to understand how these elements intersect, so consider consulting with a financial advisor for personalized guidance.

A Georgia Deferred Compensation Agreement - Short Form can be beneficial for employees looking to save for retirement while enjoying tax deferrals. Key beneficiaries include high-income earners who wish to reduce their current taxable income. Employers also gain advantages by offering these plans as part of their benefits package, helping attract and retain talent. It creates a win-win situation for both parties.

The downside of a Georgia Deferred Compensation Agreement - Short Form can include potential tax implications. If you choose to withdraw funds earlier than planned, you may face penalties or higher tax rates. Moreover, as these plans are often tied to your employer, changes in your job situation could impact your benefits. Understanding these risks will help you make informed decisions.

Setting up a Georgia Deferred Compensation Agreement - Short Form involves several straightforward steps. First, consult with a financial advisor or tax professional to understand your unique needs. Then, you can use platforms like USLegalForms to generate the necessary agreements and documentation swiftly. It’s crucial to ensure your plan complies with IRS regulations.

While a Georgia Deferred Compensation Agreement - Short Form can offer significant tax advantages, it also has some disadvantages. One main concern is that funds in these plans are typically not accessible until retirement, which limits your liquidity. Additionally, if your employer becomes insolvent, your deferred compensation may be at risk. It’s important to weigh these factors carefully.

Georgia Form 500 NOL is used to report net operating losses (NOL) that can be carried back or forward to offset future taxable income. This form is particularly useful for individuals or businesses who have incurred losses that can benefit their tax situation. Filing Form 500 NOL properly can lead to potential refunds or reductions in future tax liabilities. If you’re involved in any deferred compensation agreements, understanding its implications for your NOL can enhance your financial strategy.

Reporting deferred compensation involves including it in your taxable income on your state tax return when you receive it. If you're part of a Georgia Deferred Compensation Agreement - Short Form, you should carefully document any deferred income as it directly impacts your tax situation. Keeping clear records and understanding when and how to report this compensation ensures that you meet tax obligations without surprises.

Georgia Form 600S, which is meant for S Corporations, should be filed with the Georgia Department of Revenue. You can submit this form electronically or mail it to the appropriate address as specified in the filing instructions. Filing accurately and on time is crucial to avoid penalties. If you’re managing deferred compensation, integrating this with your Form 600S submission can streamline your tax responsibilities.

Receiving a $500 check from Georgia typically relates to tax refunds or specific stimulus initiatives. This amount may be part of an effort to support residents through tax rebates or direct payments. Check your tax filing status to see if your eligibility is linked to any deductions or credits claimed, including those tied to a Georgia Deferred Compensation Agreement - Short Form. Understanding your tax filings can provide clarity on these refunds.

The Georgia Schedule 3 form is used to report certain types of income, adjustments, and credits when filing your state tax return. This form captures details about various sources of income, such as royalties, dividends, or other unique taxable situations. Understanding how Georgia Schedule 3 works is essential for accurately reporting your earnings and avoiding tax issues later. Utilize a Georgia Deferred Compensation Agreement - Short Form to ensure you correctly document all relevant income.