This agreement allows one lien holder to subordinate its deed of trust to the lien of another lien holder. For valuable consideration, a particular deed of trust will at all times be prior and superior to the subordinate lien.

Georgia Subordination Agreement of Deed of Trust

Description

How to fill out Subordination Agreement Of Deed Of Trust?

Have you been inside a position in which you require paperwork for sometimes company or individual purposes virtually every working day? There are tons of legitimate document layouts accessible on the Internet, but getting ones you can trust isn`t effortless. US Legal Forms provides 1000s of type layouts, like the Georgia Subordination Agreement of Deed of Trust, which are composed in order to meet federal and state needs.

If you are presently informed about US Legal Forms internet site and also have an account, merely log in. After that, you may acquire the Georgia Subordination Agreement of Deed of Trust web template.

If you do not come with an bank account and would like to start using US Legal Forms, abide by these steps:

- Discover the type you want and make sure it is to the right metropolis/county.

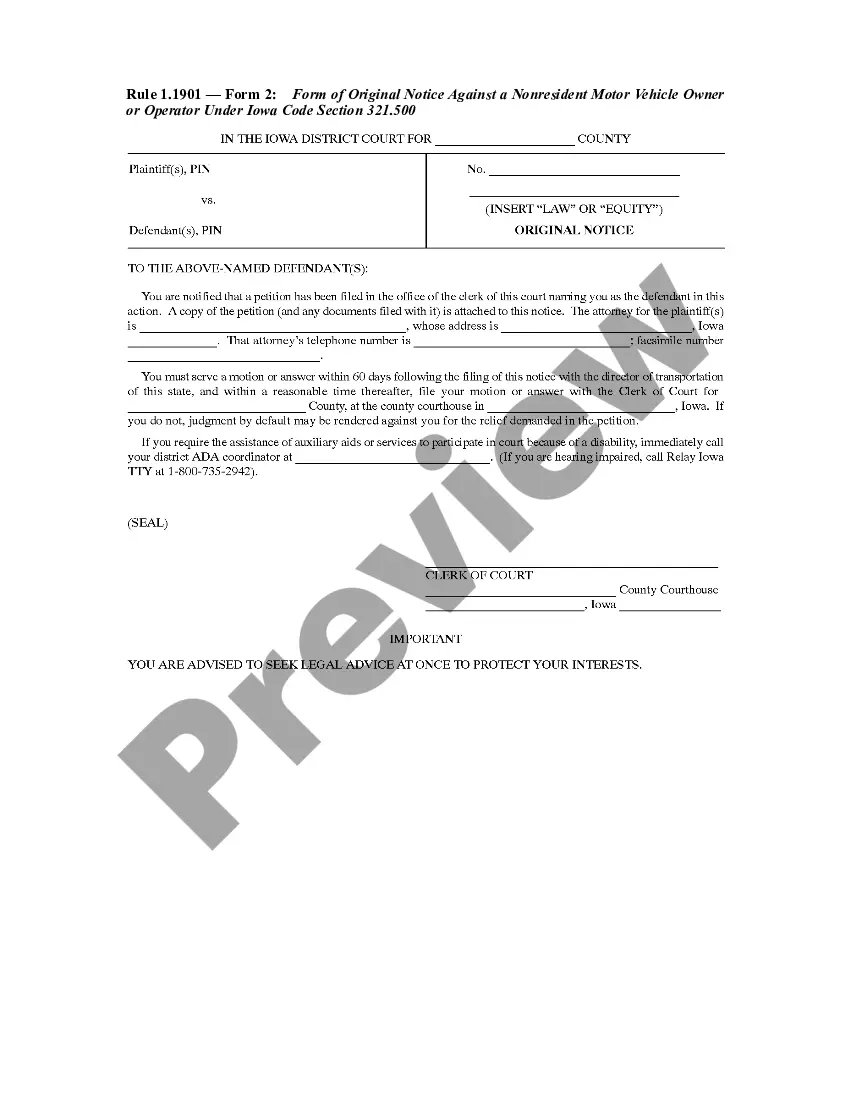

- Utilize the Preview option to check the shape.

- Look at the description to actually have selected the appropriate type.

- In case the type isn`t what you are trying to find, take advantage of the Search field to discover the type that suits you and needs.

- When you obtain the right type, just click Get now.

- Select the pricing plan you need, submit the specified details to create your account, and pay money for your order making use of your PayPal or credit card.

- Decide on a handy paper format and acquire your copy.

Find all the document layouts you may have purchased in the My Forms food selection. You can aquire a further copy of Georgia Subordination Agreement of Deed of Trust any time, if required. Just click the required type to acquire or produce the document web template.

Use US Legal Forms, probably the most considerable variety of legitimate forms, in order to save time as well as prevent faults. The assistance provides skillfully made legitimate document layouts that can be used for a range of purposes. Produce an account on US Legal Forms and start making your way of life easier.

Form popularity

FAQ

Subordination agreements are used to legally establish the order in which debts are to be repaid in the event of a foreclosure or bankruptcy. In return for the agreement, the lender with the subordinated debt will be compensated in some manner for the additional risk.

Who Benefits from a Subordination Clause? A subordination clause is meant to protect the interests of the primary lender. A primary mortgage usually covers the cost of purchasing the home; however, if there is a secondary mortgage, the clause ensures that the primary lender retains the number one priority.

Understanding Subordination Clauses A subordination clause serves to protect the lender if a homeowner defaults. If this happens, the lender then has the legal standing to repossess the home and cover their loan's outstanding balance first.

The trustor. The borrower (trustor) benefits the most from a subordination clause since this makes it easier to obtain an additional loan on their property.

TL;DR: A subordination clause is a provision in a contract that prioritizes the repayment of liens on a title. Some lenders will use the subordination clause to ensure that they will have top priority when the borrower is making payments.

Subordinate Deed of Trust means the deeds of trust granted by Borrower to secure the obligation of Borrower to repay the Subordinate Loan.

A security deed (deed to secure debt) is the customary security instrument in Georgia. Georgia does not use a Deed of Trust. Two witnesses are required to witness the signature of the grantor for a security deed to be recorded.

A subordination clause is a clause in an agreement that states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future.