Georgia State Garnishment on a Financial Institution Form Package

Description

How to fill out Georgia State Garnishment On A Financial Institution Form Package?

If you’re seeking a method to effectively finish the Georgia State Garnishment on a Financial Institution Form Package without engaging a legal expert, then you’re exactly in the ideal location.

US Legal Forms has demonstrated itself as the most comprehensive and trustworthy library of official templates for every personal and business circumstance. Every document you discover on our web service is crafted in accordance with national and state regulations, so you can rest assured that your paperwork is in proper order.

Another fantastic feature of US Legal Forms is that you never misplace the documentation you obtained - you can access any of your downloaded forms in the My documents section of your profile whenever you require it.

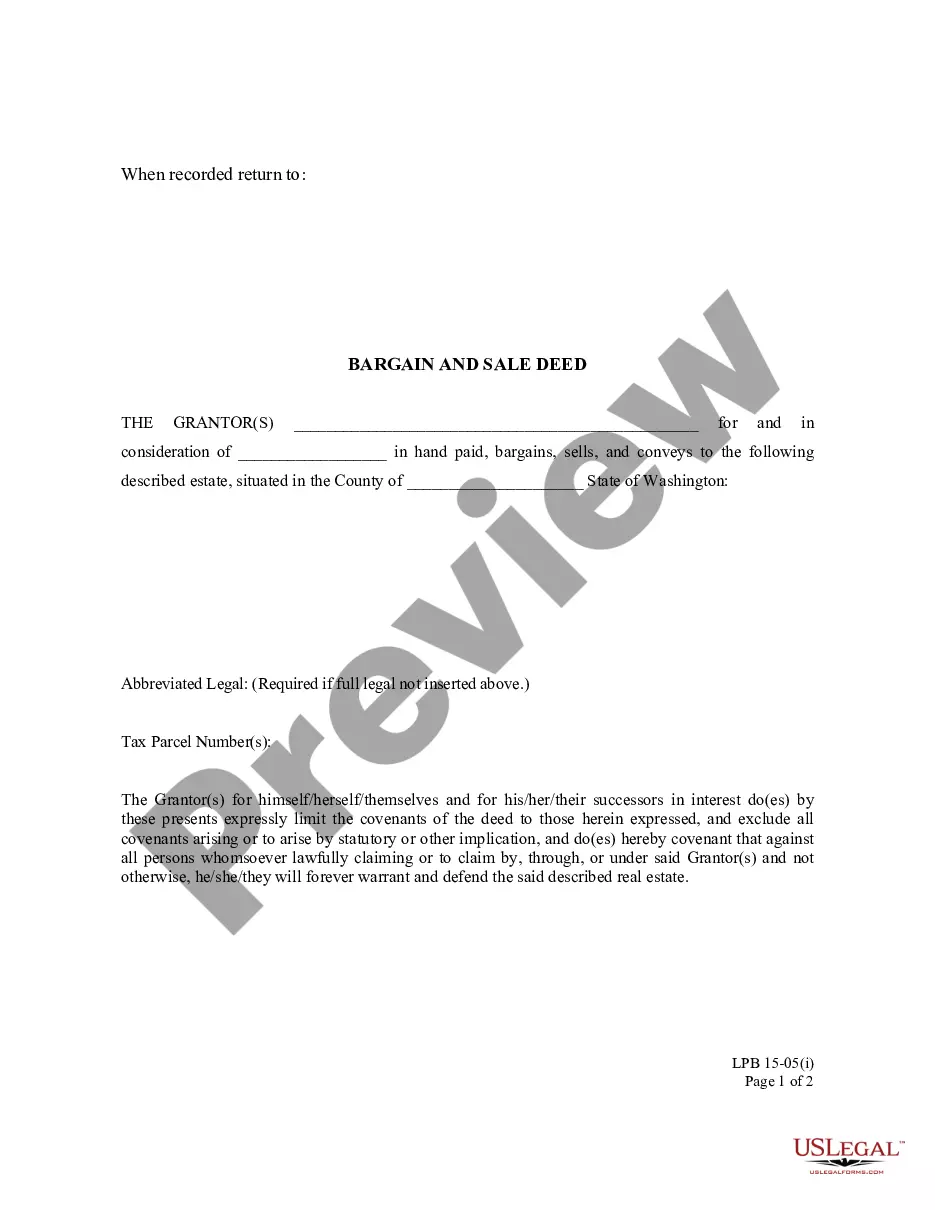

- Verify that the document visible on the page aligns with your legal needs and state regulations by reviewing its textual description or checking the Preview mode.

- Enter the form title in the Search tab at the top of the page and select your state from the dropdown menu to find an alternative template in case of any discrepancies.

- Repeat the content verification and click Buy now when you are confident about the documentation’s compliance with all the stipulations.

- Log in to your account and click Download. Create an account with the service and select the subscription plan if you do not have one yet.

- Utilize your credit card or the PayPal method to purchase your US Legal Forms subscription. The blank will be accessible for download immediately afterward.

- Choose the format in which you want to save your Georgia State Garnishment on a Financial Institution Form Package and download it by clicking the corresponding button.

- Import your template to an online editor to swiftly fill out and sign it, or print it out to prepare your physical copy manually.

Form popularity

FAQ

To garnish a bank account in Georgia, start by obtaining the Georgia State Garnishment on a Financial Institution Form Package. This package provides the necessary legal documents to initiate the garnishment process against the debtor's account. After completing the forms, file them with the appropriate court, ensuring that you adhere to all legal requirements. Finally, serve the garnishment order on the bank where the debtor holds their account.

In Georgia, the maximum amount that can be garnished from your paycheck is generally 25% of your disposable income or the amount by which your earnings exceed 30 times the federal minimum wage. This rule ensures that you retain enough income for basic living expenses. It's important to consider how the Georgia State Garnishment on a Financial Institution Form Package helps clarify these limits for both creditors and debtors.

No, employers are legally obligated to comply with wage garnishment orders issued by the court. Ignoring these orders can result in penalties for the employer, including fines. Therefore, understanding the implications of the Georgia State Garnishment on a Financial Institution Form Package is vital for both employees and employers alike.

Georgia has specific laws governing wage garnishment, which protect both creditors and debtors. Under state law, creditors can garnish a portion of wages, typically up to 25% of disposable income. Staying informed about these regulations can help you navigate the Georgia State Garnishment on a Financial Institution Form Package effectively.

After a default judgment, wages can typically be garnished as soon as the court issues a garnishment order. This often happens within a few weeks, provided the creditor has followed proper legal procedures. It's crucial to understand that the Georgia State Garnishment on a Financial Institution Form Package is applied to manage this process efficiently.

A garnishment application is a formal request submitted to the court, asking for permission to garnish a debtor's wages or bank account. Following approval, the court issues a garnishment order, legally permitting the creditor to collect the owed amount. The Georgia State Garnishment on a Financial Institution Form Package simplifies this process, guiding you through the necessary steps. Understanding these documents can help you navigate financial challenges.

In Georgia, the law limits the amount a creditor can garnish from your paycheck. Typically, creditors can garnish 25% of your disposable earnings or the amount by which your earnings exceed 30 times the federal minimum wage. The Georgia State Garnishment on a Financial Institution Form Package details these limits for your reference. Being informed helps you manage your paycheck effectively.

In Georgia, specific exemptions can protect your wages from garnishment. Generally, up to 75% of your disposable earnings may be exempt, while federal benefits are often protected. Understanding the Georgia State Garnishment on a Financial Institution Form Package can help you identify available exemptions. This knowledge is vital for managing your finances during legal proceedings.

Certain types of income are exempt from garnishment in Georgia. For instance, Social Security benefits, veterans' benefits, and some types of retirement income may not be garnished. The Georgia State Garnishment on a Financial Institution Form Package can provide clarity on what qualifies as exempt income. Knowing your rights can help you protect your finances.

A writ of garnishment is typically served by delivering it to your employer or financial institution. The Georgia State Garnishment on a Financial Institution Form Package outlines the process for correctly serving such documents. Once served, your employer or bank will need to comply with the court order. Proper service is crucial, as it ensures the garnishment is legally valid.