Georgia Security Deed

Description

Definition and meaning

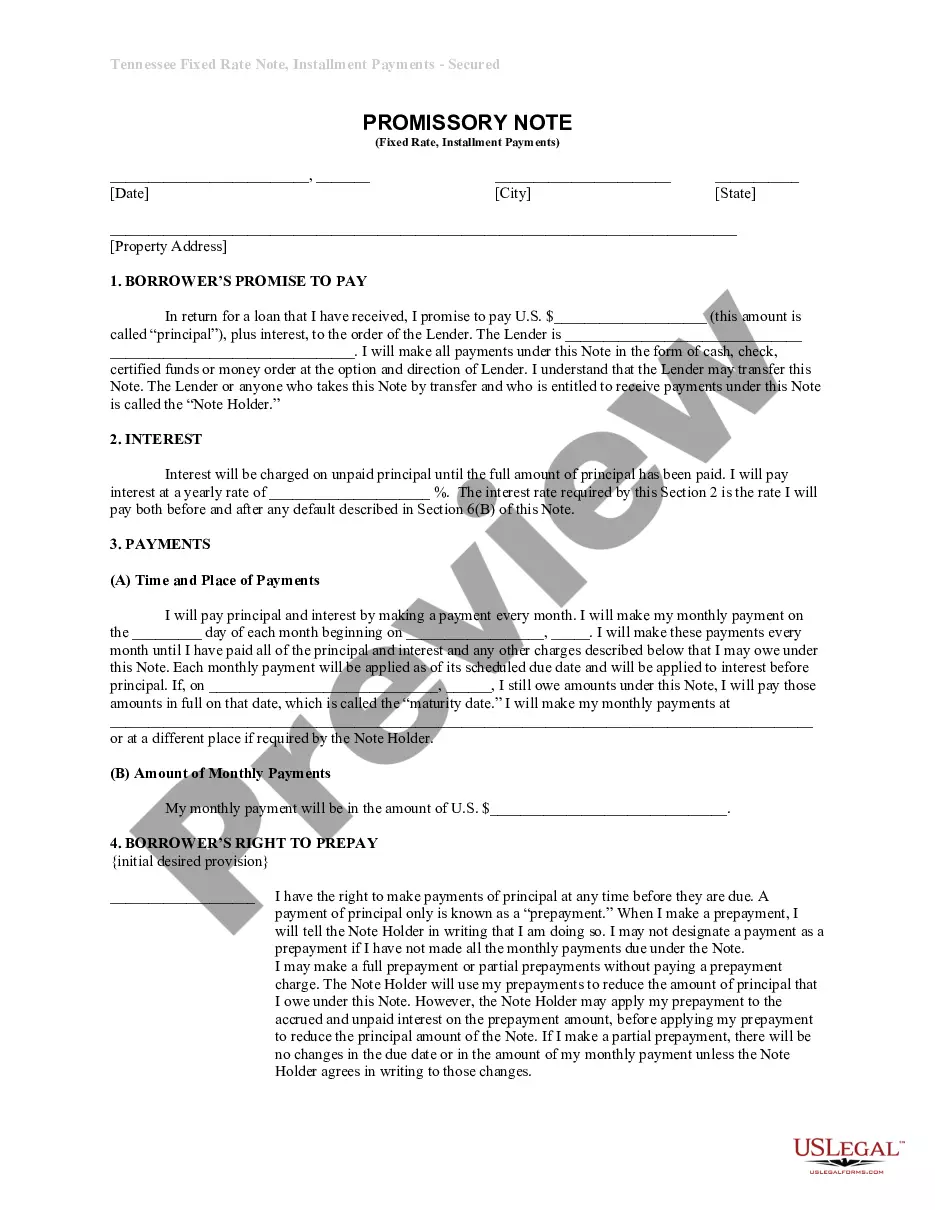

A Georgia Security Deed is a legal document that secures a loan by conveying title to property to a lender. It functions as both the borrowing agreement and the security interest, allowing lenders to hold the title to the property until the borrower repays the loan or fulfills the obligations stipulated within the deed. This document is primarily utilized in real estate transactions and ensures that the lender has a claim to the property should the borrower default on the payment.

How to complete a form

To successfully complete the Georgia Security Deed form, follow these steps:

- Provide the date of the security deed.

- Fill in the names of the borrower and lender, including their addresses.

- Describe the property in detail, including the parcel identification number.

- List any additional riders that apply to the deed, such as adjustable-rate or balloon rider.

- Sign and date the document in the presence of a notary public.

Ensure all sections are filled accurately to avoid future legal complications.

Who should use this form

The Georgia Security Deed form is primarily intended for homeowners and real estate buyers who are securing a mortgage or loan against their property. It is also applicable for lenders who wish to formalize their security interest in a property to safeguard against default. This form is essential for both parties to establish clear terms of the loan agreement in compliance with Georgia state law.

Key components of the form

The Georgia Security Deed includes several key components that are essential for its validity:

- Borrower Information: Name and contact details of the borrower.

- Lender Information: Name and contact details of the lender.

- Property Description: Detailed description, including the parcel identification number.

- Loan Details: Amount owed, interest rate, and payment terms.

- Riders: Additional provisions such as adjustable rate or balloon payment options.

These components ensure that both parties understand their rights and obligations under the agreement.

Legal use and context

The Georgia Security Deed serves a critical function in the context of property financing. It is governed by Georgia law and is used primarily in residential financing transactions. This document not only provides the legal framework for securing a mortgage but also facilitates the lender's right to foreclose on the property in case of default, thus protecting the lender’s financial interest.

State-specific requirements

When utilizing the Georgia Security Deed, it is crucial to adhere to state-specific requirements:

- The deed must be signed by the borrower in the presence of a notary.

- It must be recorded in the county where the property is located to be enforceable against third parties.

- Specific disclosures relating to fees, costs, and responsibilities must be provided in accordance with Georgia law.

Failure to comply with these requirements may affect the deed's validity and the enforceability of the loan.

How to fill out Georgia Security Deed?

Gain entry to one of the most comprehensive collections of authorized documents.

US Legal Forms serves as a platform where you can locate any state-specific form in just a few clicks, including Georgia Security Deed examples.

No need to waste time searching for a court-admissible document.

That's it! You need to complete the Georgia Security Deed template and verify it. To ensure everything is precise, consult with your local legal advisor for assistance. Join and effortlessly explore over 85,000 useful templates.

- To utilize the document library, select a subscription and create an account.

- Once completed, simply Log In and hit Download.

- The Georgia Security Deed document will promptly be saved in the My documents tab (a section for all forms you download from US Legal Forms).

- To establish a new account, adhere to the short instructions below.

- If you are going to use a state-specific template, ensure you select the correct state.

- If possible, review the description to grasp all intricacies of the form.

- Utilize the Preview feature if it’s available to examine the document's details.

- If everything appears accurate, click on the Buy Now button.

- After selecting a pricing option, create an account.

- Pay using a credit card or PayPal.

- Download the template to your device by clicking on the Download button.

Form popularity

FAQ

To file a deed in Georgia, you must prepare the document in accordance with state requirements, which include proper identification and legal descriptions for the property. Once completed, you can submit the deed to the county's clerk of court for recording. Filing a deed ensures that the ownership of the property is officially recognized and serves as a public record. For assistance, consider using the US Legal Forms platform to access the required forms and guidance.

A security deed in Georgia serves as a legal instrument between a borrower and a lender, granting the lender a security interest in the property. This deed allows the lender to take possession of the property if the borrower defaults on their payment. Essentially, it protects the lender's investment and simplifies the process of recovery in case of a breach. Understanding the ins and outs of a Georgia Security Deed can help you manage your property rights effectively.

To obtain a copy of a deed in Georgia, you can visit your local county clerk's office or their website, where many records are digitized. Additionally, you can utilize online services provided by platforms like uslegalforms, which streamline the process of accessing important legal documents, including Georgia Security Deeds.

Georgia law provides that a security deed can be cancelled by the Clerk of Superior Court upon receipt of an affidavit from an attorney with specified attachments. To find a lawyer, you may visit the State Bar of Georgia website at www.gabar.org/membership/membersearch.cfm.

In Georgia, can a security interest in real estate expire? Yes. A security interest in real estate expires (in other words, become unenforceable) seven years after expiration of the maturity of the debt.

Let's start with the definition of a deed: DEED: A written instrument by which one party, the Grantor, conveys the title of ownership in property to another party, the Grantee. A Warranty Deed contains promises, called covenants, that the Grantor makes to the Grantee.

Most people utilize a mortgage loan to finance the purchase.When the transfer is complete, the seller must sign a warranty deed and the buyer signs a type of security instrument with intent to repay the loan. The state of Georgia calls this instrument a security deed, while others call it a mortgage or deed of trust.

Contrastingly, a Security Deed or mortgage only involves two parties, the borrower and the lender.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating