Florida Form of Anti-Money Laundering Policy

Description

How to fill out Form Of Anti-Money Laundering Policy?

If you wish to complete, obtain, or print out legitimate document web templates, use US Legal Forms, the most important selection of legitimate kinds, which can be found on the web. Make use of the site`s basic and hassle-free lookup to obtain the paperwork you will need. Different web templates for company and specific reasons are categorized by types and states, or keywords and phrases. Use US Legal Forms to obtain the Florida Form of Anti-Money Laundering Policy with a couple of click throughs.

In case you are presently a US Legal Forms customer, log in in your bank account and click on the Down load button to obtain the Florida Form of Anti-Money Laundering Policy. You may also entry kinds you formerly acquired in the My Forms tab of your bank account.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have selected the form to the proper area/region.

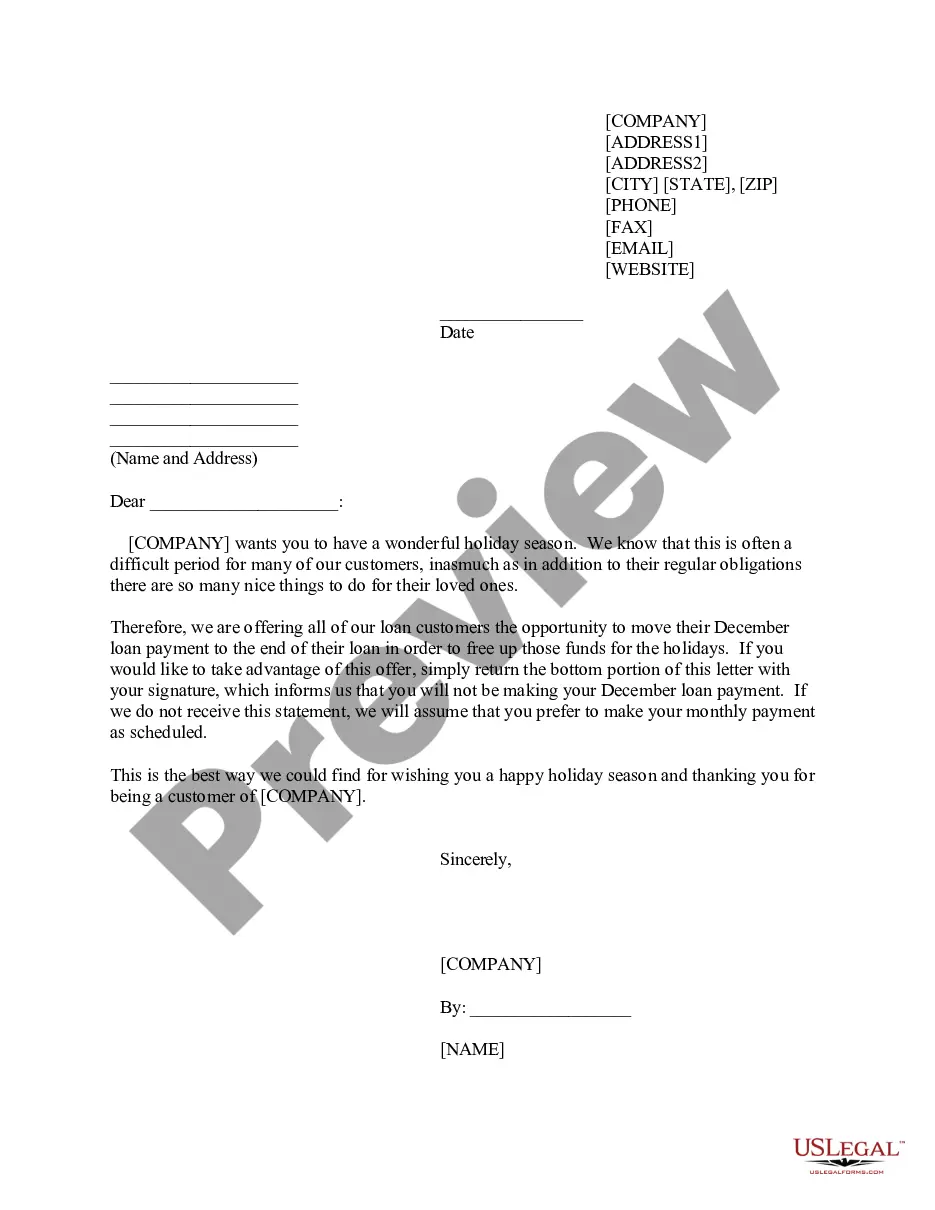

- Step 2. Use the Review choice to examine the form`s articles. Do not overlook to see the description.

- Step 3. In case you are not satisfied using the type, take advantage of the Research discipline on top of the screen to find other models of the legitimate type format.

- Step 4. Upon having discovered the form you will need, click on the Purchase now button. Pick the costs program you choose and include your credentials to register to have an bank account.

- Step 5. Procedure the financial transaction. You can utilize your bank card or PayPal bank account to finish the financial transaction.

- Step 6. Choose the formatting of the legitimate type and obtain it in your device.

- Step 7. Comprehensive, modify and print out or signal the Florida Form of Anti-Money Laundering Policy.

Every legitimate document format you buy is your own eternally. You may have acces to each type you acquired with your acccount. Click the My Forms segment and select a type to print out or obtain yet again.

Compete and obtain, and print out the Florida Form of Anti-Money Laundering Policy with US Legal Forms. There are millions of expert and status-certain kinds you may use for your company or specific needs.

Form popularity

FAQ

AML policies are designed to set a general structure of company systems and controls for combating money laundering (ML) and terrorist financing (TF). It should determine AML risk appetite, tolerances, unacceptable customer types, forbidden actions, employee responsibilities, employee rights, qualification levels, etc.

Anti-Money Laundering Form (RIGHT TO BUY)

An anti-money laundering (AML) compliance program helps businesses, including traditional financial institutions?as well as those entities identified in government regulations, such as money-service businesses and insurance companies?uncover suspicious activity associated with criminal acts, including money laundering ...

As provided in the Florida Money Laundering Act found in Section 896.101, the crime of money laundering penalizes individuals or organizations using financial transactions to hide the proceeds of unlawful activities conducted in the state of Florida.

In Simple Terms, What is Anti-Money Laundering? In the most general sense, Anti-Money Laundering (AML) refers to the collection of laws, processes, and regulations that prevent illegally obtained money from entering the financial system.

Anti-money-laundering (AML) policies and procedures exist to help financial institutions combat money laundering by stopping criminals from engaging in transactions to disguise the origins of funds connected to illegal activity.

Firms must comply with the Bank Secrecy Act and its implementing regulations ("AML rules"). The purpose of the AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing, such as securities fraud and market manipulation.

Anti-money laundering (AML) refers to legally recognized rules for preventing money laundering. Customer due diligence (CDD) refers to practices financial institutions implement to detect and report AML violations.