Florida Assignment and Conveyance of Overriding Royalty Interest

Description

How to fill out Assignment And Conveyance Of Overriding Royalty Interest?

Are you currently in the position that you need to have documents for sometimes business or specific purposes nearly every day time? There are a variety of authorized file layouts available on the net, but finding ones you can trust isn`t simple. US Legal Forms provides a large number of kind layouts, much like the Florida Assignment and Conveyance of Overriding Royalty Interest, that are composed to satisfy federal and state demands.

When you are previously acquainted with US Legal Forms internet site and possess your account, merely log in. Afterward, it is possible to obtain the Florida Assignment and Conveyance of Overriding Royalty Interest design.

If you do not come with an profile and would like to begin using US Legal Forms, adopt these measures:

- Discover the kind you want and ensure it is for that right area/region.

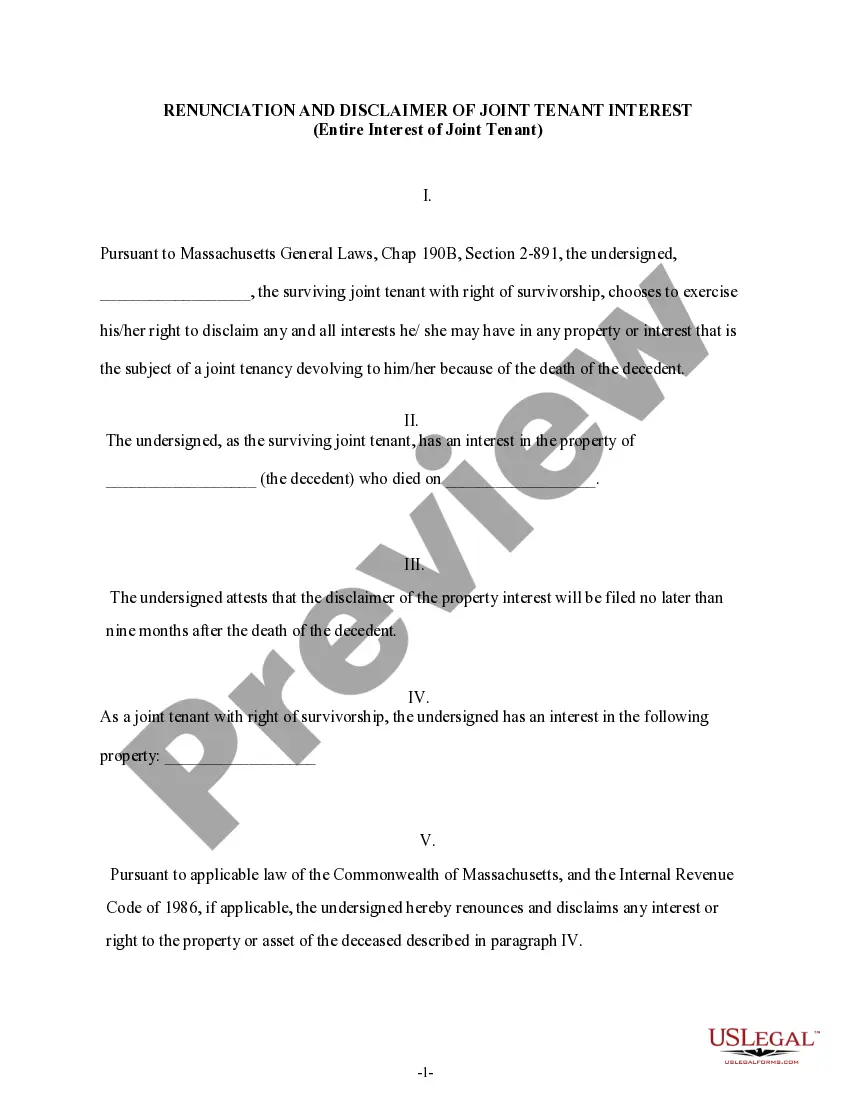

- Use the Review key to review the shape.

- Browse the description to ensure that you have selected the right kind.

- In case the kind isn`t what you are searching for, use the Look for area to discover the kind that suits you and demands.

- Whenever you find the right kind, just click Acquire now.

- Choose the prices program you would like, fill out the specified info to create your bank account, and purchase the order utilizing your PayPal or charge card.

- Pick a convenient data file file format and obtain your backup.

Locate every one of the file layouts you possess bought in the My Forms menus. You may get a extra backup of Florida Assignment and Conveyance of Overriding Royalty Interest anytime, if needed. Just select the needed kind to obtain or produce the file design.

Use US Legal Forms, the most comprehensive variety of authorized forms, to conserve some time and avoid errors. The services provides professionally made authorized file layouts which you can use for a selection of purposes. Create your account on US Legal Forms and initiate producing your way of life easier.

Form popularity

FAQ

If at any time Assignee desires to transfer or dispose of all or any portion of the Overriding Royalty Interest, Assignee must first give to Assignor written notice thereof stating: (a) the amount of the Overriding Royalty Interest offered by Assignee; (b) the form of consideration (which shall be either cash or a ...

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

There are three main types of royalty interests: Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...