Florida Payroll Specialist Agreement - Self-Employed Independent Contractor

Description

How to fill out Payroll Specialist Agreement - Self-Employed Independent Contractor?

You can spend time online searching for the legal template that meets the state and federal requirements you need.

US Legal Forms offers a vast collection of legal documents that have been reviewed by experts.

You can easily download or print the Florida Payroll Specialist Agreement - Self-Employed Independent Contractor from the platform.

First, ensure that you have selected the correct format for the county/city of your choice. Review the form description to confirm you have chosen the right document. If available, utilize the Preview button to view the template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you can complete, modify, print, or sign the Florida Payroll Specialist Agreement - Self-Employed Independent Contractor.

- Each legal template you obtain is yours indefinitely.

- To get another copy of any acquired document, visit the My documents section and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

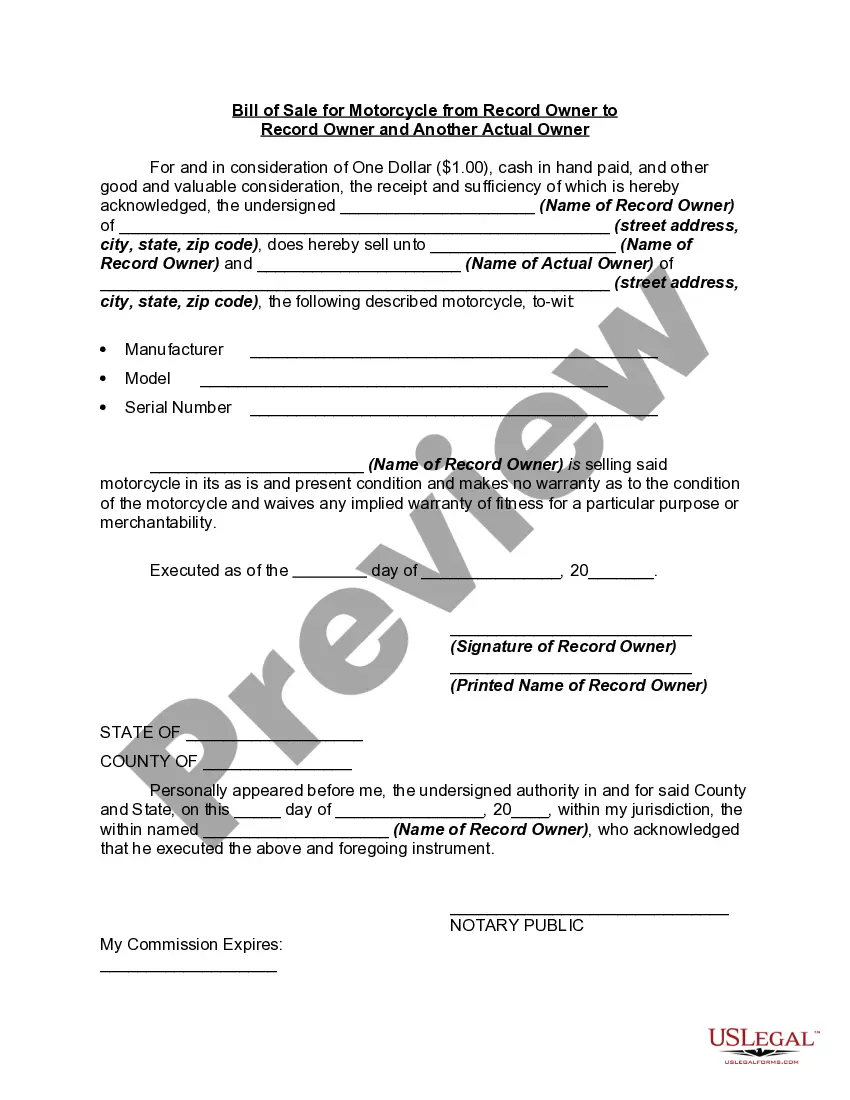

Independent contractors typically do not fall under traditional payroll processes. They usually receive payments through 1099 forms instead of regular payroll checks. However, some companies may hire independent contractors under a Florida Payroll Specialist Agreement - Self-Employed Independent Contractor to maintain clarity and ensure compliance with tax regulations. It's essential to understand the distinctions in your employment status to protect your rights.

Independent contractors must adhere to specific legal regulations to operate correctly. Generally, this involves having a written agreement, such as a Florida Payroll Specialist Agreement - Self-Employed Independent Contractor, which outlines the scope of work and payment terms. Additionally, independent contractors are responsible for managing their taxes and may need to meet local business licensing requirements, depending on their industry.

Choosing between payroll and a 1099 classification often depends on your individual circumstances. While being on payroll provides more job security and benefits, working as a 1099 contractor offers greater flexibility in how you manage your work and finances. If you are considering a Florida Payroll Specialist Agreement - Self-Employed Independent Contractor, weigh the pros and cons carefully to determine which option suits you best.

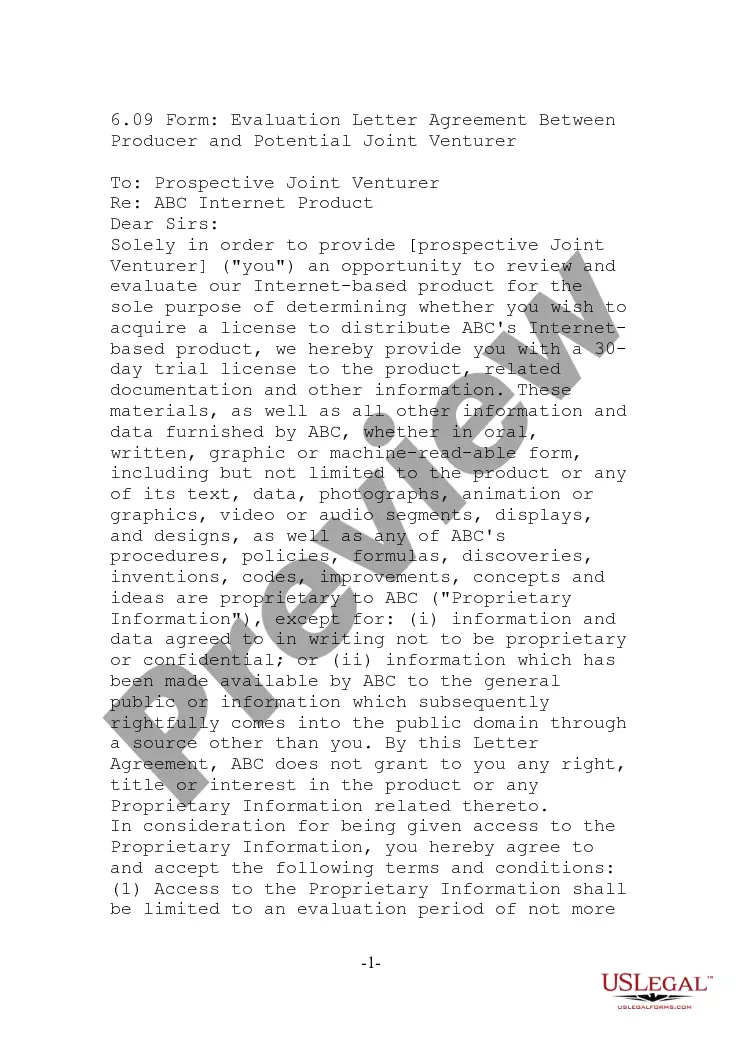

To write an independent contractor agreement, you should start by clearly defining the scope of work. Include details such as payment terms, deadlines, and the specific services required. Additionally, it is important to state the rights and obligations of both parties to avoid misunderstandings. You can find templates for a Florida Payroll Specialist Agreement - Self-Employed Independent Contractor on USLegalForms, which can simplify the process and ensure you meet all legal requirements.

Payroll for independent contractors differs from traditional employees. Payments to contractors are made based on their contract terms, with no tax withholdings required. Utilize the Florida Payroll Specialist Agreement - Self-Employed Independent Contractor to guide your payment processes. This helps ensure compliance and a clear understanding of the relationship between you and your contractors.

Filling out an independent contractor agreement is straightforward. First, clearly state the roles and responsibilities of both parties, including payment terms. Refer to the Florida Payroll Specialist Agreement - Self-Employed Independent Contractor for best practices and necessary clauses. Make sure both parties review and sign the document to formalize the agreement.

Managing payroll for independent contractors involves tracking payments and maintaining documentation. Simply calculate the payment based on the agreed rate in the Florida Payroll Specialist Agreement - Self-Employed Independent Contractor. It’s crucial to ensure you also keep records of each transaction for tax purposes. Consider using automated payroll solutions to streamline this process.

To set up payroll for 1099 employees, first, determine the payment structure. You need to track your independent contractors' work hours or project completion. Use a reliable payroll service or accounting software that can generate 1099 forms. This aligns with the Florida Payroll Specialist Agreement - Self-Employed Independent Contractor to ensure you meet all reporting requirements.

The independent contractor agreement in Florida is a legal document that defines the relationship between a contractor and a business. This agreement, like the Florida Payroll Specialist Agreement - Self-Employed Independent Contractor, sets the groundwork for service expectations, payment terms, and the scope of work. Having a solid agreement ensures compliance with state laws and protects the rights of both parties.

The basic independent contractor agreement outlines the terms of work, payment, and expectations between parties. It serves as a legal framework protecting both the contractor and the client, ensuring clarity in roles and responsibilities. A well-structured Florida Payroll Specialist Agreement - Self-Employed Independent Contractor typically includes compensation terms and project descriptions to avoid misunderstandings.