Florida Speech Pathologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Speech Pathologist Agreement - Self-Employed Independent Contractor?

If you need to finalize, obtain, or create legal document templates, utilize US Legal Forms, the top selection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to locate the documents you require.

Various templates for commercial and personal purposes are organized by categories and regions, or keywords.

Step 4. Once you have found the form you need, select the Get now button. Choose the payment plan that suits you and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Choose the format of the legal document and download it to your device. Step 7. Complete, edit, and print or sign the Florida Speech Pathologist Agreement - Self-Employed Independent Contractor. Every legal document template you acquire is yours indefinitely. You will have access to every form you saved in your account. Click the My documents section and select a form to print or download again. Stay competitive and obtain, and print the Florida Speech Pathologist Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal requirements.

- Use US Legal Forms to find the Florida Speech Pathologist Agreement - Self-Employed Independent Contractor in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Florida Speech Pathologist Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The new independent contractor law in Florida aims to clarify the relationship between workers and businesses. Essentially, it provides guidelines on how independent contractors, such as those working under a Florida Speech Pathologist Agreement - Self-Employed Independent Contractor, should be classified. This law emphasizes the need for proper documentation and fair practices to protect both parties involved. By understanding this law, you can ensure compliance and smooth operations as an independent contractor in Florida.

An independent contractor, specifically a Speech-Language Pathologist (SLP), operates as a self-employed professional who provides speech therapy services. Unlike employees, independent contractors maintain control over their work schedules, methods, and client interactions, which allows for greater flexibility. To formalize the working relationship, utilizing a Florida Speech Pathologist Agreement - Self-Employed Independent Contractor is vital for outlining responsibilities and expectations. This agreement supports both the SLP and their clients by ensuring clarity and legal protection.

Yes, a Speech-Language Pathologist (SLP) can work independently as long as they comply with state licensing requirements. Many SLPs choose to operate as self-employed independent contractors to maintain flexibility in their work. This structure allows them to serve clients directly and manage their schedules effectively. For a comprehensive understanding of this arrangement, the Florida Speech Pathologist Agreement - Self-Employed Independent Contractor can provide clear guidelines and protections for your practice.

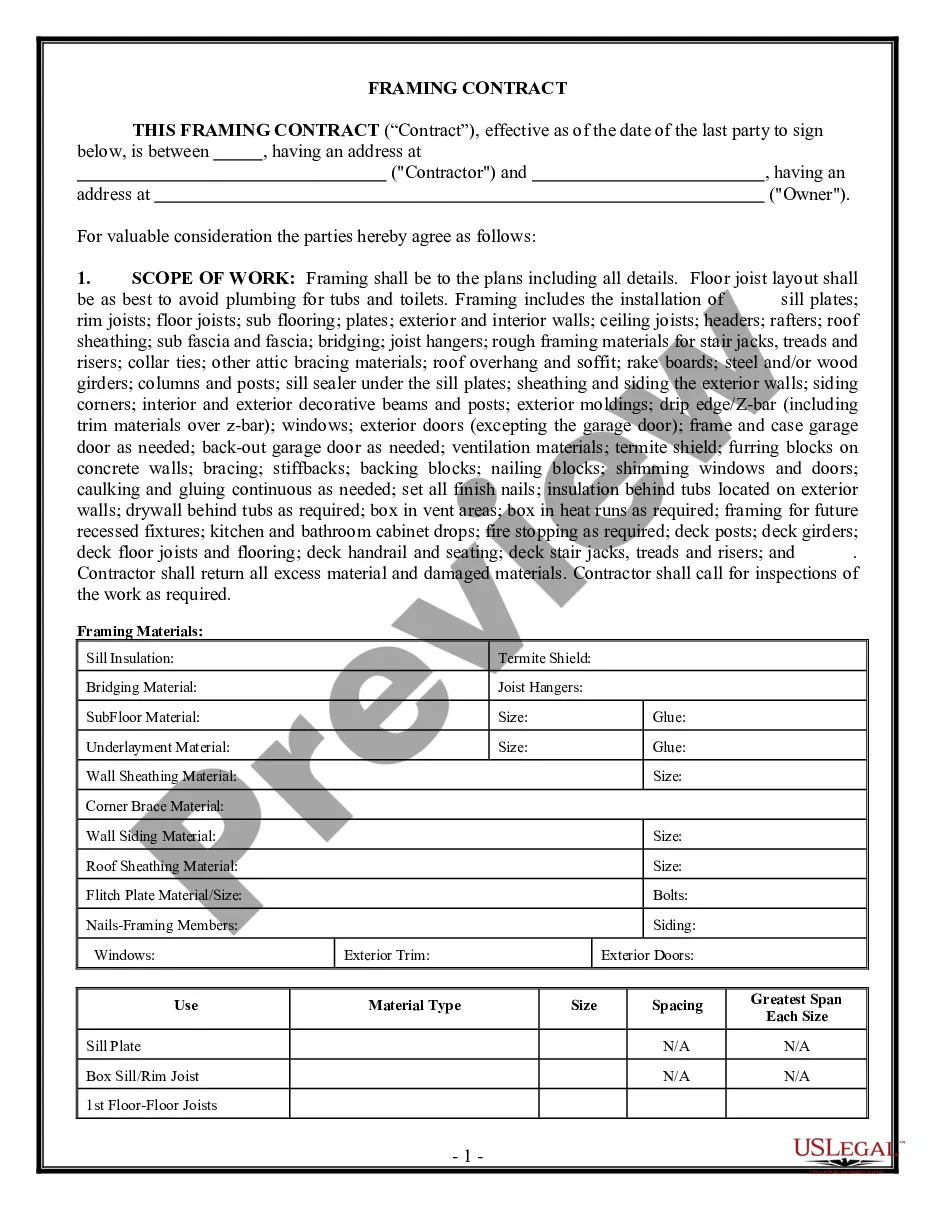

To fill out an independent contractor agreement, start by entering the names and contact details of both parties. Specify the services provided, the duration of the agreement, and the payment terms. It is important to include clauses on confidentiality and liability. The Florida Speech Pathologist Agreement - Self-Employed Independent Contractor on the US Legal Forms website is a reliable resource for ensuring all necessary details are included.

Filling out an independent contractor form involves providing your basic information, such as name and address, followed by the specific details of the services offered. Clearly outline the compensation structure and payment schedule to ensure both parties understand financial obligations. For ease, consider using the Florida Speech Pathologist Agreement - Self-Employed Independent Contractor form available through US Legal Forms, which streamlines this process.

To write an independent contractor agreement, start by clearly identifying the parties involved. Include key elements such as the scope of services, payment terms, and any deadlines. Additionally, it is crucial to state the terms regarding confidentiality and termination. For those in need of guidance, the Florida Speech Pathologist Agreement - Self-Employed Independent Contractor template available on the US Legal Forms platform can simplify this process.

To establish a private practice as a speech-language pathologist, you need to develop a solid business plan and understand the legal requirements. It's essential to register your practice and obtain any necessary licenses. Using a Florida Speech Pathologist Agreement - Self-Employed Independent Contractor can streamline client agreements and minimize misunderstandings. This approach not only protects your practice but also enhances your professional credibility.

In Florida, an independent contractor agreement is a legal document that outlines the relationship between a contractor and a client. This agreement specifies the terms of work, payment, and responsibilities, ensuring both parties are clear about their roles. For speech pathologists, having a Florida Speech Pathologist Agreement - Self-Employed Independent Contractor is vital. This agreement provides protection and clarity, fostering a successful working relationship.

You can be a freelance speech-language pathologist, allowing you to operate your practice flexibly. Freelancing enables you to work on multiple projects or with various clients, enhancing your experience and skills. To succeed, it's crucial to draft a Florida Speech Pathologist Agreement - Self-Employed Independent Contractor. This document will secure your payment terms and clarify your responsibilities in each engagement.

Yes, a speech pathologist can definitely work independently. Being an independent contractor provides a speech pathologist with the freedom to choose their clients and set their hours. By utilizing a Florida Speech Pathologist Agreement - Self-Employed Independent Contractor, they can establish the terms of their services and maintain professional standards. This agreement ensures that both the pathologist and the client understand their rights and obligations.