Florida Electrologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Electrologist Agreement - Self-Employed Independent Contractor?

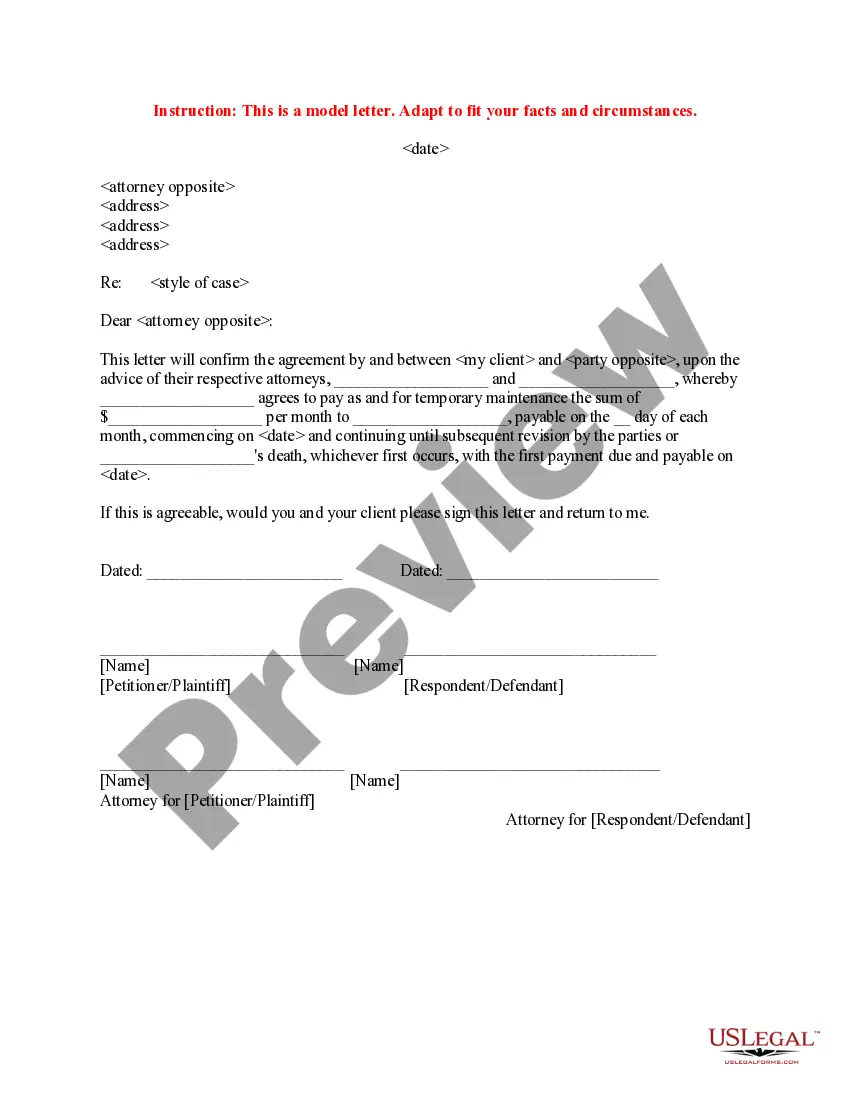

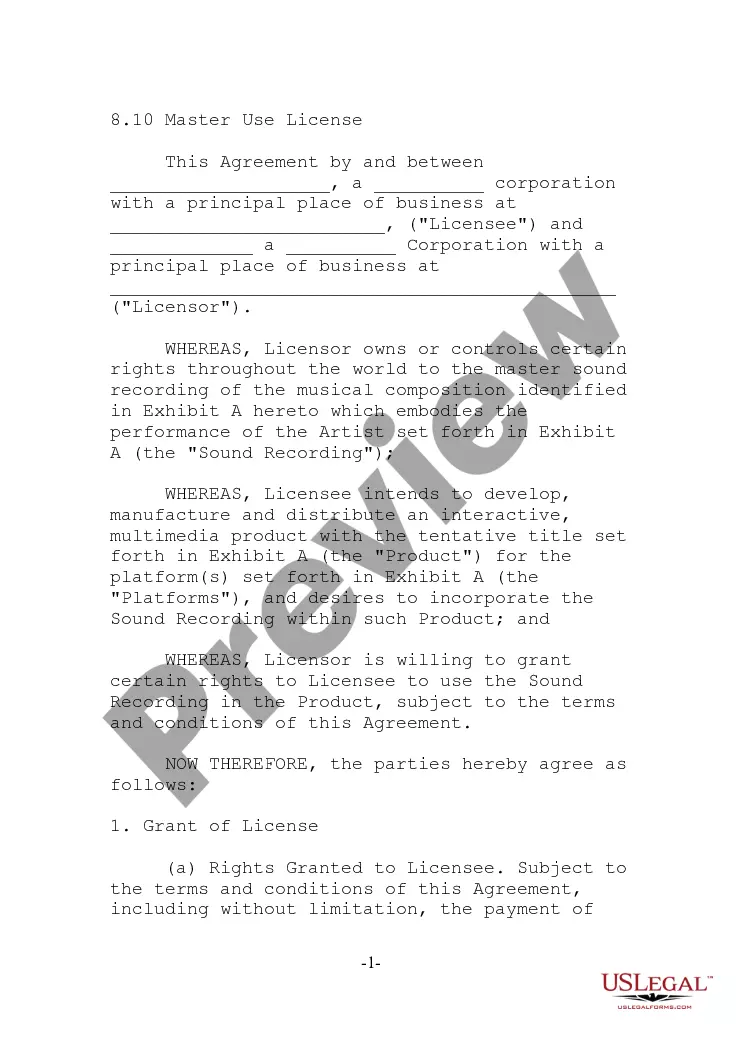

Are you presently in a situation where you require documentation for either business or personal purposes nearly every day? There are numerous legal document templates accessible online, but finding ones you can rely on is not easy. US Legal Forms offers thousands of template forms, including the Florida Electrologist Agreement - Self-Employed Independent Contractor, designed to comply with state and federal regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply sign in. After that, you can download the Florida Electrologist Agreement - Self-Employed Independent Contractor template.

If you do not have an account and want to start using US Legal Forms, follow these steps: Find the form you need and ensure it is for your specific city/state. Use the Review button to examine the document. Read the details to confirm that you have selected the correct form. If the form is not what you're looking for, use the Search field to locate the form that suits your needs and requirements. Once you find the right form, click Purchase now. Select the pricing plan you want, complete the required information to create your account, and pay for your order using your PayPal or Visa or Mastercard. Choose a convenient document format and download your copy.

By using US Legal Forms, you gain access to a broad array of legal templates that help streamline your documentation process.

Take advantage of the convenience and reliability offered by US Legal Forms to ensure you have the necessary legal documents at your fingertips.

- Access all the document templates you have purchased in the My documents section. You can download an additional copy of the Florida Electrologist Agreement - Self-Employed Independent Contractor at any time if needed. Simply click on the required form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service provides professionally created legal document templates that can be used for various purposes.

- Create an account on US Legal Forms and start making your life easier.

Form popularity

FAQ

Electrologists in Florida can expect a varied income based on factors such as experience, location, and client volume. On average, they can earn a competitive salary that reflects the demand for their specialized services. A well-structured Florida Electrologist Agreement - Self-Employed Independent Contractor can help in setting appropriate rates and ensuring fair compensation for services rendered.

You may not need to formally register your business as an independent contractor in Florida unless you are operating under a business name different from your own. However, registering can provide legal protections and enhance your professionalism. A Florida Electrologist Agreement - Self-Employed Independent Contractor can include provisions regarding registration, helping you navigate these requirements.

An independent contractor in Florida may not need a business license universally, but this can vary based on the industry and location. For example, those providing specialty services like electrology might need to adhere to particular state or local regulations. Therefore, having a Florida Electrologist Agreement - Self-Employed Independent Contractor can help clarify these requirements and protect your interests.

In Florida, independent contractors are not always required to have a business license. However, depending on the specific services they provide, certain local regulations may apply. For those working under a Florida Electrologist Agreement - Self-Employed Independent Contractor, it's wise to check local licensing requirements to ensure you are fully compliant and operating legally.

Yes, you can issue a 1099 to someone without a business license, but it's essential to ensure that the individual meets the IRS criteria for independent contracting. However, if you plan to work as a Florida Electrologist Agreement - Self-Employed Independent Contractor, obtaining a business license can add credibility and protect both parties involved in the contractual relationship.

The new independent contractor law in Florida clarifies the classification of independent contractors and how they operate under the law. It outlines the rights and responsibilities of those working as self-employed independent contractors, including specifics related to contracts, wages, and benefits. Understanding this law is crucial for any Florida Electrologist Agreement - Self-Employed Independent Contractor, ensuring compliance with state regulations.

In Florida, certified electrologists who have completed the required education and obtained their state license are permitted to perform electrolysis. The licensing process ensures that practitioners are knowledgeable and capable of executing hair removal safely and effectively. If you’re interested in starting your own practice, you can easily find resources through platforms like US Legal Forms to help you navigate the Florida Electrologist Agreement - Self-Employed Independent Contractor.

Only licensed electrologists can perform electrolysis in Florida, adhering to the licensing requirements established by state law. These professionals have undergone rigorous training, providing them with the necessary knowledge and skills for safe hair removal. This ensures that clients receive quality service while working under the framework of the Florida Electrologist Agreement - Self-Employed Independent Contractor.

In Florida, laser hair removal is regulated by the Department of Health in conjunction with the Board of Medicine. This regulatory body sets important standards that practitioners must follow to ensure client safety and competency. If you’re considering offering laser hair removal services alongside electrolysis, familiarizing yourself with these regulations can be beneficial under the Florida Electrologist Agreement - Self-Employed Independent Contractor.

Being an esthetician is not a strict requirement for performing electrolysis in Florida; however, many electrologists pursue esthetician training to enhance their qualifications. This additional training can provide valuable knowledge about skin care and client interaction. Understanding the nuances of both fields can help you work effectively under the Florida Electrologist Agreement - Self-Employed Independent Contractor.