Florida Tutoring Agreement - Self-Employed Independent Contractor

Description

How to fill out Tutoring Agreement - Self-Employed Independent Contractor?

Have you found yourself in a situation where you need documents for potential business or personal reasons almost constantly.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers a vast array of form templates, including the Florida Tutoring Agreement - Self-Employed Independent Contractor, which can be tailored to meet federal and state regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Florida Tutoring Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

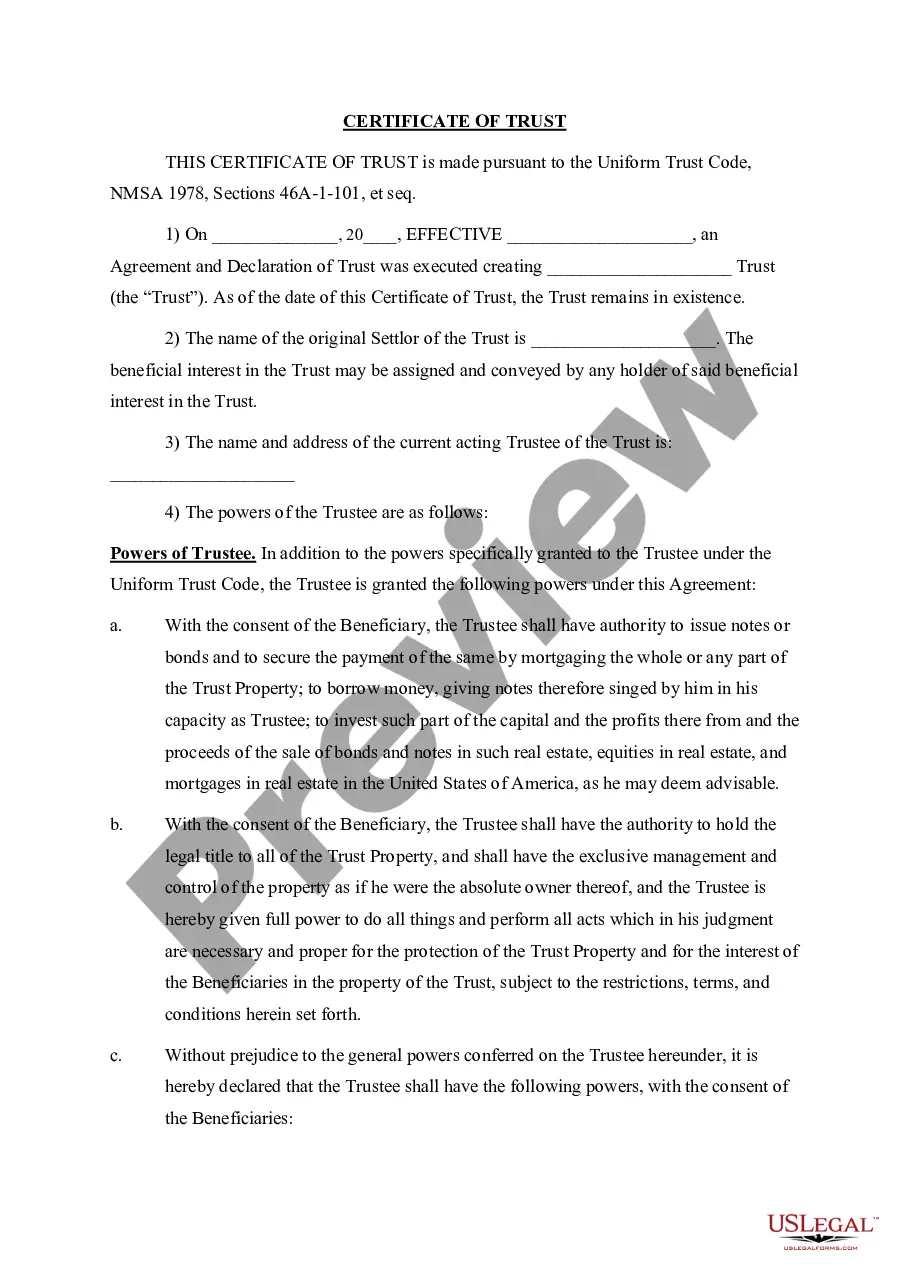

- Use the Review button to examine the form.

- Read the details to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Research field to find the form that fulfills your needs and specifications.

- When you find the right form, click Get now.

- Choose the pricing plan you desire, fill in the necessary information to create your account, and complete the payment using your PayPal or credit card.

- Select a convenient document format and download your copy.

- Locate all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Florida Tutoring Agreement - Self-Employed Independent Contractor at any time if needed. Just click on the required form to download or print the document template.

Form popularity

FAQ

Tutors, classified as self-employed independent contractors, typically receive a 1099 form rather than being employees. This classification means they handle their own taxes and have greater control over their work. Utilizing a structured approach in a Florida Tutoring Agreement - Self-Employed Independent Contractor ensures clarity in these relationships and compliance with financial regulations.

Florida has introduced legislation that affects the classification of independent contractors, making it crucial for hiring parties to understand their obligations. This law generally confirms that individuals who meet certain criteria can maintain their status as independent contractors without facing reclassification. Understanding this law is essential when forming a Florida Tutoring Agreement - Self-Employed Independent Contractor, as it impacts tax liabilities and contractual obligations.

Yes, a private tutor is considered self-employed if they operate their business independently and provide tutoring services to clients. They set their own rates, choose their hours, and manage their own client relationships. A Florida Tutoring Agreement - Self-Employed Independent Contractor formalizes this arrangement, helping to clarify expectations and responsibilities.

An independent contractor is an individual who provides services to clients while maintaining control over their work schedule and methods. They typically work for multiple clients and are responsible for their own taxes. In the context of a Florida Tutoring Agreement - Self-Employed Independent Contractor, this means that tutors operate independently, offering their expertise without direct supervision from the hiring party.

The independent contractor agreement in Florida is a legal document that outlines the terms of the working relationship between a tutor and the client. This agreement is crucial for establishing clear expectations regarding payment, responsibilities, and duration of service. Using a Florida Tutoring Agreement - Self-Employed Independent Contractor ensures that both parties understand their rights and obligations. The US Legal Forms platform offers customizable templates to help you create a comprehensive agreement that meets your specific needs.

Yes, a tutor can be classified as an independent contractor, especially if they provide services to clients on a flexible basis. This classification allows for more freedom in how you manage your tutoring business. By using a Florida Tutoring Agreement - Self-Employed Independent Contractor, you can formalize your independent status and protect your interests.

You typically need a business license in Florida when your tutoring services generate significant income or if you bring on additional staff. Local regulations can vary, so it's crucial to stay informed. A Florida Tutoring Agreement - Self-Employed Independent Contractor will help you navigate these requirements effectively.

In Florida, certain trades may be performed without a license, including some forms of tutoring. However, it's essential to clarify what type of services you offer. Leveraging a Florida Tutoring Agreement - Self-Employed Independent Contractor can provide the necessary structure and protection for your tutoring business.

While not every tutor needs a business license in Florida, it's wise to check specific regulations in your area. In many cases, operating as a self-employed tutor does require some form of registration or compliance. A Florida Tutoring Agreement - Self-Employed Independent Contractor can support you in this process by outlining your role and responsibilities.

To become a tutor in Florida, you typically need expertise in your subject area and a passion for education. While formal teaching credentials can enhance your profile, they are not mandatory. Utilizing a Florida Tutoring Agreement - Self-Employed Independent Contractor can help lay the groundwork for your tutoring services and boost your credibility.