Florida Door Contractor Agreement - Self-Employed

Description

How to fill out Door Contractor Agreement - Self-Employed?

You might spend hours online searching for the proper legal document template that meets the local and federal requirements you need.

US Legal Forms offers thousands of legal forms that are verified by experts.

You can download or print the Florida Door Contractor Agreement - Self-Employed from our services.

If accessible, use the Preview button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- Subsequently, you can complete, modify, print, or sign the Florida Door Contractor Agreement - Self-Employed.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, confirm that you have selected the correct document template for your state/city of choice.

- Review the form description to ensure you have selected the correct form.

Form popularity

FAQ

The new Florida independent contractor law establishes clearer guidelines regarding the classification and responsibilities of independent contractors. This legislation seeks to protect both workers and companies by clarifying how independent work operates. As you enter into a Florida Door Contractor Agreement - Self-Employed, understanding this law can help you navigate your rights and responsibilities efficiently.

As a 1099 employee in Florida, you have the right to receive fair compensation, work without direct supervision, and control how you complete your tasks. However, it's crucial to remember that you’re also responsible for your own taxes and benefits. Your Florida Door Contractor Agreement - Self-Employed should cover these rights to ensure you are informed and protected throughout your contract.

The new independent contractor law in Florida aims to provide clearer definitions and protections for workers in this sector. It reinforces the classification of independent contractors while ensuring they have access to certain rights. When entering into a Florida Door Contractor Agreement - Self-Employed, it is important to consider how these changes may impact your work and rights.

Yes, an independent contractor is considered self-employed. This means that they run their own business and are responsible for their own taxes. If you're navigating the world of contracting, your Florida Door Contractor Agreement - Self-Employed should clearly define your status to reinforce this important distinction and clarify your responsibilities.

In Florida, independent contractors can earn up to $600 in a year without having to file a federal tax return. However, once you surpass that threshold, you will need to report your earnings. It's essential to stay organized and know your financial limits when entering into a Florida Door Contractor Agreement - Self-Employed to avoid any tax complications.

The 7 minute rule in Florida refers to a guideline where independent contractors can classify short tasks that take up to seven minutes as separate billable items on their invoices. This can be particularly useful when managing your time effectively and ensuring you get compensated fairly. Understanding this rule can enhance your financial planning, especially when working under a Florida Door Contractor Agreement - Self-Employed.

Creating an independent contractor agreement involves outlining key elements that define the relationship between the contractor and the client. Start by detailing the services provided, payment structure, and duration of the agreement. For those needing assistance, the US Legal Forms platform offers customizable templates specifically tailored for a Florida Door Contractor Agreement - Self-Employed, making it easier for you to craft a professional and legally sound document.

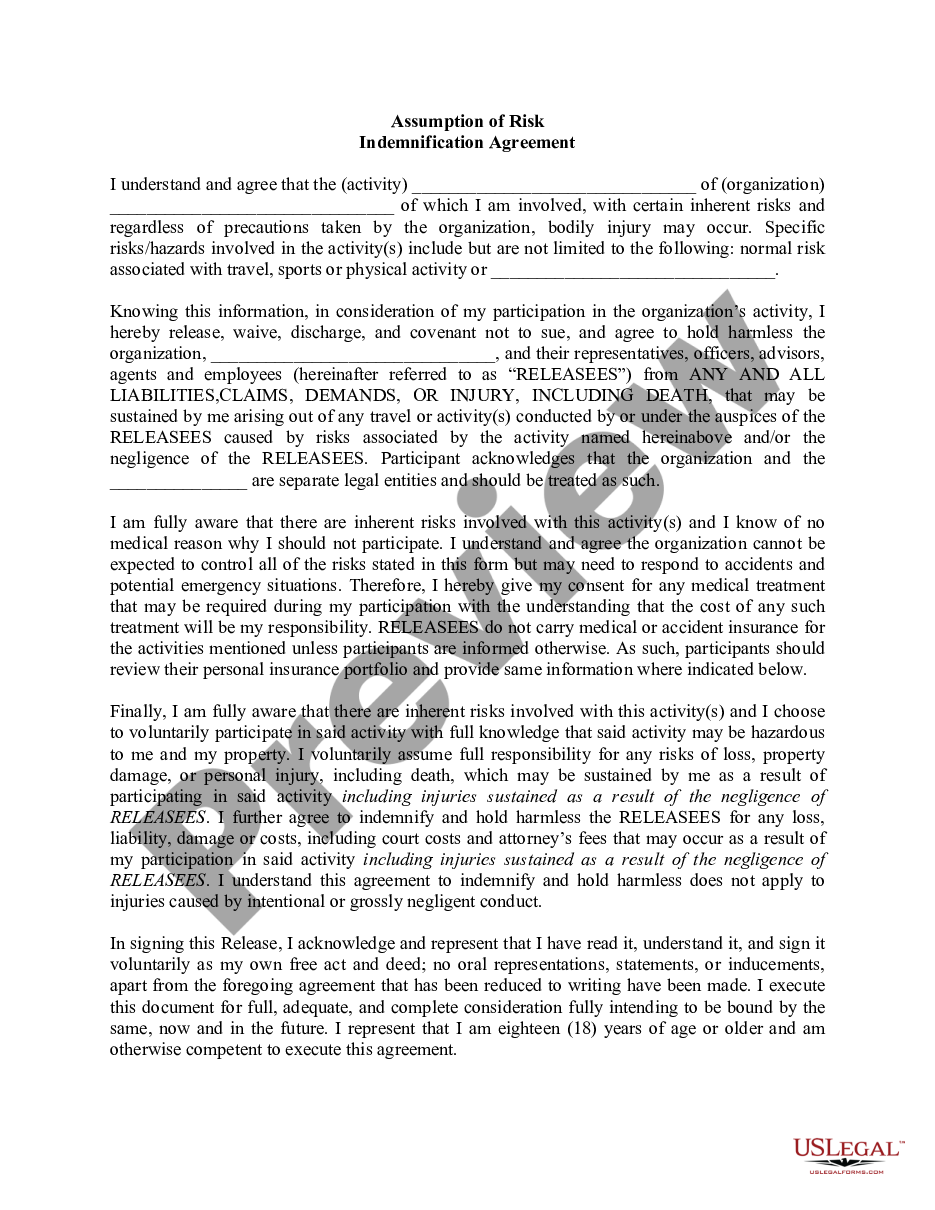

A basic independent contractor agreement is a written document that specifies the terms of a working relationship between a contractor and a client. It typically includes details such as project scope, payment terms, deadlines, and confidentiality agreements. For those in the door contracting business, a Florida Door Contractor Agreement - Self-Employed ensures both parties clearly understand their rights and obligations, creating a transparent working environment.

In Florida, an independent contractor is an individual who provides services under a contract, maintaining control over how tasks are performed. They are not employees of the company they work for, meaning they manage their own schedules and use their own tools. This classification often applies to those engaged in specific trades, like door contracting, where the Florida Door Contractor Agreement - Self-Employed outlines the responsibilities and relationship between parties.

The independent contractor agreement in Florida is a legal document that defines the relationship between the contractor and the hiring party. This agreement provides clarity on the terms of service, including payment, project deliverables, and deadlines. Using a Florida Door Contractor Agreement - Self-Employed template can help streamline this process. It ensures both parties have a clear understanding of expectations and responsibilities, paving the way for a successful working relationship.