Florida Data Entry Employment Contract - Self-Employed Independent Contractor

Description

How to fill out Data Entry Employment Contract - Self-Employed Independent Contractor?

You have the ability to spend hours online looking for the legal template that satisfies the requirements of both state and federal regulations you need.

US Legal Forms offers a vast array of legal documents that have been reviewed by experts.

You can easily download or print the Florida Data Entry Employment Agreement - Self-Employed Independent Contractor from our service.

To find an additional version of the form, utilize the Search field to locate the template that meets your needs and requirements. Once you have identified the template you desire, click Buy now to proceed. Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms. Complete your purchase. You can use your Visa, Mastercard, or PayPal account to pay for the legal document. Choose the format of your document and download it to your device. Make changes to your document if necessary. You can complete, edit, sign, and print the Florida Data Entry Employment Agreement - Self-Employed Independent Contractor. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, edit, print, or sign the Florida Data Entry Employment Agreement - Self-Employed Independent Contractor.

- Every legal template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, navigate to the My documents section and click on the appropriate button.

- If you’re using the US Legal Forms website for the first time, follow these simple instructions.

- First, ensure that you have selected the correct template for the county/city of your choice. Check the form overview to verify you have chosen the appropriate format.

- If available, use the Review button to preview the template as well.

Form popularity

FAQ

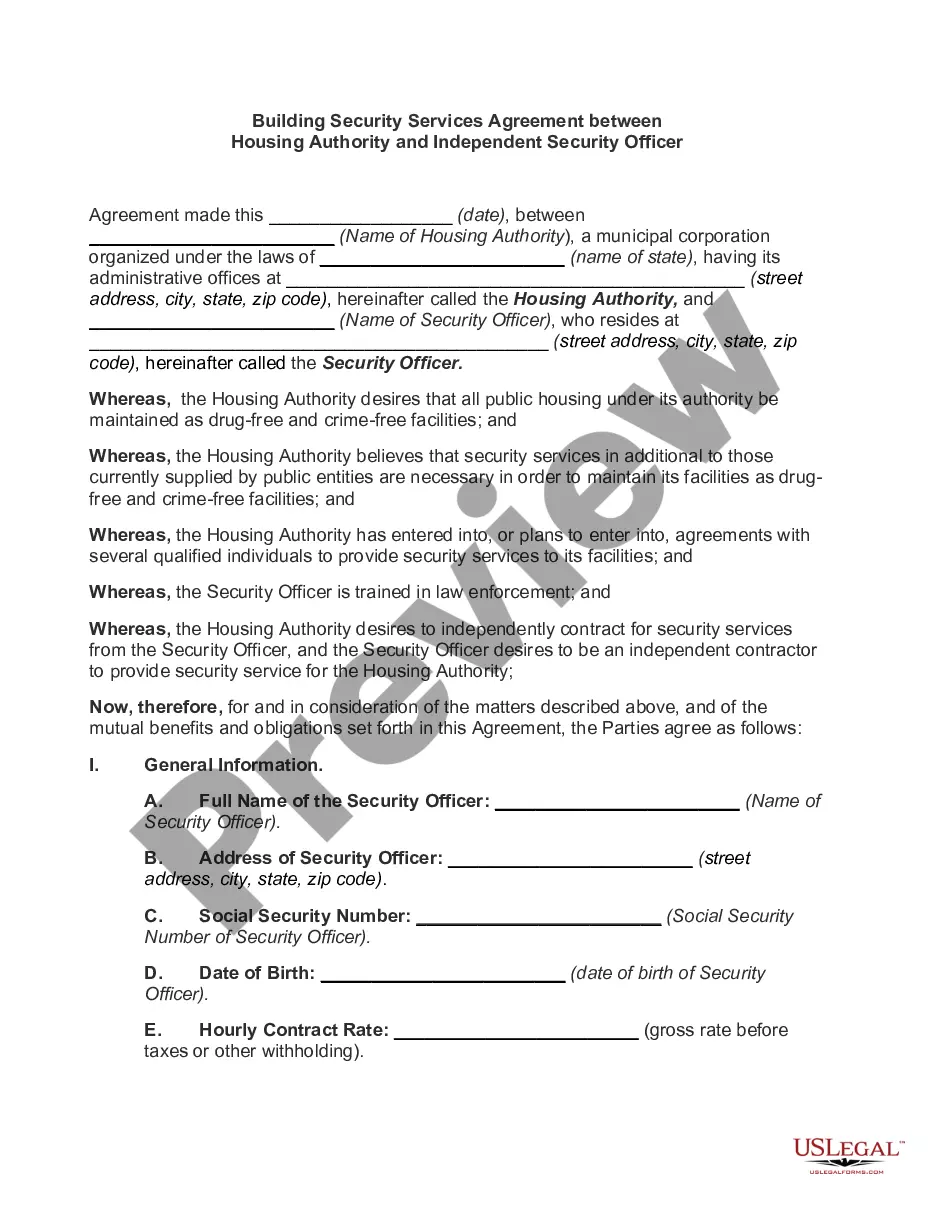

In Florida, 1099 employees, also known as independent contractors, must meet certain criteria to ensure proper classification. They should have a written agreement outlining the nature of work, payment terms, and project deadlines. The Florida Data Entry Employment Contract - Self-Employed Independent Contractor provides clarity and legal backing in these arrangements, and you can find helpful resources at uslegalforms.

The requirement for a business license varies for independent contractors in Florida. While many may not need one, consider checking local ordinances related to your specific industry. Benefit from expert guidance and documents offered at uslegalforms to determine your licensing needs efficiently.

Yes, you can issue a 1099 to an independent contractor without a business license, as long as they meet the criteria for independent contractor status. However, ensure that contracts like the Florida Data Entry Employment Contract - Self-Employed Independent Contractor are in place to avoid potential issues. Consult uslegalforms for compliant 1099 forms and procedures.

Independent contractors in Florida may need a business license, depending on the services they provide or if they engage with specific municipalities. However, not all types of independent contractors require one. It's best to consult local regulations to ensure compliance and leverage the tools from uslegalforms for clarity.

In Florida, you typically need a business license when your business location or nature of work requires it, such as certain trades or professions. If you engage in activities that require specific permits or licenses, securing these ahead of time is essential. Resources available on uslegalforms can guide you through identifying your licensing needs.

Yes, if you operate as an independent contractor in Florida, you may need to register your business, particularly if you plan to use a name different from your own. Registration helps establish your business legally and may build trust with clients. Utilize our platform to navigate the registration process easily and efficiently.

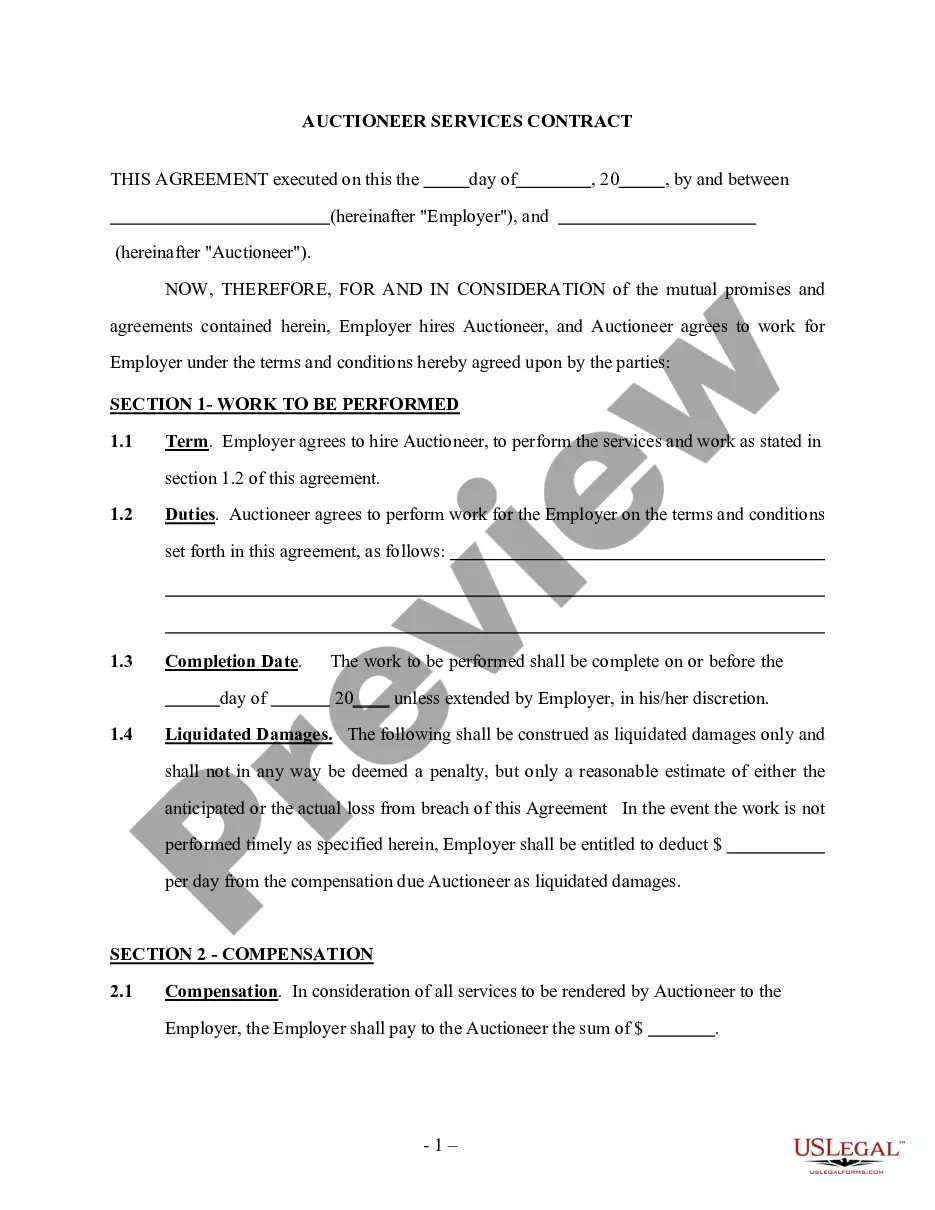

To write a contract as an independent contractor, start by clearly defining the scope of work. Include essential details such as payment terms, deadlines, and responsibilities. Make sure both parties understand their obligations within the Florida Data Entry Employment Contract - Self-Employed Independent Contractor. Consider using platforms like uslegalforms to access templates that streamline this process.

Yes, you can be self-employed and have a contract. In fact, a Florida Data Entry Employment Contract - Self-Employed Independent Contractor is beneficial for defining your relationship with clients. This contract specifies your services, payment terms, and project timelines, which helps in setting expectations. The written agreement fosters professionalism and trust between you and your clients.

Whether to say self-employed or independent contractor often depends on your context. Both terms imply that you run your own business and do not receive a traditional salary. However, the Florida Data Entry Employment Contract - Self-Employed Independent Contractor can help clarify your specific relationship with clients, making it clear you operate under a contract. Whichever term you choose, ensure it accurately reflects your business operations.

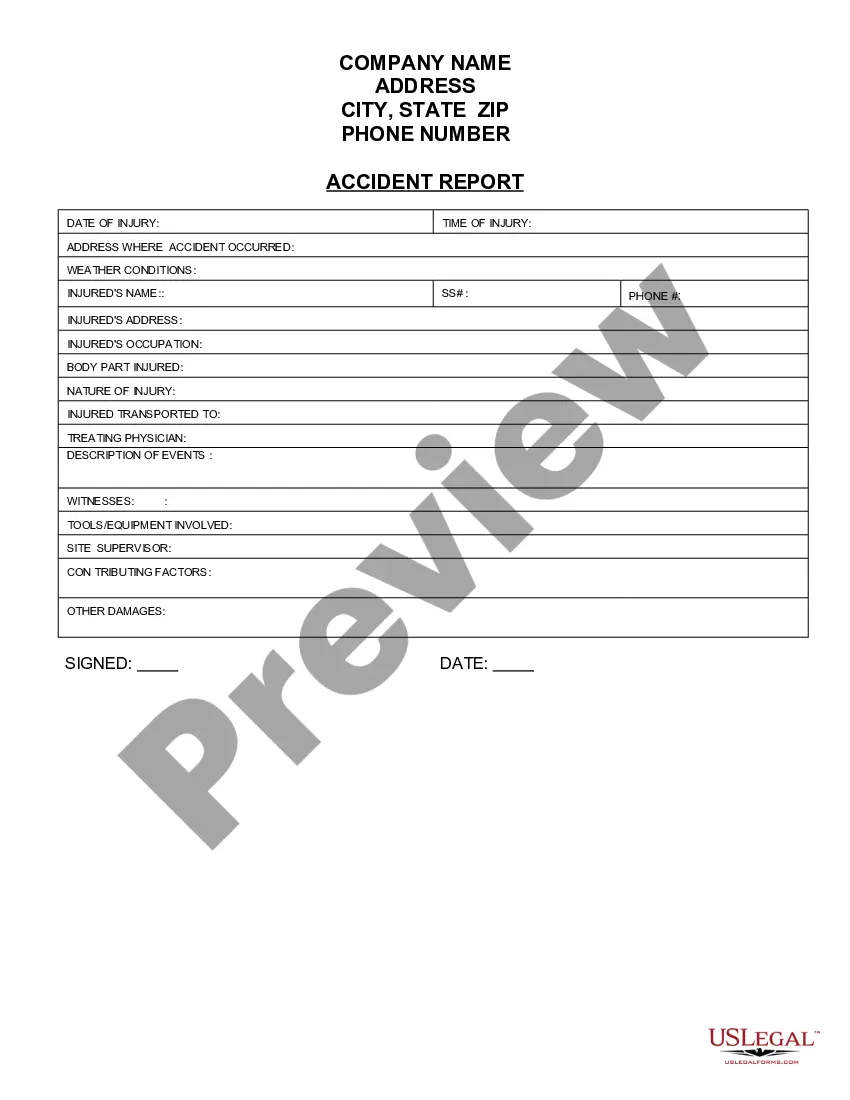

The new rules for self-employed individuals focus on tax obligations, reporting income accurately, and maintaining clear records. With the evolving landscape of remote work and independent contracting, it is crucial to understand your rights and responsibilities. The Florida Data Entry Employment Contract - Self-Employed Independent Contractor plays an essential role in outlining your terms and ensuring compliance. For excellent resources and guidance, consider platforms like uslegalforms.