Florida Carpentry Services Contract - Self-Employed Independent Contractor

Description

How to fill out Carpentry Services Contract - Self-Employed Independent Contractor?

If you need to be thorough, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s simple and user-friendly search to locate the documents you require.

Numerous templates for business and personal uses are organized by categories and states or keywords.

Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find alternate versions of the legal document format.

Step 4. Once you have found the form you need, click the Acquire now button. Choose your preferred pricing plan and enter your information to register for an account.

- Use US Legal Forms to locate the Florida Carpentry Services Contract - Self-Employed Independent Contractor in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Obtain button to find the Florida Carpentry Services Contract - Self-Employed Independent Contractor.

- You can also access forms you previously acquired in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct county/state.

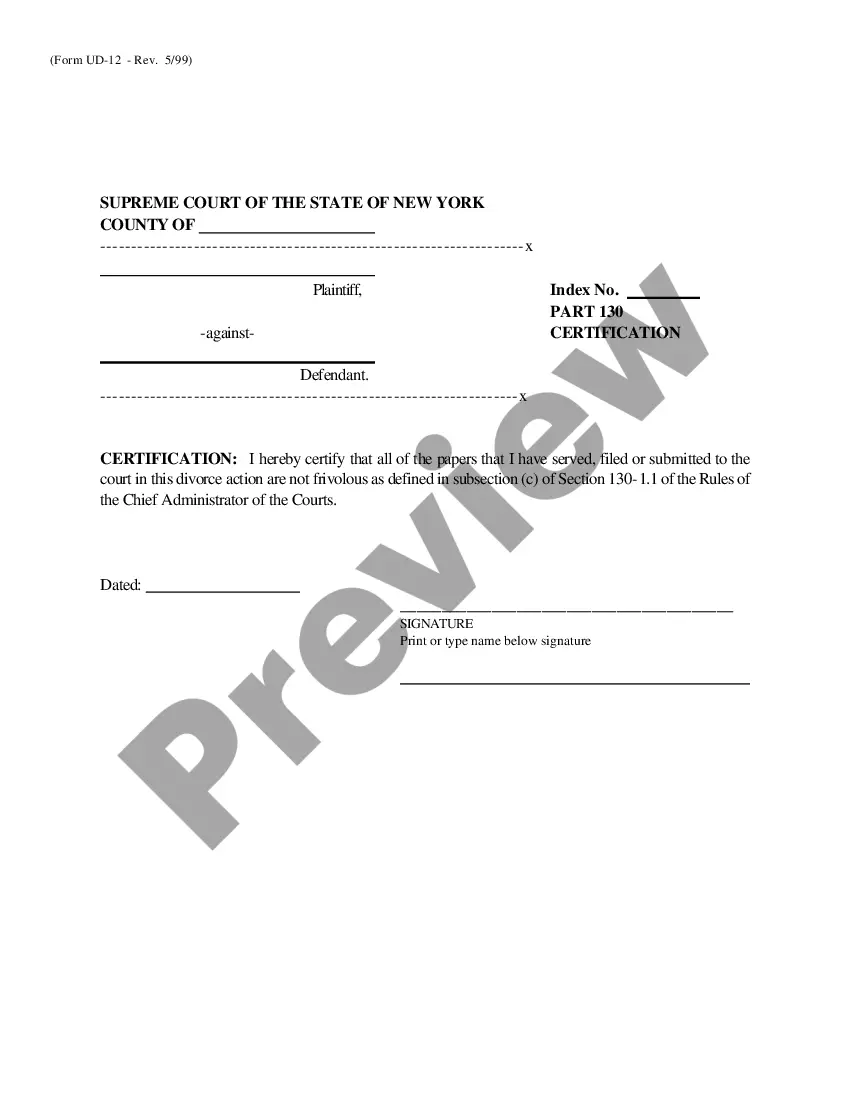

- Step 2. Utilize the Preview option to review the form’s details. Remember to read the summary.

Form popularity

FAQ

To create an independent contractor contract, start by outlining the project details, payment conditions, and timelines. Make sure to define responsibilities clearly to avoid misunderstandings. Utilizing a Florida Carpentry Services Contract - Self-Employed Independent Contractor available on US Legal Forms can streamline this process and guarantee you cover all necessary elements effectively.

Yes, you can create your own legally binding contract as an independent contractor in Florida. However, it’s important to include all essential terms like scope of work, payment, and termination clauses. Using a Florida Carpentry Services Contract - Self-Employed Independent Contractor from US Legal Forms can simplify this process and ensure your agreement meets legal standards.

An independent contractor agreement in Florida outlines the terms of the working relationship between the contractor and the client. This contract clarifies roles, payment terms, deadlines, and other expectations. By using a Florida Carpentry Services Contract - Self-Employed Independent Contractor, you safeguard your rights and establish clear communication with your client.

Yes, as a self-employed independent contractor in Florida, you may need a business license depending on your location and the nature of your work. Some counties or cities require licenses for carpentry services. It's essential to check with your local government. Additionally, having a Florida Carpentry Services Contract - Self-Employed Independent Contractor can help ensure compliance with local regulations.

Independent contractors typically need to complete several forms before starting work. This includes a W-9 form for tax purposes and potentially a contract outlining the details of your services. Depending on the project, you may also need to fill out additional permits or licenses. Utilizing US Legal forms can simplify this process, helping you manage the necessary documentation for your Florida Carpentry Services Contract - Self-Employed Independent Contractor.

Writing a contract as an independent contractor for Florida carpentry services involves several key elements. First, clearly outline the scope of work, including specific tasks, timelines, and payment details. Additionally, include terms regarding termination and confidentiality. For guidance, consider using the US Legal platform to ensure your Florida Carpentry Services Contract - Self-Employed Independent Contractor is comprehensive and legally sound.

An independent contractor carpenter is a skilled professional who operates their own business, providing carpentry services on a contract basis. This means they are not employed by a company but rather work for themselves, allowing them the freedom to choose projects and clients. When working under the Florida Carpentry Services Contract - Self-Employed Independent Contractor, they can outline terms that best suit their work and financial goals. This arrangement often leads to greater flexibility and potentially higher earnings, as they manage their own workload and business decisions.

The 7-minute rule in Florida helps determine whether certain work-related activities qualify as billable time, particularly in contract work like carpentry. If an independent contractor spends more than seven minutes on a task, it typically counts as billable toward the client. Knowing how to apply this rule can be beneficial for those under a Florida Carpentry Services Contract - Self-Employed Independent Contractor, as it helps maximize invoicing accuracy.

The updated independent contractor law in Florida simplifies the process of defining independent contractor status. It specifies the conditions under which workers can be classified as independent contractors, which affects those working under a Florida Carpentry Services Contract - Self-Employed Independent Contractor. This law aims to protect contractors while providing clarity for both workers and employers.

The new federal rule on independent contractors provides guidelines to ensure consistent treatment across states. It focuses on the level of control an employer has over a worker, which affects the classification as independent contractors or employees. Understanding this rule is essential for those engaged in the Florida Carpentry Services Contract - Self-Employed Independent Contractor, as it influences how you should manage your business responsibilities.