Florida A Summary of Your Rights Under the Fair Credit Reporting Act

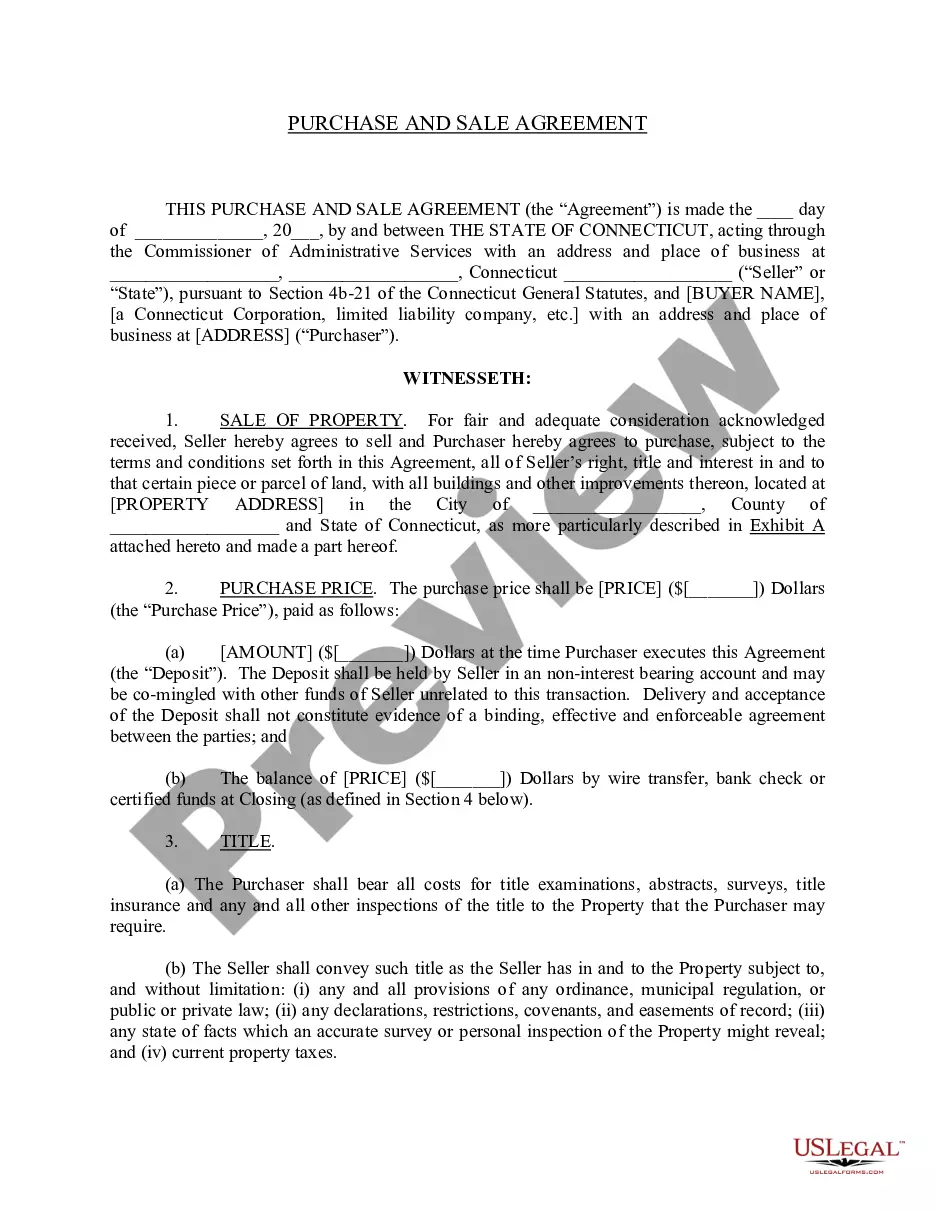

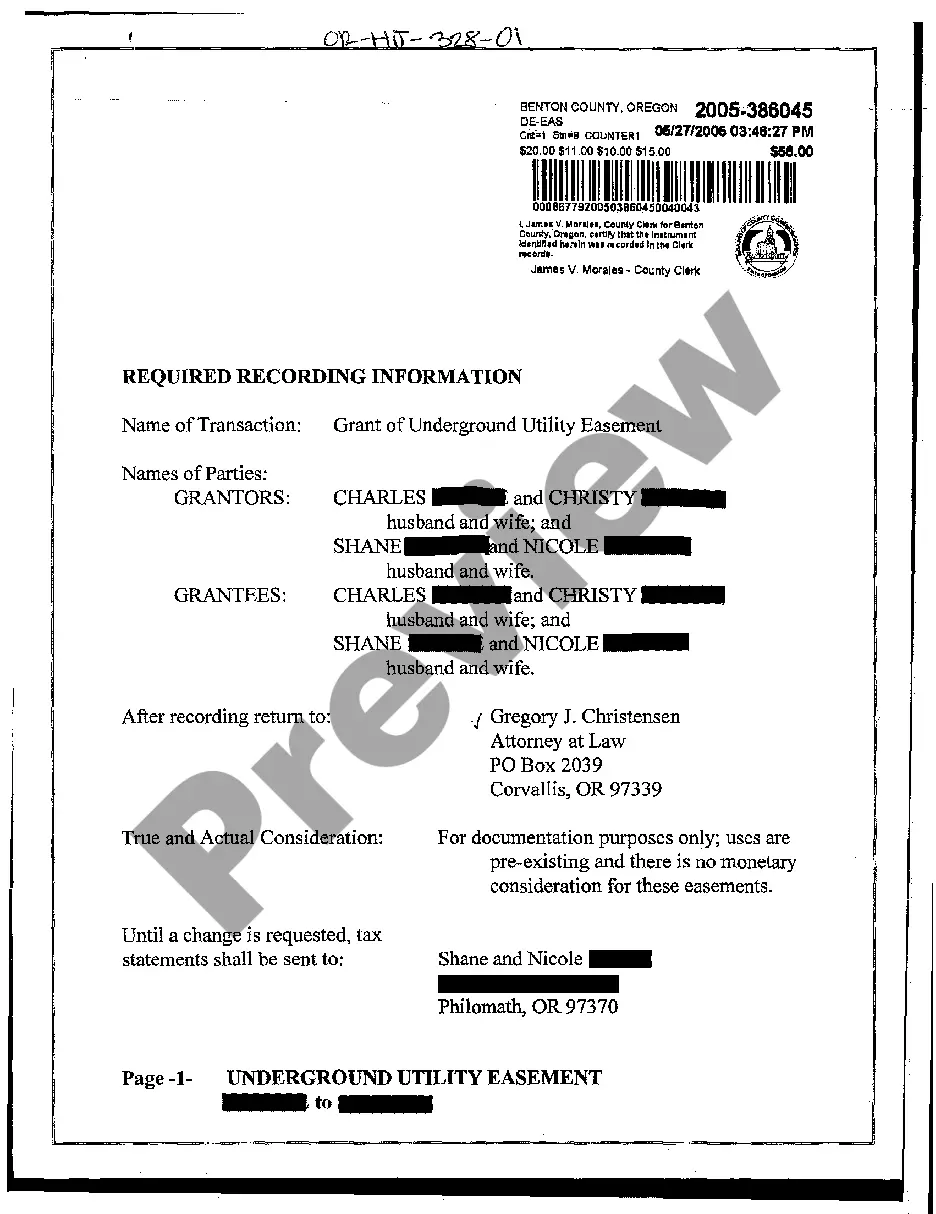

Description

How to fill out A Summary Of Your Rights Under The Fair Credit Reporting Act?

Choosing the best lawful record web template can be quite a have a problem. Of course, there are plenty of layouts available on the Internet, but how would you obtain the lawful type you need? Take advantage of the US Legal Forms website. The service offers 1000s of layouts, such as the Florida A Summary of Your Rights Under the Fair Credit Reporting Act, that you can use for organization and private needs. Each of the forms are inspected by specialists and fulfill state and federal specifications.

If you are presently signed up, log in for your accounts and click the Obtain key to find the Florida A Summary of Your Rights Under the Fair Credit Reporting Act. Use your accounts to search throughout the lawful forms you possess bought in the past. Proceed to the My Forms tab of your accounts and get an additional duplicate of your record you need.

If you are a brand new user of US Legal Forms, listed here are simple guidelines so that you can stick to:

- Initial, make sure you have chosen the appropriate type for your town/state. It is possible to examine the form utilizing the Review key and look at the form outline to make sure this is the best for you.

- In the event the type fails to fulfill your preferences, use the Seach industry to find the right type.

- Once you are certain the form is acceptable, go through the Buy now key to find the type.

- Select the costs strategy you desire and type in the required information and facts. Make your accounts and pay money for the transaction making use of your PayPal accounts or Visa or Mastercard.

- Pick the data file format and download the lawful record web template for your device.

- Comprehensive, change and produce and signal the obtained Florida A Summary of Your Rights Under the Fair Credit Reporting Act.

US Legal Forms may be the most significant local library of lawful forms where you can find numerous record layouts. Take advantage of the company to download skillfully-manufactured papers that stick to status specifications.

Form popularity

FAQ

Four Basic Steps to FCRA Compliance Step 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must: ... Step 2: Certification To The Consumer Reporting Agency. ... Step 3: Provide Applicant With Pre-Adverse Action Documents. ... Step 4: Notify Applicant Of Adverse Action. Four Basic Steps to FCRA Compliance mcdowellagency.com ? resources ? four-basic-ste... mcdowellagency.com ? resources ? four-basic-ste...

Under the FCRA, consumers also have a right to: Verify the accuracy of their report when it's required for employment purposes. Receive notification if information in their file has been used against them in applying for credit or other transactions.

The Fair Credit Reporting Act of 1970 ensures that consumer reporting agencies use procedures which are fair and equitable to the consumer with regard to the confidentiality, accuracy, and relevancy of personal information.

? You have the right to know what is in your file. In addition, all consumers are entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from nationwide specialty consumer reporting agencies. See .consumerfinance.gov/learnmore for additional information.

? You have the right to know what is in your file. information about you in the files of a consumer reporting agency (your ?file disclosure?). You will be required to provide proper identification, which may include your Social Security number. In many cases, the disclosure will be free. A Summary of Your Rights Under ... - Federal Trade Commission Federal Trade Commission (.gov) ? articles ? pdf Federal Trade Commission (.gov) ? articles ? pdf PDF

Notice violations under the FCRA might occur when: a creditor fails to notify you when it supplies negative credit information to a credit reporting agency. a user of credit information (such as a prospective employer or lender) fails to notify you of a negative decision based on your credit report. Most Common Violations of the FCRA - Nolo nolo.com ? legal-encyclopedia ? most-com... nolo.com ? legal-encyclopedia ? most-com...

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

Fix Errors on Your Credit Report: 8 Tips for Writing an Effective Complaint Letter to the Credit Reporting Agency Provide identification information. ... Clearly identify the mistake. ... Be brief and to the point. ... Type the letter. ... Don't quote Fair Credit Reporting Act laws. ... Include proof, if you have it. ... Proofread! How to Write a Complaint Letter to a Credit Reporting Agency theconsumerlawgroup.com ? library ? how-t... theconsumerlawgroup.com ? library ? how-t...