Florida LLC Agreement - Open Source

Description

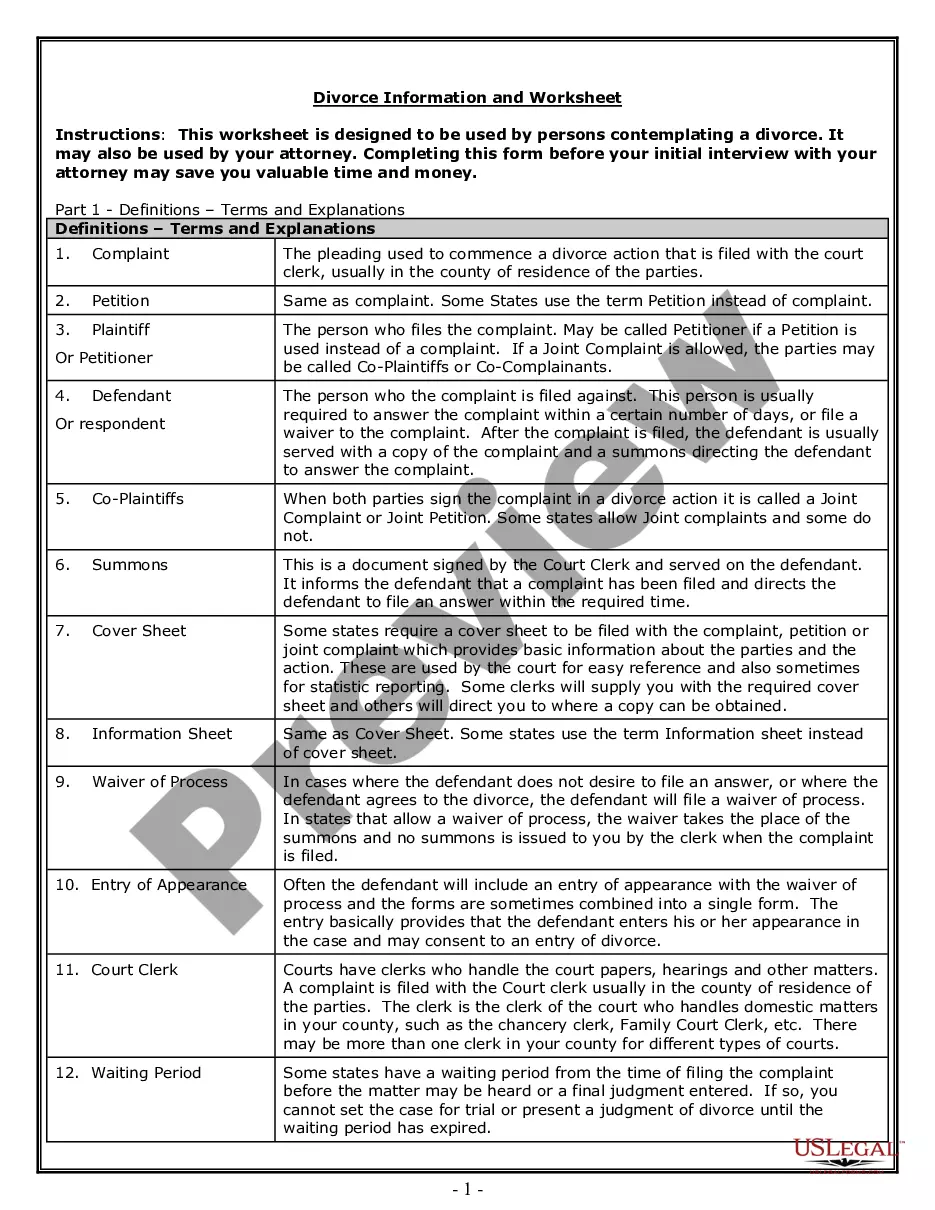

How to fill out LLC Agreement - Open Source?

If you want to complete, download, or print legitimate file templates, use US Legal Forms, the biggest selection of legitimate forms, that can be found online. Utilize the site`s easy and hassle-free look for to discover the documents you require. Different templates for company and specific functions are sorted by types and suggests, or key phrases. Use US Legal Forms to discover the Florida LLC Agreement - Open Source in just a number of click throughs.

If you are already a US Legal Forms consumer, log in in your account and then click the Acquire switch to have the Florida LLC Agreement - Open Source. Also you can gain access to forms you in the past delivered electronically from the My Forms tab of your own account.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Ensure you have selected the form for that proper town/nation.

- Step 2. Use the Review option to examine the form`s content material. Do not neglect to learn the information.

- Step 3. If you are unsatisfied with the type, utilize the Search field at the top of the monitor to get other models from the legitimate type format.

- Step 4. Upon having found the form you require, click on the Get now switch. Pick the pricing program you choose and add your qualifications to register on an account.

- Step 5. Approach the financial transaction. You may use your credit card or PayPal account to accomplish the financial transaction.

- Step 6. Select the formatting from the legitimate type and download it on your own product.

- Step 7. Complete, edit and print or indication the Florida LLC Agreement - Open Source.

Every single legitimate file format you purchase is your own property eternally. You might have acces to every single type you delivered electronically with your acccount. Click the My Forms section and pick a type to print or download again.

Remain competitive and download, and print the Florida LLC Agreement - Open Source with US Legal Forms. There are thousands of specialist and state-certain forms you can utilize for the company or specific requires.

Form popularity

FAQ

You can file your Articles of Organization online on the Sunbiz.org website, mail in a form or have Incfile do it on your behalf for free. The State of Florida charges $125 to start an LLC: $100 to file your Articles of Organization and $25 to designate your Registered Agent.

The operating agreement for an LLC does not need to be notarized. If you make changes to the operating agreement once it has been agreed to by all members/owners, retain the original copy and save the changes as a new version.

What's included in an Florida operating agreement? Name and Purpose. LLC Management - Member or Manager. Registered Agent. LLC Duration. Capital Contributions. Indemnification. LLC Tax Status. Profit and Loss Distributions.

The operating agreement should include the following: Basic information about the business, such as official name, location, statement of purpose, and registered agent. Tax treatment preference. Member information. Management structure. Operating procedures. Liability statement. Additional provisions.

The laws in Florida don't require an LLC to use an Operating Agreement. Instead, the owners of the LLC can operate the business as they choose, as long as they follow the requirements and limitations of business laws in the state.

This can cause conflict amongst members, particularly if a legal dispute arises. If you do choose to draft an LLC Operating Agreement for your Florida LLC, there is no requirement for it to be notarized.

Florida's requirements include: Registered agent. LLCs must list the name and address of a registered agent with a physical address (no post office boxes) in Florida. The registered agent must be available during normal business hours to accept important legal and tax documents for the business.

Although most states do not require the creation of an operating agreement, it is nonetheless regarded as a critical document that should be included when forming a limited liability company. Once each member (owner) signs the document, it becomes a legally binding set of regulations that must be followed.