Florida Sample Founder Stock Repurchase Agreement between MachOne Communications, Inc. and Michael Solomon

Description

How to fill out Sample Founder Stock Repurchase Agreement Between MachOne Communications, Inc. And Michael Solomon?

Choosing the right lawful papers template could be a battle. Of course, there are a variety of templates available online, but how do you find the lawful develop you will need? Use the US Legal Forms website. The support delivers a large number of templates, such as the Florida Sample Founder Stock Repurchase Agreement between MachOne Communications, Inc. and Michael Solomon, which you can use for company and private needs. Each of the varieties are checked out by experts and meet up with state and federal requirements.

Should you be previously listed, log in to the accounts and click on the Down load key to find the Florida Sample Founder Stock Repurchase Agreement between MachOne Communications, Inc. and Michael Solomon. Use your accounts to check from the lawful varieties you possess bought earlier. Proceed to the My Forms tab of your respective accounts and have one more version of the papers you will need.

Should you be a fresh end user of US Legal Forms, listed below are basic instructions so that you can comply with:

- First, make sure you have selected the right develop for the metropolis/region. You may check out the form utilizing the Review key and read the form information to make sure this is basically the right one for you.

- In case the develop will not meet up with your needs, utilize the Seach area to discover the proper develop.

- When you are sure that the form is suitable, click the Buy now key to find the develop.

- Choose the pricing prepare you want and enter the needed information. Design your accounts and purchase the order utilizing your PayPal accounts or bank card.

- Opt for the file file format and obtain the lawful papers template to the system.

- Complete, revise and printing and signal the received Florida Sample Founder Stock Repurchase Agreement between MachOne Communications, Inc. and Michael Solomon.

US Legal Forms is definitely the most significant local library of lawful varieties for which you can discover numerous papers templates. Use the company to obtain skillfully-produced papers that comply with state requirements.

Form popularity

FAQ

Example. A trader enters into a repurchase agreement with a hedge fund by agreeing to sell U.S. treasuries with a market value of $9,579,551.63 to a hedge fund at a repo rate of 0.09% with a fixed one week tenor.

A share buyback is when companies pay shareholders to buy back their own shares, cancel them and, ultimately, reduce share capital. While fewer shares remain in circulation, shareholders get both a larger stake in the company and a higher return on future dividends.

A share repurchase or buyback is a decision by a company to buy back its own shares from the marketplace. A company might buy back its shares to boost the value of the stock and to improve the financial statements. Companies tend to repurchase shares when they have cash on hand and the stock market is on an upswing.

Fixed price tender offer In this method of buyback of shares in India, the company approaches shareholders via a tender. Shareholders who wish to sell their shares can submit them to the company for sale. As the name suggests the price is fixed by the company and is over and above the prevailing market price.

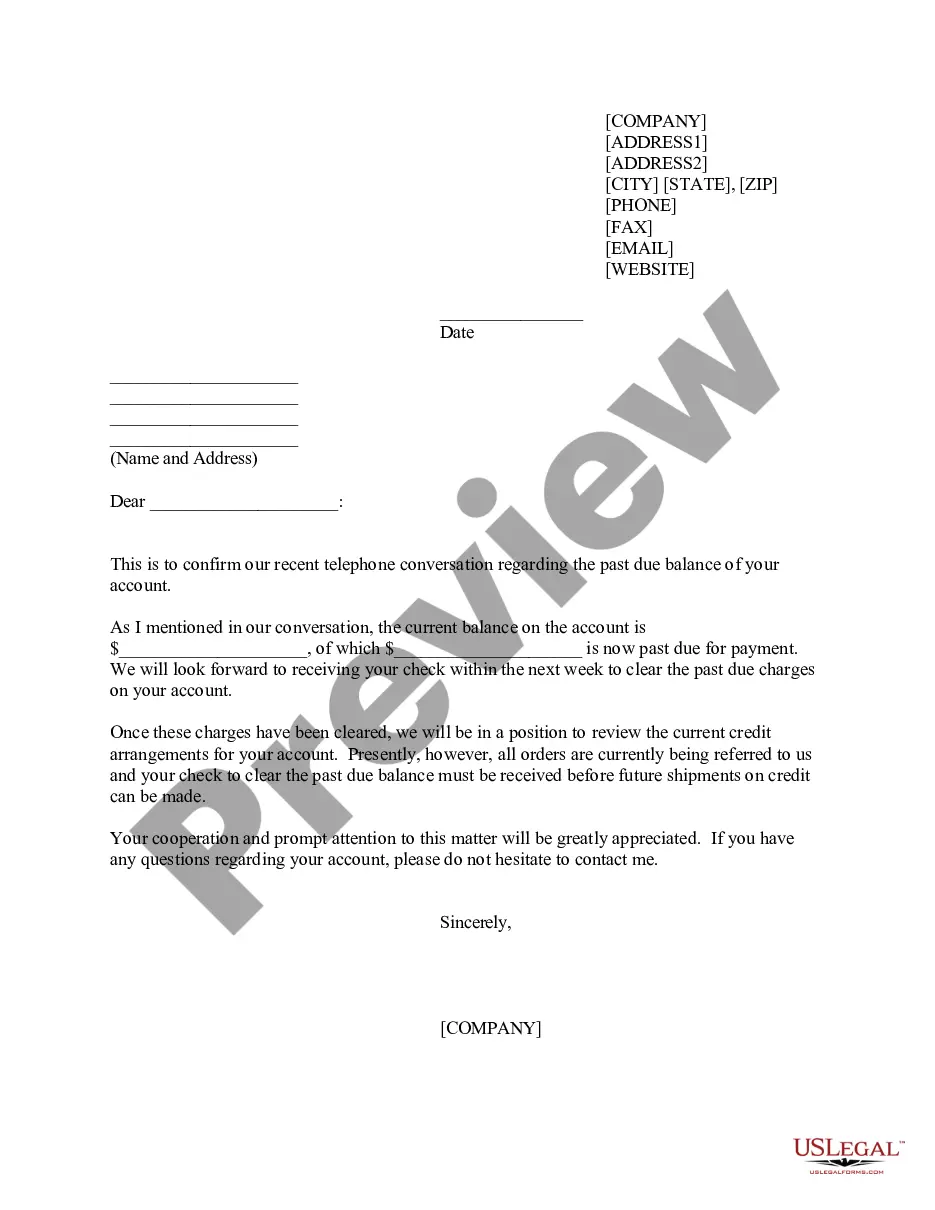

A buyback agreement is a legal document in which a business owner transfers the ownership of shares back to the company instead of selling them directly to an investor. For example, a buyback agreement can be used when a company wants to repurchase its stock from current shareholders.

A Share Repurchase Agreement is contract between a corporation and one or more of its shareholders where the corporation can buy back some of its own common stock. The document identifies the parties involved and records the total price of the shareholding, the method of payment, and the date of the transaction.