A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

Florida Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

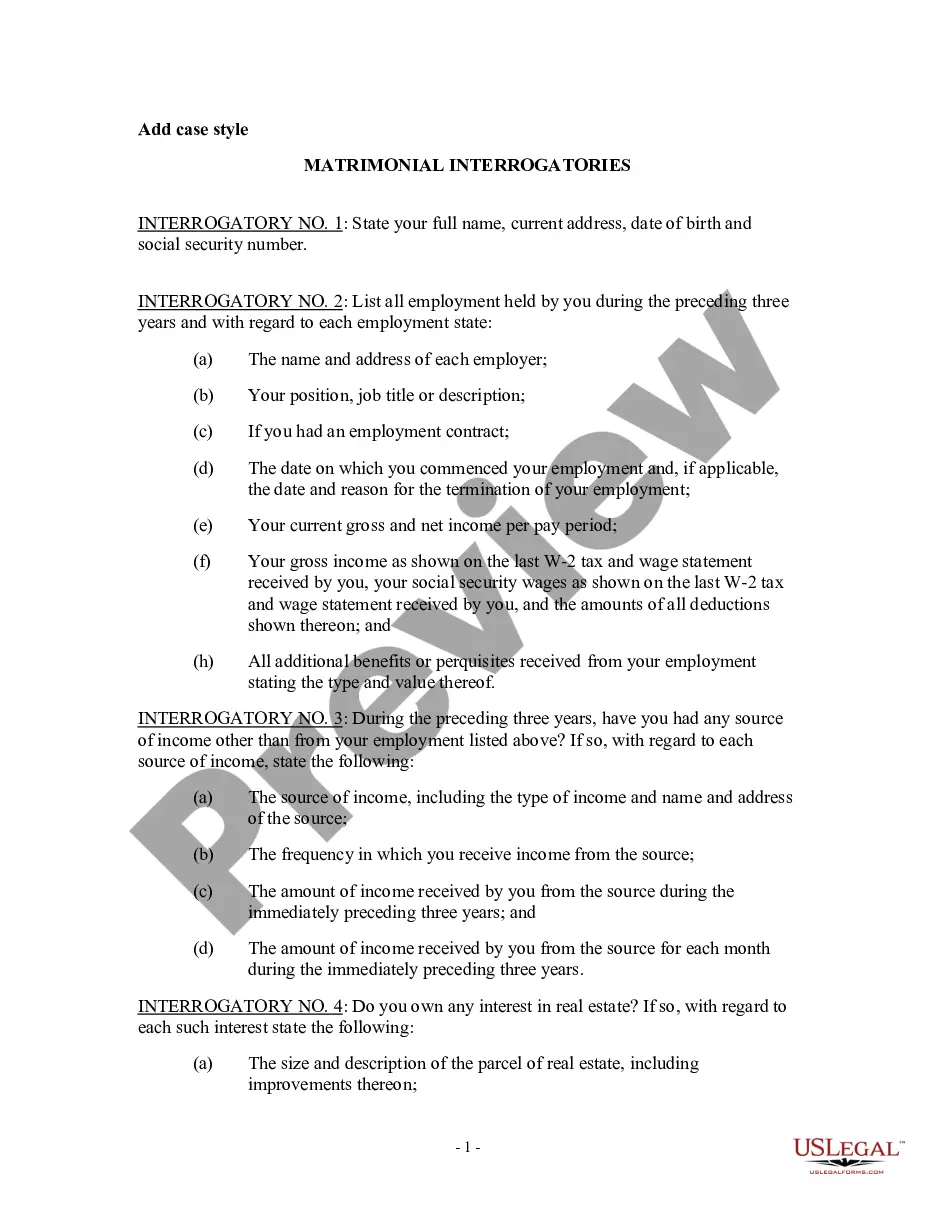

How to fill out Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

Locating the appropriate authentic documents template can be a challenge. Certainly, there are numerous templates accessible online, but how will you find the genuine form you require.

Utilize the US Legal Forms website. The service provides a vast array of templates, such as the Florida Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law, which you can use for business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

If you are currently registered, Log In to your account and click the Download button to obtain the Florida Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law. Use your account to browse through the legal forms you may have previously ordered. Proceed to the My documents section of your account and download another copy of the document you need.

Select the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Florida Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law. US Legal Forms is the largest repository of legal forms where you can find numerous document templates. Utilize the service to acquire professionally crafted documents that comply with state regulations.

- First, ensure you have chosen the correct form for your city/county.

- You can review the form using the Preview button and examine the form details to confirm it is the right one for you.

- If the form does not meet your criteria, use the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click the Purchase now button to acquire the form.

- Select the pricing plan you wish and enter the required information.

- Create your account and complete your order using your PayPal account or credit card.

Form popularity

FAQ

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Section 95.11 Florida Statutes is where the statute of limitations applicable to almost all consumer debts can be found. It provides for a 5 year limitations period on debts founded on a written instrument and for a 4 year period on debts founded otherwise.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Some of the key assets that are exempt from creditors in Florida include: Head of household wages. Annuities and life insurance proceeds and cash surrender value. Homestead (up to 1/2 acre in a city and 160 acres in the county) Retirement accounts, including Roth IRA, IRA, 401k.

Section 95.11 Florida Statutes is where the statute of limitations applicable to almost all consumer debts can be found. It provides for a 5 year limitations period on debts founded on a written instrument and for a 4 year period on debts founded otherwise.

Consumers in Florida are also protected under the Florida Consumer Collection Protection Act (FCCPA), a state law that prohibits both original creditors and third-party debt collectors from using deceptive and abusive practices to collect debt.

The statute of limitations for debt in Florida is usually five years. This means that a creditor has five years to start a lawsuit against you for the money you owe. This is because most debts are based on written agreements.

However, should you fail to clear your debt, the debt collectors may file a lawsuit in court and a judgment made against you as a result. If this happens, you will become a "judgment debtor."

Statute of Limitations in Florida for Debt The statute of limitations for debt in Florida is usually five years. This means that a creditor has five years to start a lawsuit against you for the money you owe. This is because most debts are based on written agreements.