Florida Utilization by a REIT of partnership structures in financing five development projects

Description

How to fill out Utilization By A REIT Of Partnership Structures In Financing Five Development Projects?

You can spend hours online trying to find the authorized file format that fits the federal and state requirements you require. US Legal Forms offers thousands of authorized forms that are reviewed by specialists. It is simple to obtain or printing the Florida Utilization by a REIT of partnership structures in financing five development projects from your services.

If you already possess a US Legal Forms profile, you may log in and click on the Download key. Following that, you may comprehensive, modify, printing, or indicator the Florida Utilization by a REIT of partnership structures in financing five development projects. Every authorized file format you acquire is your own for a long time. To obtain yet another copy of any obtained kind, go to the My Forms tab and click on the related key.

If you use the US Legal Forms web site the first time, follow the basic guidelines beneath:

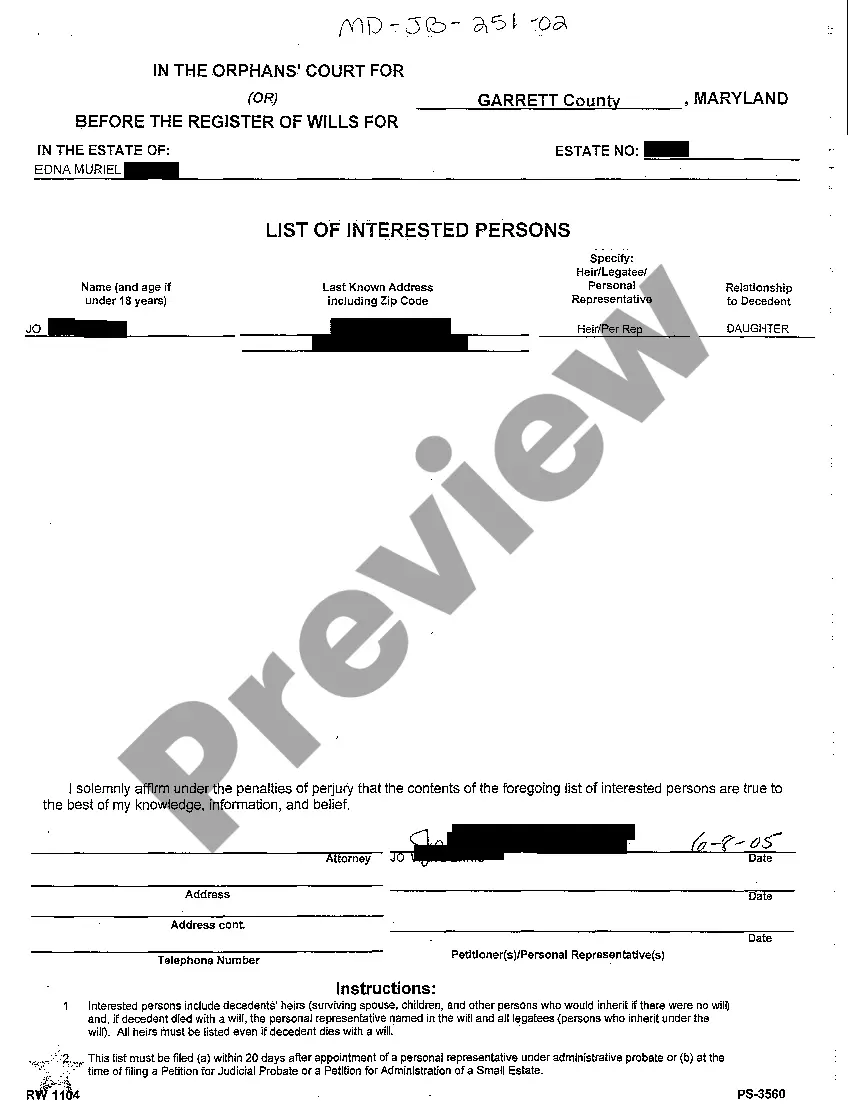

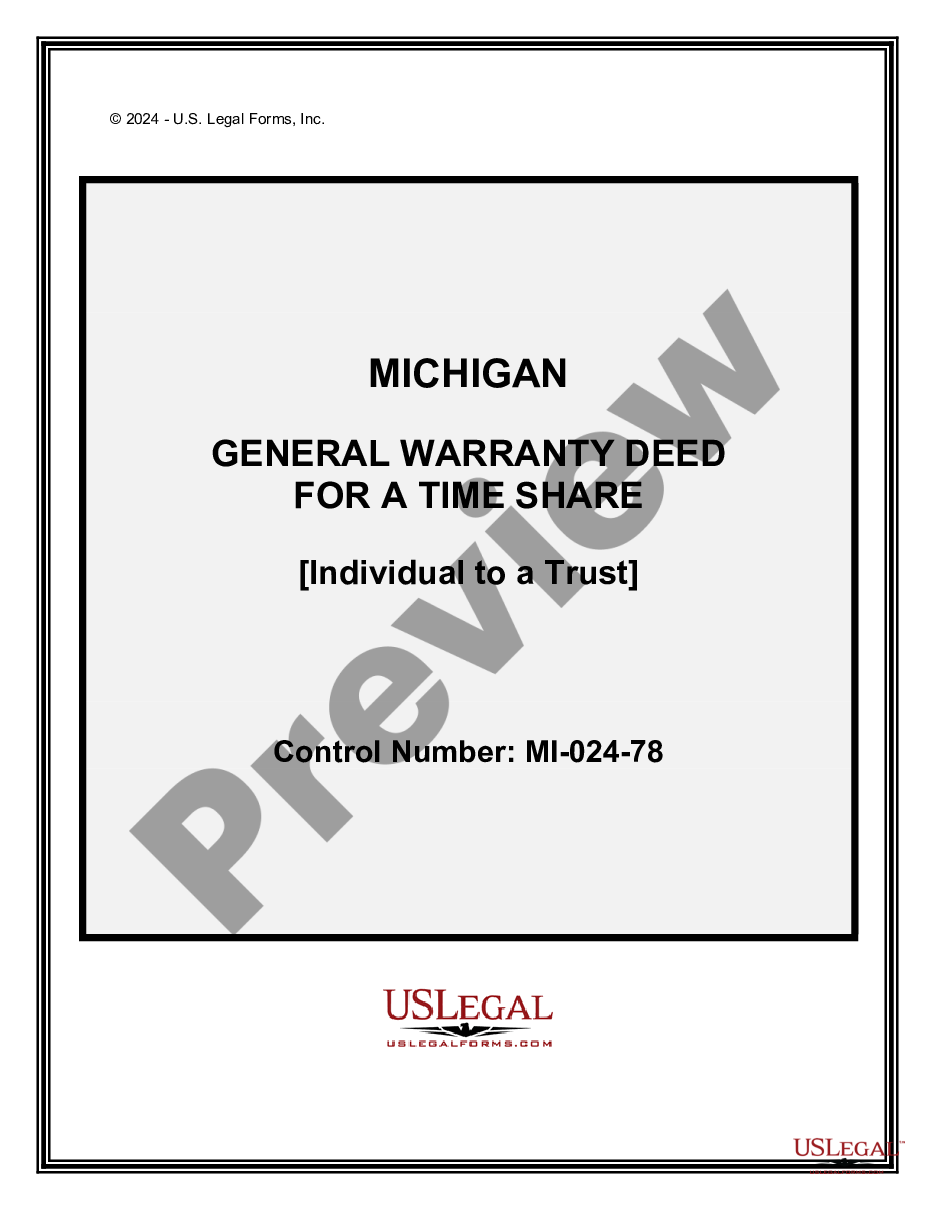

- Very first, ensure that you have chosen the correct file format to the state/city of your choosing. Look at the kind information to make sure you have picked the right kind. If readily available, utilize the Review key to check through the file format too.

- In order to locate yet another version of the kind, utilize the Search area to obtain the format that fits your needs and requirements.

- When you have identified the format you want, simply click Purchase now to proceed.

- Select the costs prepare you want, key in your credentials, and register for a merchant account on US Legal Forms.

- Full the financial transaction. You can use your credit card or PayPal profile to fund the authorized kind.

- Select the structure of the file and obtain it to your device.

- Make modifications to your file if necessary. You can comprehensive, modify and indicator and printing Florida Utilization by a REIT of partnership structures in financing five development projects.

Download and printing thousands of file layouts while using US Legal Forms Internet site, that offers the biggest variety of authorized forms. Use skilled and express-specific layouts to handle your business or specific requirements.

Form popularity

FAQ

REIT is an acronym for Real Estate Investment Trust, which is a company that owns, operates, or finances commercial real estate. A Master Limited Partnership ? MLP for short ? is an entity structure that works as a hybrid of a corporation and a partnership.

Largest Real-Estate-Investment-Trusts by market cap #NameC.1Prologis 1PLD??2American Tower 2AMT??3Equinix 3EQIX??4Simon Property Group 4SPG??56 more rows

A REIT can be a trust, a state law corporation, an LLC, or a partnership (or other type of eligible state law entity), so long as it is taxable as a C corporation.

REITs offer investors the benefits of real estate investment along with the ease and advantages of investing in publicly traded stock. REITs have historically provided investors dividend-based income, competitive market performance, transparency, liquidity, inflation protection and portfolio diversification.

Instead of receiving cash in the sale, the owners of the real estate receive operating partnership (OP) units that can convert into REIT shares. This structure, like the alternative DownREIT, enables real estate investors to continue benefiting from a property after transferring ownership.

?UPREIT? is an acronym that stands for ?Umbrella Partnership Real Estate Investment Trust?. It is a type of property acquisition transaction, where a property owner contributes his/her property to a Real Estate Investment Trust (a ?REIT?) in exchange for ownership in the REIT.

REITs are companies that own (and often operate) income-producing real estate, such as apartments, warehouses, self-storage facilities, malls and hotels. Their appeal is simple: The most reliable REITS have a track record for paying large and growing dividends.

There are three types of REITs: Equity REITs. Most REITs are equity REITs, which own and manage income-producing real estate. ... Mortgage REITs. ... Hybrid REITs.