Florida Form Letters - Notice of Default

Description

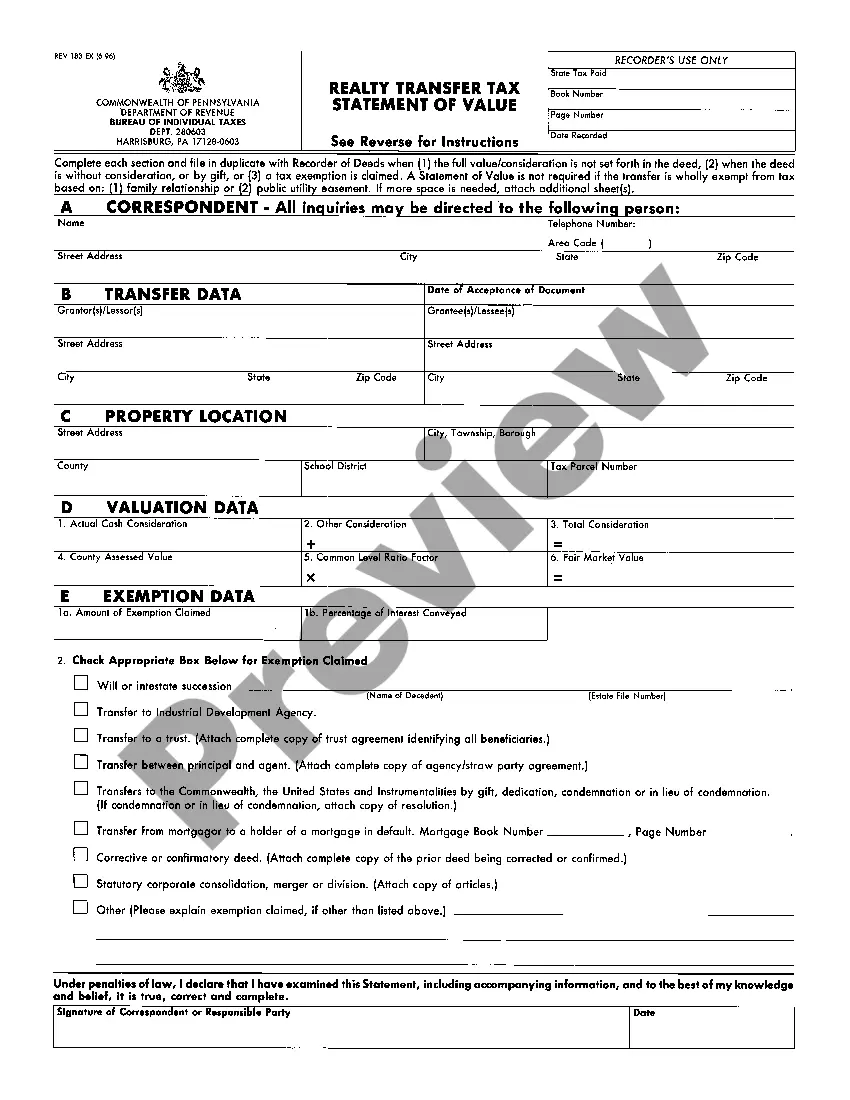

How to fill out Form Letters - Notice Of Default?

Discovering the right legal document template can be quite a have a problem. Naturally, there are tons of templates available on the Internet, but how would you obtain the legal kind you want? Use the US Legal Forms internet site. The services delivers a large number of templates, including the Florida Form Letters - Notice of Default, which you can use for organization and personal requires. Every one of the kinds are examined by pros and satisfy federal and state requirements.

If you are already registered, log in in your accounts and click on the Acquire key to obtain the Florida Form Letters - Notice of Default. Make use of accounts to search through the legal kinds you have purchased earlier. Check out the My Forms tab of your accounts and acquire another copy in the document you want.

If you are a brand new user of US Legal Forms, allow me to share easy recommendations that you should adhere to:

- Initial, be sure you have chosen the right kind to your town/area. You can look through the shape using the Preview key and study the shape description to make certain this is basically the best for you.

- In case the kind is not going to satisfy your needs, use the Seach area to discover the right kind.

- Once you are positive that the shape is acceptable, select the Get now key to obtain the kind.

- Pick the costs prepare you desire and enter in the needed information and facts. Design your accounts and purchase your order making use of your PayPal accounts or Visa or Mastercard.

- Choose the submit file format and acquire the legal document template in your device.

- Total, change and produce and sign the attained Florida Form Letters - Notice of Default.

US Legal Forms is the greatest library of legal kinds where you will find various document templates. Use the company to acquire appropriately-created documents that adhere to express requirements.

Form popularity

FAQ

I am writing to inform you that you are now in default of your obligations outlined in our contract. Your company has not only failed to produce the desired amount of product within the agreed time, but the batch of items you did send us are not fit for purpose. You clearly have not met the required specification.

How Notices of Default Work The name and address of the borrower. The name and address of the lender. The legal address of the property. Full details on the nature of the default. What action is required to cure the default. The deadline and the intentions of the lender if the deadline is passed without a cure.

If you receive a default notice you should: Pay the amount owed and your usual repayment within 30 days. Once you have caught up with repayments, you are no longer in default and the lender cannot start legal action against you.

What is a default notice? This is a letter your creditor sends to warn that you are behind on payments and your account may default. Creditors usually send a default notice after six months of missed or under payments. They will give you at least two weeks to make up missed payments.

Sample Loan Default Letter I am writing to inform you that your loan is now in default. We must receive payment on the total past due amount of by to prevent legal action. If you have overlooked this payment, please pay it in full now. If you need to make an alternate payment arrangement, please call us.

The Florida foreclosure process begins with a ?Notice of Default? when the lender notifies you that you are in default of your mortgage. This is notice that you have fallen behind enough that the lender is beginning foreclosure proceedings. This typically happens after the borrower is more than 3 payments behind.

Technically speaking, a notice of default is not a foreclosure. Instead, it serves as notice that you are behind in your payments and that your property may be sold as a result of foreclosure if you don't act soon.

A notice of default is a statement sent by one contract party to notify another that the latter was in default by failing to fulfil the terms of an agreement and a legal action would follow if the latter continue to default.