Florida Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

If you want to obtain, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the website's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories, states, or keywords.

Every legal document template you acquire is yours indefinitely. You can access each form you downloaded from your account. Select the My documents section and choose a form to print or download again.

Acquire and download, and print the Florida Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Use US Legal Forms to acquire the Florida Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to download the Florida Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Make sure you have selected the form for the appropriate state/country.

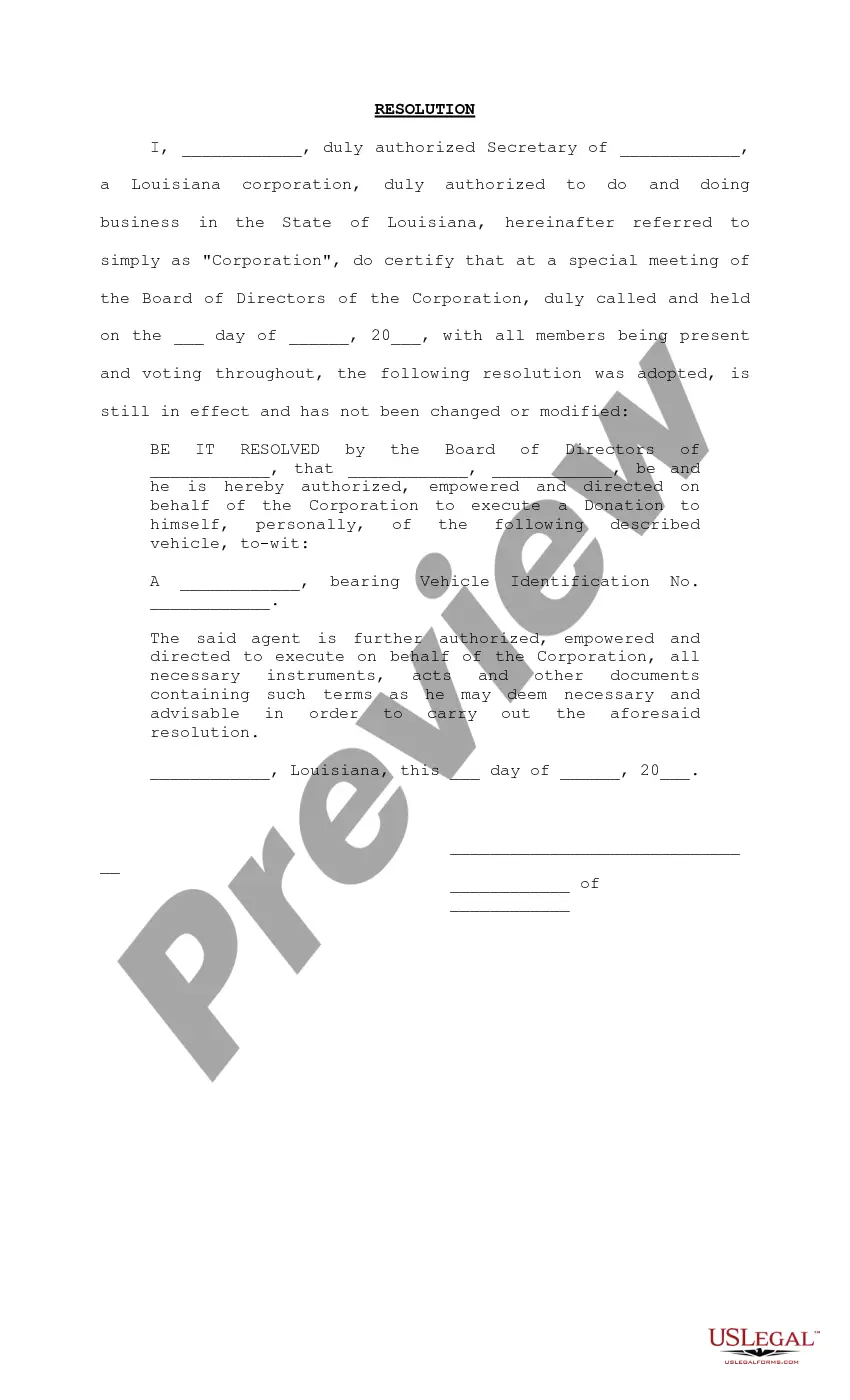

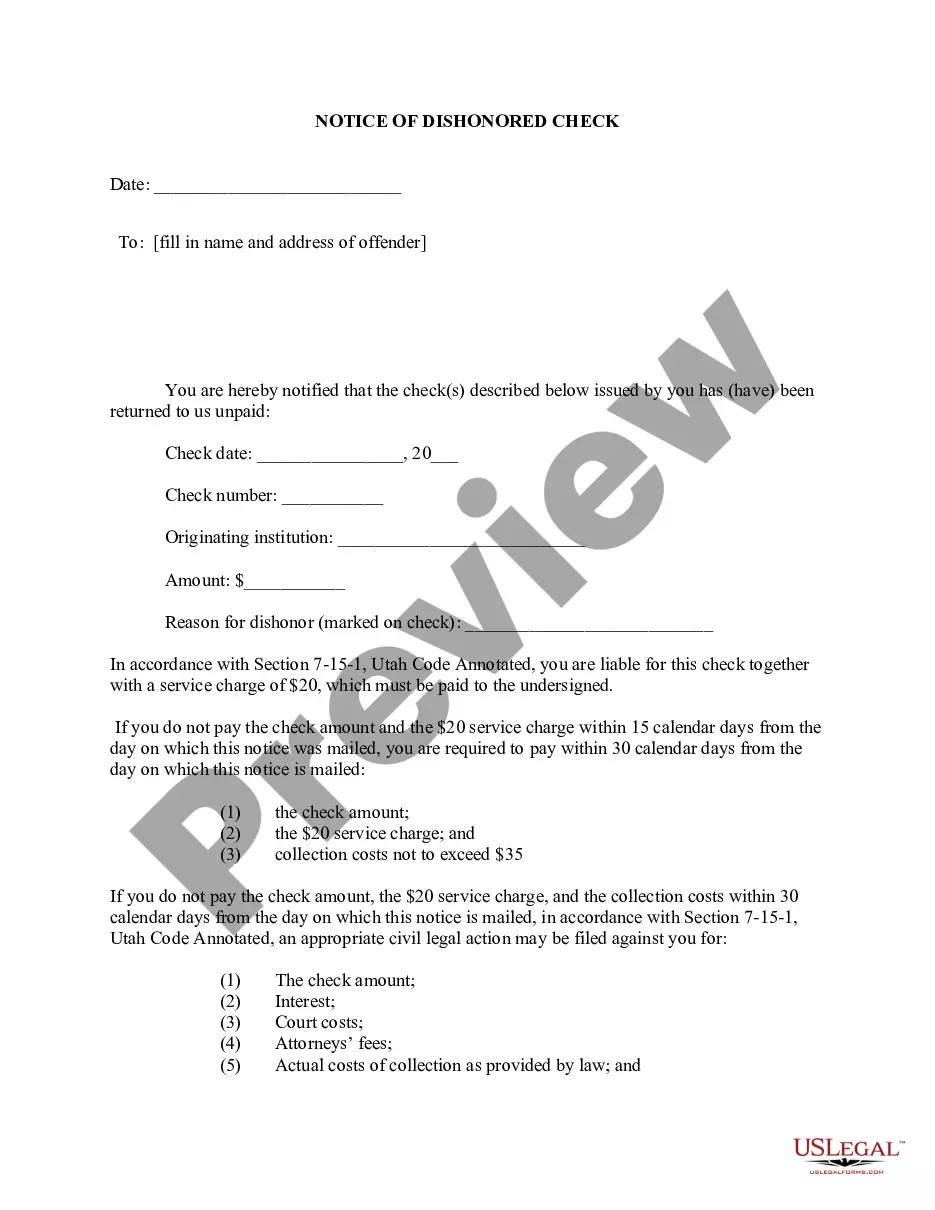

- Step 2. Use the Preview option to examine the form’s content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. After you have found the form you need, select the Buy now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the file format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Florida Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

Form popularity

FAQ

To file a multi-member LLC in Florida, you must submit the necessary forms to the Division of Corporations, including your LLC's name and the registered agent's information. Additionally, drafting an operating agreement and a Florida Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is advisable to outline financial arrangements. Utilizing a service like US Legal Forms can simplify your filing process, ensuring compliance.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

An LLC resolution is a document describing an action taken by the managers or owners of a company, with a statement regarding the issue that needs to be voted on. This does not need to be a complicated document, and need only include necessary information.

Your EIN confirmation letter does show LLC ownership. This is a document sent directly from the IRS (Internal Revenue Service). It will show your EIN, LLC name and the member of the LLC who is the authorized responsible member!

What should a resolution to open a bank account include?LLC name and address.Bank name and address.Bank account number.Date of meeting when resolution was adopted.Certifying signature and date.

A Statement of Organizer is a document that states the initial members or managers of an LLC. The authorized person/organizer at IncNow prepares this document. While the Operating Agreement should be sufficient proof of ownership, some banks require further assurance.

An LLC resolution is a document describing an action taken by the managers or owners of a company, with a statement regarding the issue that needs to be voted on. This does not need to be a complicated document, and need only include necessary information.

To make your new LLC officially exist you must file LLC formation documents (also known as a Certificate of Organization, Certificate of Formation, or Articles of Organization) with the Secretary of State's office or whichever department handles business filings in the state in which you are forming.

Documents Of Resolution (DOR) Documents of Resolution (DORs) are the first tools that establish action plans and time frames, developed by the examiner, to induce and monitor compliance by the credit union officials. They are a step beyond remedial recommendations in the Findings section of an examination report.

A resolution in business refers to a proposal made during a meeting of the company's shareholders or directors. It is discussed, and its approval represents an official confirmation of an action of any kind that will be taken by the company.