Florida Agreement Replacing Joint Interest with Annuity

Description

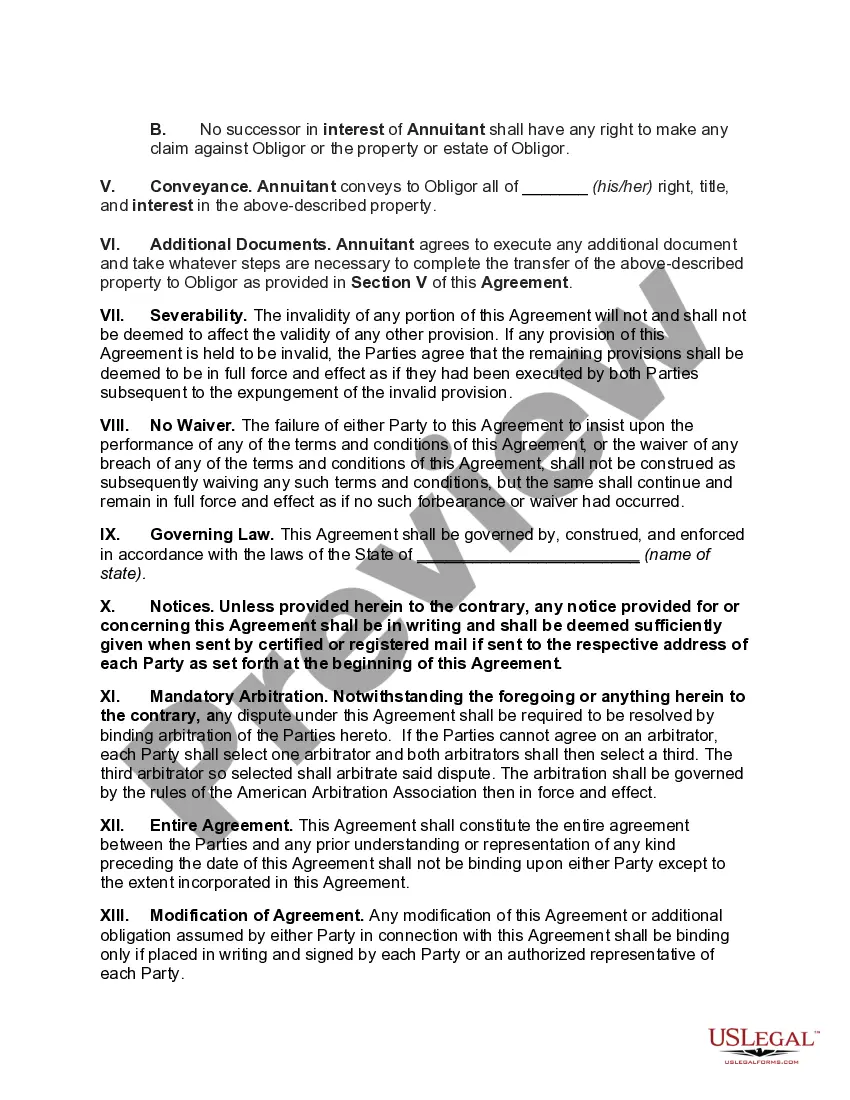

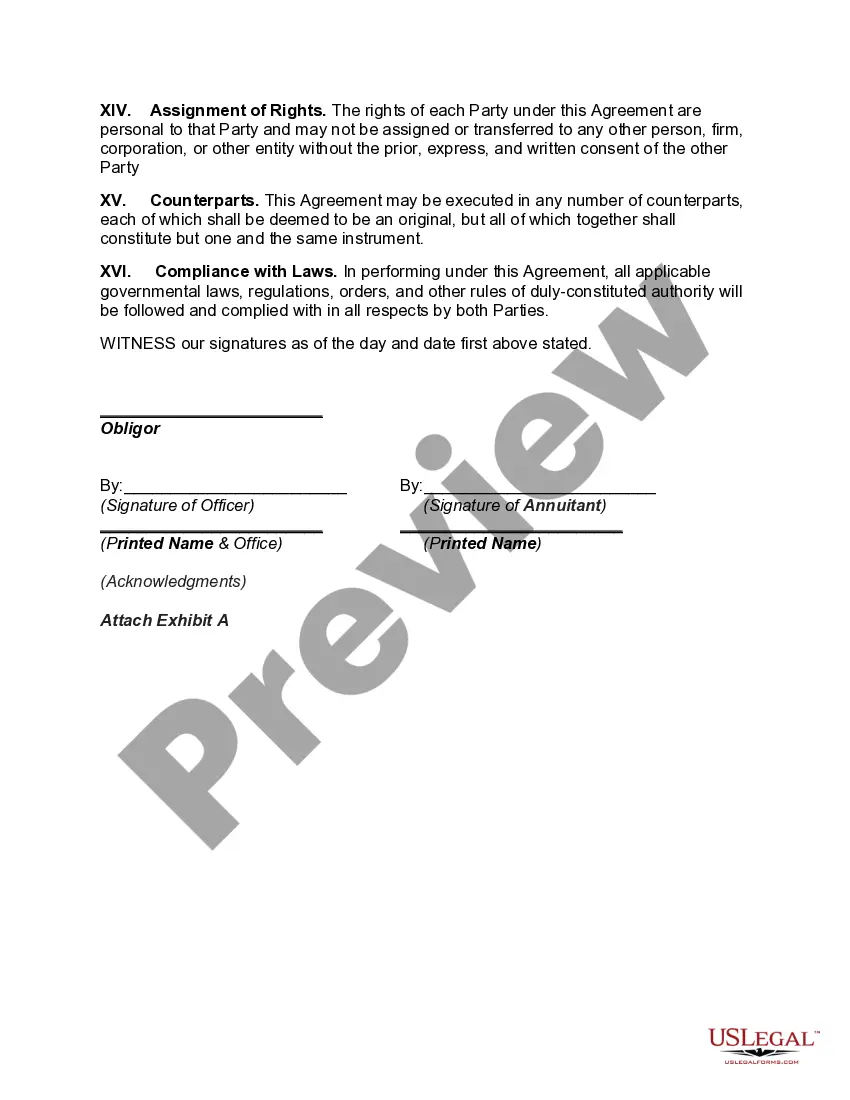

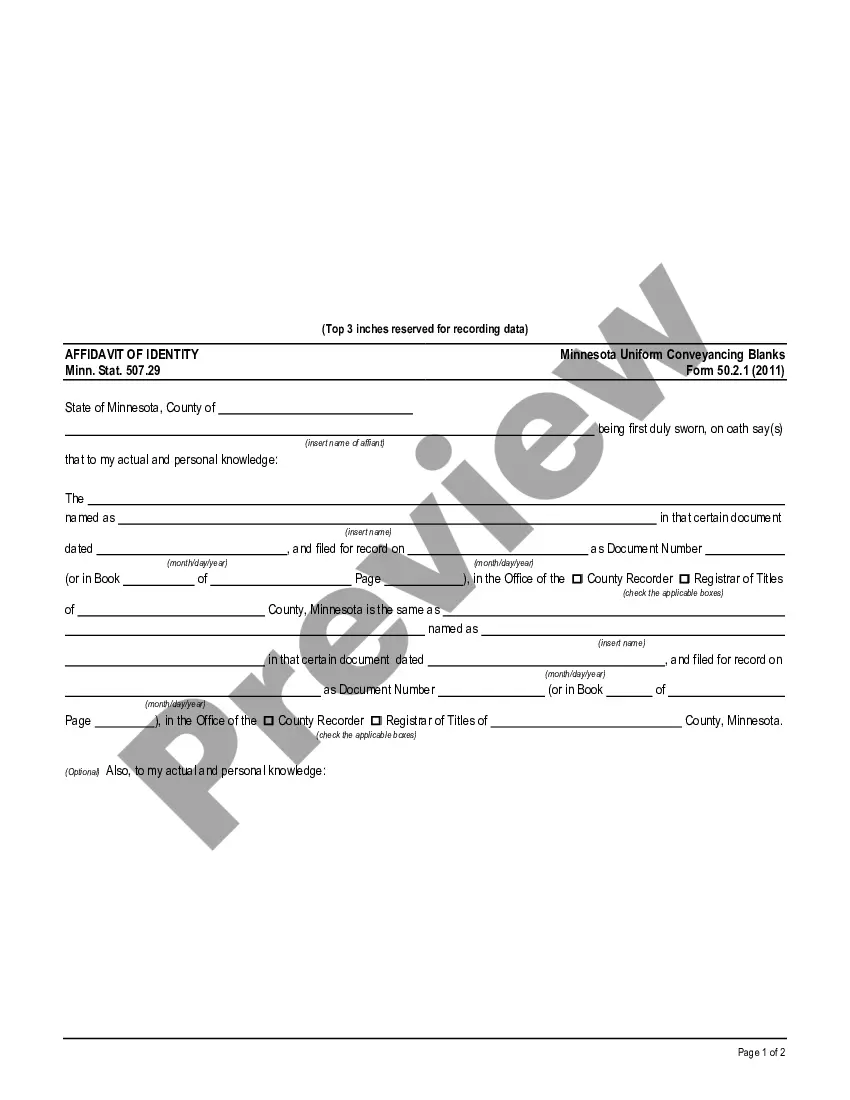

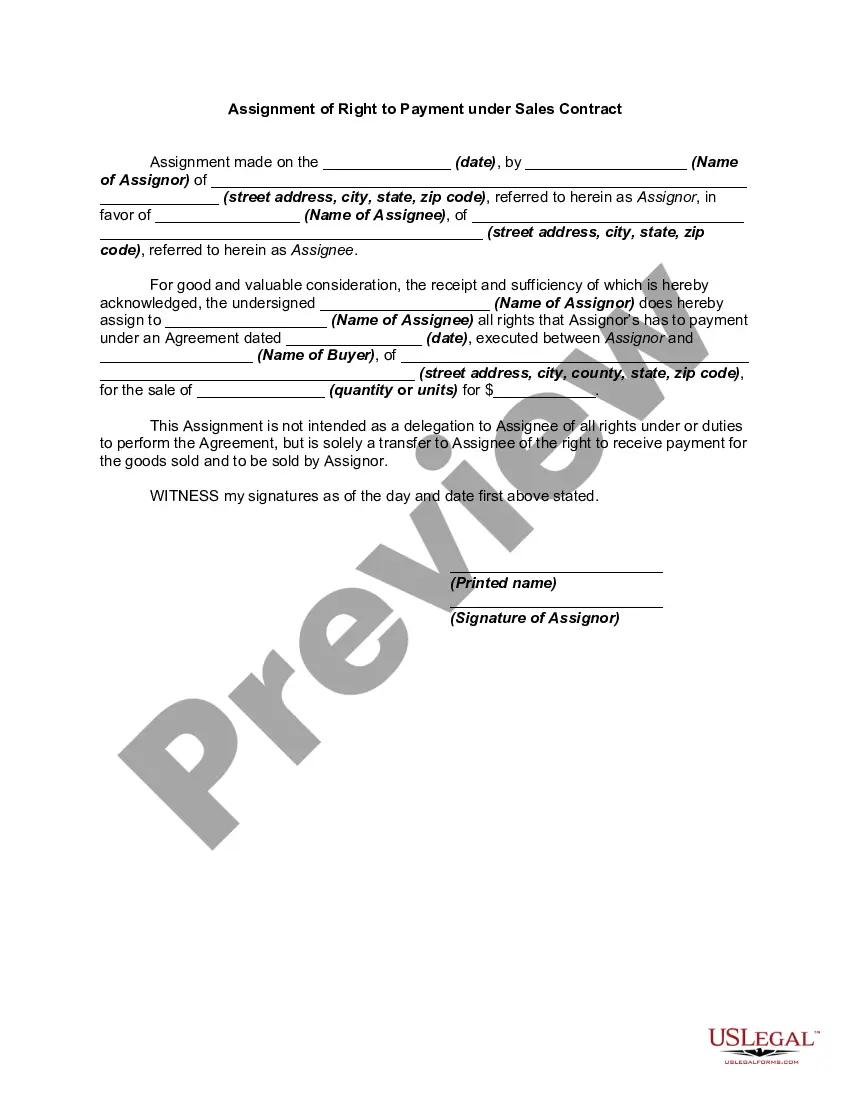

How to fill out Agreement Replacing Joint Interest With Annuity?

US Legal Forms - one of the largest collections of valid forms in the United States - offers a diverse selection of legitimate document templates that you can obtain or create.

By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of documents such as the Florida Agreement Replacing Joint Interest with Annuity in just minutes.

If you already have an account, Log In and obtain the Florida Agreement Replacing Joint Interest with Annuity from the US Legal Forms library. The Obtain button will be visible on every form you view.

Then, choose your preferred pricing plan and provide your details to register for an account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction. Select the format and download the form to your device.

- You can access all previously acquired forms in the My documents section of your account.

- If you are a new user of US Legal Forms, follow these simple steps to get started.

- Ensure you have selected the correct form for the city/state. Click the Preview button to examine the form's content.

- Review the form summary to ensure you have selected the correct one.

- If the form doesn’t meet your needs, use the Search feature at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your decision by clicking the Purchase now button.

Form popularity

FAQ

An annuity operates by accepting deposits that accumulate interest over time. This interest can compound, leading to greater returns as both your initial investment and the accrued interest earn interest. The Florida Agreement Replacing Joint Interest with Annuity can effectively help you understand how this process benefits joint annuitants, ensuring clarity on financial growth.

The owner should be a person, but it can also be a trust that represents the interest of a person. If one owner dies, the joint owner, like a copilot, takes the helm. A corporation can't own an annuity.

Under the ruling, a beneficiary can perform a Section 1035 exchange on an inherited annuity, but the exchange must conform to all the other rules that apply to inherited annuities. Non-qualified annuities can't be rolled over into an individual retirement account or other qualified annuity.

What is a Section 1035 Exchange? A 1035 exchange is a provision in the tax code which allows you, as a policyholder, to transfer funds from a life insurance, endowment or annuity to a new policy, without having to pay taxes.

Annuities outside of an IRA structure can be transferred as a nontaxable event by using the IRS approved 1035 transfer rule. Annuities within an IRA can transfer directly to another IRA with an annuity carrier, and not create any tax consequences as well.

The new owner of the annuity can start receiving payments, change beneficiaries, and cash out the policy whenever they want. To give the annuity away, you simply contact the insurance company and state that you want to gift the ownership of the annuity policy to someone else or a trust.

The new owner of the annuity can start receiving payments, change beneficiaries, and cash out the policy whenever they want. To give the annuity away, you simply contact the insurance company and state that you want to gift the ownership of the annuity policy to someone else or a trust.

So what is not allowable in a 1035 exchange? Single Premium Immediate Annuities (SPIAs), Deferred Income Annuities (DIAs), and Qualified Longevity Annuity Contracts (QLACs) are not allowed because these are irrevocable income contracts.

A joint and survivor annuity is an insurance product designed for couples that continues to make regular payments as long as one spouse lives. A joint and survivor annuity has the advantage of providing income if one or both people live longer than expected.

Jointly owned annuities are similar to annuities owned by a single person in that the death benefit is triggered by the death of one of the owners. This means that although the second owner is still alive, the annuity will pay out the death benefit to the beneficiary.