Florida Private Annuity Agreement

Description

How to fill out Private Annuity Agreement?

You might spend numerous hours online trying to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms provides a multitude of legal documents that can be examined by experts.

You can effortlessly obtain or print the Florida Private Annuity Agreement from the service.

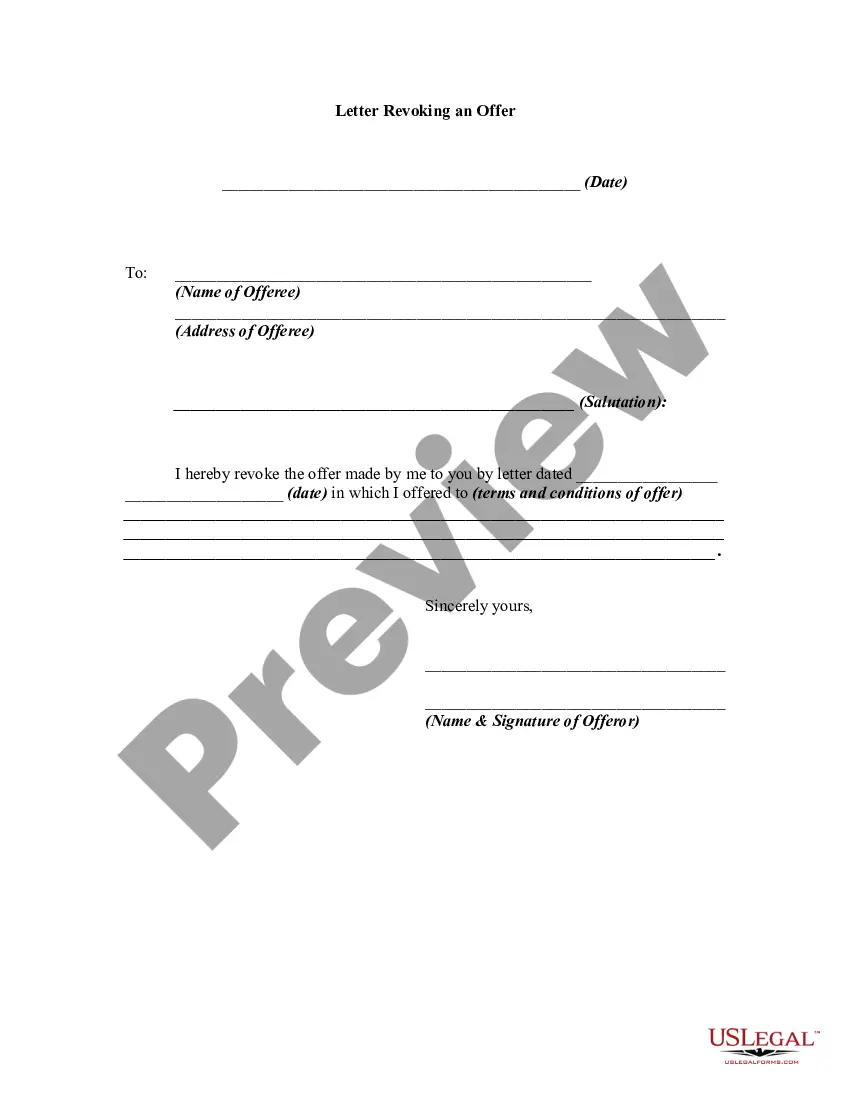

If offered, use the Preview button to view the document template as well. To find another version of your form, utilize the Search field to locate the template that fulfills your needs and requirements.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Florida Private Annuity Agreement.

- Each legal document template you acquire is yours forever.

- To obtain a duplicate of the downloaded form, visit the My documents tab and click the appropriate button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/town of your choice.

- Review the form description to confirm you've chosen the right one.

Form popularity

FAQ

The 10% penalty on annuities generally applies to early withdrawals made before you reach the age of 59½. If you withdraw funds from your Florida Private Annuity Agreement before this age, you may incur this penalty. Understanding these implications is essential for managing your investments wisely. Always consult with a financial advisor to devise strategies that effectively mitigate such penalties.

Insuring the life of the transferee is an available option; however, any connection of the life insurance policy to the private annuity will be deemed as a secured transaction.

A private annuity is a special agreement in which an individual (annuitant) transfers property to an obligor. The obligor agrees to make payments to the annuitant according to an agreed-upon schedule in exchange for the property transfer.

Each annuity payment is treated as part tax-free return of basis, part capital gain, and part ordinary income until your entire basis is recovered. Once your basis is recovered, the entire annuity is treated as part capital gain and part ordinary income until you have surpassed your life expectancy.

Are annuities protected from creditors in Florida? Annuities are perhaps the most popular financial product for asset protection planning. Florida statute 222.14 provides that annuities and annuity proceeds are exempt from creditors.

Thus, annuity payments to an annuitant who was outliving his life expectancy is taxed as ordinary income. Additionally, the annuity payment must be based on IRS actuarial tables and cannot be related in any way to the amount of income earned by the asset; otherwise, the asset will be included in the annuitant's estate.

If an annuity owner is a Florida resident and the insurance company licensed to sell annuities in Florida becomes insolvent, a fixed deferred annuity will be guaranteed by the Florida Life & Health Insurance Guaranty Association (FLHIGA) for up to an aggregate amount of $250,000.