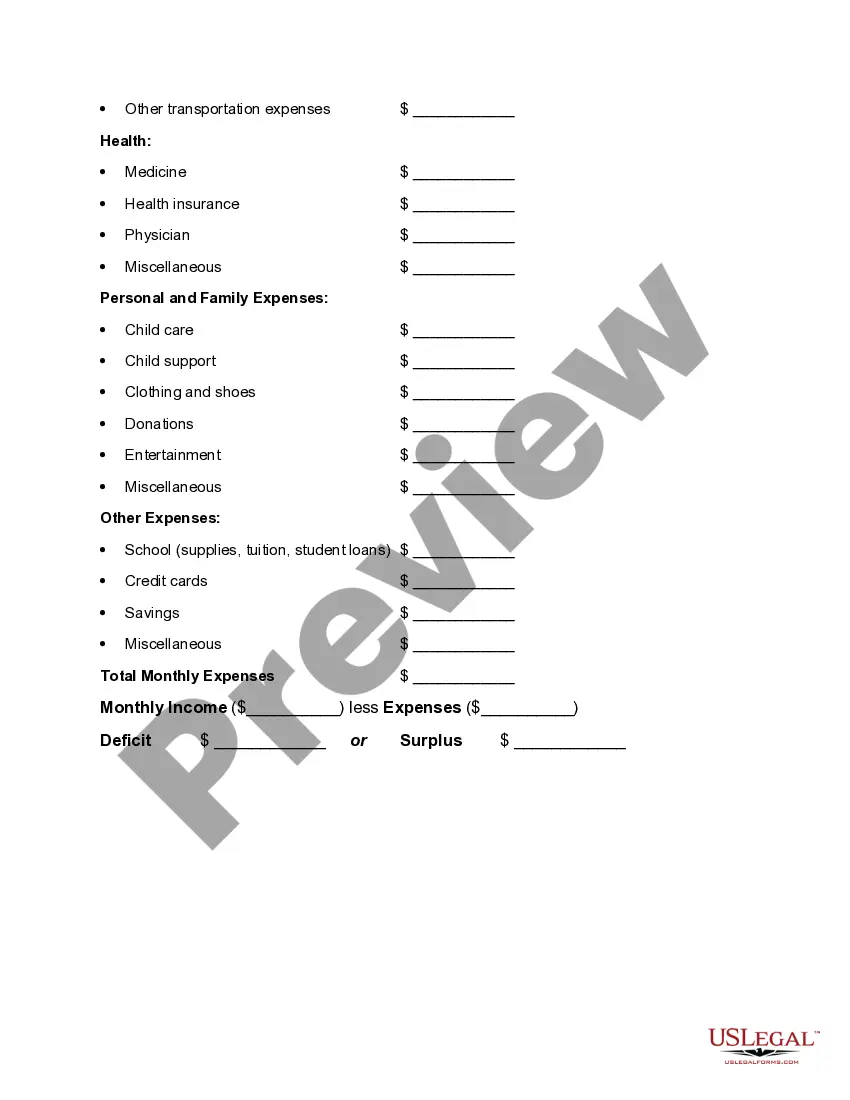

Florida Worksheet for Making a Budget

Description

How to fill out Worksheet For Making A Budget?

You can spend hours online trying to locate the legal document template that fits both state and federal requirements you need.

US Legal Forms provides thousands of legal documents that are vetted by experts.

You can effortlessly obtain or print the Florida Worksheet for Creating a Budget from my services.

If available, utilize the Preview button to review the document template as well.

- If you have a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can fill out, modify, print, or sign the Florida Worksheet for Creating a Budget.

- Every legal document template you purchase is yours permanently.

- To access another copy of a purchased form, visit the My documents section and click the respective button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions listed below.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Check the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

A simple, step-by-step guide to creating a budget in Google SheetsStep 1: Open a Google Sheet.Step 2: Create Income and Expense Categories.Step 3: Decide What Budget Period to Use.Step 4: Use simple formulas to minimize your time commitment.Step 5: Input your budget numbers.Step 6: Update your budget.

How to Make a Budget Plan: 6 Easy StepsSelect your budget template or application.Collect all your financial paperwork or electronic bill information.Calculate your monthly income.Establish a list of your monthly expenses.Categorize your expenses and designate spending values.Adjust your budget accordingly.

How to Create a Monthly Budget in 6 StepsTOTAL YOUR MONTHLY TAKE-HOME PAY.ADD UP WHAT YOU SPEND ON FIXED EXPENSES.ADD UP WHAT YOU SPEND ON NON-MONTHLY COSTS.ADD UP CONTRIBUTIONS TO FINANCIAL GOALS.ADD UP YOUR DISCRETIONARY SPENDING.DO SOME SIMPLE MATH.

The Easy (and Free) Way to Make a Budget SpreadsheetStep 1: Pick Your Program. First, select an application that can create and edit spreadsheet files.Step 2: Select a Template.Step 3: Enter Your Own Numbers.Step 4: Check Your Results.Step 5: Keep Going or Move Up to a Specialized App.

5 Steps to Creating a BudgetStep 1: Determine Your Income. This amount should be your monthly take-home pay after taxes and other deductions.Step 2: Determine Your Expenses.Step 3: Choose Your Budget Plan.Step 4: Adjust Your Habits.Step 5: Live the Plan.

7 Steps to a Budget Made EasyStep 1: Set Realistic Goals.Step 2: Identify your Income and Expenses.Step 3: Separate Needs and Wants.Step 4: Design Your Budget.Step 5: Put Your Plan Into Action.Step 6: Seasonal Expenses.Step 7: Look Ahead.

How to Make a Budget Plan: 6 Easy StepsSelect your budget template or application.Collect all your financial paperwork or electronic bill information.Calculate your monthly income.Establish a list of your monthly expenses.Categorize your expenses and designate spending values.Adjust your budget accordingly.

Senator Elizabeth Warren popularized the so-called "50/20/30 budget rule" (sometimes labeled "50-30-20") in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

A budget should include your income, savings, debt repayment, and general expenses.Income. To calculate your total income, you need to account for all of your different income sources.Savings (Including Retirement)Debt Repayment.General Expenses.