Florida LLC Operating Agreement for Husband and Wife

Description

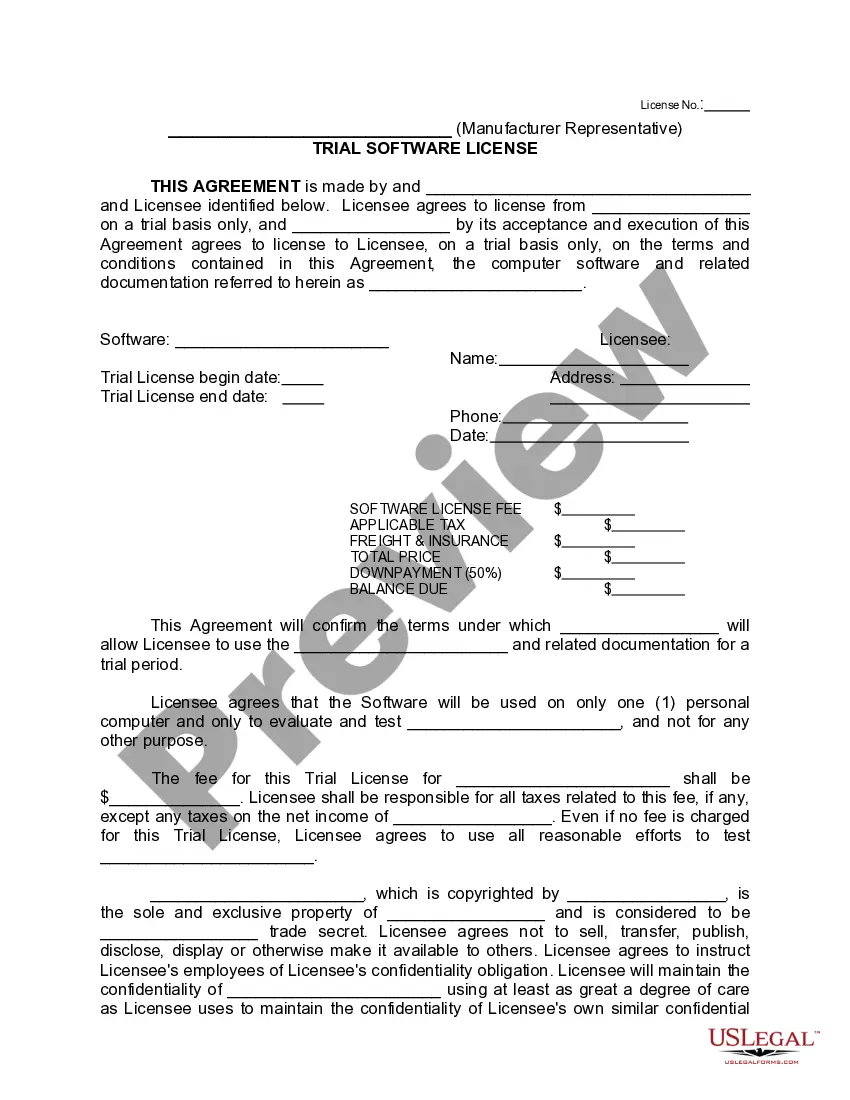

How to fill out LLC Operating Agreement For Husband And Wife?

It is feasible to spend hours online searching for the legal document template that meets your state and federal requirements.

US Legal Forms offers a vast array of legal forms that can be reviewed by experts.

You can obtain or print the Florida LLC Operating Agreement for Husband and Wife from our service.

To find another version of the form, use the Search field to locate the template that suits your needs and requirements.

- If you have a US Legal Forms account, you can sign in and click on the Download button.

- Then, you can complete, modify, print, or sign the Florida LLC Operating Agreement for Husband and Wife.

- Every legal document template you obtain is yours permanently.

- To acquire another copy of the purchased form, visit the My documents tab and click on the respective button.

- If you are using the US Legal Forms site for the first time, follow the basic instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the form description to confirm you have chosen the correct one.

Form popularity

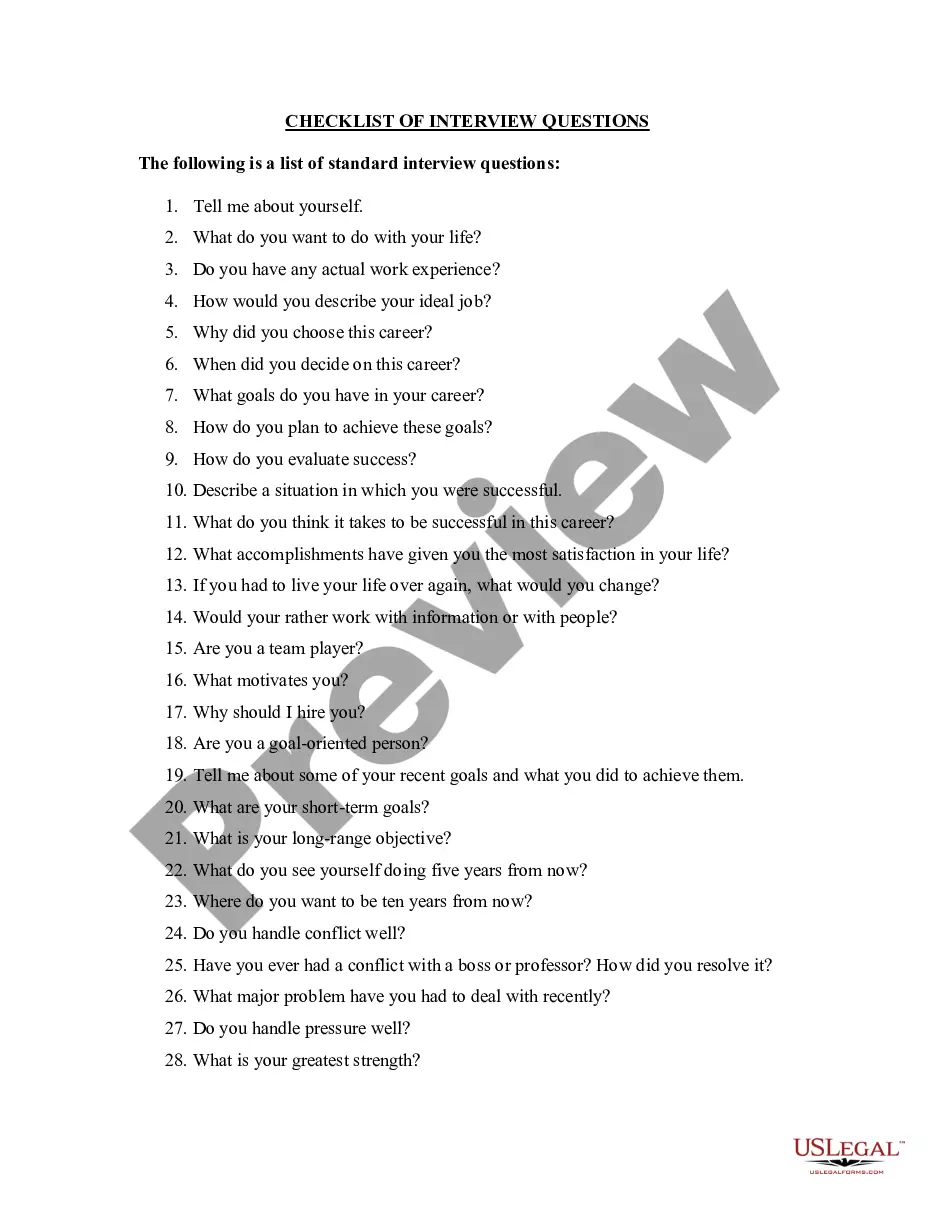

FAQ

member LLC in Florida is a business structure owned by one individual, offering flexibility and liability protection. This setup is beneficial for many, and having a Florida LLC Operating Agreement for Husband and Wife can enhance clarity and organization, even for a single member.

While a single-member LLC in Florida is not legally required to have an operating agreement, it is advisable to create one. A Florida LLC Operating Agreement for Husband and Wife can help clarify your intentions and business operations even if there is only one owner.

If a sole LLC owner dies without an operating agreement, Florida law may not automatically grant ownership to the spouse. To ensure a smooth transition of ownership, having a Florida LLC Operating Agreement for Husband and Wife is crucial, as it explicitly states ownership and management succession.

If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC.

Income taxes from your LLC are based on your personal salary and profit from the business. If you choose to set up your LLC with just one spouse as a member, you can classify it as a sole proprietorship or a corporation. If your LLC has more than one member, you can classify it as a partnership or corporation.

Under this rule, a married couple can treat their jointly owned business as a disregarded entity for federal tax purposes if: the LLC is wholly owned by the husband and wife as community property under state law. no one else would be considered an owner for federal tax purposes, and.

This is the case in Florida and any other states that have adopted the Model Act. c. Hold the interest in a single member LLC as tenants by the entirety between husband and spouse.

If an LLC is owned by a husband and wife in a non-community property state the LLC should file as a partnership. However, in community property states you can have your multi-member (husband and wife owners) and that LLC can get treated as a SMLLC for tax purposes.

Since Florida is a non-community property state, a LLC owned by a husband and wife would then be deemed a partnership for IRS purposed and should file its returns accordingly. However, each spouse would now be potentially personally liable for various federal and state taxes; along with judgments from creditors.

Under this rule, a married couple can treat their jointly owned business as a disregarded entity for federal tax purposes if: the LLC is wholly owned by the husband and wife as community property under state law.