Florida Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages

Description

How to fill out Agreement Waiving Right Of Inheritance Between Husband And Wife In Favor Of Children By Prior Marriages?

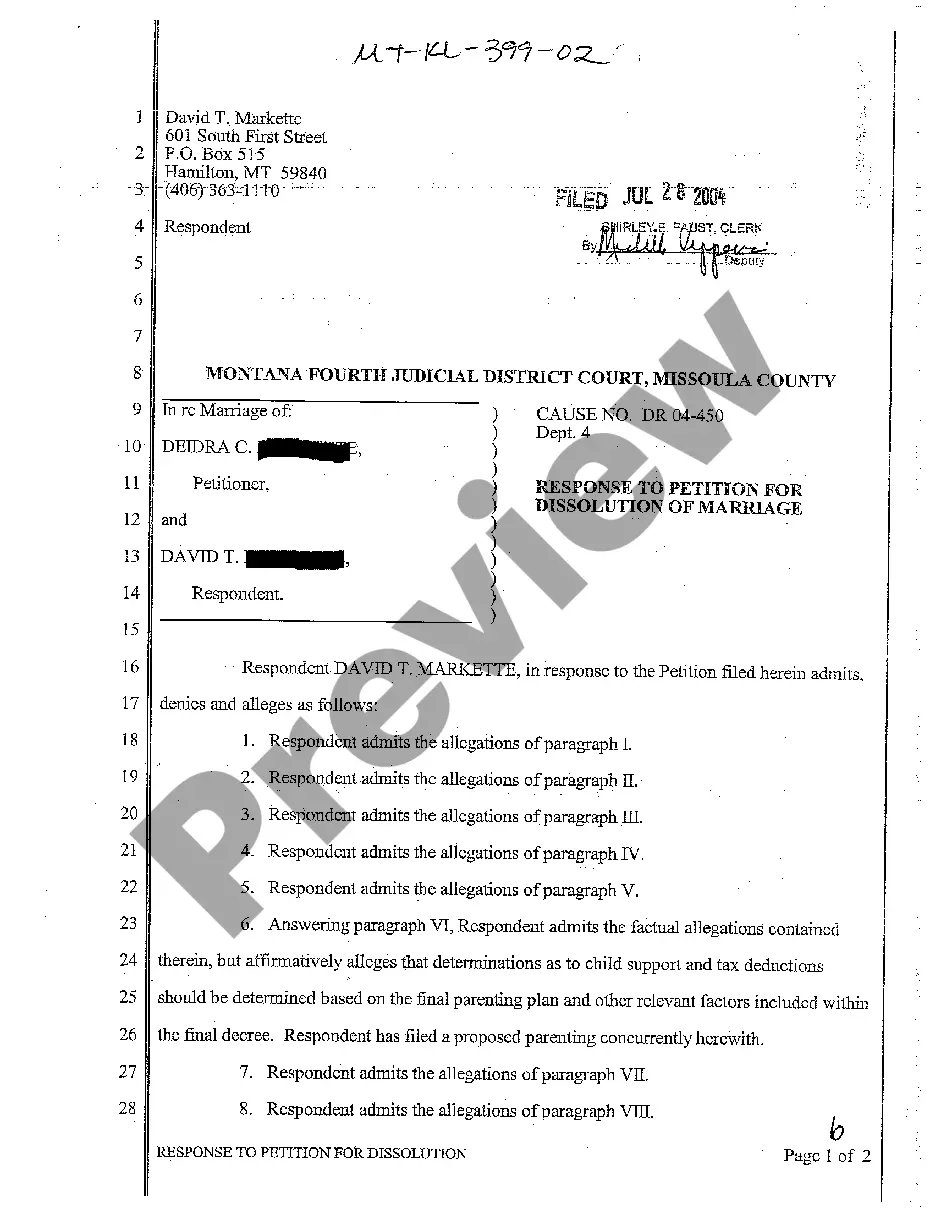

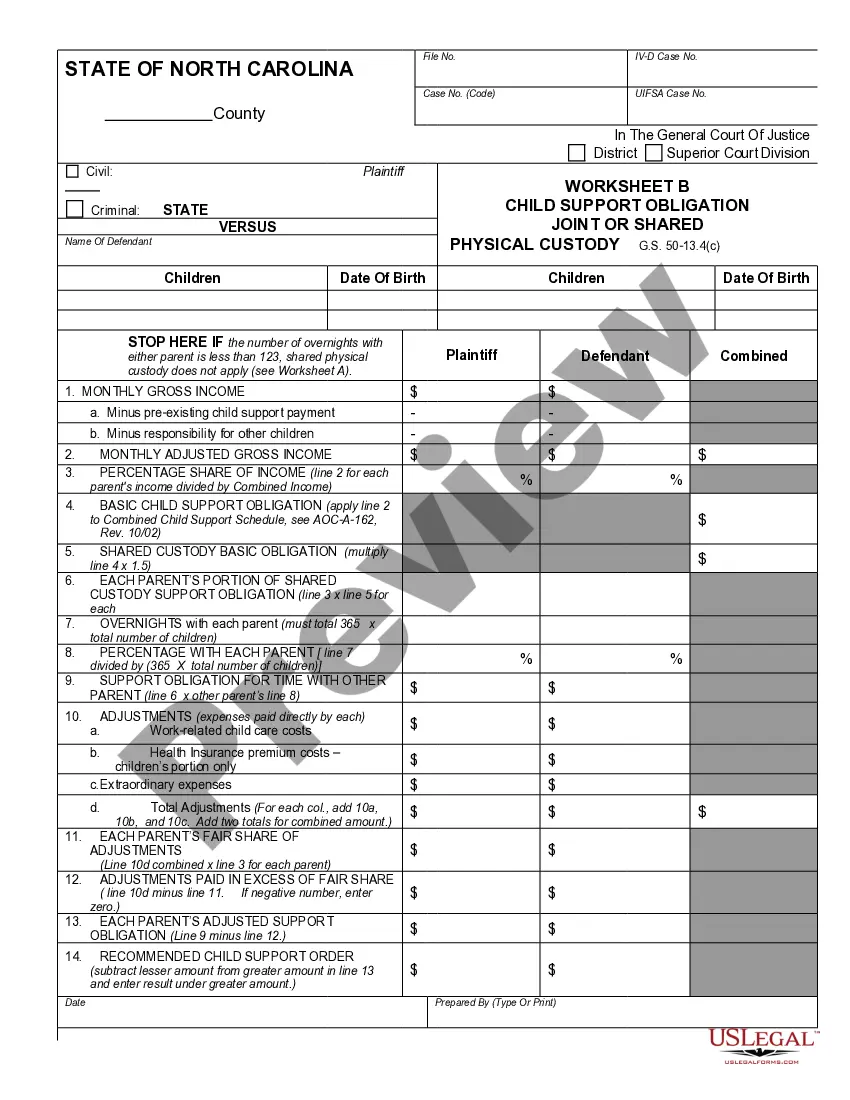

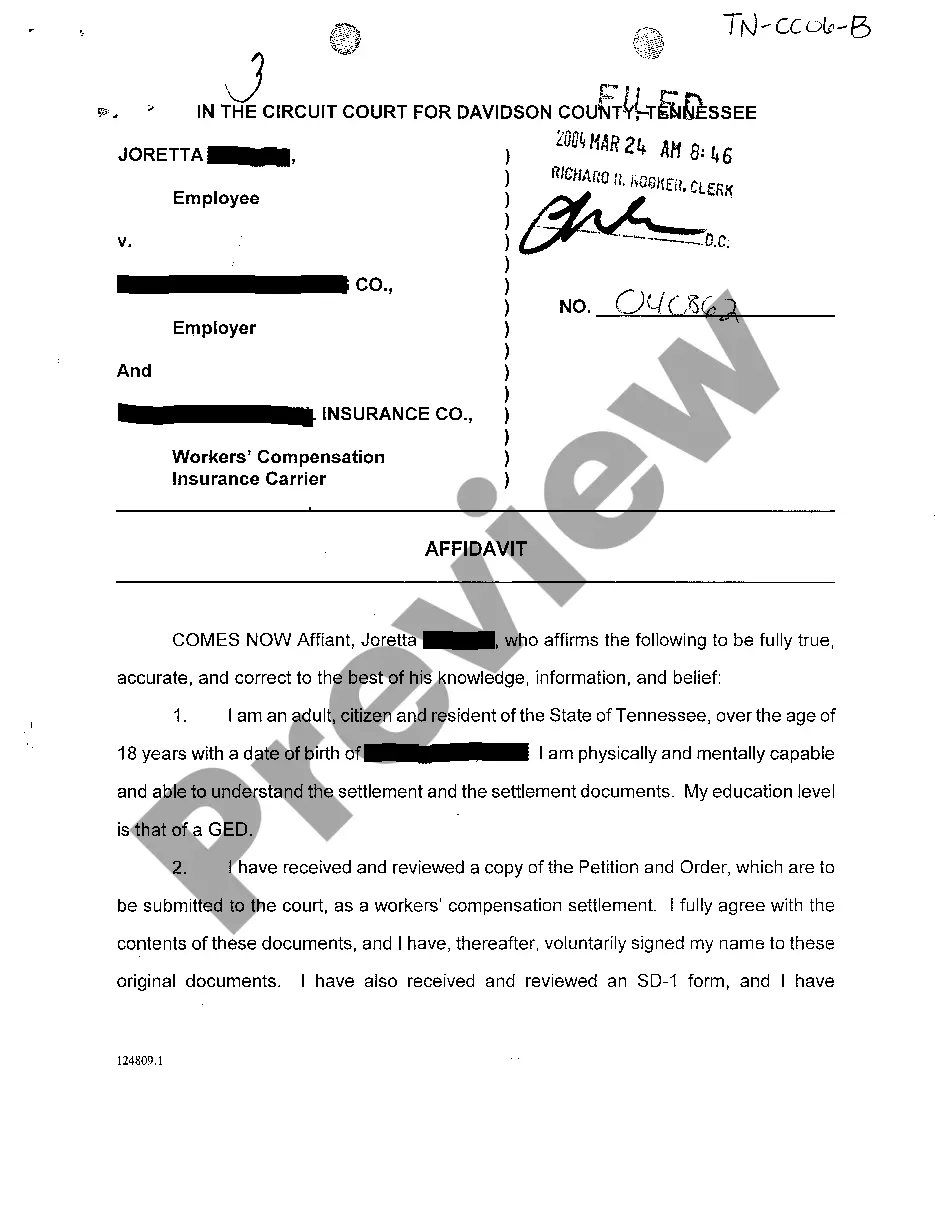

If you wish to full, down load, or produce lawful record layouts, use US Legal Forms, the biggest assortment of lawful kinds, that can be found on the Internet. Make use of the site`s simple and handy look for to find the paperwork you want. Various layouts for enterprise and personal functions are sorted by classes and suggests, or keywords. Use US Legal Forms to find the Florida Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages in just a handful of clicks.

When you are presently a US Legal Forms consumer, log in to the accounts and click the Obtain button to obtain the Florida Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages. You can also entry kinds you previously saved in the My Forms tab of your own accounts.

If you are using US Legal Forms the first time, follow the instructions under:

- Step 1. Ensure you have selected the shape for the appropriate area/nation.

- Step 2. Utilize the Preview solution to look over the form`s information. Don`t overlook to see the description.

- Step 3. When you are unhappy with all the type, take advantage of the Research discipline on top of the monitor to locate other versions of your lawful type template.

- Step 4. After you have located the shape you want, click the Get now button. Opt for the prices strategy you like and include your references to sign up on an accounts.

- Step 5. Procedure the purchase. You may use your bank card or PayPal accounts to complete the purchase.

- Step 6. Select the file format of your lawful type and down load it in your gadget.

- Step 7. Complete, change and produce or sign the Florida Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages.

Every lawful record template you get is your own property permanently. You may have acces to every single type you saved in your acccount. Click on the My Forms segment and choose a type to produce or down load once more.

Compete and down load, and produce the Florida Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages with US Legal Forms. There are millions of professional and condition-certain kinds you may use for your enterprise or personal requirements.

Form popularity

FAQ

However, it is defined the same way as ?heirs of law? under the Florida probate code. In both cases, a person's next of kin in Florida are their: Current spouse. Children, grandchildren and great-grandchildren (biological and adopted)

When a person leaving an estate dies without being survived by any person entitled to it, the property will be turned over to the state. NOTE: Stepchildren are not considered lineal descendants per Section 732.103, Florida Statutes. Adopted children have the same status as natural children.

Florida Intestate Succession The first to inherit is the surviving spouse. There must be a valid marriage to be a surviving spouse. If there are no children, the spouse gets everything. Next in line are the children.

Ing to the Florida Probate Code, in most cases, the surviving spouse will be entitled to some or all of the estate, including the following: Elective share of any cash and investments. Family allowance. Homestead property.

Inheritance laws typically prioritize spouses and children, but the amount and percentage each receives can vary. If the deceased had a will, assets distribution will be as per the will. However, the surviving spouse may still have certain rights to a portion of the estate, depending on the jurisdiction.

Florida elective share law prevents surviving spouses from being denied a share of the trust, estate or property. This law entitles a surviving spouse to a portion of the deceased spouse's estate, regardless of what the will says. Surviving spouses can override the Will's terms to receive 30% of the estate.

Here's how it works: In Florida, if you die without a will, and you're married, your spouse will get all of your estate assets, even if you have children. However, if you have children from a previous relationship, your spouse will only inherit half of your estate, and your children will inherit the other half.

Form for Waiver of Spousal Rights Like I mentioned before, there is no specific form for a waiver of spousal rights in Florida. A spouse can waive all rights all just an individual right. Typically, the right that is waived the most often is the Florida Homestead due to its restrictions.