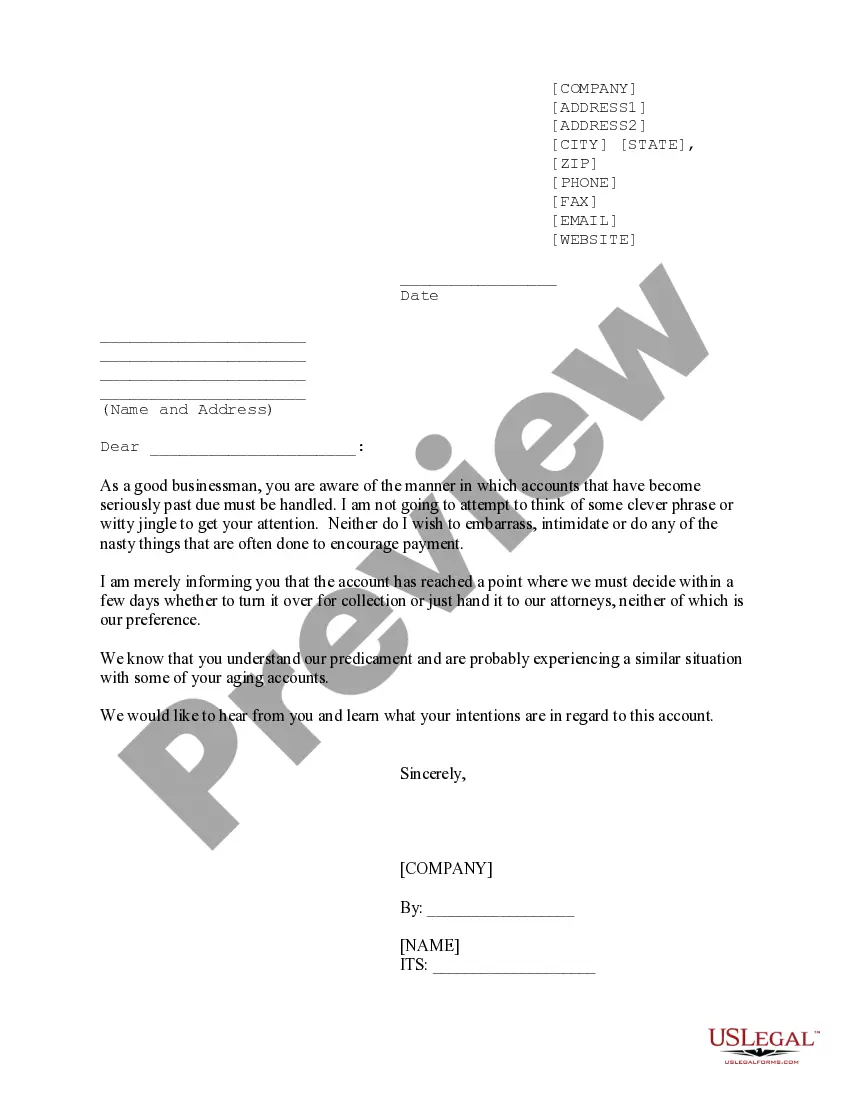

Florida Sample of a Collection Letter to Small Business in Advance

Description

How to fill out Sample Of A Collection Letter To Small Business In Advance?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a vast selection of legal document templates that you can download or create.

Utilizing the website, you can access thousands of forms for business and personal uses, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Florida Sample of a Collection Letter to Small Business in Advance within moments.

If you already have a subscription, Log In and download the Florida Sample of a Collection Letter to Small Business in Advance from the US Legal Forms library. The Download button will appear on every form you examine. You can find all previously downloaded forms in the My documents section of your account.

Make modifications. Fill out, edit, and print and sign the downloaded Florida Sample of a Collection Letter to Small Business in Advance.

Every template you add to your account does not have an expiration date and is yours forever. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Gain access to the Florida Sample of a Collection Letter to Small Business in Advance with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- If you want to use US Legal Forms for the first time, here are simple instructions to help you get started.

- Make sure you have selected the correct form for your city/county. Click the Preview button to review the form’s details. Check the form summary to ensure you have chosen the right form.

- If the form does not meet your requirements, use the Search area at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase Now button. Then, select the payment plan you prefer and provide your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to make the payment.

- Choose the format and download the form to your device.

Form popularity

FAQ

To write a good collection email, start with a professional subject line that conveys the purpose. In the body, be clear and concise about the debt owed, any relevant due dates, and how they can make payment. Using insights from a Florida sample of a collection letter to small business in advance can improve the effectiveness of your email and ensure you cover key points.

A nice collection letter should remain polite while clearly stating the need for payment. It could begin with a friendly greeting, followed by the details of the outstanding debt, and include an encouragement for timely payment. Referencing a Florida sample of a collection letter to small business in advance can help you find the right balance between firmness and courtesy.

To write a collection statement, present a concise overview of the debt in question. Include the debtor's name, the total amount owed, outstanding charges, and payment options. A Florida sample of a collection letter to small business in advance might offer useful structure when formulating this statement, ensuring all essential details are covered.

A debt collector validation letter is a communication that requests the creditor to provide proof of the debt. This letter typically includes the debtor's information, the amount owed, and a request for verification. You can refer to a Florida sample of a collection letter to small business in advance for clarity on structuring your validation request.

To write a good collection letter, maintain a professional and courteous tone throughout. Clearly state the amount owed, the payment terms, and provide options for payment. Incorporating elements from a Florida sample of a collection letter to small business in advance will help structure your message effectively, ensuring clarity and professionalism.

A collection letter serves as a formal request for payment from a debtor. It explains the outstanding balance, provides context for the debt, and encourages the debtor to settle their account. Utilizing a Florida sample of a collection letter to small business in advance can guide you in drafting a clear and effective communication.

To create a collection letter, start by including your business information and the debtor's details. Use a clear and polite tone, and include the amount owed, a brief payment history, and a due date. A well-crafted Florida sample of a collection letter to small business in advance can serve as an excellent template to ensure all necessary information is included.

A collection notice is a formal communication sent to a debtor to inform them about their outstanding balance. For instance, a Florida sample of a collection letter to small business in advance can clearly outline the amount owed, the due date, and any late fees. This notice helps maintain professionalism while encouraging timely payments.

Start your letter requesting proof of debt with your contact details and the debt collector's information. Politely ask for documentation that validates the debt you owe. Using a Florida Sample of a Collection Letter to Small Business in Advance can help ensure you ask for the right information in a structured and clear manner.

The structure of a collection letter typically includes a header with your information, a greeting, and a clear statement of the debt. Following that, outline the request for payment and include a deadline. Reference a Florida Sample of a Collection Letter to Small Business in Advance for an example of how to format and present your message professionally.