Florida Subscription Receipt

Description

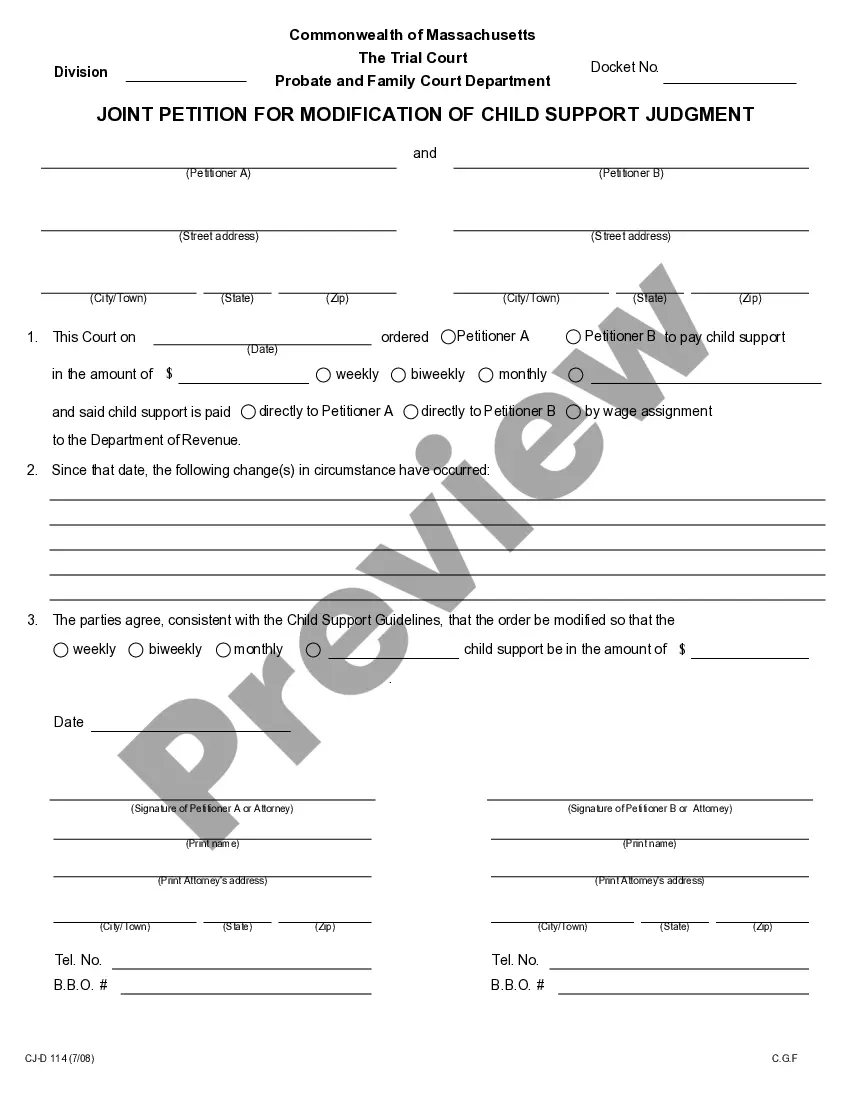

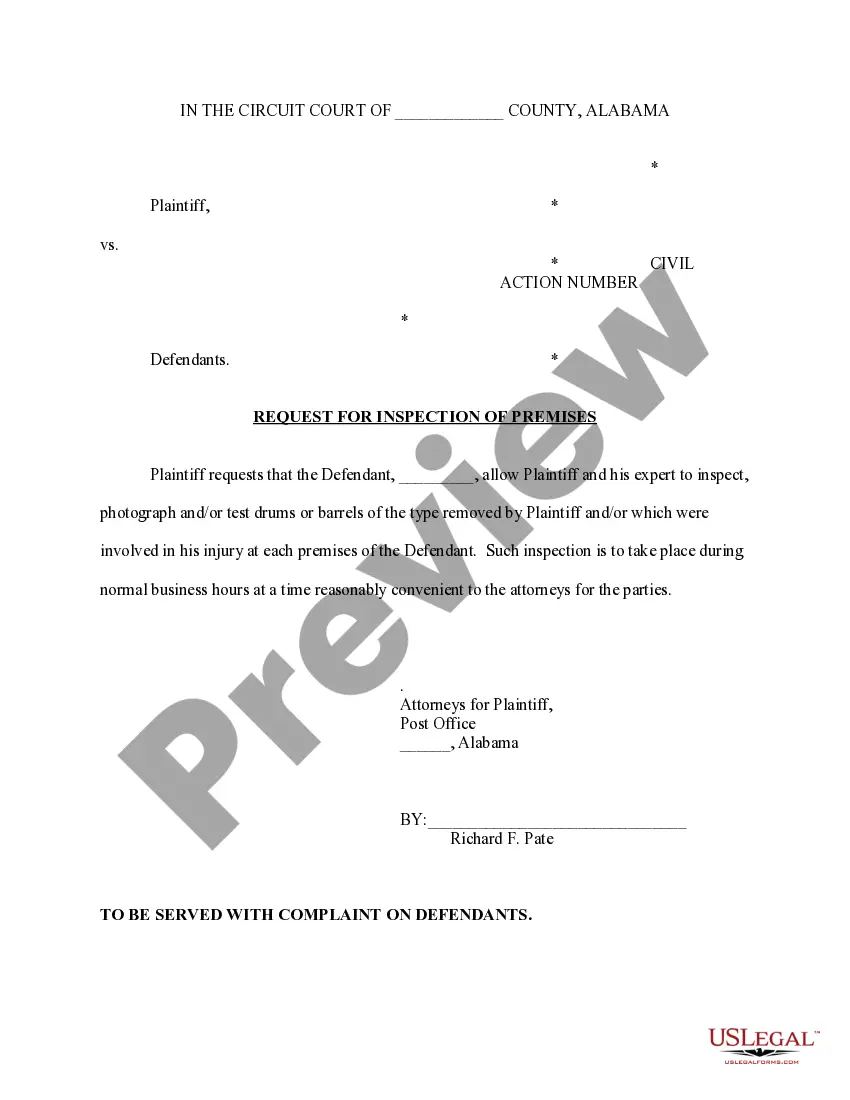

How to fill out Subscription Receipt?

If you need to finalize, acquire, or produce sanctioned document templates, utilize US Legal Forms, the largest array of legal forms available online.

Employ the site`s straightforward and user-friendly search feature to locate the documents you need.

Various templates for business and personal uses are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, select the Purchase now option. Choose the payment plan you desire and enter your details to register for an account.

Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the payment.

- Take advantage of US Legal Forms to procure the Florida Subscription Receipt in just a few clicks.

- If you are currently a US Legal Forms subscriber, Log In to your account and click on the Download button to obtain the Florida Subscription Receipt.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, consult the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Preview feature to review the form`s content. Don`t forget to verify the details.

- Step 3. If you are not satisfied with the form, employ the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

You must pay a tax to operate any business within city limits. A business tax receipt is proof of payment and it is required before a business opens.

Based on the facts provided, the purchase of the subscriptions to the software and cloud-computing services described in your letter is not subject to Florida sales and use tax.

What is a Business Tax Receipt (BTR)? (Formerly known as an Occupational License.) A BTR is a tax for the privilege of engaging in or managing a business, profession, or occupation within the town limits. (The Florida Legislature enacted legislation which amended references to Occupational License.

Florida does not directly address the taxability of digital goods in statute. Even though Florida defines tangible property very broadly, (it even includes electricity), the Florida Department of Revenue has ruled items electronically delivered and lacking physicality are not taxable.

The sale of subscriptions to periodicals that are delivered to a subscriber in this state by a carrier or means other than by mail, such as home delivery, is subject to tax.

Mobile communications and video services are taxed at the total Florida rate of 7.44%, plus applicable local tax rate.

Subscription products are an indirect transaction. The customer pays a subscription fee that covers the cost of goods. The thing to be mindful of is that the products are subject to sales tax. So you have to tax the goods through the monthly subscription fee.

Nearly three years after it became legal to tax all online purchases, the nation's third-largest state is finally about to do so. On Monday, Gov. Ron DeSantis signed into law a plan to require out-of-state online retailers to collect sales taxes on purchases made by Floridians.

In Florida, you will need a general business license, called a business tax receipt, if you provide goods and/or services to the general public whether you are operating your new business at home or in a separate commercial location.

Apple apps / iPhone apps and Android apps are subject to sales tax in many cases. As a consumer, you may want to check recent receipts from these app stores to see if you were charged sales tax for apps you purchased, just as a point of interest.