Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

US Legal Forms - one of the most extensive collections of valid documents in the United States - provides a range of legitimate document templates that you can download or create.

While navigating the website, you will find thousands of documents for business and personal purposes, organized by type, state, or keywords.

You can quickly access the latest versions of documents such as the Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption within moments.

If the document does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

If you are satisfied with the document, confirm your choice by clicking the Purchase now button. Then select the payment plan you prefer and provide your information to create an account.

- If you already have a monthly membership, Log In and download the Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption from the US Legal Forms library.

- The Download button will appear on each document you view.

- You can access all previously downloaded documents in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have chosen the correct document for your locality/region.

- Click the Review button to review the document's content.

Form popularity

FAQ

Yes, you must report your 1099-S.

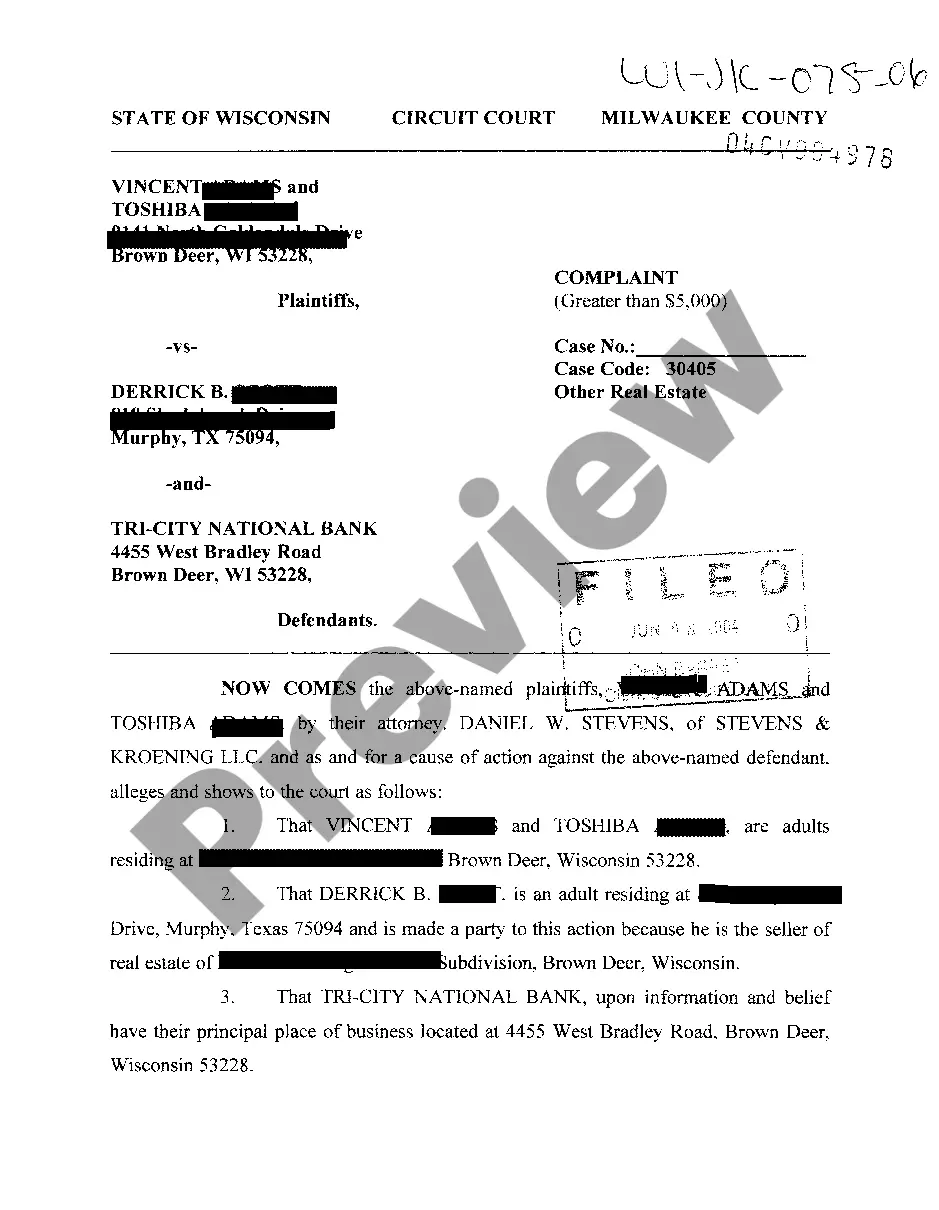

CERTIFICATION FOR NO INFORMATION REPORTING. ON THE SALE OR EXCHANGE OF A PRINCIPAL RESIDENCE. This form may be completed by the seller of a principal residence.

When you sell your home, federal tax law requires lenders or real estate agents to file a Form 1099-S, Proceeds from Real Estate Transactions, with the IRS and send you a copy if you do not meet IRS requirements for excluding the taxable gain from the sale on your income tax return.

You may not always receive a 1099-S form. When selling your home, you may have signed a form certifying you will not have a taxable gain on the sale.

If you are looking for 1099s from earlier years, you can contact the IRS and order a wage and income transcript. The transcript should include all of the income that you had as long as it was reported to the IRS. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS.

If you have not received an expected 1099 by a few days after that, contact the payer. If you still do not get the form by February 15, call the IRS for help at 1-800- 829-1040. In some cases, you may obtain the information that would be on the 1099 from other sources.

The form you are referring to Certification for No Information Reporting on the Sale or Exchange of a Principal Residence is a form which is to be completed by the seller of a principal residence in order to determine whether the sale or exchange needs to be reported to the IRS on Form 1099-S, Proceeds

The form you are referring to Certification for No Information Reporting on the Sale or Exchange of a Principal Residence is a form which is to be completed by the seller of a principal residence in order to determine whether the sale or exchange needs to be reported to the IRS on Form 1099-S, Proceeds

File Form 1099-S, Proceeds From Real Estate Transactions, to report the sale or exchange of real estate.