Florida Sales Receipt

Description

How to fill out Sales Receipt?

Are you currently in a situation where you frequently require documents for business or particular tasks almost every day.

There are numerous authentic document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Florida Sales Receipt, which are designed to meet federal and state regulations.

Once you find the appropriate form, click Purchase now.

Choose your preferred pricing plan, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Florida Sales Receipt template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the template you need and ensure it corresponds to the correct city/region.

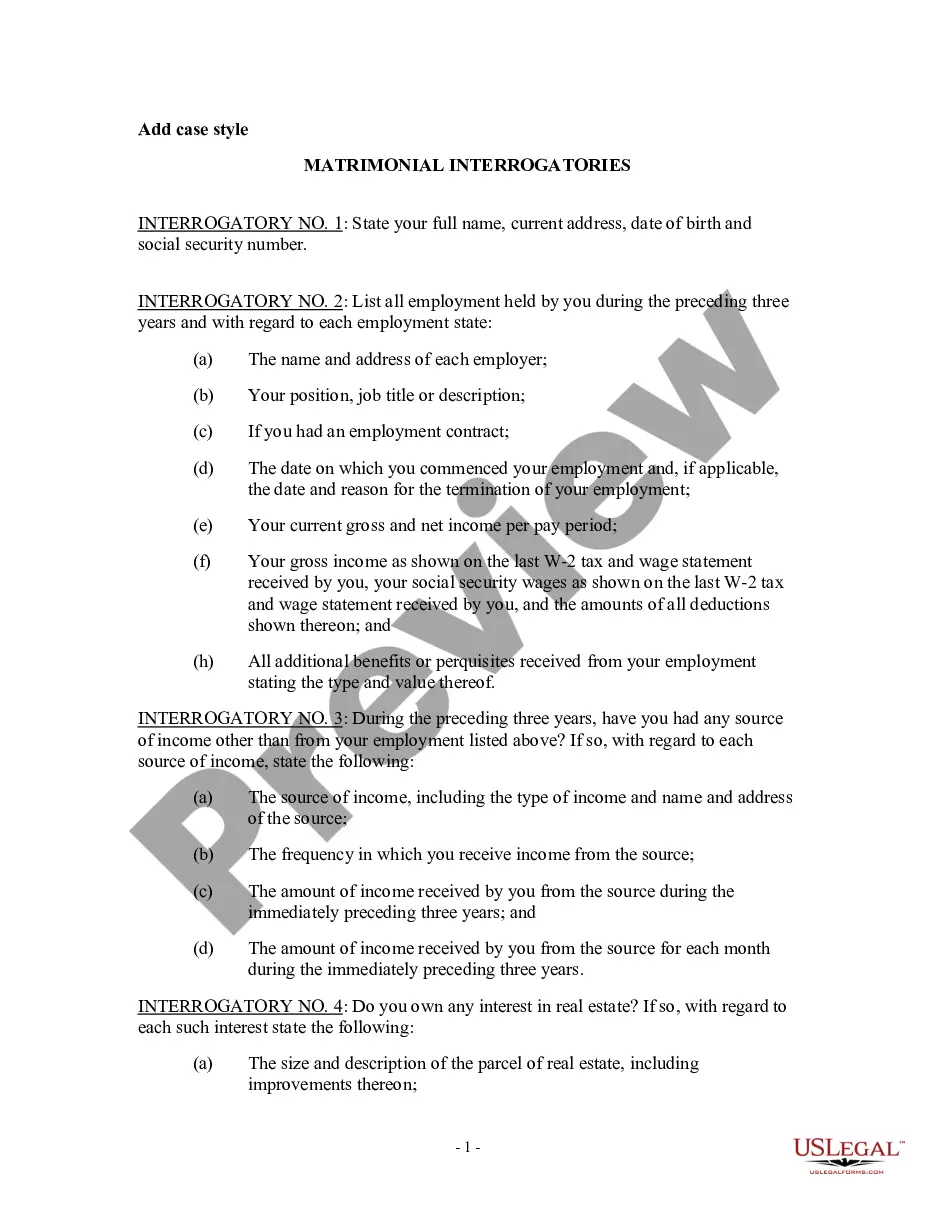

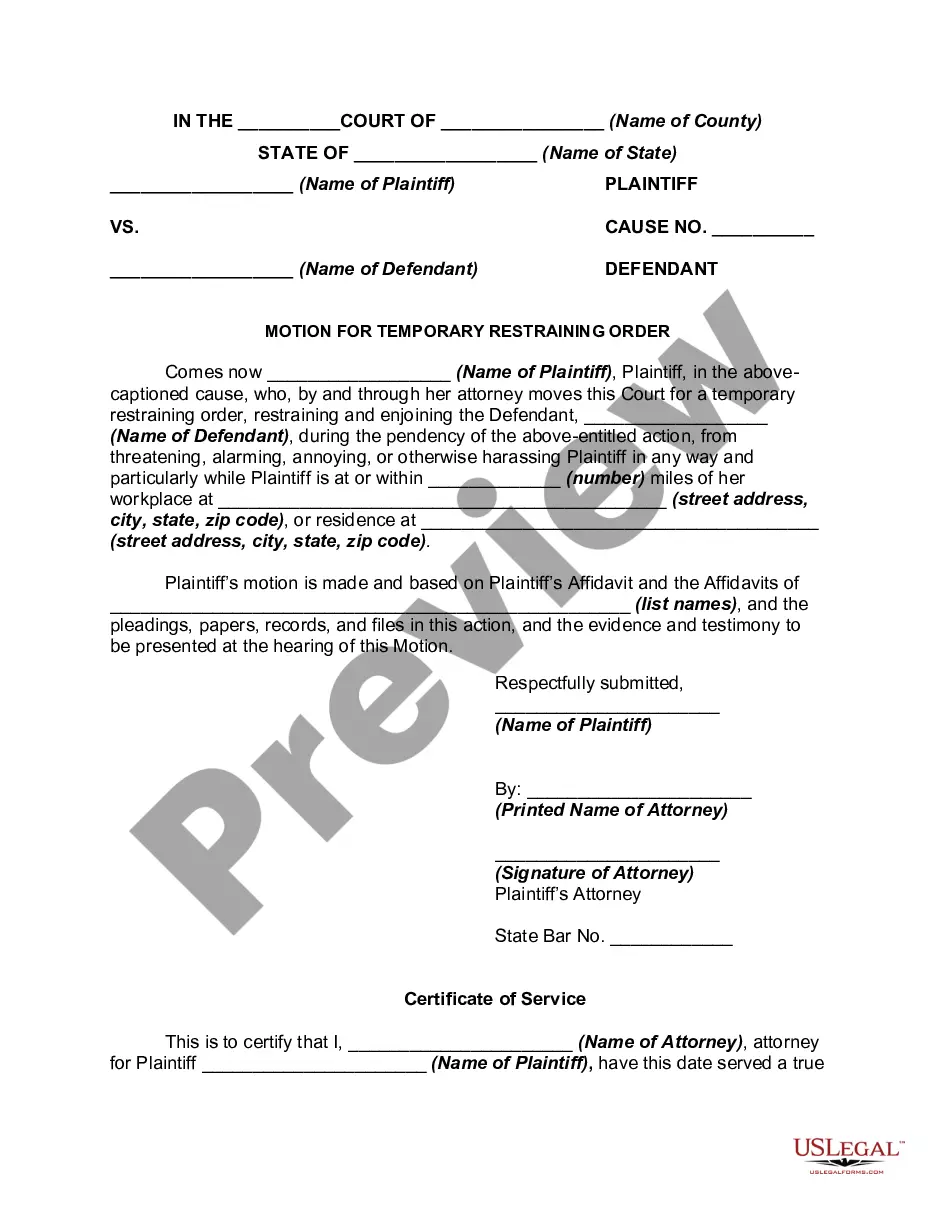

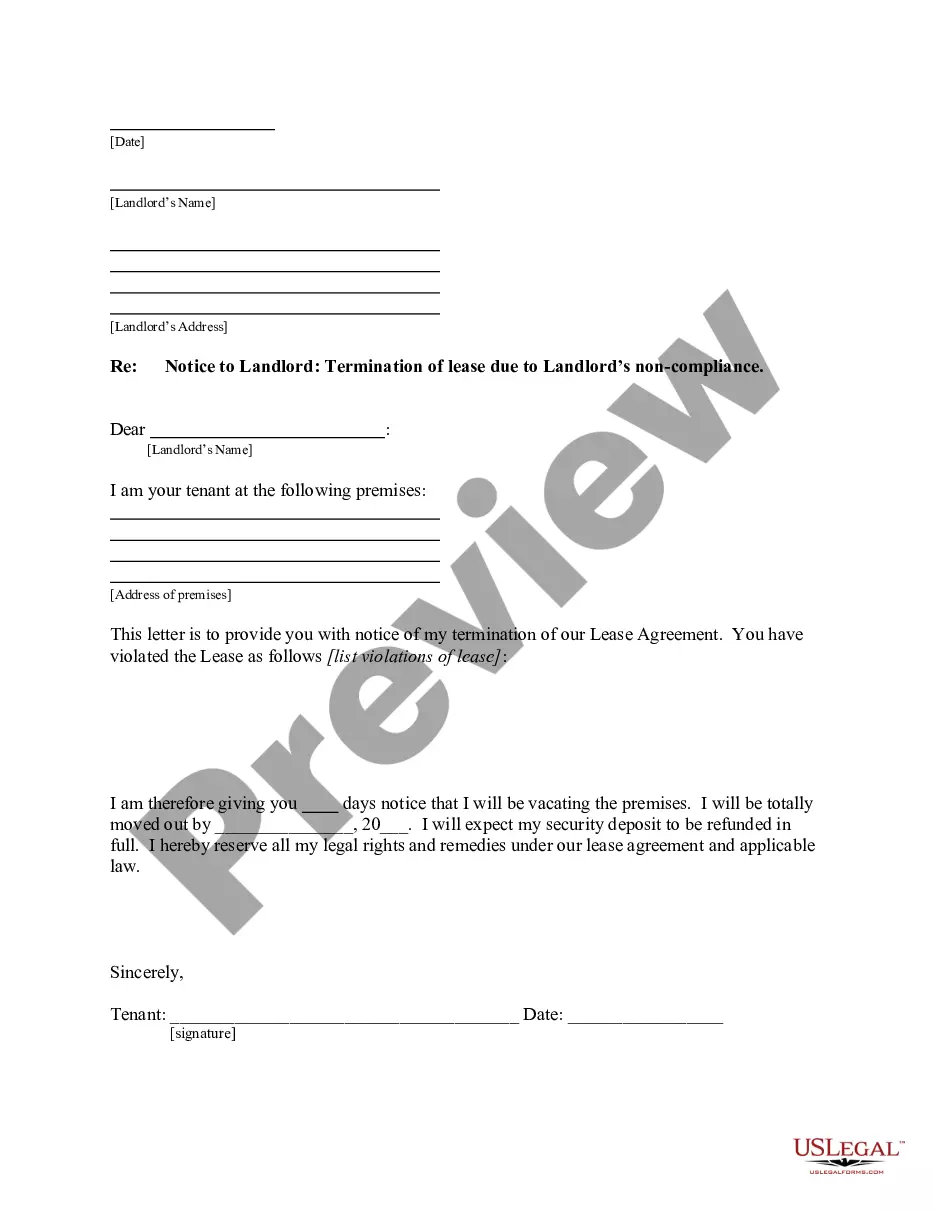

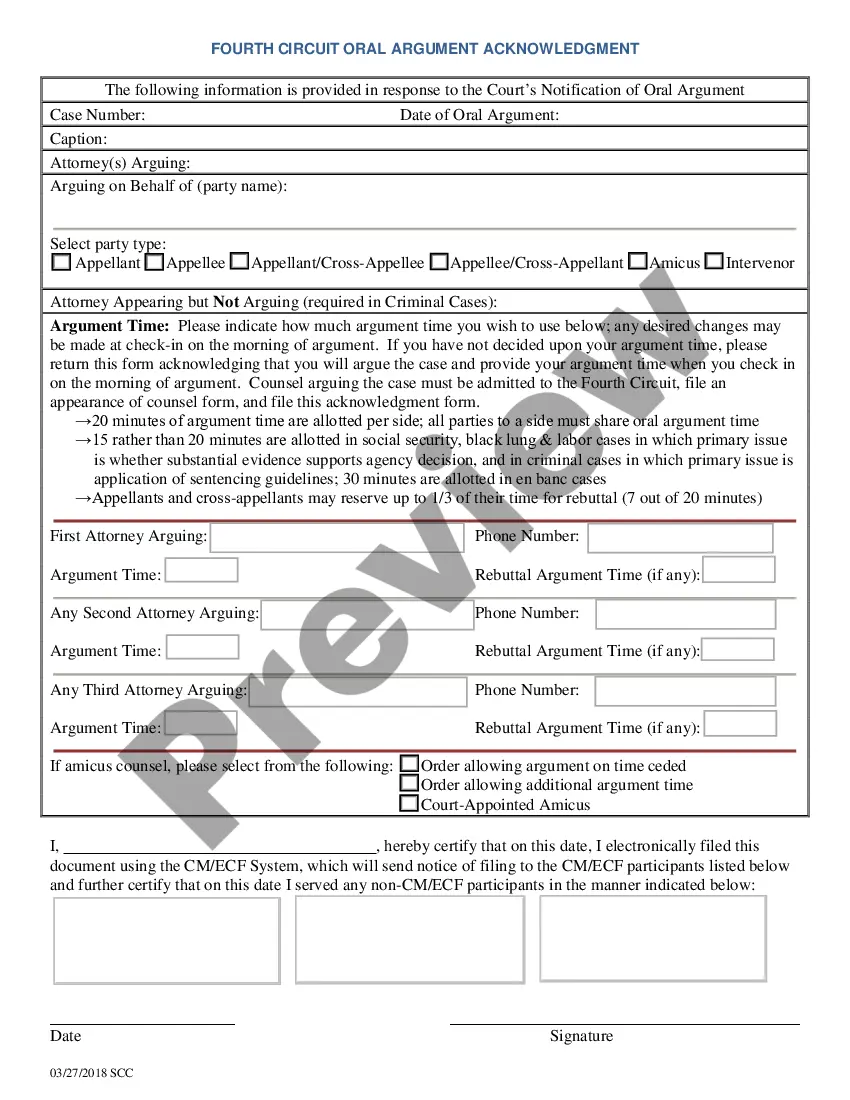

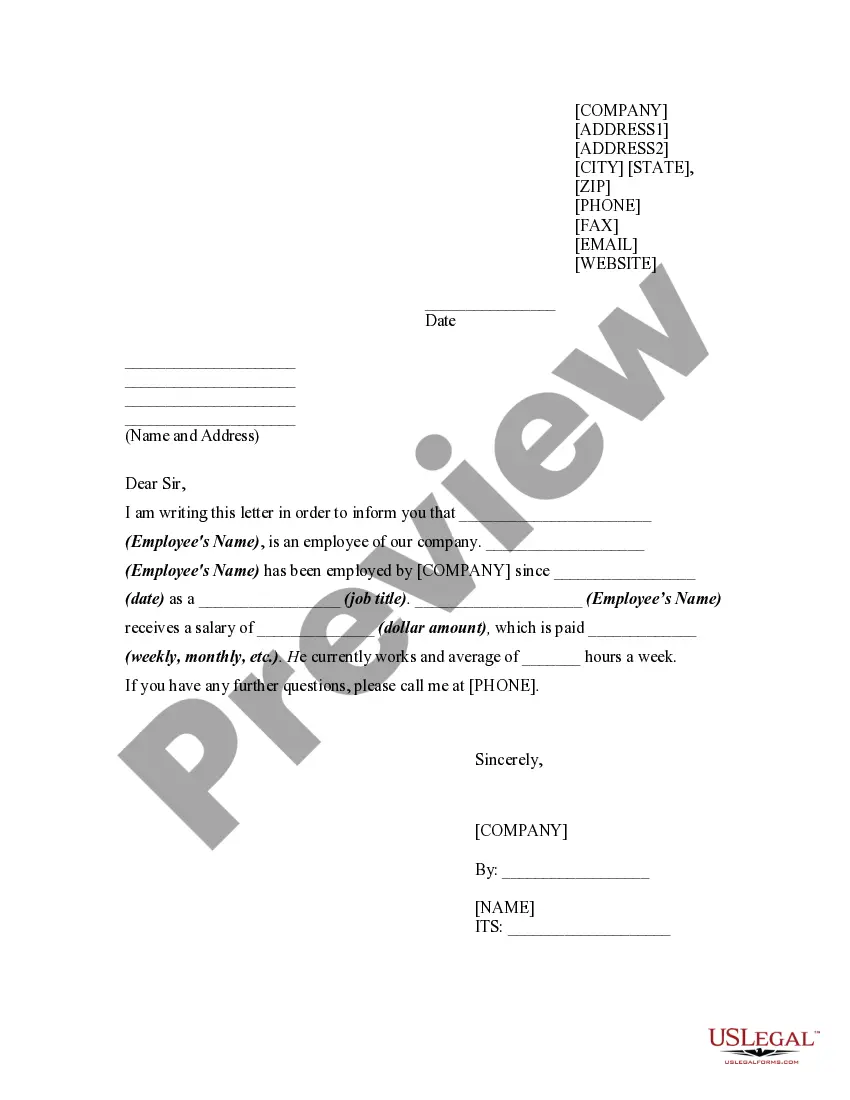

- Utilize the Preview button to examine the form.

- Check the details to confirm you have selected the right template.

- If the form does not meet your needs, use the Search field to find the form that suits your requirements.

Form popularity

FAQ

To claim your Florida sales tax back, you generally need to file a refund request with the Florida Department of Revenue. Gather all relevant documents, including your Florida Sales Receipt, which will help substantiate your claim. The process can vary based on the type of sale and the surrounding circumstances, but you can always check the department’s guidelines for a clearer path. Don’t hesitate to seek assistance if necessary.

Yes, you can claim sales tax on your taxes in Florida under certain conditions. If you itemize your deductions, you may deduct state and local sales taxes instead of income tax as specified by the IRS. Just keep your receipts, including your Florida Sales Receipt, as proof of your purchases. This can lead to significant savings, especially for major purchases.

To declare sales tax in Florida, you need to complete a sales tax return through the Florida Department of Revenue. Start by collecting sales receipts, including your Florida Sales Receipt, which provide detailed records of your taxable sales. Submit your return and payment online, or mail it to the appropriate address. Ensure you file your returns on time to avoid penalties.

The collection allowance in Florida sales tax is determined based on the total sales tax you collect. Florida allows sellers to retain a percentage of the tax collected as compensation for administrative costs. To calculate this, use the figure from your Florida Sales Receipt that represents the total sales tax collected, and then apply the designated collection allowance rate. Keeping thorough records will help you track these amounts accurately.

Claiming sales tax on your taxes involves documenting your eligible purchases throughout the year, using your Florida Sales Receipt as evidence. You can either deduct this amount or receive a credit on your state tax return. Ensure all records are accurate and match your receipts, as this will support your claim during any audits. Thoroughly reviewing tax guidelines will help you maximize your benefit.

A sales tax refund allows you to recover taxes you overpaid when making purchases. In Florida, this refund typically applies to business expenses where sales tax was incorrectly charged. You will need to provide proof, such as your Florida Sales Receipt, showing the original transaction details. The state’s Department of Revenue oversees the process, ensuring you receive the refund efficiently.

To get a Florida sales tax ID number, you should register online with the Florida Department of Revenue. Fill out the application form with your business details, and ensure all information is accurate. Once approved, you will receive your ID, which allows you to issue and manage Florida Sales Receipts effectively.

Obtaining a Florida sales tax exemption certificate typically takes a few days, depending on your application submission method. You can apply for this certificate online through the Florida Department of Revenue. Having an exemption certificate can streamline your purchases and aid in documenting Florida Sales Receipts.

No, Florida's sales tax number is not the same as the Employer Identification Number (EIN). The sales tax number is specifically for tax purposes related to sales transactions, while the EIN is used to identify a business for federal tax reporting. Make sure to differentiate between these numbers as you record your Florida Sales Receipts.

You can find information about sales tax rates in Florida on the Florida Department of Revenue's website. Each city or county may have different rates, so it's important to check the specific location relevant to your business. Understanding these rates is crucial for accurate calculations on Florida Sales Receipts.