Florida Notice of Default on Promissory Note Installment

Description

How to fill out Notice Of Default On Promissory Note Installment?

Finding the appropriate legal document template can be a challenge. Naturally, there are numerous formats accessible online, but how can you locate the legal form you need? Utilize the US Legal Forms website.

The platform offers thousands of templates, including the Florida Notice of Default on Promissory Note Installment, which can be used for business and personal purposes. Each document is reviewed by experts and meets state and federal regulations.

If you are already registered, Log In to your account and click on the Acquire button to obtain the Florida Notice of Default on Promissory Note Installment. Use your account to browse the legal forms you may have purchased earlier. Visit the My documents section of your account and download another copy of the document you need.

US Legal Forms is the largest repository of legal documents where you can find various file templates. Utilize the service to acquire properly crafted documents that meet state requirements.

- First, ensure that you have selected the correct form for your location. You can review the document using the Preview option and read the form description to confirm it meets your needs.

- If the form does not satisfy your requirements, use the Search field to find the appropriate document.

- Once you are confident that the form is accurate, click on the Get now button to obtain the document.

- Choose the pricing plan you prefer and enter the required details. Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, modify, print, and sign the downloaded Florida Notice of Default on Promissory Note Installment.

Form popularity

FAQ

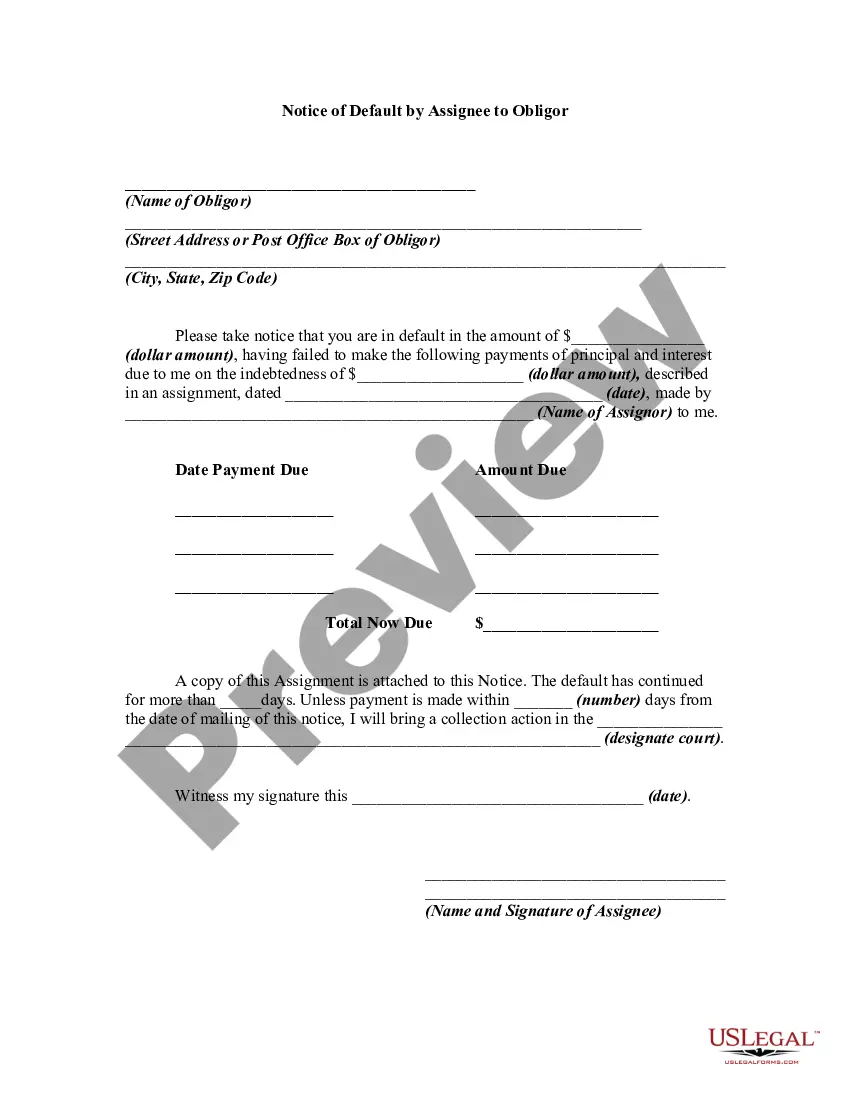

To write a Florida Notice of Default on Promissory Note Installment, begin by clearly stating your intention to declare a default. Include essential details such as the date of the note, the names of the parties involved, and the specific terms that have been violated. Next, provide a clear account of the missed payments and any other relevant information. You can streamline this process by using the templates available on the US Legal Forms platform, which can help ensure that you include all necessary elements.

If someone defaults on a promissory note, the lender may issue a Florida Notice of Default on Promissory Note Installment as a first step. This action informs the borrower of their non-compliance and outlines the consequences. The lender may then pursue legal options, which could include foreclosure or seeking a court judgment. Utilizing platforms like USLegalForms can provide you with the necessary tools and forms to address defaults effectively, ensuring proper legal procedures are followed.

When you receive a Florida Notice of Default on Promissory Note Installment, it signals that your lender considers your account in jeopardy due to missed payments. At this stage, you may have the opportunity to rectify the situation by bringing your payments up to date. If you do not respond, the lender may begin the foreclosure process or take legal steps to recover the outstanding debt. Timely communication with your lender is critical to explore potential options.

Receiving a Florida Notice of Default on Promissory Note Installment indicates that you have missed one or more payments. This notice is a formal warning, and it usually outlines the amount owed and the actions that may follow. It is essential to address the situation promptly, either by making the required payments or by seeking assistance to negotiate a solution. Taking immediate action can help you avoid further legal consequences.

Legally enforcing a promissory note involves a few important steps, starting with documenting any default through a Florida Notice of Default on Promissory Note Installment. Next, consider negotiation or mediation to resolve the debt amicably. If these approaches do not yield results, filing a lawsuit in court may be necessary to enforce your rights under the contract. Consulting a legal expert familiar with promissory notes can provide guidance tailored to your situation.

To enforce a promissory note in Florida, begin by reviewing the specific terms of the agreement that pertain to default. You may need to issue a Florida Notice of Default on Promissory Note Installment to formally establish the breach of contract. If the borrower does not respond or fulfill their obligations, you can escalate the situation by filing a lawsuit to recover the debt. This legal route is crucial to ensuring compliance with the agreement.

Remedies for default on a promissory note may include demanding immediate repayment of the outstanding balance. You can also pursue legal action to recover the owed amount through court. In Florida, a Notice of Default on Promissory Note Installment may be used to clearly lay out the terms and initiate the recovery process. Knowing your rights and options can lead to a more favorable resolution.

When someone defaults on a promissory note, it's important to review the terms of the agreement first. This often involves reaching out to the borrower directly to discuss their situation and potential repayment options. If you find that communication fails, consider sending a Florida Notice of Default on Promissory Note Installment to formally document the default. This step ensures that you uphold legal rights and prepare for possible enforcement actions.

A Florida Notice of Default on Promissory Note Installment is a formal notification that the borrower has failed to meet their repayment obligations. This document typically outlines the amount past due and gives the borrower a specified time to remedy the situation. Understanding this notice is crucial, as it starts the process of default and potential foreclosure. It serves as an important warning that further action may follow if the debt remains unpaid.

A Florida Notice of Default on Promissory Note Installment typically appears as a formal letter. It includes headings for the date and the involved parties. The body will detail the default amount, payment terms, and necessary steps for the borrower to take to correct the situation. For a more structured and legally compliant document, consider using resources from uslegalforms, which provides templates and guidance.