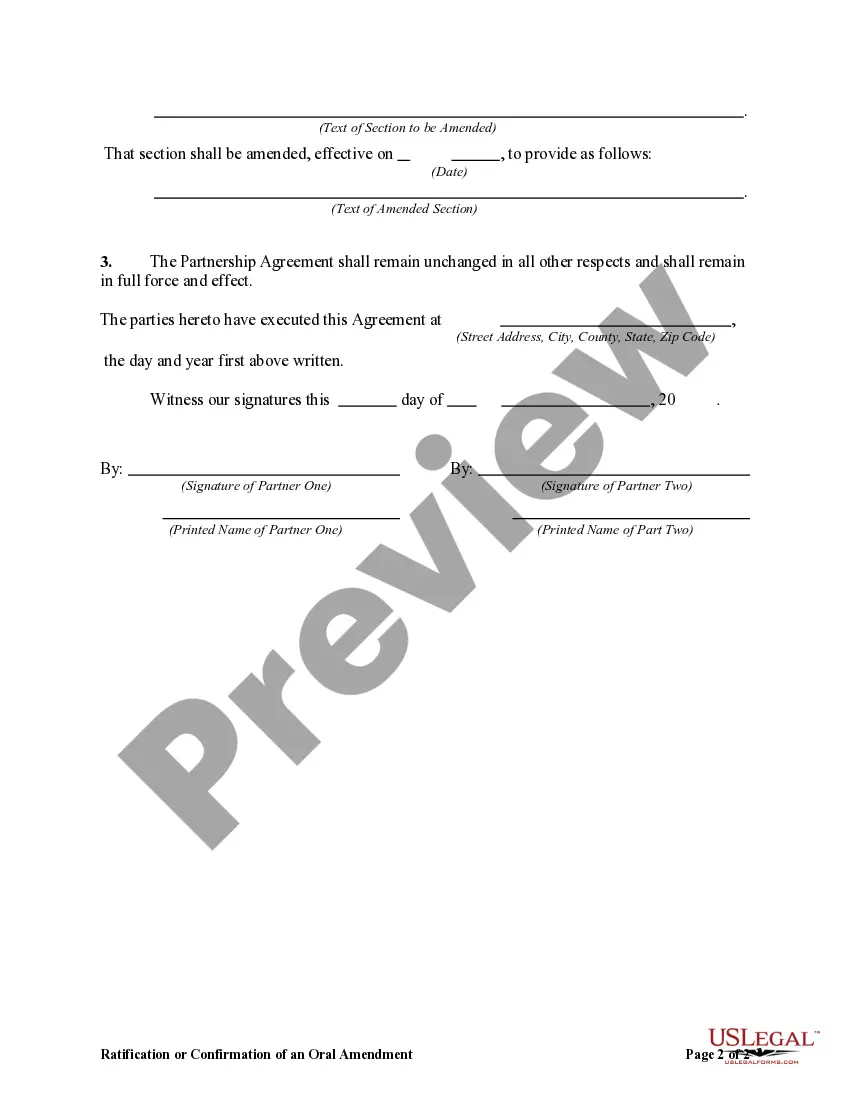

Florida Ratification or Confirmation of an Oral Amendment to Partnership Agreement

Description

How to fill out Ratification Or Confirmation Of An Oral Amendment To Partnership Agreement?

Locating the appropriate legitimate document template can be rather challenging.

Of course, there are numerous templates available online, but how can you find the authentic form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Florida Ratification or Confirmation of an Oral Amendment to a Partnership Agreement, which you can utilize for both business and personal purposes.

First, ensure you have chosen the correct form for your city/county. You can review the form using the Preview button and examine the form description to confirm it is the proper one for you.

- All the forms are verified by experts and meet federal and state requirements.

- If you are already registered, Log In to your account and click the Acquire button to obtain the Florida Ratification or Confirmation of an Oral Amendment to a Partnership Agreement.

- Use your account to browse the legal forms you may have purchased previously.

- Go to the My documents tab of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions for you to follow.

Form popularity

FAQ

Dissolving a partnership in Florida involves formally notifying all partners and settling any outstanding obligations. You will need to file appropriate documentation with the state and potentially inform creditors. Following these steps helps avoid legal complications, and utilizing services like uslegalforms can assist you in navigating the dissolution process smoothly.

A general partnership in Florida does not need to register with the state unless it chooses to file a statement of partnership authority, which is optional. While registration is not compulsory, it can provide additional legal protection and clarity for partners, especially in business transactions. Understanding the nuances of partnership registration can help you make informed decisions. Check out USLegalForms for more resources on Florida partnership laws.

Not all states require partnerships to possess articles of partnership; however, having them can be advantageous in outlining the roles and responsibilities of each partner. These articles serve as a foundational document that clarifies business operations and expectations. While Florida may not mandate them, having clearly defined articles can help prevent disputes and enhance communication among partners. For assistance in drafting or reviewing these documents, USLegalForms offers user-friendly templates.

A general partnership is not classified as a registered organization in Florida, as it does not require formal registration with the state. Instead, it operates based on mutual agreements between partners. However, filing a statement of partnership authority can lend the partnership a more formal presence, which may be beneficial. To learn more about the benefits of filing in Florida, visit USLegalForms for detailed information.

Florida does not impose a filing requirement for all partnerships, but specific partnerships may choose to file a statement of partnership authority. This filing serves to outline the partners involved and their authority in business dealings, enhancing transparency. While it is not mandatory, filing can help prevent misunderstandings among partners and third parties. If you’re seeking more insights into partnership requirements, consider exploring our resources at USLegalForms.

In Florida, general partnerships are not required to register with the state; however, they do have the option to file a statement of partnership authority. This filing can enhance the partnership's legitimacy, particularly when dealing with banks and other entities. Additionally, registering provides a public record, which can help in disputes or clarifying roles. To better understand your options, USLegalForms offers comprehensive guides to help you navigate Florida's legal partnership landscape.

The President may form and negotiate, but the treaty must be advised and consented to by a two-thirds vote in the Senate. Only after the Senate approves the treaty can the President ratify it. Once it is ratified, it becomes binding on all the states under the Supremacy Clause.

An amendment may be proposed by a two-thirds vote of both Houses of Congress, or, if two-thirds of the States request one, by a convention called for that purpose. The amendment must then be ratified by three-fourths of the State legislatures, or three-fourths of conventions called in each State for ratification.

Ratify means to approve or enact a legally binding act that would not otherwise be binding in the absence of such approval. In the constitutional context, nations may ratify an amendment to an existing or adoption of a new constitution.

The Statute of Frauds can be satisfied by any signed writing that (1) reasonably identifies the subject matter of the contract, (2) is sufficient to indicate that a contract exists, and (3) states with reasonable certainty the material terms of the contract.