Florida Sample Letter for Dormant Letter

Description

How to fill out Sample Letter For Dormant Letter?

Are you in a location where you frequently require documents for business or personal purposes? There are many legal document templates available online, but finding trustworthy versions isn't straightforward.

US Legal Forms offers a wide array of form templates, including the Florida Sample Letter for Dormant Letter, designed to meet both federal and state requirements.

If you are already familiar with the US Legal Forms site and possess an account, simply Log In. Afterwards, you can retrieve the Florida Sample Letter for Dormant Letter template.

Access all the document templates you have purchased in the My documents section. You can obtain a new version of the Florida Sample Letter for Dormant Letter whenever necessary. Just select the desired form to download or print the document template.

Utilize US Legal Forms, the most comprehensive collection of legal documents, to save time and avoid errors. The service offers professionally crafted legal templates that you can utilize for various purposes. Create an account on US Legal Forms and start making your life simpler.

- Locate the form you need and ensure it corresponds to your specific city or region.

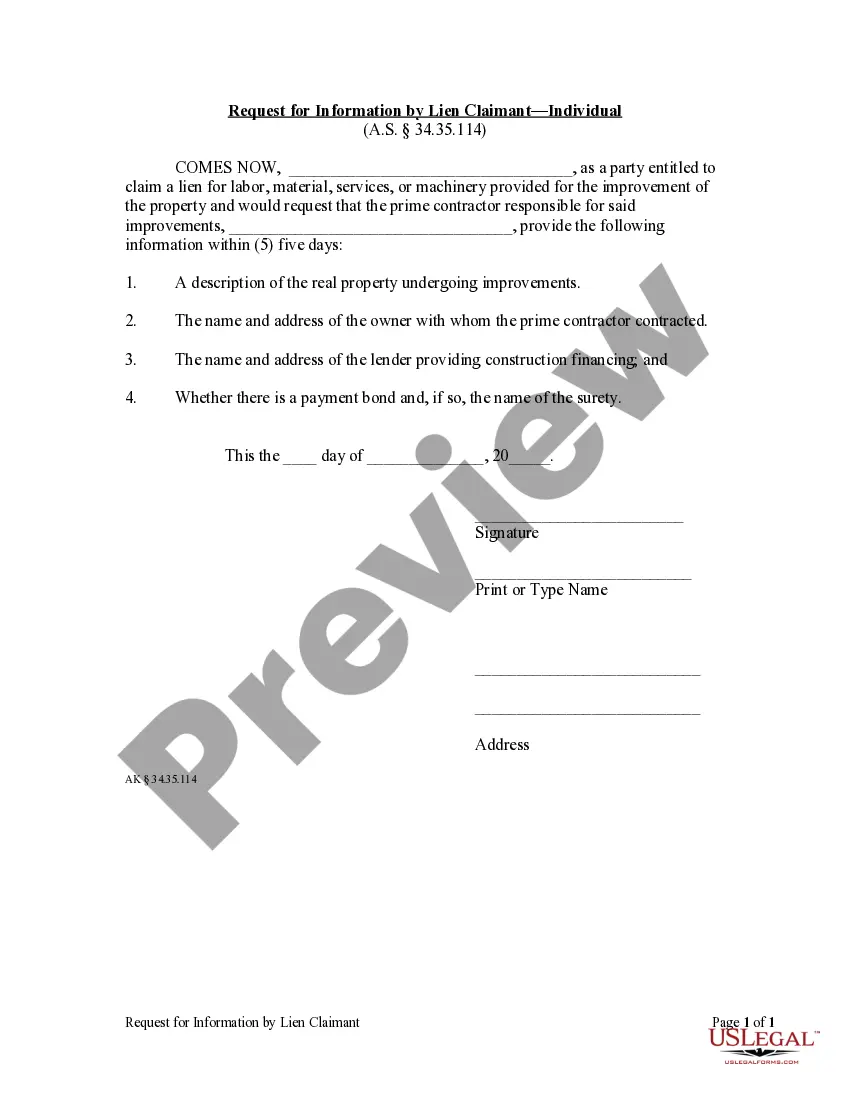

- Utilize the Review option to scrutinize the document.

- Read the description to confirm that you have selected the right form.

- If the form does not match your needs, use the Search field to find the form that fulfills your requirements.

- Once you find the correct form, click on Get now.

- Choose the payment plan you want, enter the necessary details to create your account, and complete the transaction using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

To write a letter to reactivate your account, begin with your personal details and account number. Clearly express your desire to reactivate and provide any necessary context that supports your request. Utilizing examples from the Florida Sample Letter for Dormant Letter can streamline your writing process. This method can increase the likelihood of a successful reactivation.

When writing an account reactivation letter, aim for clarity and conciseness. Start by addressing the recipient and stating your account information, followed by the reason for your request to reactivate the account. You may find it helpful to consult the Florida Sample Letter for Dormant Letter for guidance. A well-structured letter can enhance your chances of a positive response.

To write a letter asking for a closed account, you should start by clearly stating your request. Include your name, account number, and any relevant dates. It is also essential to explain why you are requesting the closure and refer to the Florida Sample Letter for Dormant Letter to ensure you have a proper structure. This approach can make your communication clear and effective.

A dormant account is usually one that has not seen any financial activity for a designated period, commonly one year. Such accounts can include checking, savings, or investment accounts that lack deposits or withdrawals. If you find yourself with a dormant account, using a Florida Sample Letter for Dormant Letter can facilitate the reactivation process. This proactive approach helps you manage your finances effectively and keeps your account in good standing.

Dormant accounts typically show little to no activity over a specific timeframe, such as no transactions for a year or more. They may still hold a balance, but without any interaction, they can be classified as inactive. Using a Florida Sample Letter for Dormant Letter can help you clarify your account's status and initiate any necessary steps to reactivate it. This ensures your funds remain accessible and avoid potential fees.

A dormant status can occur when a bank account has not had any transactions for an extended period. For instance, if an account has no deposits or withdrawals for over a year, it may be deemed dormant. In such cases, you may need a Florida Sample Letter for Dormant Letter to reactivate the account. This letter serves as a formal method to communicate your intent to resume activities on the account.

Typically, activating a dormant account requires providing identification, such as a driver's license or passport, and sometimes a utility bill for proof of address. Additionally, using a Florida Sample Letter for Dormant Letter can help reinforce your request for reactivation. These documents ensure a smooth process when returning your account to active status.

When writing a letter for a dormant account, start by clearly stating your intent to reactivate the account. Include your account details and any necessary personal information. Utilize a format similar to the Florida Sample Letter for Dormant Letter to make sure you cover all essentials, ensuring a prompt response from your financial institution.

A dormant account can include savings accounts or checking accounts that show no activity for an extended time, usually over six to twelve months. For example, if you have not made any deposits or withdrawals within this timeframe, your account may be classified as dormant. Staying informed can help you avoid this status and maintain access to your funds.

The documents often required to activate a dormant account include a valid government-issued ID and proof of address. In some cases, financial institutions may request the submission of a Florida Sample Letter for Dormant Letter as part of their reactivation procedure. These documents help ensure the security and authenticity of your request.