Florida Revocable Trust for Asset Protection

Description

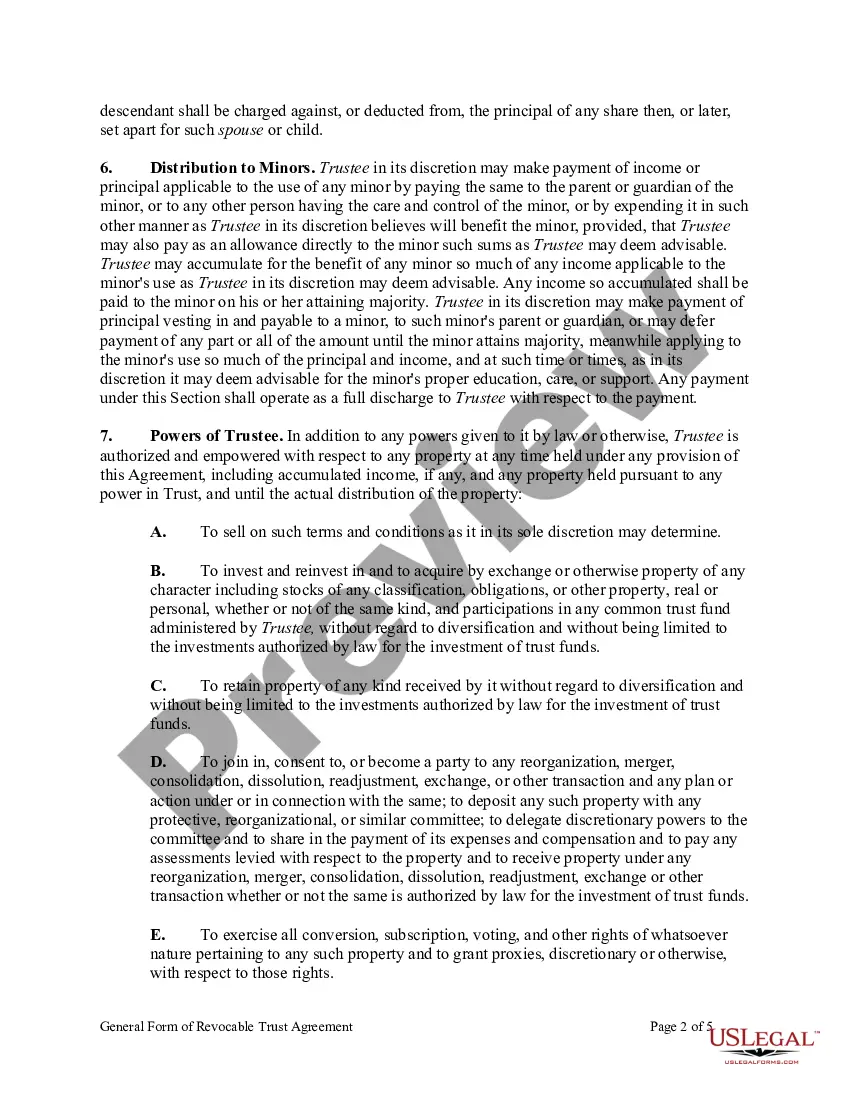

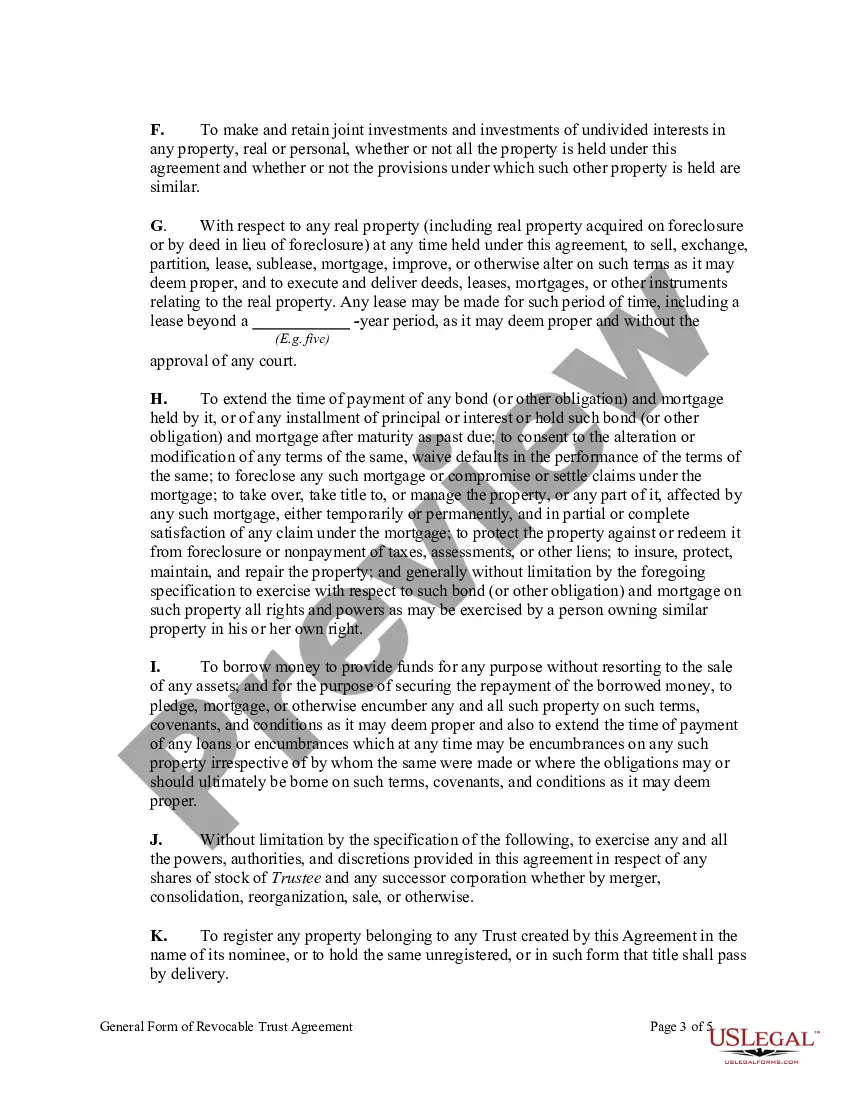

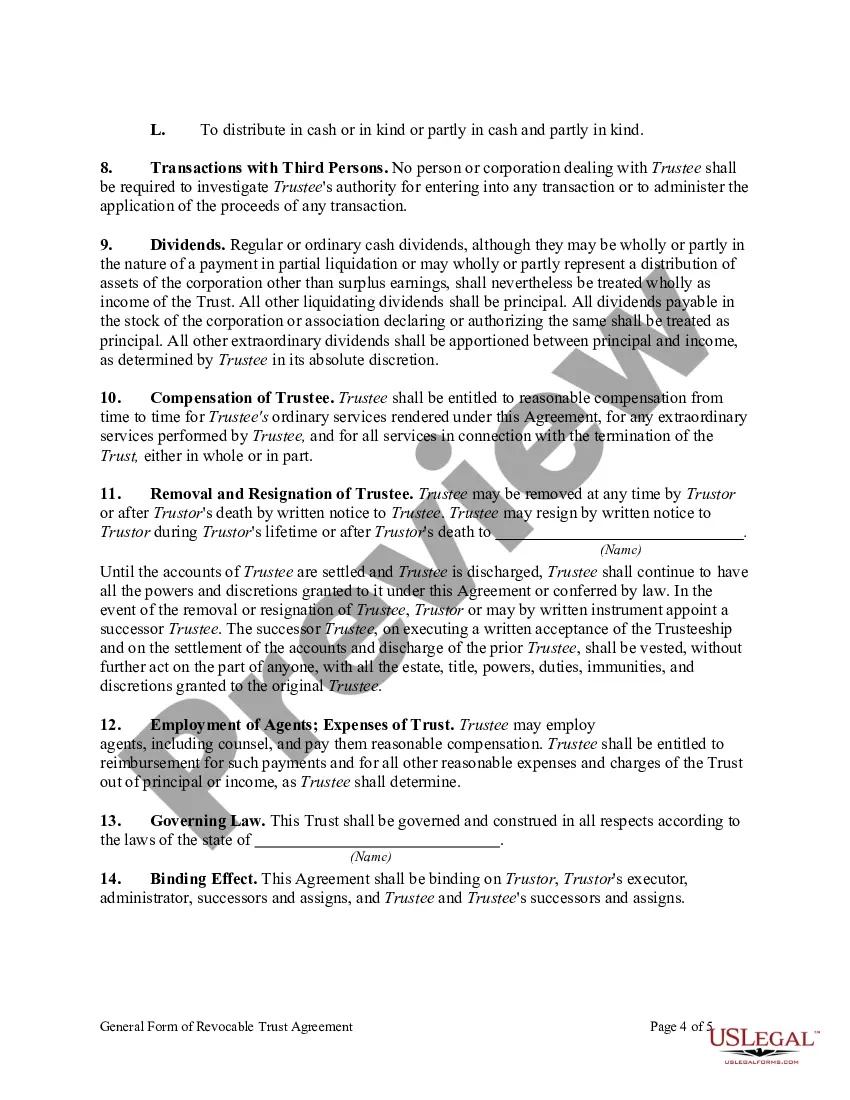

How to fill out Revocable Trust For Asset Protection?

Selecting the optimal legal document template can be challenging. It goes without saying that there are numerous templates available online, but how do you locate the legal document you require.

Utilize the US Legal Forms website. The platform provides a vast selection of templates, such as the Florida Revocable Trust for Asset Protection, suitable for both business and personal purposes.

All documents are reviewed by experts and comply with federal and state regulations.

Once you are certain the document is suitable, click the Buy now button to acquire the document. Select your preferred payment plan and provide the required details. Create your account and complete the purchase using your PayPal account or a credit card.

Choose the document format and download the legal document template to your device. Fill out, modify, print, and sign the obtained Florida Revocable Trust for Asset Protection. US Legal Forms is the largest repository of legal documents where you can find various record templates. Use the platform to access professionally-crafted documents that meet state requirements.

- If you are already registered, Log In to your account and click on the Download button to retrieve the Florida Revocable Trust for Asset Protection.

- Utilize your account to review the legal documents you have previously purchased.

- Visit the My documents section of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure you have chosen the correct document for your city/region. You can preview the form using the Review button and read the form description to confirm it is suitable for you.

- If the document does not meet your needs, use the Search field to find the appropriate document.

Form popularity

FAQ

The best trust structure for asset protection typically depends on your specific needs and circumstances. Many people find that a Florida Revocable Trust for Asset Protection strikes the right balance between flexibility and security. This type of trust allows you to manage your assets while providing a layer of protection from creditors, making it a popular choice for many.

The requirements for an asset protection trust vary by state but generally include legal eligibility to create a trust, a clear designation of beneficiaries, and a funded trust with assets. Additionally, it's crucial to ensure compliance with Florida laws if you are using a Florida Revocable Trust for Asset Protection. Consulting with a legal professional can help you meet these requirements effectively.

Setting up a protective trust involves several key steps, beginning with choosing the right type of trust for your situation. It's essential to draft the trust agreement clearly and ensure that all assets intended for protection are properly transferred to the trust. A Florida Revocable Trust for Asset Protection can help you safeguard your assets, and platforms like US Legal Forms can provide the resources needed to streamline this process.

Writing an asset protection trust involves careful planning and legal documentation. First, you need to outline your objectives and specify the assets you wish to protect. Consulting with a legal expert can guide you in creating a Florida Revocable Trust for Asset Protection that not only safeguards your assets but also meets state laws and your specific needs.

One of the biggest mistakes parents often make when establishing a trust fund is failing to specify the terms adequately. This oversight can lead to family disputes or unintended consequences regarding asset distribution. To avoid this, consider using a Florida Revocable Trust for Asset Protection, which allows flexibility and clarity in defining how and when your assets will be distributed to your heirs.

While a Florida Revocable Trust for Asset Protection does offer certain benefits, it does not provide complete asset protection from creditors or lawsuits. Instead, it serves as an estate planning tool that facilitates the transfer of assets upon death and simplifies probate. For stronger asset protection, consider additional strategies or structures that may work in tandem with your trust.

Creating a trust in Florida does not legally require a lawyer, but having one can ensure that your Florida Revocable Trust for Asset Protection meets all legal standards. A lawyer can help navigate the complex laws and provide personalized advice suited to your unique situation. By working with a legal professional, you can avoid potential pitfalls that could affect your asset protection strategy.

A Florida Revocable Trust for Asset Protection can help manage your assets during your lifetime, but it does not provide full protection from Medicaid claims. When applying for Medicaid, assets held in a revocable trust may still be counted as part of your resources. It is important to understand that while a revocable trust allows you to maintain control of your assets, it does not offer the same protections as an irrevocable trust. For tailored advice on asset protection strategies, consider using the US Legal Forms platform, where you can find resources and templates to help you navigate this complex area.

In Florida, a revocable trust does not need to be recorded with the state. However, it is advisable to keep it in a secure location and inform your beneficiaries of its existence. This allows for smoother management of the trust's terms and ensures that your wishes are fulfilled efficiently after your passing.

If asset protection is your primary goal, consider an irrevocable trust or a fully funded spendthrift trust. These types of trusts provide a higher level of protection compared to a Florida Revocable Trust for Asset Protection, as they prevent creditors from seizing the assets within them. Consulting with a legal expert can help you choose the best option tailored to your needs.