Florida Sample Letter for Disputed Balance Notice

Description

How to fill out Sample Letter For Disputed Balance Notice?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a vast selection of legal form templates that you can download or print.

By utilizing the site, you can access countless forms for business and personal use, categorized by type, states, or keywords. You can obtain the latest versions of documents such as the Florida Sample Letter for Disputed Balance Notice in moments.

If you hold a membership, Log In and download the Florida Sample Letter for Disputed Balance Notice from the US Legal Forms library. The Download button will appear on every document you view. You can retrieve all previously downloaded forms from the My documents section of your account.

Make modifications. Complete, edit, print, and sign the downloaded Florida Sample Letter for Disputed Balance Notice.

Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and select the form you need. Access the Florida Sample Letter for Disputed Balance Notice with US Legal Forms, the most extensive library of legal document templates. Take advantage of a wide range of professional and state-specific templates that fulfill your business or personal requirements and needs.

- If you are using US Legal Forms for the first time, here are some simple steps to help you get started.

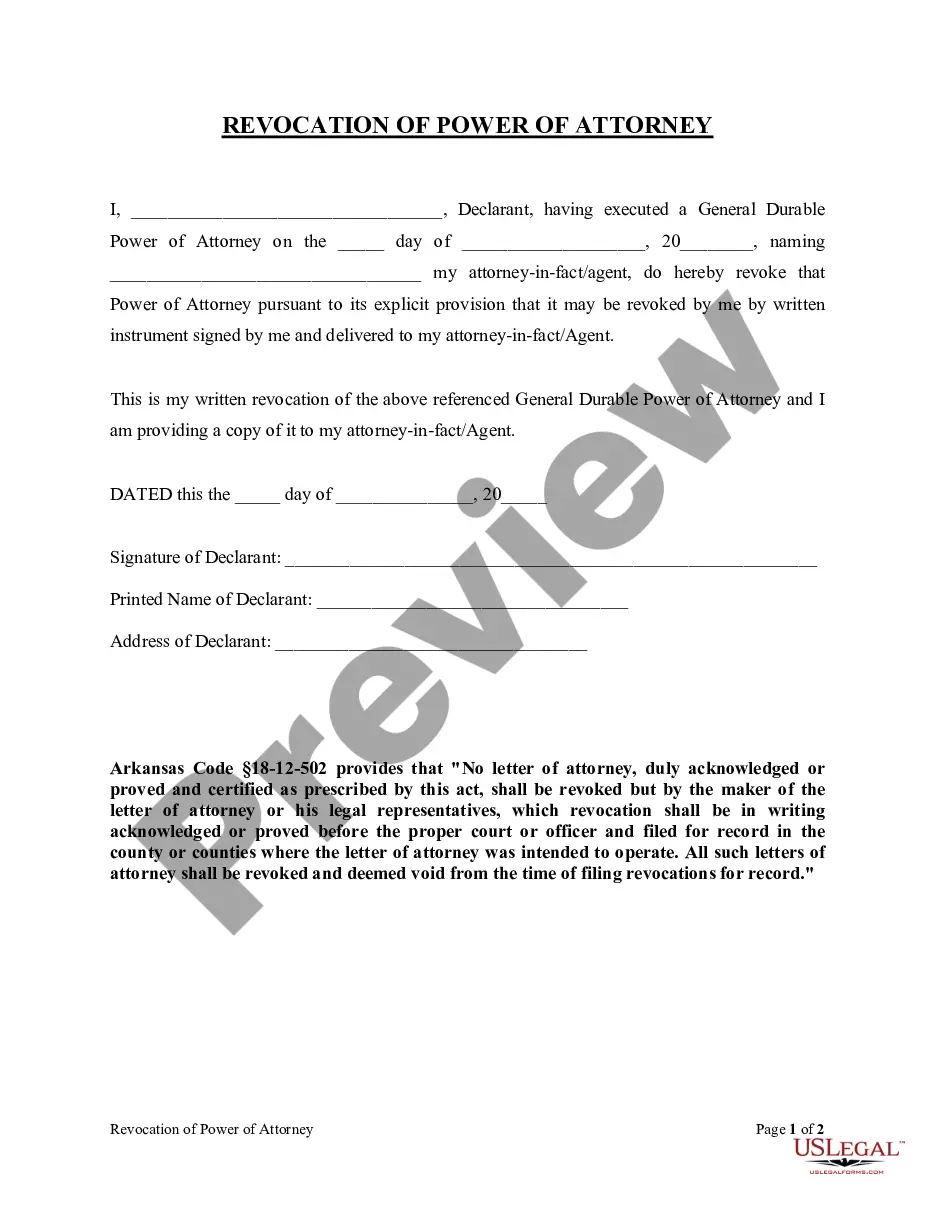

- Make sure you have selected the appropriate form for your city/state. Click the Review button to inspect the form's content. Check the form details to verify that you have chosen the correct template.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Order now button. Then, select the pricing plan you prefer and provide your information to create an account.

- Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Choose the format and download the document to your device.

Form popularity

FAQ

When disputing a collection, it's important to be direct and focused. Clearly state that you are disputing the collection and mention any supporting evidence you may have. Remember, using a Florida Sample Letter for Disputed Balance Notice can help you formulate your message effectively, ensuring you express your concerns in a way that is respectful and makes your position clear.

A letter disputing charges should clearly state your intention to challenge the charges. You can begin by outlining the specific charges you are disputing and then present any relevant facts or documentation to support your case. For your situation, a Florida Sample Letter for Disputed Balance Notice can provide a structured format, helping you include all necessary information for clarity.

Writing a letter of disputing charges requires providing essential details such as account information and specific charges you are disputing. Present your case logically, as found in a Florida Sample Letter for Disputed Balance Notice, while ensuring to request a review or action. This method helps in achieving a favorable outcome.

To dispute a bill for services, begin with the date and your contact details, followed by a brief description of the bill. Clearly outline the reasons for your dispute in an organized fashion, as you would in a Florida Sample Letter for Disputed Balance Notice. This structured approach will enhance clarity and effectiveness.

When writing a letter of debt dispute, start by referencing the specific debt in question, along with your identification details. Ensure to explain the reason for your dispute clearly, using your Florida Sample Letter for Disputed Balance Notice as a guide. Including any evidence will reinforce your claim and prompt a swift response.

Writing a good debt settlement letter involves stating your financial situation frankly and proposing an agreeable settlement amount. Clarity is key; your Florida Sample Letter for Disputed Balance Notice should include your contact information and any supporting documents. This way, you present a strong case for your proposal.

A good dispute letter begins with a polite greeting, followed by a clear introduction of the matter in question. Be concise, use bullet points for any facts, and include supporting evidence with your Florida Sample Letter for Disputed Balance Notice. Finally, conclude with a request for action, ensuring the recipient knows how to proceed.

To write a legal dispute letter, start by clearly stating the purpose of your letter and what you are disputing. Provide any relevant details, such as account numbers and dates, to support your case. A well-structured Florida Sample Letter for Disputed Balance Notice will outline your dispute clearly and request a prompt response.

Credit dispute letters can effectively challenge inaccuracies on your credit report. When used correctly, they prompt credit bureaus to investigate and respond. Utilizing a Florida Sample Letter for Disputed Balance Notice helps ensure that your letter is persuasive and adheres to the required format.

To remove collections from your credit report, you need to send a request letter to the creditor or collection agency disputing the accuracy. Make sure to provide your account details and the reasons for your request. A Florida Sample Letter for Disputed Balance Notice can help structure your letter to increase your chances of success.