Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information. If such a request is made and is received within 60 days after the consumer learned of the adverse action, the user, within a reasonable period of time, must disclose to the consumer the nature of the information.

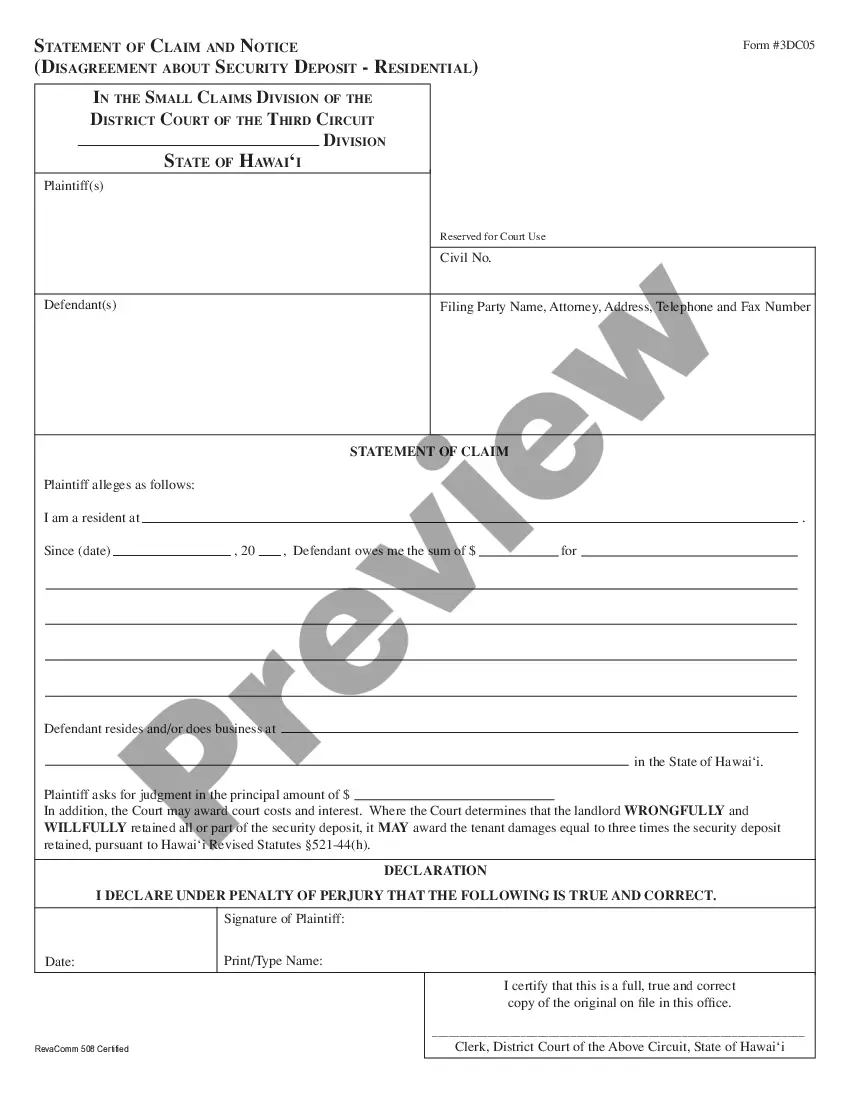

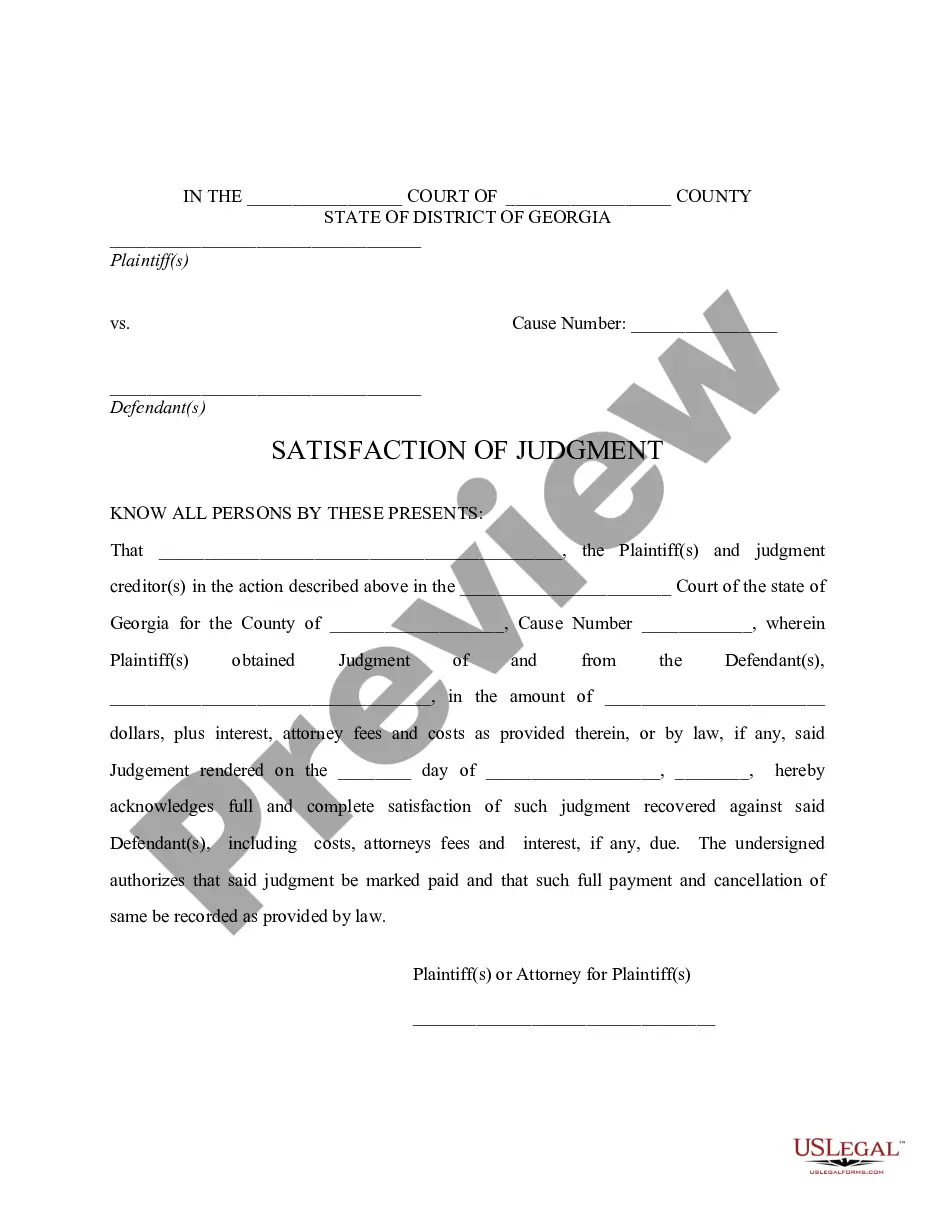

Florida Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency

Description

How to fill out Notice Of Increase In Charge For Credit Based On Information Received From Person Other Than Consumer Reporting Agency?

Have you been in the place the place you require paperwork for possibly company or individual reasons nearly every working day? There are plenty of lawful document templates available online, but locating ones you can rely on is not simple. US Legal Forms gives thousands of develop templates, like the Florida Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency, which can be written to meet state and federal specifications.

When you are currently familiar with US Legal Forms web site and possess a free account, merely log in. After that, you are able to download the Florida Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency design.

If you do not provide an account and need to begin to use US Legal Forms, adopt these measures:

- Find the develop you want and ensure it is for the appropriate metropolis/state.

- Take advantage of the Review key to examine the form.

- See the information to ensure that you have chosen the correct develop.

- When the develop is not what you are trying to find, utilize the Look for discipline to discover the develop that meets your requirements and specifications.

- Whenever you get the appropriate develop, click on Purchase now.

- Pick the pricing prepare you need, complete the necessary details to produce your money, and pay for the order using your PayPal or credit card.

- Choose a handy data file structure and download your backup.

Discover each of the document templates you possess purchased in the My Forms food list. You can obtain a further backup of Florida Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency anytime, if needed. Just click the essential develop to download or produce the document design.

Use US Legal Forms, the most substantial collection of lawful forms, to save time and prevent mistakes. The service gives appropriately made lawful document templates which you can use for an array of reasons. Make a free account on US Legal Forms and start generating your daily life a little easier.

Form popularity

FAQ

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion).

(a) Every consumer reporting agency shall, upon request and proper identification of any consumer, clearly and accurately disclose to the consumer: (1) The nature and substance of all information (except medical information) in its files on the consumer at the time of the request.

What does this statement mean as a response of collection dispute "Account information disputed by a consumer, meets FCRA requirements?" It means the creditor disagrees with your dispute, but has agreed to acknowledge the fact that you are disputing it.

The ?adverse action notice? must include the name, address, and phone number of the consumer reporting company that supplied the report; a copy of the consumer report; a statement confirming that the company supplying the report did not make the decision to take the unfavorable action and can't give specific reasons ...

Indirect disputes occur when a consumer contacts a credit reporting company to dispute information being reported by a lender or other source.

CONSUMER DISPUTES ? REINVESTIGATION IN PROGRESS ? This is a consumer initiated dispute and is actively being investigated by Equifax. A rescore request to remove the dispute verbiage cannot be processed.

Section 604(f) prohibits any person from obtaining a consumer report from a consumer reporting agency (CRA) Page 2 unless the person has certified to the CRA the permissible purpose(s) for which the report is being obtained and certifies that the report will not be used for any other purpose.

The FCRA provides people multiple ways to dispute inaccurate information on their credit reports. Commonly, people dispute the accuracy of information on their credit reports with a credit reporting company, such as Experian, Equifax, or TransUnion.