The Fair Credit Reporting Act (FCRA) is designed to help ensure that credit bureaus furnish correct and complete information to businesses to use when evaluating your application. Your rights include:

The right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

The right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

Any company that denies your application must supply the name and address of the credit bureau they contacted, provided the denial was based on information given by the credit bureau.

The right to a free copy of your credit report when your application is denied because of information supplied by the credit bureau. Your request must be made within 60 days of receiving your denial notice.

If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the furnisher of information are legally obligated to investigate your dispute.

A right to add a summary explanation to your credit report if your dispute is not resolved to your satisfaction.

Florida Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency

Description

How to fill out Request For Disclosure Of Reasons For Increasing Charge For Credit Regarding Credit Application Where Action Was Based On Information Not Obtained By Reporting Agency?

Are you presently in a place the place you need to have files for both business or person functions virtually every day? There are a variety of legitimate document themes available on the Internet, but locating versions you can depend on isn`t easy. US Legal Forms provides thousands of kind themes, like the Florida Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency, that are published to fulfill federal and state requirements.

If you are currently acquainted with US Legal Forms internet site and possess a free account, simply log in. After that, you are able to down load the Florida Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency web template.

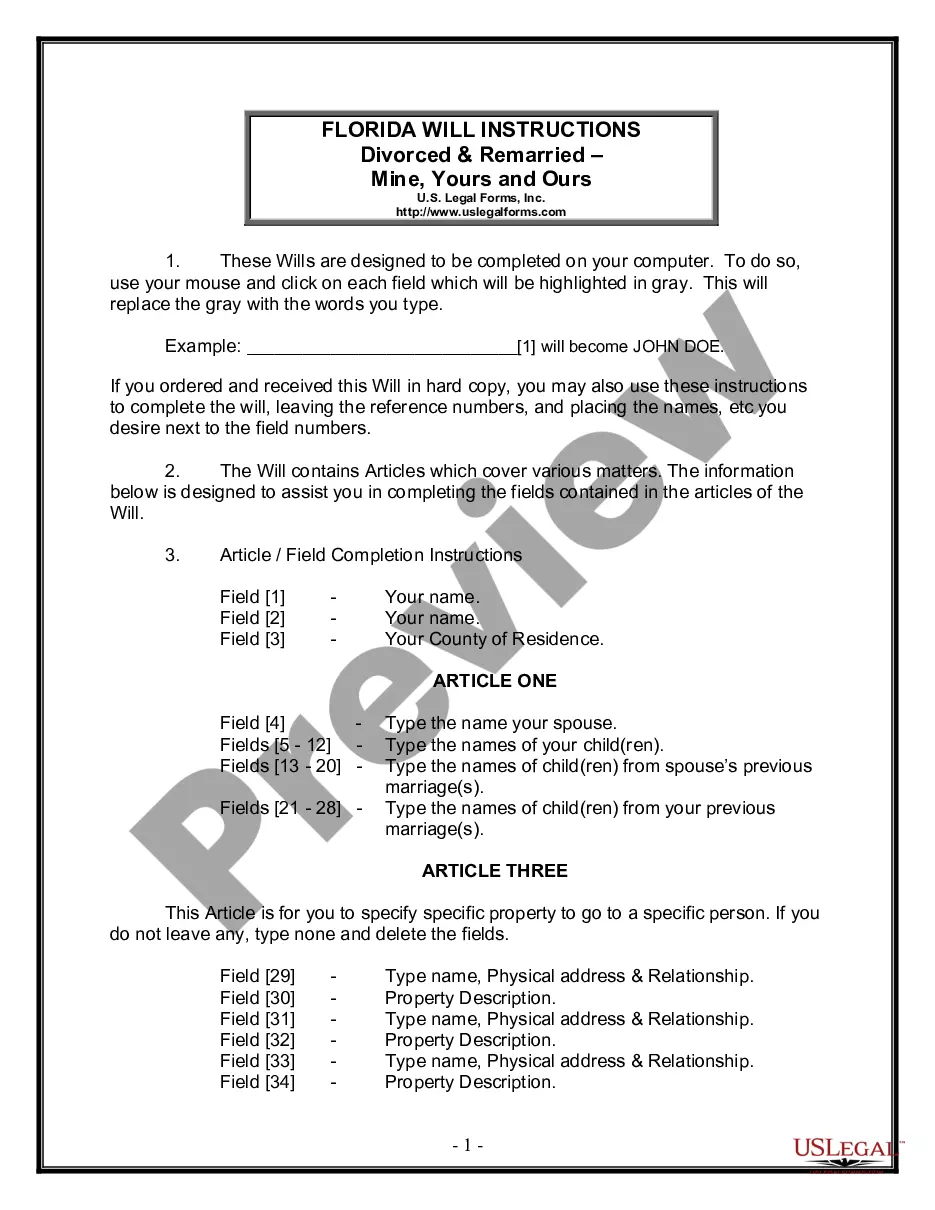

Should you not have an account and wish to start using US Legal Forms, abide by these steps:

- Get the kind you will need and make sure it is for your correct town/county.

- Take advantage of the Preview button to review the shape.

- Browse the explanation to actually have selected the correct kind.

- If the kind isn`t what you`re trying to find, utilize the Research industry to find the kind that suits you and requirements.

- Once you obtain the correct kind, click Purchase now.

- Opt for the pricing strategy you would like, complete the necessary info to produce your money, and purchase your order utilizing your PayPal or Visa or Mastercard.

- Decide on a convenient paper structure and down load your duplicate.

Discover every one of the document themes you might have purchased in the My Forms food list. You can obtain a additional duplicate of Florida Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency any time, if necessary. Just click on the required kind to down load or printing the document web template.

Use US Legal Forms, by far the most extensive selection of legitimate types, in order to save efforts and prevent errors. The services provides skillfully manufactured legitimate document themes which you can use for a variety of functions. Produce a free account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

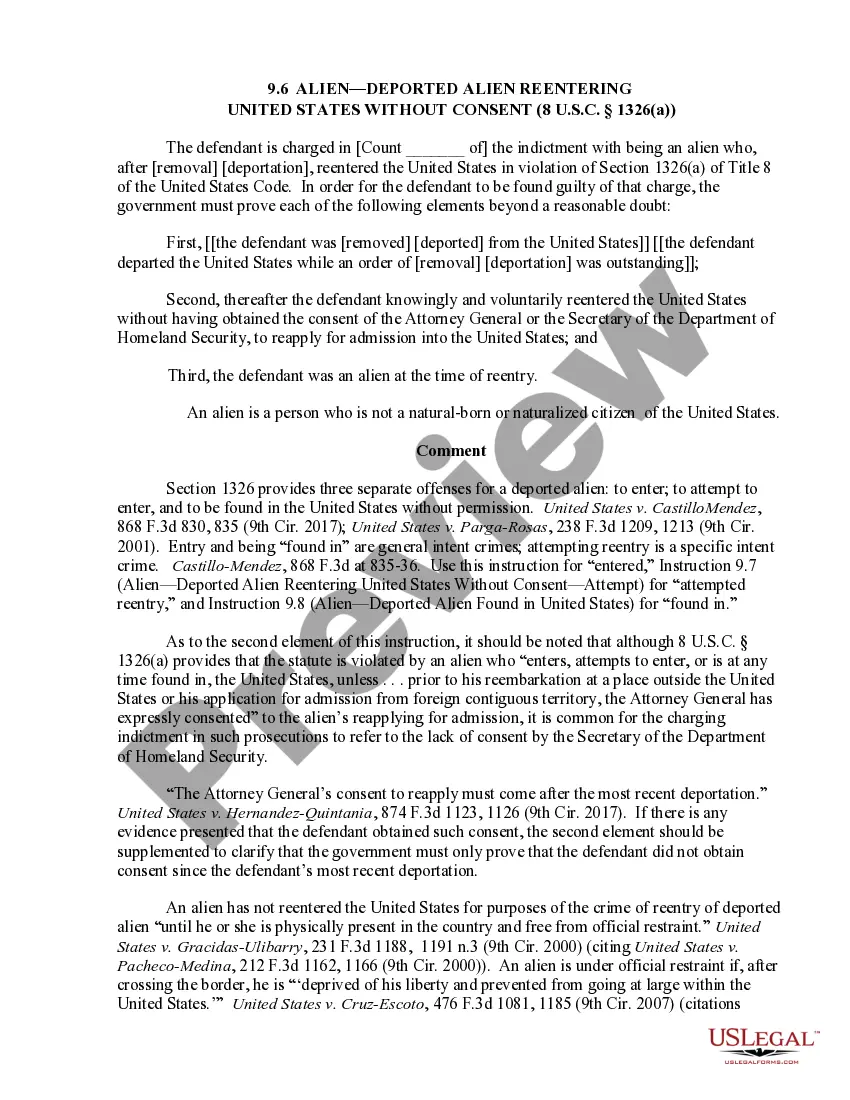

Section 1681a of the Fair Credit Reporting Act defines an ?investigative consumer report? as ?a consumer report or portion thereof in which information on a consumer's character, general reputation, personal characteristics, or mode of living is obtained through personal interviews with neighbors, friends, or ...

Duty to Promptly Correct and Update Information. Section 623(a) of the FCRA also requires a person who regularly furnishes information to CRAs to promptly notify a CRA if the person determines the previously furnished information is not complete or accurate.

[15 U.S.C. § 1681] (1) The banking system is dependent upon fair and accurate credit reporting. Inaccurate credit reports directly impair the efficiency of the banking system, and unfair credit reporting methods undermine the public confidence which is essential to the continued functioning of the banking system.

Section 604(f) prohibits any person from obtaining a consumer report from a consumer reporting agency (CRA) Page 2 unless the person has certified to the CRA the permissible purpose(s) for which the report is being obtained and certifies that the report will not be used for any other purpose.

(a) Every consumer reporting agency shall, upon request and proper identification of any consumer, clearly and accurately disclose to the consumer: (1) The nature and substance of all information (except medical information) in its files on the consumer at the time of the request.

Reporting of Medical Debt: The three major credit bureaus (Equifax, Transunion, and Experian) will institute a new policy by March 30, 2023, to no longer include medical debt under a dollar threshold (the threshold will be at least $500) on credit reports.

Section 623(a)(5): Duty of furnishers to provide date of delinquency on charge-off, collection or similar accounts | Federal Trade Commission.

Sections 623(a)(1)(A) and (a)(1)(C). If at any time a person who regularly and in the ordinary course of business furnishes information to one or more CRAs determines that the information provided is not complete or accurate, the furnisher must promptly provide complete and accurate information to the CRA.