Florida Charitable Remainder Inter Vivos Unitrust Agreement

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

Are you presently in a situation where you need documents for potential business or particular activities almost every day.

There are numerous legal document templates accessible online, but finding reliable forms is not easy.

US Legal Forms offers thousands of form templates, including the Florida Charitable Remainder Inter Vivos Unitrust Agreement, which are crafted to meet federal and state requirements.

Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

Select a convenient paper format and obtain your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Florida Charitable Remainder Inter Vivos Unitrust Agreement anytime, if needed. Just click on the desired form to download or print the document template. Use US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes. The service provides properly drafted legal document templates that can be utilized for various purposes. Set up your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Florida Charitable Remainder Inter Vivos Unitrust Agreement template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

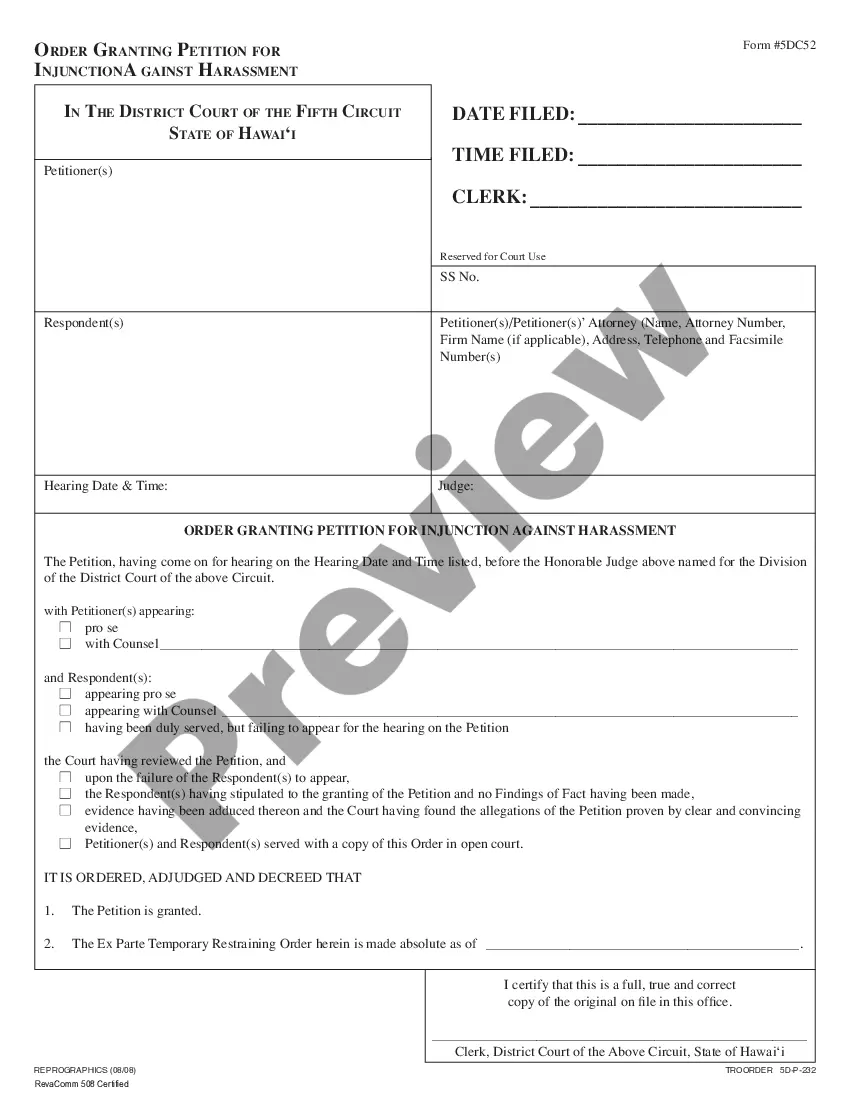

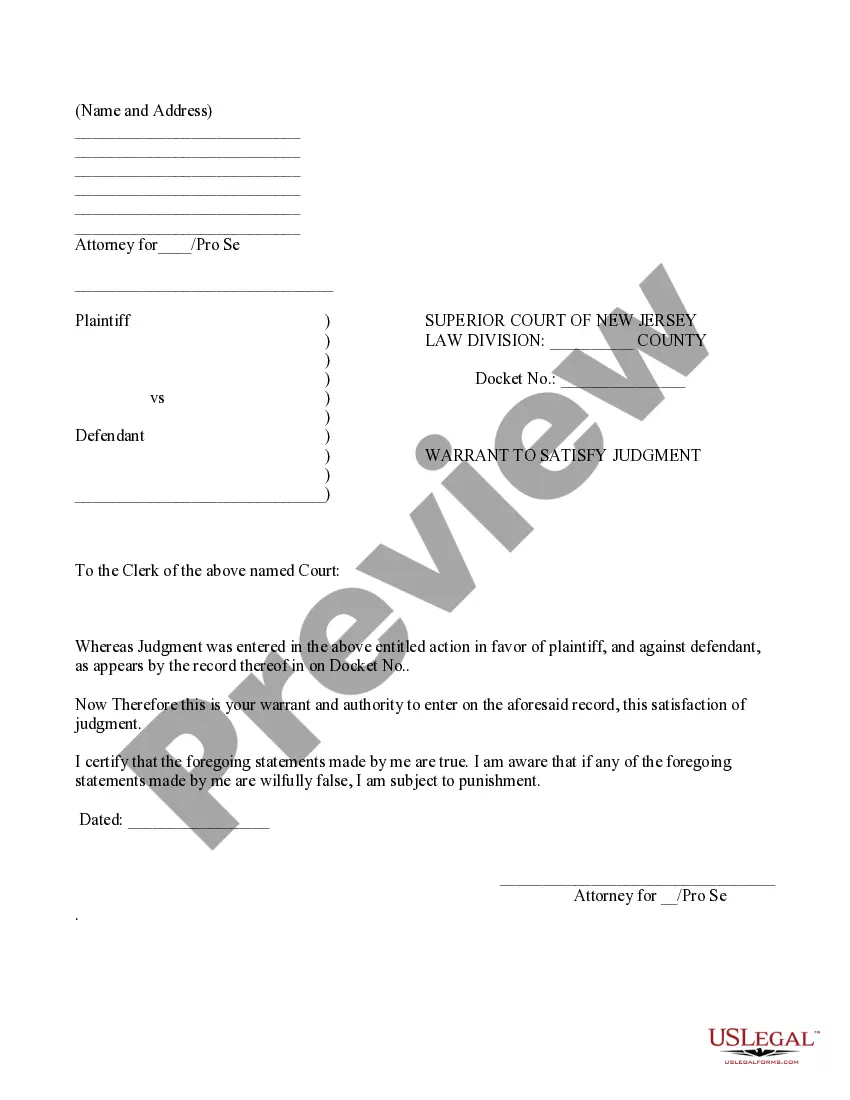

- Locate the form you need and ensure it is for the correct city/region.

- Utilize the Review button to examine the form.

- Check the summary to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search box to find the form that satisfies your needs and requirements.

- Once you find the right form, click Purchase now.

Form popularity

FAQ

The 10 percent rule for a Florida Charitable Remainder Inter Vivos Unitrust Agreement stipulates that the remainder interest must be at least 10 percent of the initial value of the trust assets. This rule is crucial in ensuring that donors meaningfully contribute to charitable causes while also receiving income during their lifetime. By adhering to this rule, you can ensure compliance and maximize the beneficial impacts of your trust.

One disadvantage of a Florida Charitable Remainder Inter Vivos Unitrust Agreement is that it can limit access to funds. Contributors may face restrictions on how they can withdraw income during the trust period. Additionally, setting up this type of trust can require significant legal and administrative costs. It’s vital to weigh these factors before committing to a charitable trust.

A remainder trust is a type of trust that designates its remaining assets to be distributed to a charity after the income beneficiaries have received their payments. This arrangement allows donors to enjoy income during their lifetime while ensuring a charitable contribution after their passing. Remainder trusts provide a means of financially supporting both the donor's family and charitable organizations. The Florida Charitable Remainder Inter Vivos Unitrust Agreement offers a clear framework for establishing such trusts.

The primary difference between a lead trust and a remainder trust lies in the distribution of income. A lead trust pays income to a charity for a specified period, after which the remaining assets go to non-charitable beneficiaries. In contrast, a remainder trust provides income to the beneficiaries first, with remaining assets allocated to charity later. Understanding their differences is vital for effective financial planning. The Florida Charitable Remainder Inter Vivos Unitrust Agreement can aid in structuring your trust to meet specific goals.

An example of a remainder trust is a charitable remainder Unitrust that provides income to the donor for a set number of years before the remaining assets are given to a charity. For instance, if a donor places $100,000 into the trust, they could receive annual payments for 10 years, after which the charity receives the trust's balance. This model optimally blends income with charitable support. Utilizing the Florida Charitable Remainder Inter Vivos Unitrust Agreement helps in establishing such trusts efficiently.

An inter vivos charitable remainder trust is a trust created during the lifetime of the donor. It allows the donor to receive income from the trust assets for a specified term or for life, while ensuring that the remaining assets benefit a charity after the term ends. This type of trust is an excellent opportunity for individuals looking to make a significant charitable contribution while retaining income. The Florida Charitable Remainder Inter Vivos Unitrust Agreement is designed to simplify this process.

The remainder of a trust refers to the assets that remain after all income distributions have been made to beneficiaries during the trust's term. In the context of a charitable remainder trust, this remainder is ultimately directed to a charity, fulfilling the donor's philanthropic goals. Understanding the remainder concept is crucial for effective estate planning. The Florida Charitable Remainder Inter Vivos Unitrust Agreement clearly outlines how the remainder will be allocated.

A charitable remainder flip Unitrust is a unique charitable trust that provides income to the donor or beneficiaries for a specified period. Upon a triggering event, such as the sale of an asset, the trust flips, and the remaining assets are distributed to the designated charitable organizations. This structure allows donors to support a cause while benefiting from potential tax advantages. The Florida Charitable Remainder Inter Vivos Unitrust Agreement facilitates this arrangement effectively.

A Charitable Remainder Trust (CRT) provides income to the donor and designates remaining assets to charitable organizations after the donor's death. Conversely, a Charitable Lead Trust (CLT) directs income to charities for a specified term, with the principal returning to the donor or their heirs afterward. Both trusts serve different financial and philanthropic purposes, offering unique benefits based on your goals.

A charitable remainder trust (CRT) is a broader category that encompasses various structures; one of these is the charitable remainder unitrust (CRUT). The main difference lies in the payout method; a CRUT bases payouts on a fixed percentage of the trust’s value, while a standard CRT might offer fixed dollar amounts. Understanding this distinction helps you choose the right option for your financial strategy.