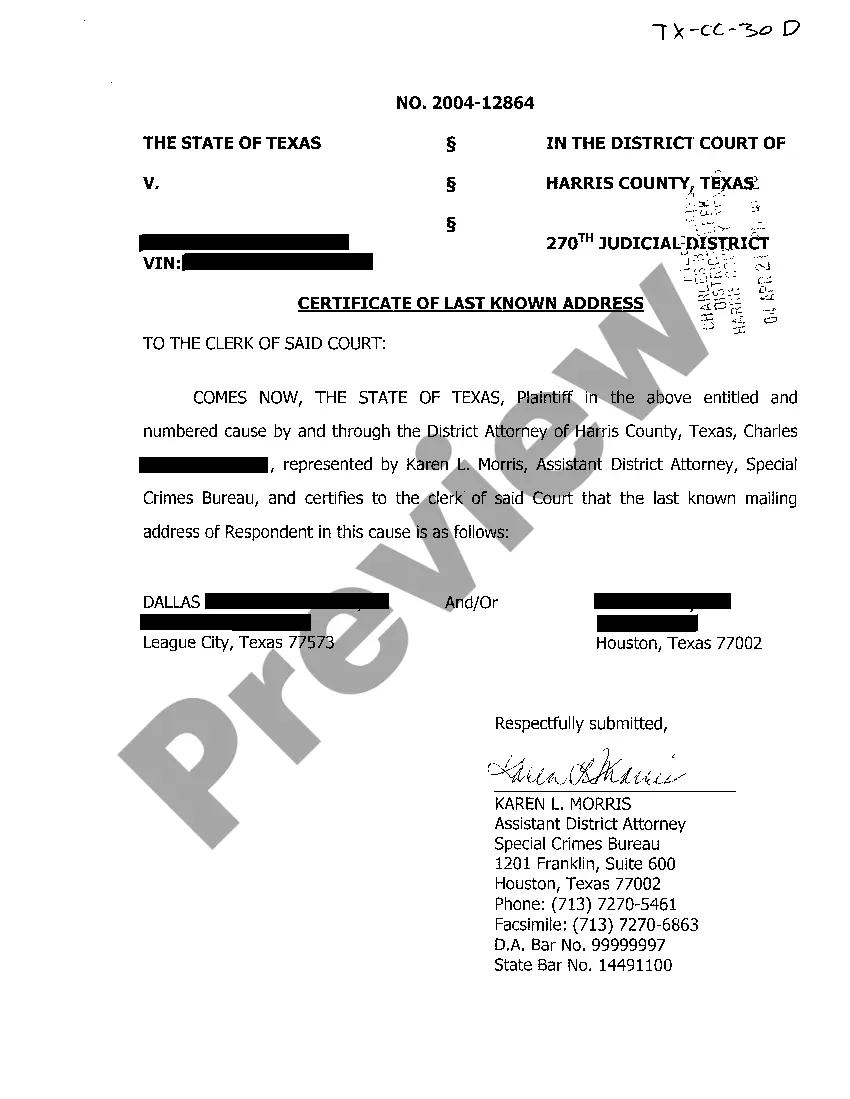

Florida General Release of Claims

Description

How to fill out General Release Of Claims?

US Legal Forms - one of the most essential repositories of legal templates in the United States - offers a diverse selection of legal document formats that you can purchase or print.

While using the site, you can access thousands of templates for commercial and personal purposes, categorized by types, states, or keywords. You can locate the latest versions of forms like the Florida General Release of Claims in moments.

If you possess a monthly subscription, Log In and obtain the Florida General Release of Claims from the US Legal Forms database. The Acquire button will appear on each template you view. You have access to all previously downloaded templates in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the purchase.

Select the format and download the form to your device. Make modifications. Fill out, edit, and print and sign the downloaded Florida General Release of Claims. Every template you added to your account does not have an expiration date and belongs to you permanently. So, if you want to download or print another copy, simply go to the My documents section and click on the template you need.

- Ensure you have selected the appropriate form for your city/county.

- Click the Review button to examine the form's details.

- Check the form summary to ensure you have chosen the correct form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find the right one.

- If you are pleased with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

To fill out a release of claims form, begin by clearly identifying the parties involved and the nature of the claims being released. It is vital to outline the specifics of the situation and the details of the waiver. For guidance, refer to the templates provided by USLegalForms, which can assist you in creating a Florida General Release of Claims that is both comprehensive and legally binding.

An example of release of claims is when an individual agrees to release a company from future claims related to an injury sustained during an event. A Florida General Release of Claims often outlines the specific circumstances under which the release is valid. This aids in protecting organizations from potential lawsuits and clarifying the rights of all parties involved.

Yes, you can write your own liability waiver, but it is important to follow specific guidelines to ensure it is enforceable. Your waiver should clearly communicate the risks involved and the intent to release liability. Using templates from USLegalForms can save you time while ensuring that your Florida General Release of Claims covers all necessary legal aspects.

Filling out a general release of liability form requires careful attention to detail. Start by entering the names of the involved parties, followed by a clear description of the activity and any associated risks. Utilizing a template from USLegalForms can simplify the process, ensuring that your Florida General Release of Claims is correctly filled out.

Notarization of release of liability forms is not always required; however, doing so adds an extra layer of validation. In Florida, for a General Release of Claims, notarization is advisable, as it can strengthen the document's enforceability. Consider consulting with legal resources to understand the best practices for your situation.

To ensure your release of liability form is legally sound, include clear terms and definitions. It's also helpful to use a well-structured format that specifies the risks involved. Platforms like USLegalForms offer templates designed to help you create effective Florida General Release of Claims, ensuring compliance with state laws.

A release of liability clause typically states that one party waives the right to sue another party for any claims arising from a specific activity. For instance, a Florida General Release of Claims might be included in a contract for a sports event, where participants acknowledge the risks involved and release the event organizers from liability. This clause helps protect the organizers while informing participants of their rights.

A general release means you agree to forfeit the right to make any further claims against another party concerning specific matters. This typically includes all claims arising from past incidents, effectively closing the case. It is important to carefully evaluate a Florida General Release of Claims before signing, ensuring that you are fully aware of its implications.

The 90-day rule for insurance claims in Florida mandates that an insurer must respond to a claim within 90 days of submission. If the insurance company fails to respond within this time frame, they may lose the right to dispute the claim. Knowing this rule empowers you to understand your rights concerning a Florida General Release of Claims.

An example of a Florida General Release of Claims might occur when an employee settles a workplace injury claim. By signing the release, the employee might receive a lump sum payment and, in return, agrees not to pursue any further claims against the employer related to the incident. This comprehensive approach protects the employer and provides certainty for the employee.