Florida Corporate Guaranty - General

Description

How to fill out Corporate Guaranty - General?

Are you presently in the location that you require to have documents for potentially business or specific purposes almost every day.

There are numerous authorized document templates accessible on the web, but finding ones you can rely on is challenging.

US Legal Forms offers a vast array of form templates, including the Florida Corporate Guaranty - General, that are designed to comply with state and federal regulations.

Once you acquire the right form, click on Get now.

Select the payment plan you require, provide the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and hold an account, just Log In.

- After that, you can download the Florida Corporate Guaranty - General template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for the correct city/region.

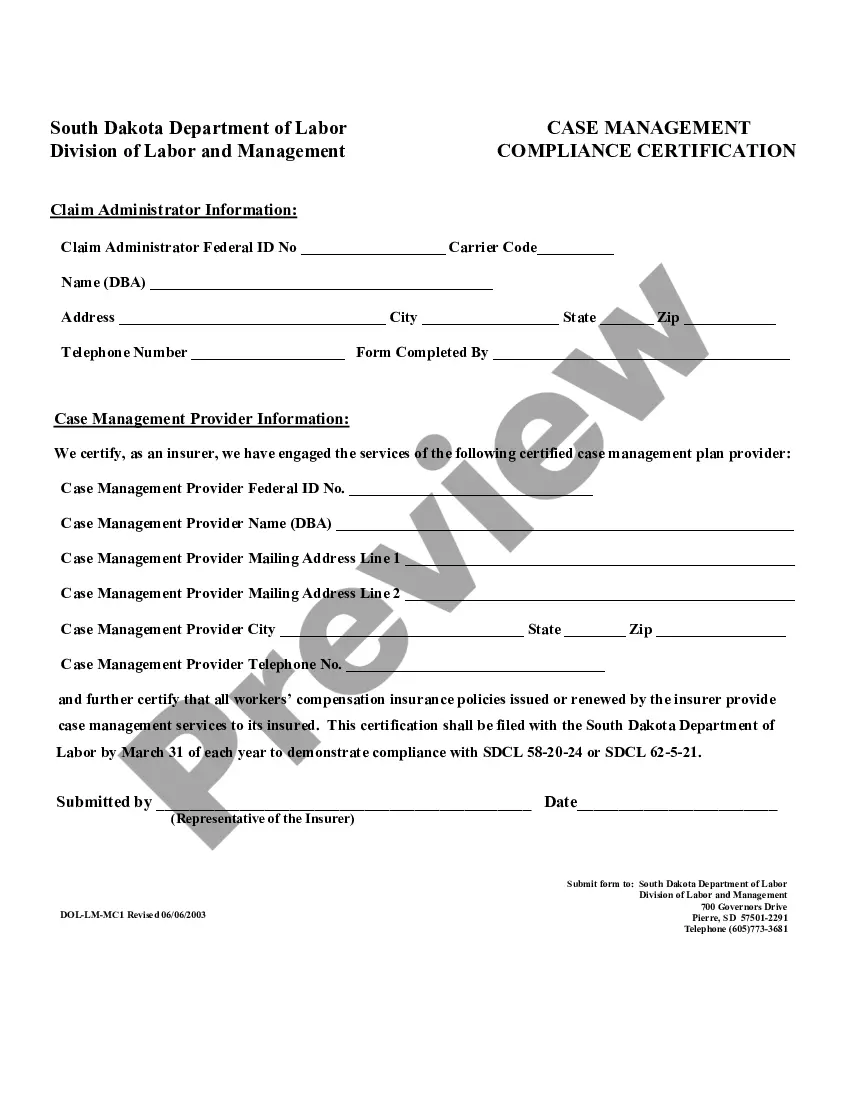

- Utilize the Review option to examine the form.

- Read the description to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

To file a Florida corporate tax return, gather all necessary financial documents, including income statements and balance sheets. Use Form F-1120 to complete and submit your filing by the due date. It is essential to ensure compliance with Florida Corporate Guaranty - General rules to avoid penalties and maintain good standing.

The main difference lies in the entity providing the guarantee. A corporate guarantee involves a business entity promising to cover debts, while a personal guarantee involves an individual taking on financial responsibility. Understanding these differences is significant when navigating Florida Corporate Guaranty - General, since they impact risk and liability.

The three primary types of guarantees include corporate guarantees, personal guarantees, and bank guarantees. Corporate guarantees are often used in business transactions to ensure payment obligations. Understanding the differences among these types is crucial, especially for those engaged in Florida Corporate Guaranty - General.

Typically, a general partnership does not need to be formally registered in Florida; however, it may need to file for a fictitious name if using a business name. That said, understanding the implications of forming a partnership is crucial, and the Florida Corporate Guaranty - General can assist in navigating these requirements.

Yes, you can file the Florida F-7004 electronically, which streamlines the process and ensures timely submission. Electronic filing often reduces errors and speeds up processing times. For comprehensive guidance on electronic submissions, the Florida Corporate Guaranty - General is a reliable resource.

Any partnership generating income in Florida should file a Florida partnership return. This includes limited partnerships and general partnerships alike. To navigate the complexities of these requirements, consider referring to the Florida Corporate Guaranty - General as a helpful resource.

A partnership return must be filed by businesses that engage in profit-sharing between partners. This applies regardless of whether the partnership is formal or informal. Familiarizing yourself with the Florida Corporate Guaranty - General can help clarify your responsibilities and avoid any tax complications.

Corporations doing business in Florida are required to file Florida F 1120. This form captures the income, gains, losses, and deductions of the corporation. By staying informed about the Florida Corporate Guaranty - General, corporations can ensure they meet their tax obligations effectively.

In Florida, partnerships must file a partnership return if they have income, deductions, or credits. This return, known as the Florida F 1065, helps report the income earned by the partnership. Understanding your filing responsibilities with the Florida Corporate Guaranty - General is essential to ensure compliance.

Residents of Florida must file a tax return if they meet specific income thresholds. This requirement often depends on total income, age, and filing status. If you are unsure about whether you need to file, the Florida Corporate Guaranty - General can provide clarity on your obligations.