Florida Executive Employee Stock Incentive Plan

Description

How to fill out Executive Employee Stock Incentive Plan?

If you require extensive, obtain, or print legal document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you seek.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you acquire is yours forever. You will have access to every form you obtained in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and download, and print the Florida Executive Employee Stock Incentive Plan with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to find the Florida Executive Employee Stock Incentive Plan in just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download option to obtain the Florida Executive Employee Stock Incentive Plan.

- You can also access forms you previously acquired from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

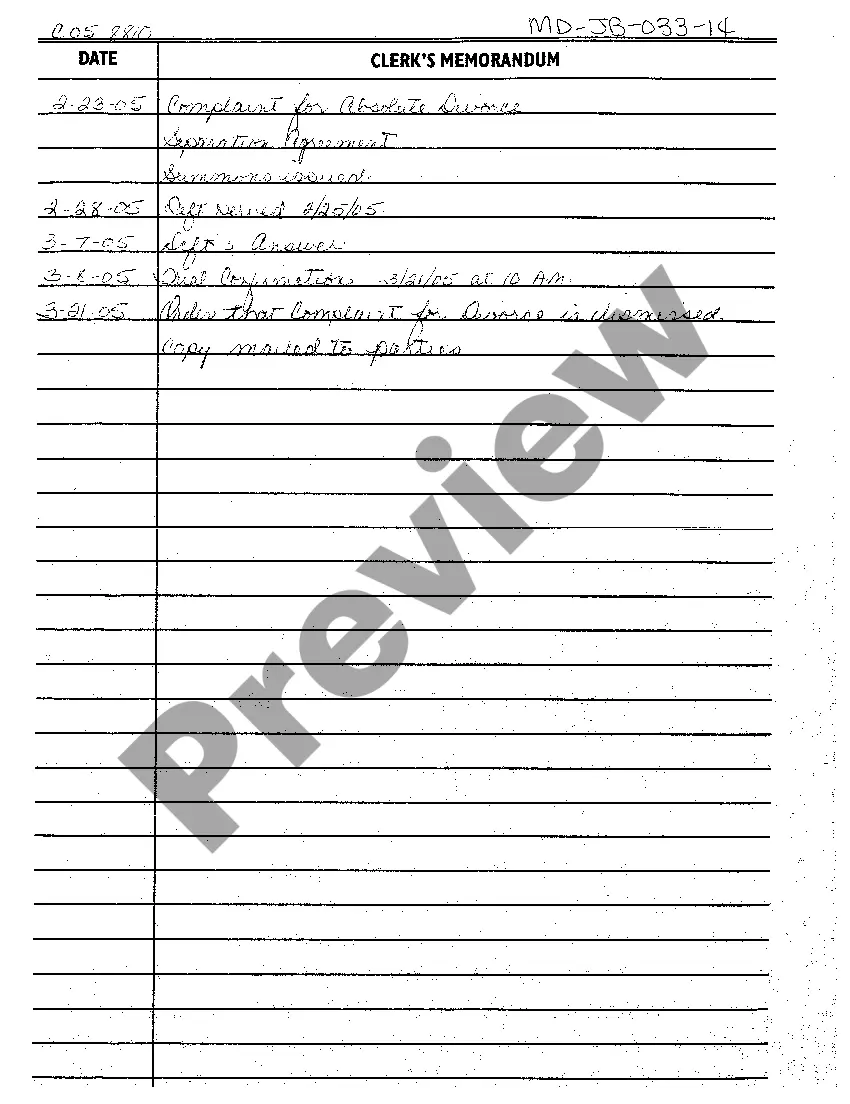

- Step 2. Use the Preview feature to review the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you desire, click the Purchase now option. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Process the transaction. You may use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Florida Executive Employee Stock Incentive Plan.

Form popularity

FAQ

To apply for an Employee Stock Ownership Plan (ESOP), you should first check if your company has implemented a Florida Executive Employee Stock Incentive Plan. If so, speak with your HR department or management about the application process and any documentation required. Utilizing platforms like UsLegalForms can streamline your application and ensure all documents meet legal standards.

Typically, employees of a company, particularly those in key roles or executives, qualify for incentive stock options under a Florida Executive Employee Stock Incentive Plan. However, eligibility often depends on criteria set by the company, such as tenure and performance metrics. Understanding these qualifications benefits employees seeking to maximize their stock compensation.

An employee stock incentive program is designed to reward employees with company shares as part of their compensation. The Florida Executive Employee Stock Incentive Plan encourages employees to invest in the company's future, thereby fostering loyalty and commitment. This approach can lead to increased productivity and improved performance. If you’re considering this program, US Legal Forms offers comprehensive resources to help you establish and manage your plan effectively.

The Florida Executive Employee Stock Incentive Plan, also known as an ESOP, is a program that allows employees to acquire shares in the company they work for. This plan not only provides employees with a sense of ownership, but it also aligns their interests with the company's success. As a result, employees may be more motivated to contribute to the company's growth. By implementing this plan, businesses can enhance employee retention and satisfaction.

Non-Statutory Options (NSO) provide flexibility within the Florida Executive Employee Stock Incentive Plan but also come with specific drawbacks. On the positive side, NSOs can be offered to a wide range of employees, enhancing equity compensation. However, the downside is that they often incur immediate tax liabilities upon exercise. Understanding these factors can help you make informed decisions regarding your equity compensation.

Yes, reporting your ESOP on your tax return is crucial for compliance. When you exercise stock options or sell shares, you may need to report these transactions as income. It's recommended to consult a tax professional to understand how the Florida Executive Employee Stock Incentive Plan impacts your tax situation and ensure you meet all reporting requirements.

One downside of the Florida Executive Employee Stock Incentive Plan is that it can tie a significant portion of your retirement savings to your company’s performance. If the company struggles, the value of your shares may decline, affecting your overall financial stability. Therefore, it’s essential to diversify your investments and not rely solely on your ESOP for retirement planning.

Filing for an ESOP under the Florida Executive Employee Stock Incentive Plan involves submitting specific documents to the appropriate regulatory bodies. You typically need to file Form 5500 if your ESOP is qualified and meets the necessary requirements. Using platforms like uslegalforms can simplify this process by providing the needed forms and guidance tailored to your situation.

To claim your share of the Florida Executive Employee Stock Incentive Plan, start by reviewing the specific terms of your plan. Generally, you will need to notify your employer about your intent to exercise your stock options or claim your shares. It’s advisable to consult with a financial advisor or an attorney to ensure you comply with all requirements and understand any tax implications.

You typically do not report stock purchases on your taxes until you sell the stocks. When you do sell, you will need to report the proceeds and any gains or losses on your tax return. If your stock purchases were part of a Florida Executive Employee Stock Incentive Plan, tracking the details is crucial for when you sell. Using a platform like US Legal Forms can help simplify tracking these transactions and ensure compliance.