Florida Demand for Collateral by Creditor

Description

How to fill out Demand For Collateral By Creditor?

You might invest hours online trying to identify the legal form that fulfills the federal and state requirements you need.

US Legal Forms provides a vast selection of legal documents that can be reviewed by professionals.

You can conveniently obtain or create the Florida Demand for Collateral by Creditor through our service.

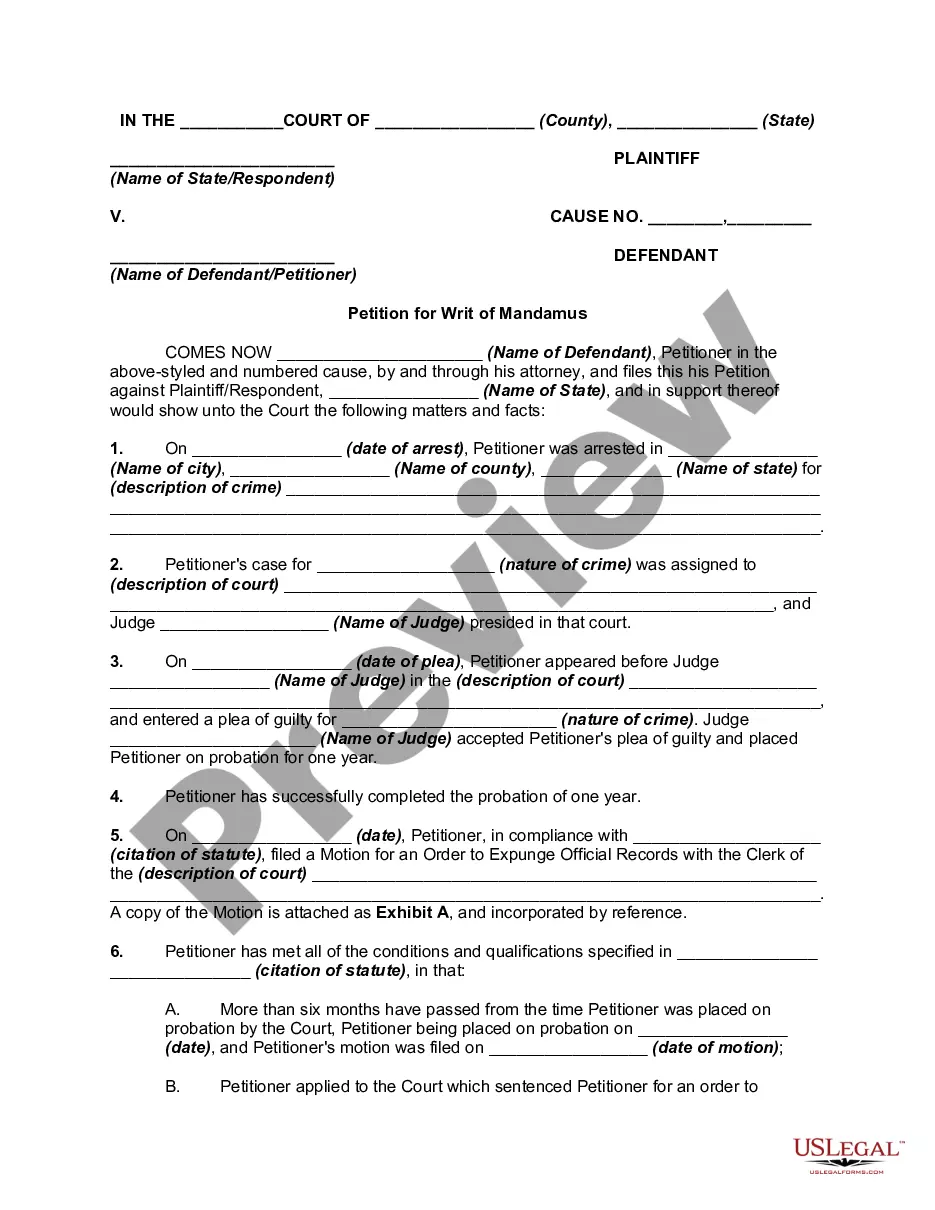

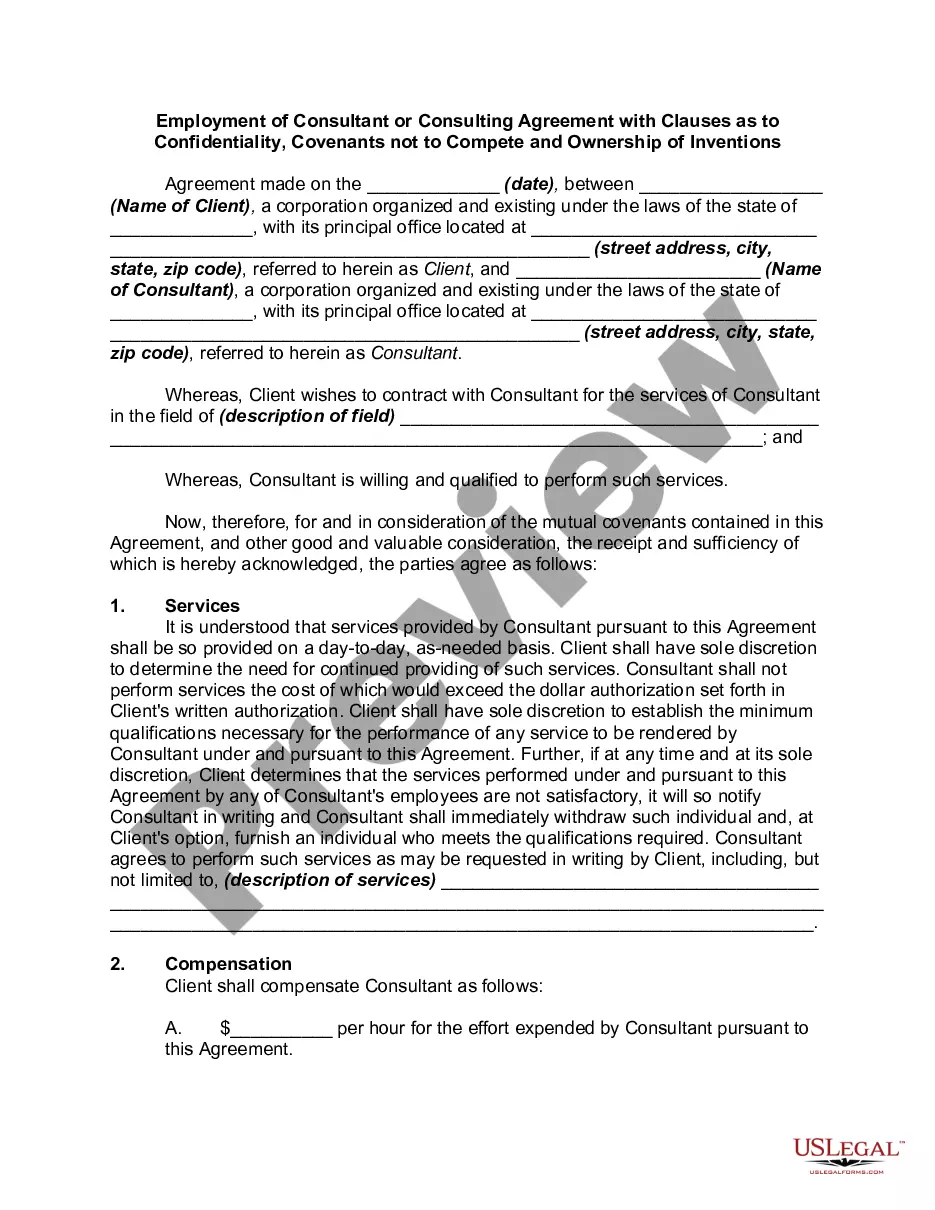

If available, utilize the Preview button to view the form as well.

- If you already possess a US Legal Forms account, you can sign in and then click the Download button.

- After that, you can complete, modify, print, or sign the Florida Demand for Collateral by Creditor.

- Every legal document you obtain is yours indefinitely.

- To acquire an additional copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct form for your preferred state/city.

- Review the form details to confirm that you have chosen the right document.

Form popularity

FAQ

A UCC 3 amendment filing does not have an expiration date on its own, as it modifies an existing UCC filing. However, the original filing's duration of five years still applies, meaning UCC 3 filings must be renewed along with the original. Being aware of this is important if you receive a Florida Demand for Collateral by Creditor. Consider uslegalforms to navigate these filings easily.

A UCC fixture filing is also valid for five years, similar to standard UCC filings in Florida. This status pertains to personal property that becomes attached to real estate. If you are facing a Florida Demand for Collateral by Creditor and have fixtures involved, you must be aware of her time limits. Uslegalforms can assist you with managing these documents effectively.

UCC filings are valid for five years in most jurisdictions, including Florida. After this period, a creditor must renew the filing to keep the secured interest active. This renewal is crucial, especially if you have outstanding debts related to a Florida Demand for Collateral by Creditor. You can simplify renewals using uslegalforms' resources.

In Florida, a UCC filing generally remains effective for five years from the date of filing. Creditors may choose to renew the filing before it expires to maintain their secured interest. If you receive a Florida Demand for Collateral by Creditor, understanding UCC filing durations is essential for managing your obligations. Utilizing uslegalforms can guide you through the renewal process.

In Florida, creditors can pursue a range of collection methods, but they cannot take your home without following specific legal procedures. Home foreclosure occurs primarily when mortgage payments are missed. However, a Florida Demand for Collateral by Creditor can inform you of your rights and help you take necessary steps to protect your property. Consider uslegalforms to understand your options better.

1 filing in Florida is a legal document that a creditor files to secure an interest in a specific asset or collateral. This filing serves to notify other creditors about the secured interest. If you are dealing with a Florida Demand for Collateral by Creditor, understanding the UCC1 process can help protect your assets. Using uslegalforms can streamline the filing process efficiently.

For a creditor to establish an enforceable security interest, they must meet three key requirements: attachment, which means the creditor's interest must attach to the collateral; value, where the creditor must provide value to the debtor; and rights, where the debtor must have rights in the collateral. Understanding these elements is crucial, especially when addressing Florida Demand for Collateral by Creditor issues. Platforms like US Legal Forms can guide you through these complexities, ensuring your security interests are protected.

The statute for notice to creditors in Florida is outlined in the Florida Statutes, specifically regarding the requirements for giving notice. When creditors need to inform debtors about repossession or other collection actions, following the legal notice requirements is essential. This ensures that all parties are informed and can take appropriate actions. For assistance with these statutory obligations, check out uslegalforms for the latest information.

The right to take possession of collateral until a debt is repaid is known as the right of repossession. This right allows a creditor to reclaim assets to mitigate losses before receiving full payment. Debtors should be aware of their terms to avoid unintentional defaults. For more specific guidance regarding repossession rights, uslegalforms offers valuable resources.

The exemption from creditors in Florida identifies specific assets or income that cannot be seized to satisfy debts. Common exemptions include homestead property, certain retirement accounts, and personal property up to a set value. Understanding these exemptions is crucial for debtors seeking to protect their assets while managing obligations. You can learn more about these protections through uslegalforms.