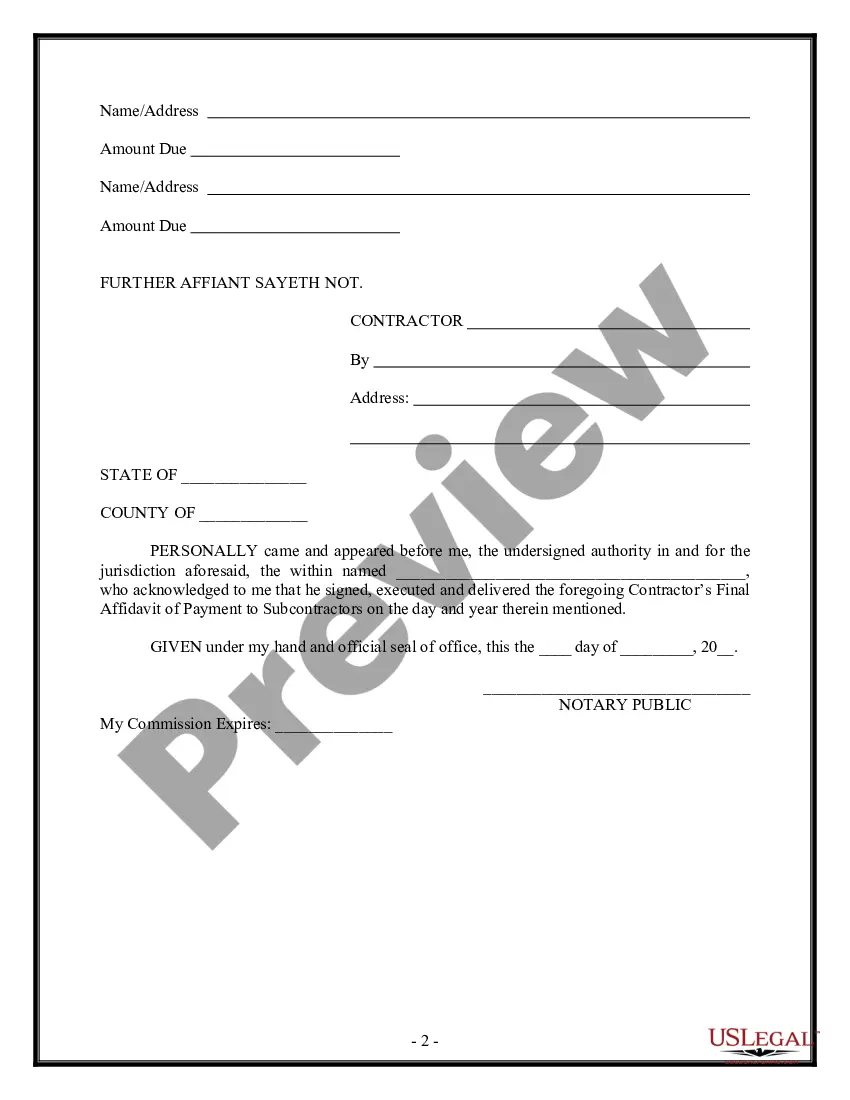

Florida Contractor's Final Affidavit of Payment to Subcontractors

Description

How to fill out Contractor's Final Affidavit Of Payment To Subcontractors?

If you wish to total, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s simple and convenient search to find the documents you need.

A wide array of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, select the Buy now button. Choose the payment plan you prefer and enter your information to create an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to obtain the Florida Contractor's Final Affidavit of Payment to Subcontractors within just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to get the Florida Contractor's Final Affidavit of Payment to Subcontractors.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to check the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find other versions of the legal form template.

Form popularity

FAQ

Florida allows payments to be withheld for the following reasons: An improper pay request, A bona fide dispute, A material breach of contract by the claimant.

FLORIDA'S CONSTRUCTION LIEN LAW ALLOWS SOME UNPAID CONTRACTORS, SUBCONTRACTORS, AND MATERIAL SUPPLIERS TO FILE LIENS AGAINST YOUR PROPERTY EVEN IF YOU HAVE MADE PAYMENT IN FULL. UNDER FLORIDA LAW, YOUR FAILURE TO MAKE SURE THAT WE ARE PAID MAY RESULT IN A LIEN AGAINST YOUR PROPERTY AND YOUR PAYING TWICE.

If the supplier contracts with the property owner, Florida does not require a preliminary notice. In Florida, the deadline to file a mechanics lien is 90 days from last furnishing labor or materials to the project. The claimant must serve a copy of the lien on the property owner within 15 days after filing the lien.

Subcontractors. For Subcontractors, undispited amounts must be paid within the longer of 30 days after payment is due, or 30 days from receipt of invoice.

You cannot usually withhold payment from a subcontractor if the job you are contracted to run does not pay you for work on time or at all. The subcontractor can place a mechanic's lien against your property to recover his owed funds, and he can sue you to recover additional damages.

When Can Contractors Withhold Payment From Subcontractors? The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

This can be due to a dispute or contractual breach between two parties for non-performance of a certain clause. Provided that a party to a contract issues a compliant withholding-notice setting out the grounds and the sums attributable to each ground, then the party may legitimately withhold payment.

This means that if a lien is filed against your property, your property could be sold against your will to pay for labor, materials, or other services which your contractor may have failed to pay.

If the supplier contracts with the property owner, Florida does not require a preliminary notice. In Florida, the deadline to file a mechanics lien is 90 days from last furnishing labor or materials to the project.

Notice of Commencement RequirementNotices of Commencement are required in Florida. Property owners must get them filed. The only exception is when there is a construction lender on the job, in which event, the property owner is relieved from this duty and the construction lender must make the filing.