Florida Affidavit of Lost Promissory Note

Description

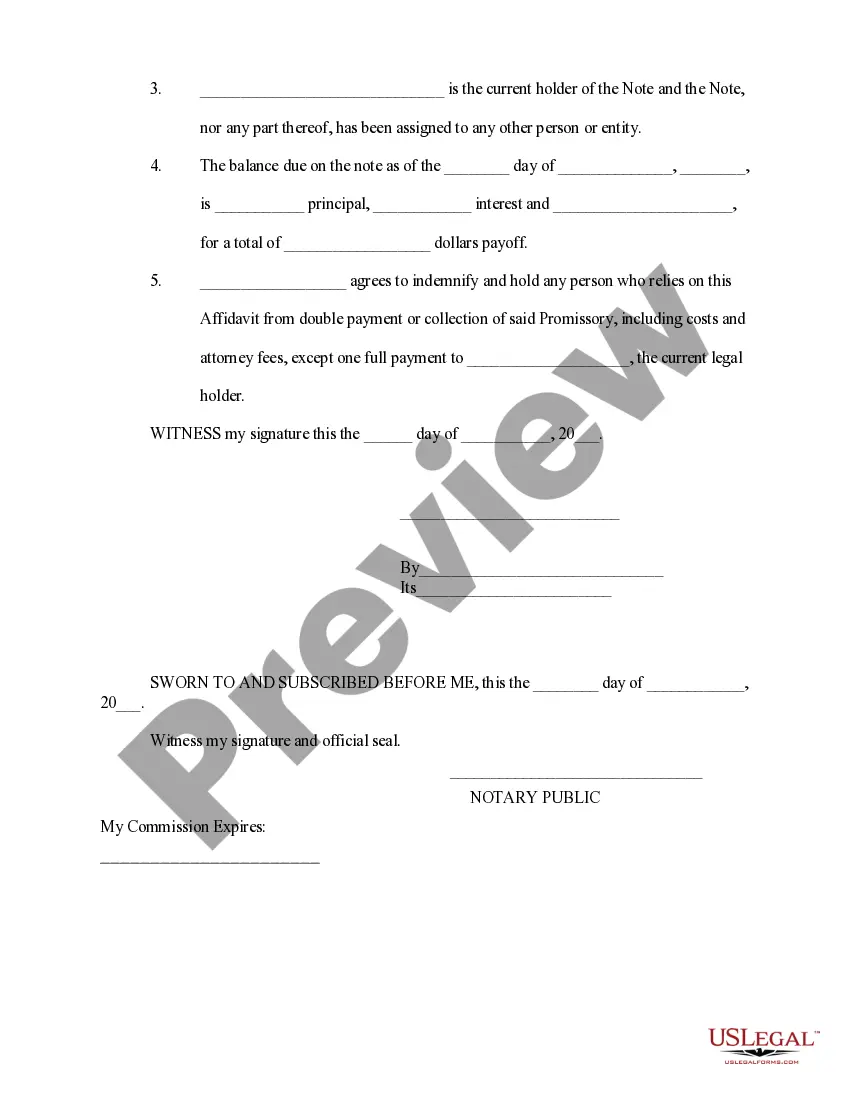

How to fill out Affidavit Of Lost Promissory Note?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal document templates that you can obtain or print.

By using the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You can find the latest document types such as the Florida Affidavit of Lost Promissory Note in just seconds.

If you hold a monthly subscription, Log In and obtain the Florida Affidavit of Lost Promissory Note from the US Legal Forms library. The Download option will be available on every form you view. You have access to all previously acquired forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Complete, modify, print, and sign the Florida Affidavit of Lost Promissory Note that you have obtained. Every template you have added to your account does not expire and is yours permanently. Therefore, if you wish to obtain or print another copy, simply navigate to the My documents section and click on the form you need. Access the Florida Affidavit of Lost Promissory Note through US Legal Forms, one of the most extensive compilations of legal document templates. Utilize a vast array of professional and state-specific templates that comply with your business or personal requirements.

- Ensure you have selected the correct form for your city/state.

- Utilize the Preview feature to examine the content of the form.

- Check the form description to confirm you have chosen the right document.

- If the form does not suit your needs, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Next, select your preferred payment plan and provide your information to register for an account.

Form popularity

FAQ

A lost note affidavit is a sworn statement made by the lender that it has lost the original note. The affidavit also contains factual representations from the lender about the status of the note and the loan.

Promissory notes are not usually recorded. They are enforceable even if they are not recorded. The hiring of a lawyer is an important decision that should not be based solely upon advertisements.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

Unlike a deed of trust or mortgage, the promissory note is typically not recorded in the county land records (except in a few states like Florida). Instead, the lender holds on to this document until the amount borrowed is repaid.

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

Losing the original note or a copyThe original copy of a valid promissory note is usually held by the lender, but the borrower should also keep a copy of the signed document. If the borrower does not repay the loan, the lender can pursue appropriate legal action.

The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.

You can get a copy of your Master Promissory Notes by going to studentloans.gov and entering your FSA ID. Click on Completed Master Promissory Notes under the menu bar heading that says My Loan Documents. The completed Master Promissory Notes will appear, and you can download them directly.

The borrower records the note by debiting the cash account and crediting the notes payable account. The rest of the notes payable formula includes that interest due to date is accrued at the end of each financial period by debiting the interest expense account and crediting the interest payable liability account.