Florida Certificate of Dissolution Limited Partnership is a legal document used to officially dissolve a limited partnership in the state of Florida. This document is required to be filed with the Florida Secretary of State in order to dissolve the partnership and end its legal status. There are two types of Florida Certificate of Dissolution Limited Partnership, an Administrative Dissolution and a Voluntary Dissolution. An Administrative Dissolution occurs when the limited partnership has not filed the necessary documents or paid the required fees. A Voluntary Dissolution occurs when the partners agree to end the partnership voluntarily. Both types of dissolution require the filing of a Certificate of Dissolution Limited Partnership with the Florida Secretary of State in order to be finalized.

Florida Certificate of Dissolution Limited Partnership

Description

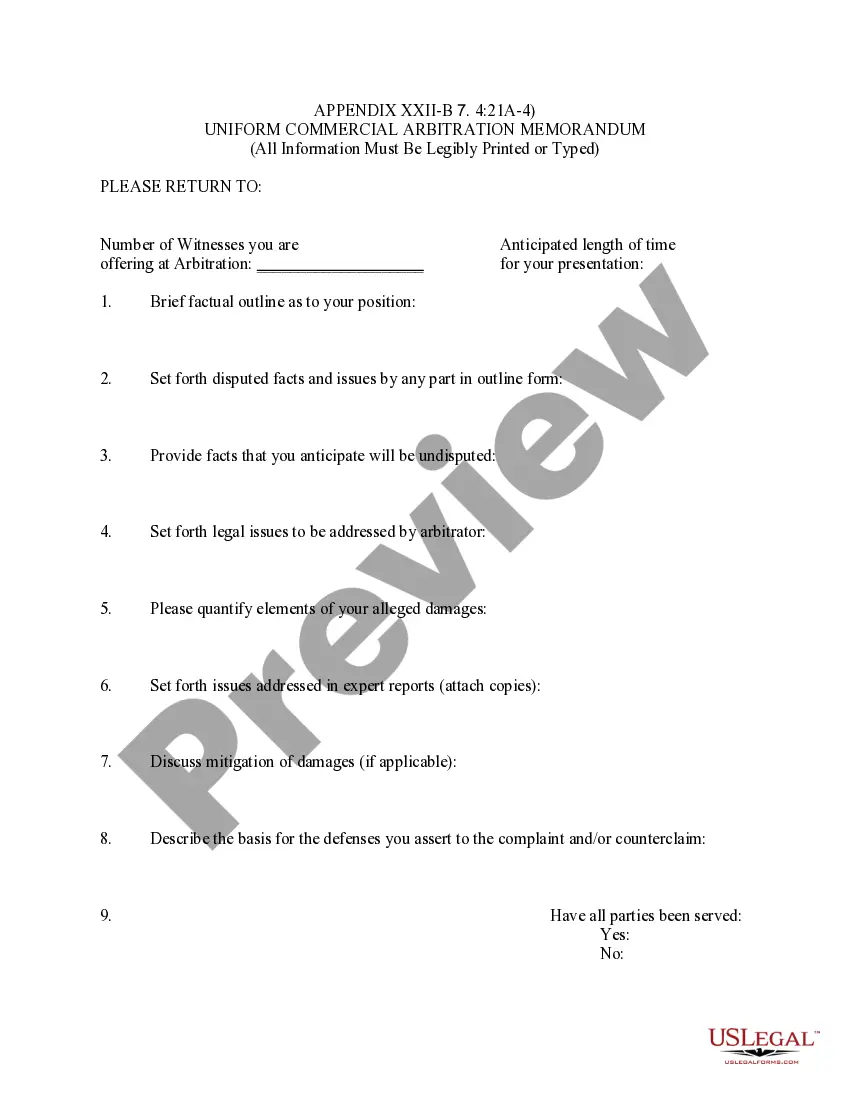

How to fill out Florida Certificate Of Dissolution Limited Partnership?

Handling legal documents demands focus, accuracy, and utilizing correctly-prepared templates. US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your Florida Certificate of Dissolution Limited Partnership template from our service, you can rest assured it adheres to federal and state laws.

Engaging with our service is straightforward and quick. To access the necessary documents, all you need is an account with an active subscription. Here’s a concise guide for you to acquire your Florida Certificate of Dissolution Limited Partnership in just minutes.

All documents are crafted for multiple usages, such as the Florida Certificate of Dissolution Limited Partnership you see on this page. If you require them again in the future, you can fill them out without additional payment - simply access the My documents tab in your profile and finalize your document whenever necessary. Experience US Legal Forms and complete your business and personal paperwork swiftly and in full legal compliance!

- Ensure to meticulously review the form content and its alignment with general and legal standards by previewing it or consulting its description.

- Look for another official blank if the one opened previously does not align with your circumstances or state regulations (the tab for that is located in the top page corner).

- Log in to your account and save the Florida Certificate of Dissolution Limited Partnership in your desired format. If it’s your initial experience with our service, click Buy now to proceed.

- Create an account, choose your subscription plan, and make a payment using your credit card or PayPal account.

- Select the format in which you prefer to receive your form and click Download. Print the blank or incorporate it into a professional PDF editor for a paperless submission.

Form popularity

FAQ

To dissolve a limited partnership in Florida, you must file a Florida Certificate of Dissolution Limited Partnership with the Division of Corporations. This document officially terminates the partnership's existence. It is also a good idea to notify creditors and settle any outstanding obligations before you file. USLegalForms provides helpful templates and guidelines to navigate this process smoothly and ensure that you meet all legal requirements.

To create a Limited Liability Partnership (LLP) in Florida, you need to file a Florida Certificate of Registration for a Limited Liability Partnership. This requires basic information about your partnership, including the name, address, and the designated partners. Additionally, it's essential to draft a partnership agreement that outlines the rules and responsibilities of each partner. Utilizing platforms like USLegalForms can simplify the paperwork and help you ensure compliance with Florida regulations.

To dissolve an LLC partnership in Florida, you need to submit a Florida Certificate of Dissolution Limited Partnership to the state. This process requires settling any debts and notifying creditors, as well as filing any final tax returns. Using the USLegalForms platform can simplify the necessary paperwork, ensuring you meet all legal requirements effectively. Completing these steps helps you conclude your partnership smoothly.

To deactivate your business in Florida, you should file a Florida Certificate of Dissolution Limited Partnership with the Florida Department of State. This document officially terminates your partnership's existence in the state. It's essential to settle any outstanding debts and liabilities before you proceed. Additionally, you may want to notify your employees and clients about the closure.

To dissolve a limited partnership in Florida, you need to file a Florida Certificate of Dissolution Limited Partnership with the Division of Corporations. This document requires the name of the partnership, the date of dissolution, and details about the partners involved. Additionally, it is crucial to settle any outstanding debts, distribute assets, and follow any provisions outlined in your partnership agreement. Using the US Legal Forms platform can simplify this process, ensuring you meet all requirements effectively.

To dissolve a limited partnership in Florida, you must file a Florida Certificate of Dissolution Limited Partnership with the state. This document officially ends the partnership's legal existence. It's important to ensure that all debts and obligations are settled before filing. Utilizing our USLegalForms platform can simplify this process and provide the necessary forms.

To close their business account, partnerships need to send the IRS a letter that includes the complete legal name of their business, the EIN, the business address and the reason they wish to close their account.

The fee to get a certificate of status for a corporation or other entity is $8.75. This can be paid (by mail or in person) by check or money order payable to the Florida Department of State, as well as by credit or debit card if the request is made online. Checks must be in U.S. currency and from a U.S. bank.

LLC Fees Annual Report (& Supplemental Fee)$ 138.75Filing Fee (Required)$ 100.00Registered Agent Fee (Required)$ 25.00Total Fee For New Florida/Foreign LLC$ 125.00Change of Registered Agent$ 25.0018 more rows