Florida Satisfaction, Release or Cancellation of Mortgage by Corporation

Description

Key Concepts & Definitions

Satisfaction Release or Cancellation of Mortgage: This is a legal document issued by the mortgage lender indicating that the borrower has fully paid off their mortgage. This document is essential because it formally removes the lien from the borrower's property that was held as security for the loan.

Step-by-Step Guide to Obtaining a Satisfaction of Mortgage

- Final Mortgage Payment: Ensure that all payments are completed, including any fees or accrued interest.

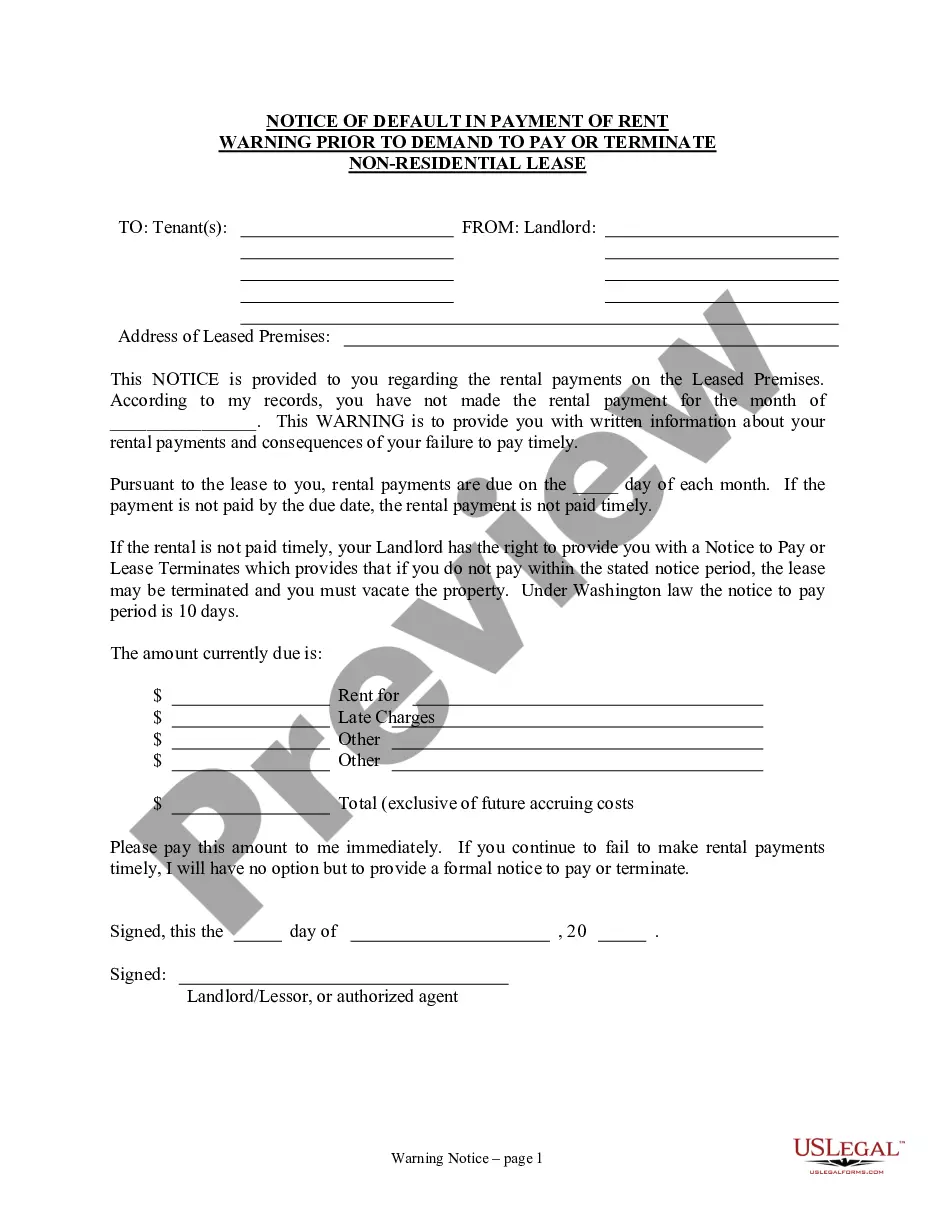

- Contact Your Lender: Request a satisfaction document. This request can usually be made online, by phone, or in writing.

- Review the Document: Once received, review the document for accuracy, ensuring your name, the property address, and other key details are correct.

- Record the Document: File the satisfaction of mortgage with your local county recorders office to officially release the lien from your property.

- Confirmation: Follow up to ensure that the document has been recorded and your property records are updated to reflect this change.

Risk Analysis

- Delays in Documentation: Failing to obtain the satisfaction of mortgage document can cause issues in proving the mortgage has been paid off.

- Incorrect Information: Errors in the document can lead to potential legal disputes or issues in record keeping.

- Loss of Original Documents: Losing important original documents can lead to complications in property transactions or refinancing.

Best Practices for Mortgage Release

- Maintain Communication with Lender: Regular updates and clear communication can prevent misunderstandings and errors.

- Keep Records: Preserve all payment receipts and correspondences with your lender until the mortgage release is confirmed.

- Verify with County Recorder: Ensuring the documents are recorded correctly avoids future complications with property claims.

Common Mistakes & How to Avoid Them

- Not Reviewing the Final Document: Always check the details in the satisfaction document for accuracy to avoid errors that can affect property records.

- Failing to Record the Document: It's crucial to record the satisfaction document at your local county recorder's office to legally remove the lien from your property.

- Ignoring Follow-Up: Ensure that the property records are updated by checking with the county recorder post submission of the document.

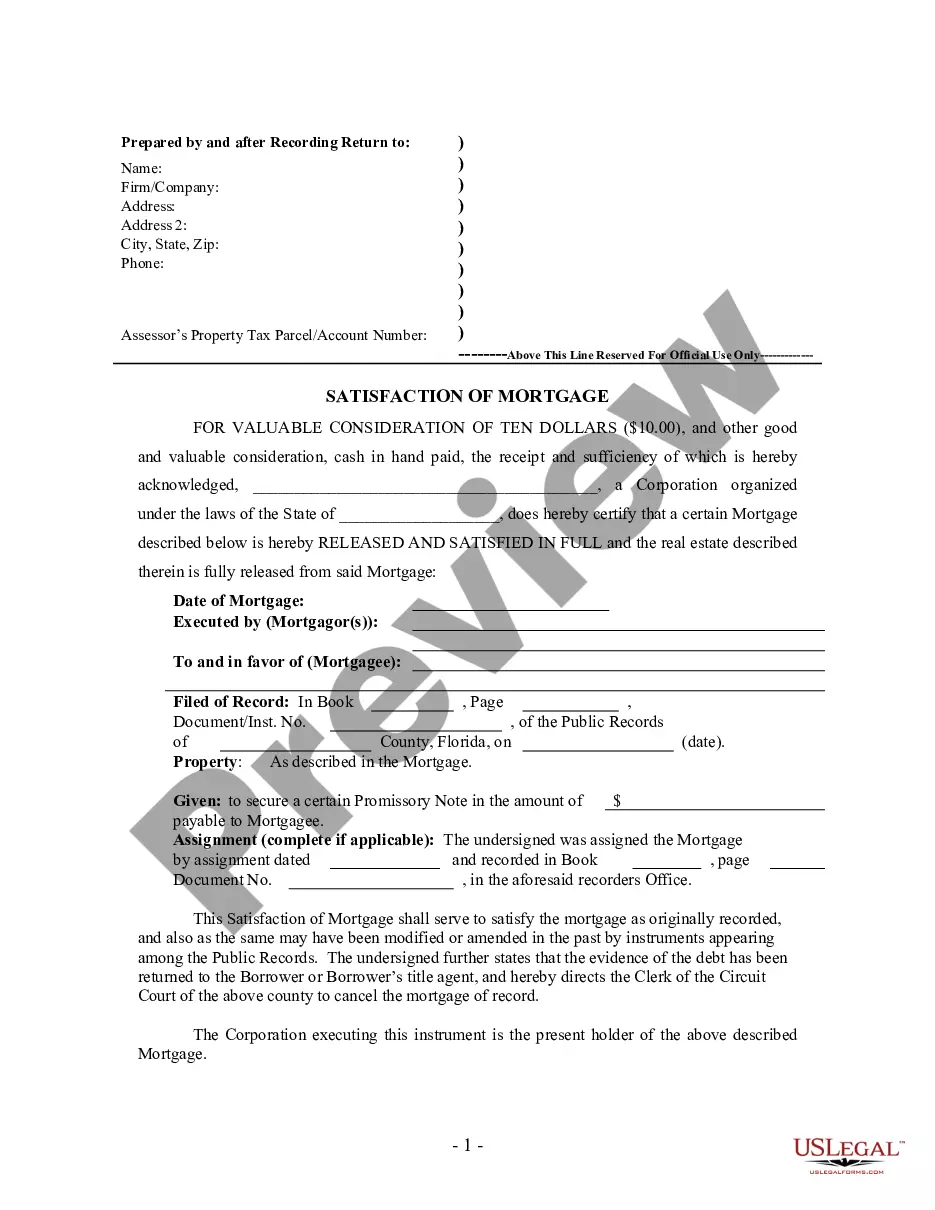

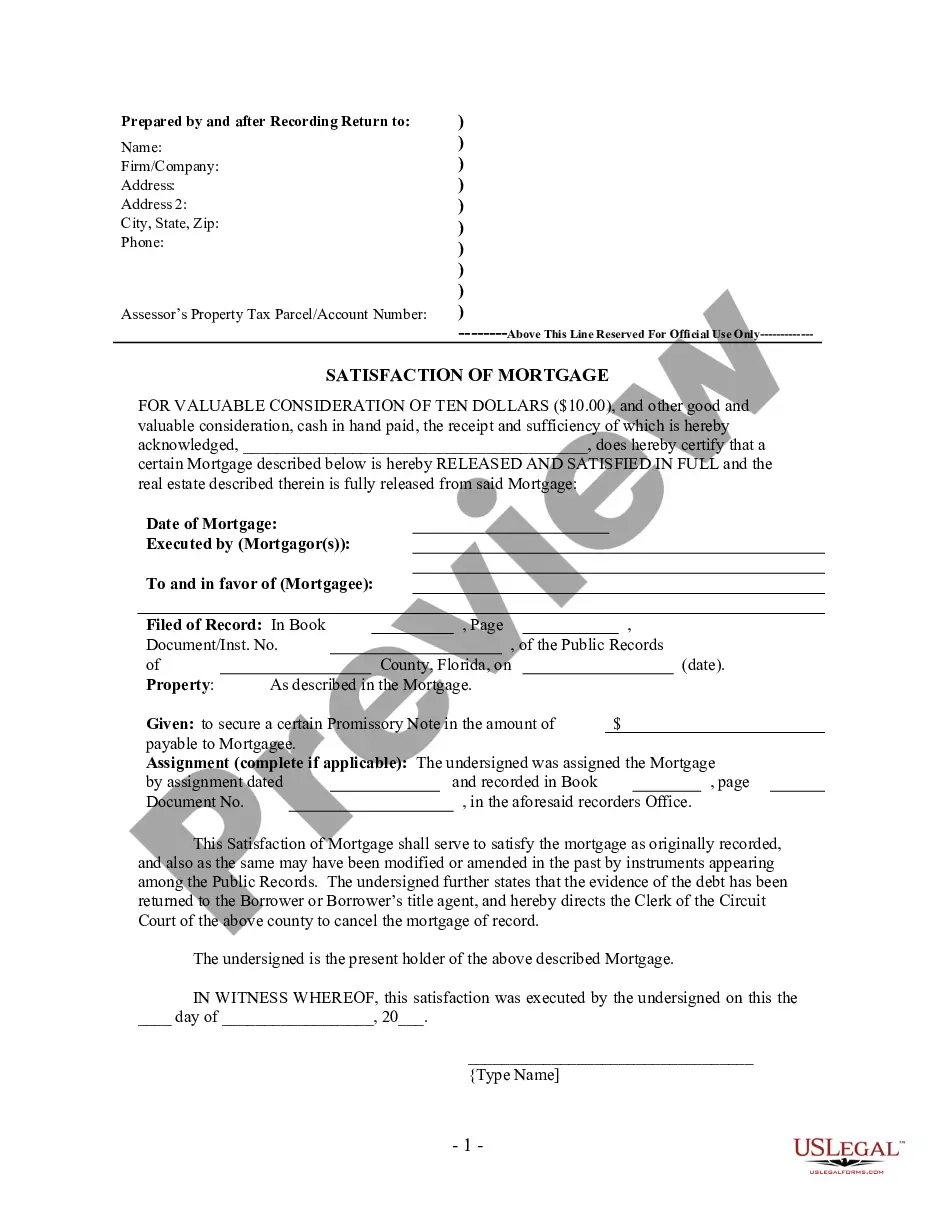

How to fill out Florida Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

Obtain access to one of the most extensive collections of legal documents.

US Legal Forms is indeed a solution to locate any state-specific file in moments, such as Florida Satisfaction, Release, or Cancellation of Mortgage by Corporation templates.

No need to squander hours searching for a court-admissible template.

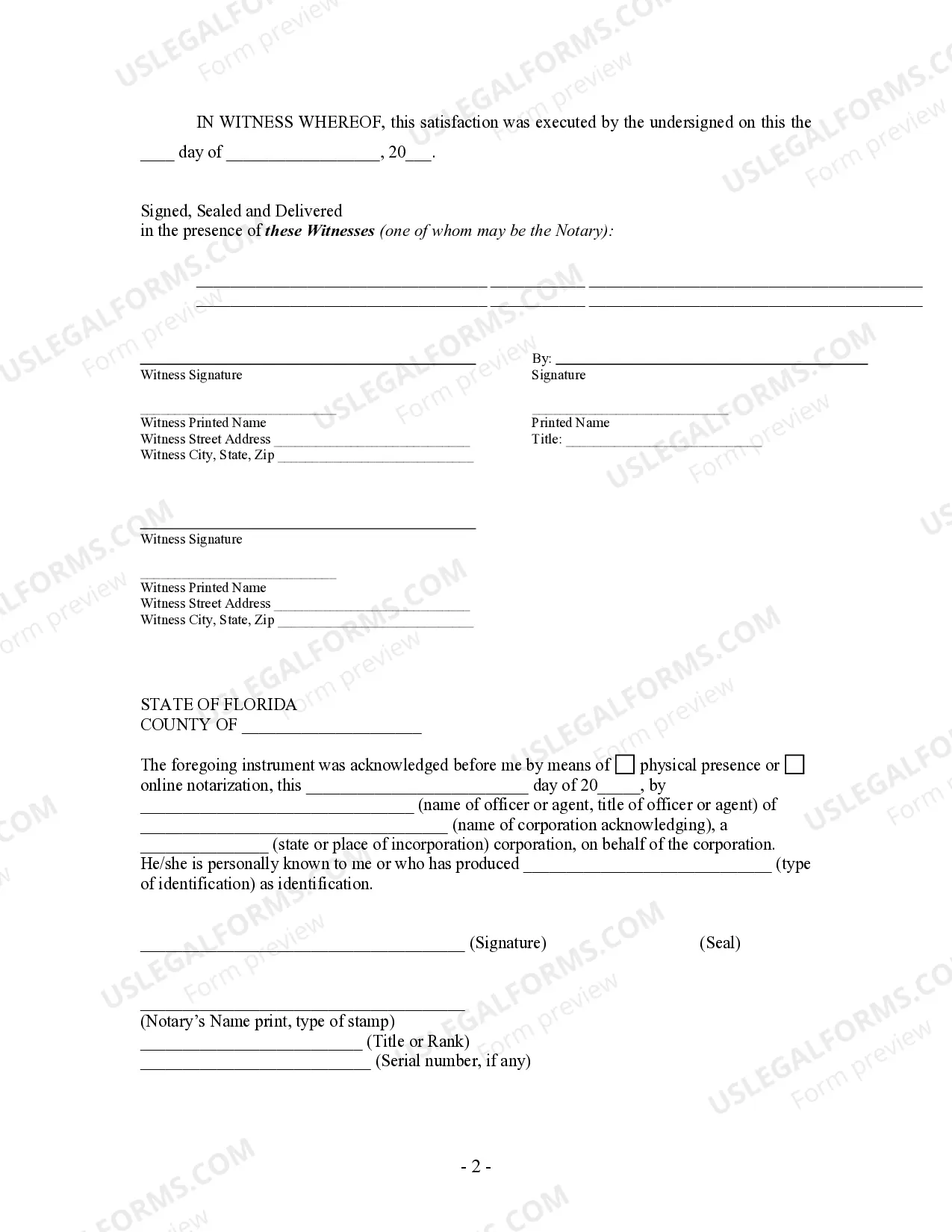

Use the Preview option if it's available to examine the document's content. If everything appears correct, click on the Buy Now button. After selecting a pricing plan, create your account. Pay using a credit card or PayPal. Download the document to your device by clicking Download. That's it! You should complete the Florida Satisfaction, Release or Cancellation of Mortgage by Corporation form and verify it. To make sure everything is accurate, consult your local legal advisor for assistance. Register and effortlessly locate over 85,000 valuable forms.

- Our certified professionals guarantee that you receive current examples every time.

- To take advantage of the forms library, select a subscription and set up an account.

- If you've already done this, simply Log In and then click Download.

- The Florida Satisfaction, Release or Cancellation of Mortgage by Corporation template will automatically be saved in the My documents tab (a section for all forms you save on US Legal Forms).

- To set up a new profile, adhere to the simple instructions provided below.

- If you are planning to use a state-specific example, ensure you specify the correct state.

- If possible, review the description to understand all of the details of the form.

Form popularity

FAQ

Satisfaction or release of mortgage refers to the official acknowledgment that a mortgage obligation has been fully met. In Florida, this typically involves the lender issuing a document that confirms the mortgage is clear and that the borrower has fulfilled their payment responsibilities. This acknowledgment is vital for homeowners looking to improve their financial standing or sell their property.

In Florida, the requirements for a satisfaction of mortgage include the full payment of the mortgage balance and the submission of a Satisfaction of Mortgage document to the county clerk. The lender must file this document within a specific timeframe after receiving the payment. Utilizing UsLegalForms can simplify this process by providing the necessary forms and guidance to ensure compliance with Florida laws.

The terms satisfaction and release often intertwine, yet they have distinct meanings. Satisfaction refers to the borrower completely paying off the mortgage, while release involves the lender providing official documentation to confirm this. In cases of Florida Satisfaction, Release or Cancellation of Mortgage by Corporation, understanding these differences can clarify your mortgage status and ensure proper legal acknowledgment.

In Florida, a lender must record a satisfaction of mortgage within 60 days after receiving the full payment. This prompt action protects property owners and helps prevent complications with future transactions. Knowing the timeline can help you ensure your Florida Satisfaction, Release or Cancellation of Mortgage by Corporation is properly documented. Services like U.S. Legal Forms can simplify this journey for you.

The statute of satisfaction of mortgages in Florida requires lenders to file a satisfaction of mortgage within a specific timeframe after receiving full payment. This law ensures that property owners can clear their outstanding debts from public records promptly. It's crucial to understand this statute to facilitate your Florida Satisfaction, Release or Cancellation of Mortgage by Corporation. Legal tools from U.S. Legal Forms can assist you with this paperwork.

When no satisfaction of mortgage is recorded, the mortgage may still appear as an active debt on public records. This can lead to complications when attempting to sell the property or apply for new loans. In Florida, it's essential to have a clear record to ensure your Florida Satisfaction, Release or Cancellation of Mortgage by Corporation is officially recognized. U.S. Legal Forms can help you navigate this process effectively.

Typically, you can expect to receive a mortgage satisfaction letter within 30 days after your final payment. However, processing times may vary depending on the lender and their policies. It’s important to follow up to ensure that your Florida Satisfaction, Release or Cancellation of Mortgage by Corporation is properly handled. Using comprehensive services like U.S. Legal Forms can streamline this process.

Obtaining a partial release of a mortgage can be somewhat challenging, as it requires lender approval and often involves additional documentation. Lenders typically want to ensure that the remaining mortgage balance is still secure after part of the property is released. Using UsLegalForms can streamline this process by providing the necessary forms and instructions, aiding in your Florida Satisfaction, Release or Cancellation of Mortgage by Corporation.

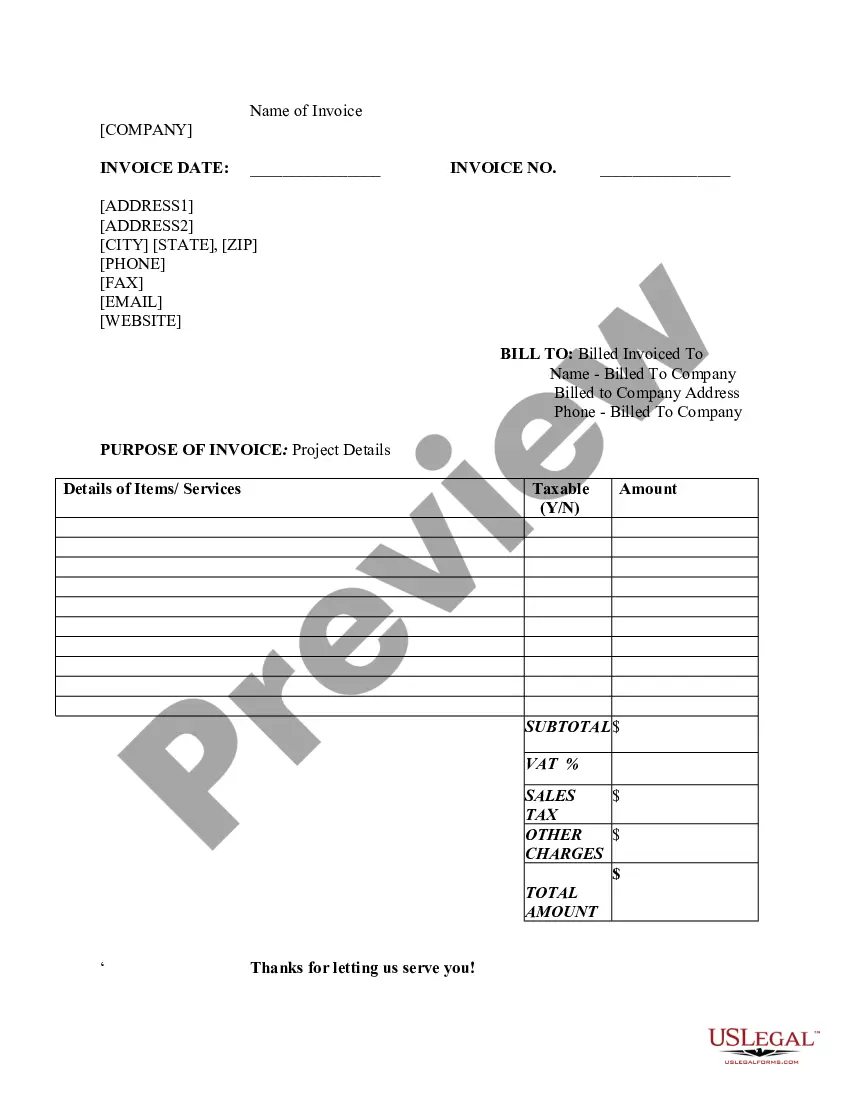

Filling out a satisfaction of mortgage form requires basic information like your name, the lender's name, and mortgage details, such as the volumetric number. Make sure to detail the satisfaction statement clearly. You may find it beneficial to use UsLegalForms, which offers templates and instructions to help you accurately complete your satisfaction of mortgage form, supporting your Florida Satisfaction, Release or Cancellation of Mortgage by Corporation.

To release your mortgage in Florida, you need to obtain a satisfaction document from your lender, sign it, and have it notarized if required. Afterward, file this document with the local county clerk’s office. Utilizing our platform at UsLegalForms can simplify this process, providing you with the correct forms and clear guidance to ensure your Florida Satisfaction, Release or Cancellation of Mortgage by Corporation is executed correctly.