Florida Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Florida Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Utilize one of the most extensive collections of legal documents.

US Legal Forms is essentially a site where you can locate any state-specific file in just a few clicks, including Florida Satisfaction, Release or Cancellation of Mortgage by Individual templates.

No need to squander hours of your time searching for a court-acceptable form. Our certified professionals ensure you receive current documents each time.

After selecting a pricing plan, create an account. Pay via credit card or PayPal. Download the sample to your device by clicking on the Download button. That's it! You should complete the Florida Satisfaction, Release or Cancellation of Mortgage by Individual template and verify it. To confirm that everything is accurate, consult your local legal advisor for assistance. Register and simply access over 85,000 useful templates.

- To benefit from the forms library, select a subscription and create your account.

- Once you’ve done that, simply Log In and click on the Download button.

- The Florida Satisfaction, Release or Cancellation of Mortgage by Individual file will be promptly saved in the My documents section (a section for each form you store on US Legal Forms).

- To establish a new profile, refer to the brief guidelines below.

- If you need a state-specific example, make sure to specify the correct state.

- If possible, review the description to grasp all the details of the document.

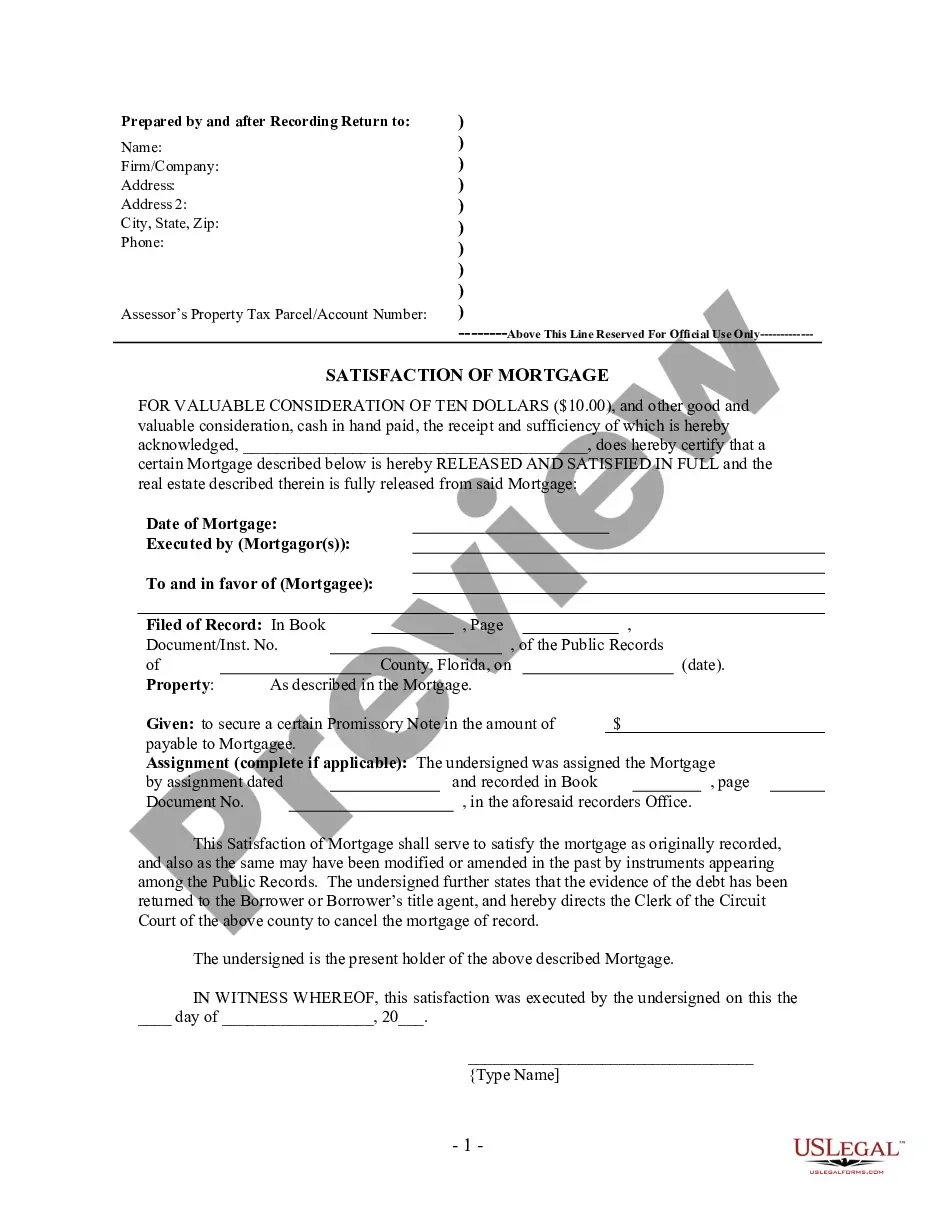

- Utilize the Preview feature if available to assess the document's content.

- If everything looks good, click Buy Now.

Form popularity

FAQ

The difference between satisfaction and release lies mainly in their usage. Satisfaction is a broader term that encompasses the entire process of repaying the mortgage, leading to the official confirmation of no remaining debt. Release, however, typically refers to the lender's action in legally eliminating the mortgage from public records. When navigating Florida Satisfaction, Release or Cancellation of Mortgage by Individual, understanding these terms will empower you.

While both terms deal with the conclusion of a mortgage agreement, satisfaction of mortgage specifically indicates that the mortgage has been fully repaid. In contrast, a release of mortgage refers to the act of the lender providing formal documentation that acknowledges the mortgage debt has been satisfied. Knowing these definitions helps clarify your path concerning Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

To record a satisfaction of a mortgage, you first need to obtain the satisfaction document from your lender. After securing the document, take it to the county clerk's office where the original mortgage was filed. Filing this document properly ensures that it reflects the release of the mortgage in public records. Using services like UsLegalForms can help guide you through these steps related to Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

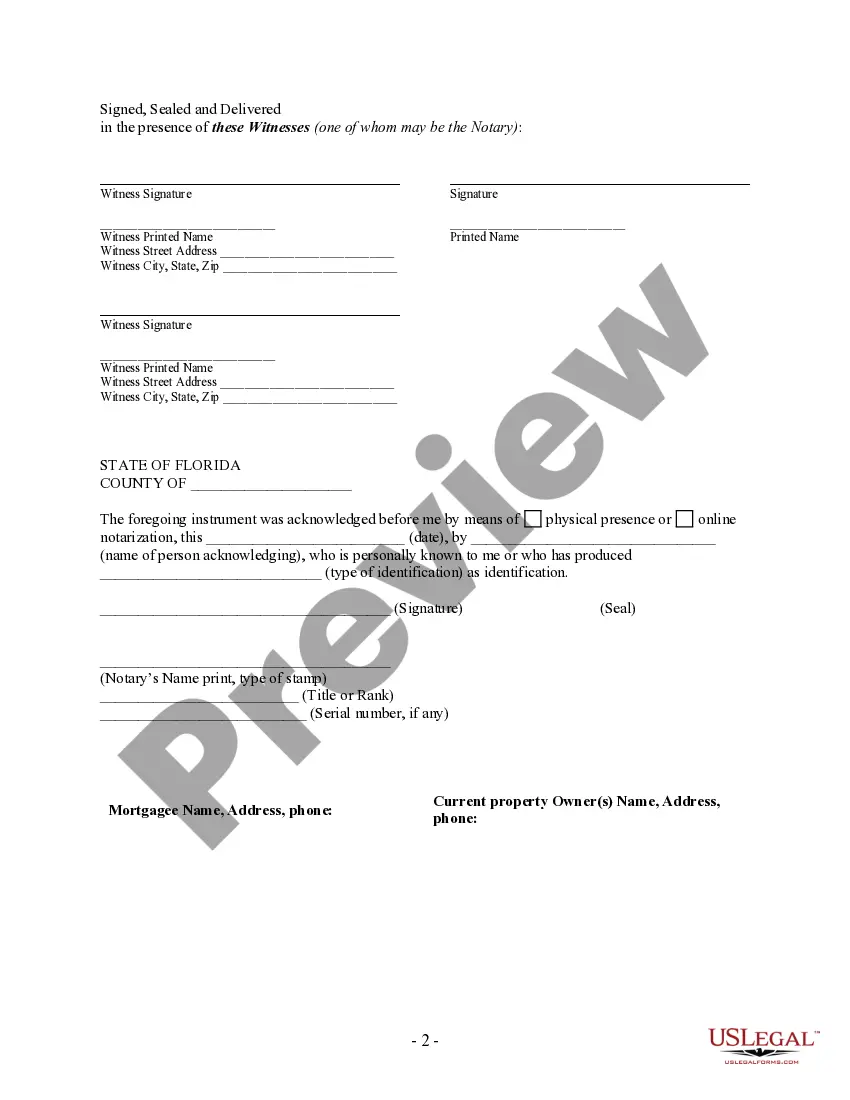

In Florida, a satisfaction of mortgage typically does not require notarization, but it does need to be signed by the lender. It is crucial to ensure that the satisfaction is properly executed and recorded with the county clerk's office. When navigating Florida Satisfaction, Release or Cancellation of Mortgage by Individual, checking local requirements will help ensure a smooth process.

A mortgage discharge and a mortgage release are often used interchangeably, but they are technically different. A mortgage discharge typically refers to the complete removal of a mortgage obligation, usually upon full payment. In contrast, a mortgage release can apply to a partial payment, allowing for the removal of a specific lien on a portion of the property. Understanding these terms is essential for those dealing with Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

To record a satisfaction of your mortgage, you must submit the notarized satisfaction document to the county clerk or recorder's office where your property is located. This action ensures that the public records reflect the full satisfaction of the mortgage. Using platforms like USLegalForms can assist you in correctly preparing the document for recording.

Yes, in Florida, a satisfaction of mortgage generally needs to be notarized to be considered valid. Notarization serves to verify the identities of the parties involved and adds a layer of authenticity to the document. This step is essential for a proper Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

Filling out a satisfaction of mortgage form includes entering the borrower and lender's names and the specific details of the mortgage, such as the account number and the property address. Clearly state that you are confirming the payment in full of the mortgage. Using a reliable platform like USLegalForms can help streamline this process and ensure accuracy.

To fill out a mortgage release form, you should start by gathering relevant information, such as the original mortgage details and property information. Clearly enter the borrower and lender's names, property address, and any necessary dates. This process is crucial for ensuring a valid Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

In Florida, a lender must record the satisfaction of mortgage within 60 days after receiving the payoff of the mortgage. This prompt action is essential for providing clear title to the homeowner, underscoring the importance of the Florida Satisfaction, Release or Cancellation of Mortgage by Individual. Delays in recording can result in complications for property owners, so timely follow-up is advised. For clarity and efficiency, using services like US Legal Forms can streamline this process.