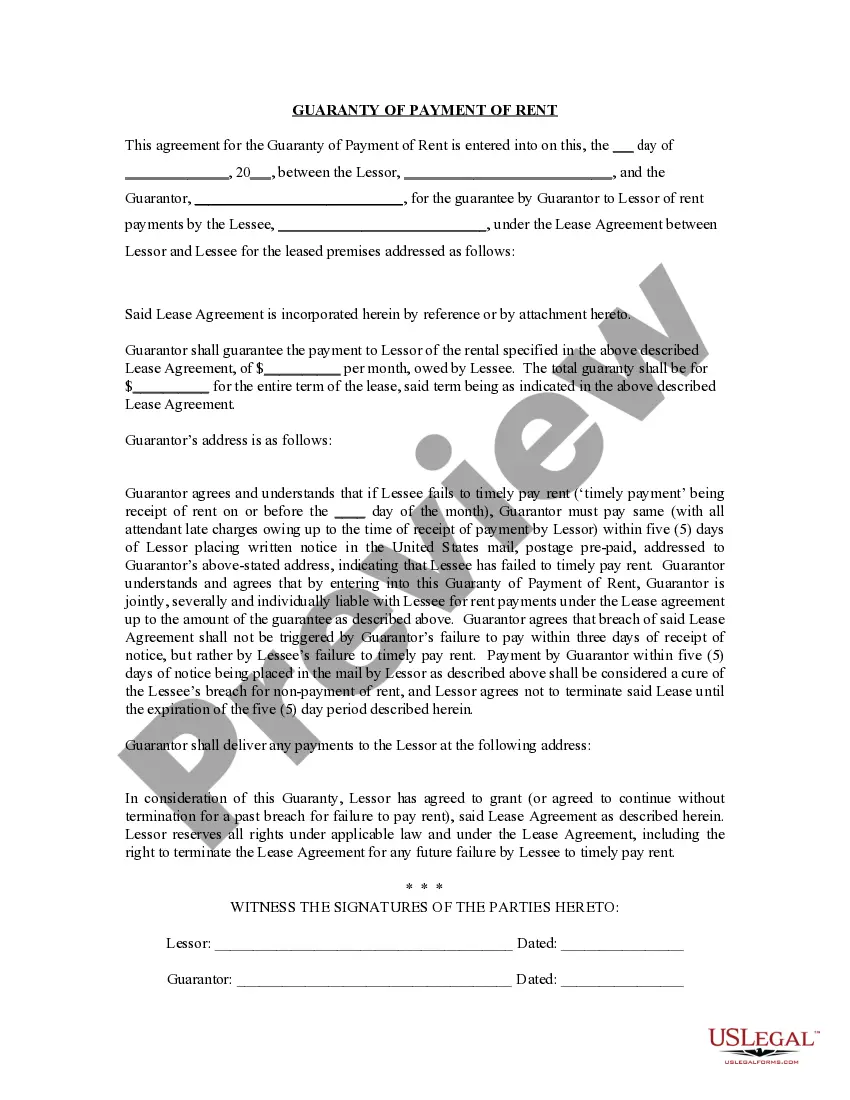

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Florida Guaranty or Guarantee of Payment of Rent

Description

How to fill out Florida Guaranty Or Guarantee Of Payment Of Rent?

Access the most comprehensive collection of legal documents.

US Legal Forms is essentially a platform where you can locate any state-specific form in just a few clicks, such as Florida Guaranty or Guarantee of Payment of Rent templates.

No need to squander hours of your time searching for a court-admissible example.

If everything is satisfactory, click Buy Now. After selecting a pricing plan, create an account. Pay using a credit card or PayPal. Download the document to your device by clicking Download. That's it! You should complete the Florida Guaranty or Guarantee of Payment of Rent form and review it. To ensure accuracy, consult your local legal advisor for assistance. Join and effortlessly discover over 85,000 useful templates.

- To utilize the forms library, choose a subscription and set up your account.

- If you have already completed this step, simply Log In and click Download.

- The Florida Guaranty or Guarantee of Payment of Rent template will promptly be saved in the My documents section (a section for every document you store on US Legal Forms).

- To establish a new account, refer to the straightforward instructions outlined below.

- If you're going to use state-specific documents, ensure you specify the correct state.

- If feasible, review the description to understand all the intricacies of the document.

- Utilize the Preview feature if it’s available to examine the document's details.

Form popularity

FAQ

A guarantor typically needs to demonstrate a stable income and sufficient financial backing to cover your rent. Generally, the income requirement is around three times the monthly rent amount, but this can vary by landlord. You may also consider using a Florida Guaranty or Guarantee of Payment of Rent to reassure landlords about potential payment issues. Using tools from USLegalForms can assist you in understanding the specifics required by your landlord.

If you don't have a guarantor, consider other options to secure your lease. You might look into securing a Florida Guaranty or Guarantee of Payment of Rent through a co-signer or additional financial documentation. Some landlords may accept higher deposits as a substitute for a guarantor. Additionally, platforms like USLegalForms can provide you with resources that help you understand your options and find alternative solutions.

A letter of guarantee is a written agreement where a guarantor agrees to take on the financial responsibility for your rent. This document outlines the terms and conditions, securing the landlord's interests. Understanding this concept is crucial when navigating your Florida Guaranty or Guarantee of Payment of Rent needs.

A guarantor needs to provide relevant financial documents that prove their capability to cover rental payments. This may include proof of income, identification, and sometimes a letter of guarantee. Ensuring your guarantor has the right documents will help solidify your Florida Guaranty or Guarantee of Payment of Rent arrangement.

The rent guarantee program is a strategic service that helps landlords collect rent consistently while minimizing risks associated with renting. This program usually involves a contractual arrangement where a guarantor ensures rent payments even when tenants default. In Florida, the Florida Guaranty or Guarantee of Payment of Rent provides a reliable solution for landlords seeking reassurance and financial protection. Consider leveraging uslegalforms to navigate and implement these essential programs effectively.

The minimum guaranteed rent refers to the lowest amount of rent that a landlord can receive under a rent guarantee agreement. This figure may vary depending on the terms set in the lease and the specifics of the guarantee program. In Florida, landlords often find confidence in programs that provide a clear minimum guarantee, ensuring they do not suffer from unexpected losses. Investigating the Florida Guaranty or Guarantee of Payment of Rent can help determine appropriate guarantees for your rental agreements.

A rent guarantee program is a service that protects landlords by ensuring they receive monthly rent payments, even in cases of tenant default. These programs typically involve a third party that assumes the financial risk associated with tenant non-payment. By implementing a Florida Guaranty or Guarantee of Payment of Rent, landlords can maintain financial stability while attracting responsible tenants. Many landlords choose this route to mitigate risks and enhance their rental business.

Guaranty law in Florida encompasses various regulations that govern the responsibilities of guarantors. It outlines how guarantees must be structured and the obligations they entail, especially in relation to the Florida Guaranty or Guarantee of Payment of Rent. Familiarizing yourself with these laws can safeguard your interests when signing a lease or credit agreement. Consulting with professionals can clarify any uncertainties you may have.

In Florida, the insurance guaranty limit varies depending on the type of insurance, but most commonly, it covers up to $300,000 for general claims. This limit provides security in the event of an insurance company failing. While it does not specifically relate to the Florida Guaranty or Guarantee of Payment of Rent, being informed about such limits is beneficial. Understanding this aspect can help you make more informed financial decisions.

A personal guarantee in a lease means that an individual agrees to be personally liable for the lease obligations should the tenant default. This arrangement is a prevalent feature in the Florida Guaranty or Guarantee of Payment of Rent. It provides reassurance to landlords, as they have an additional party accountable for rent payments. Clarity in these agreements can foster a more trustworthy landlord-tenant relationship.