This is a sworn statement of account from a corporate or LLC lienor in response to a request from an owner for a sworn statement.

Florida Sworn Statement Of Account From Lienor to Owner - Construction - Mechanic Liens - Corporation or LLC

Description

Key Concepts & Definitions

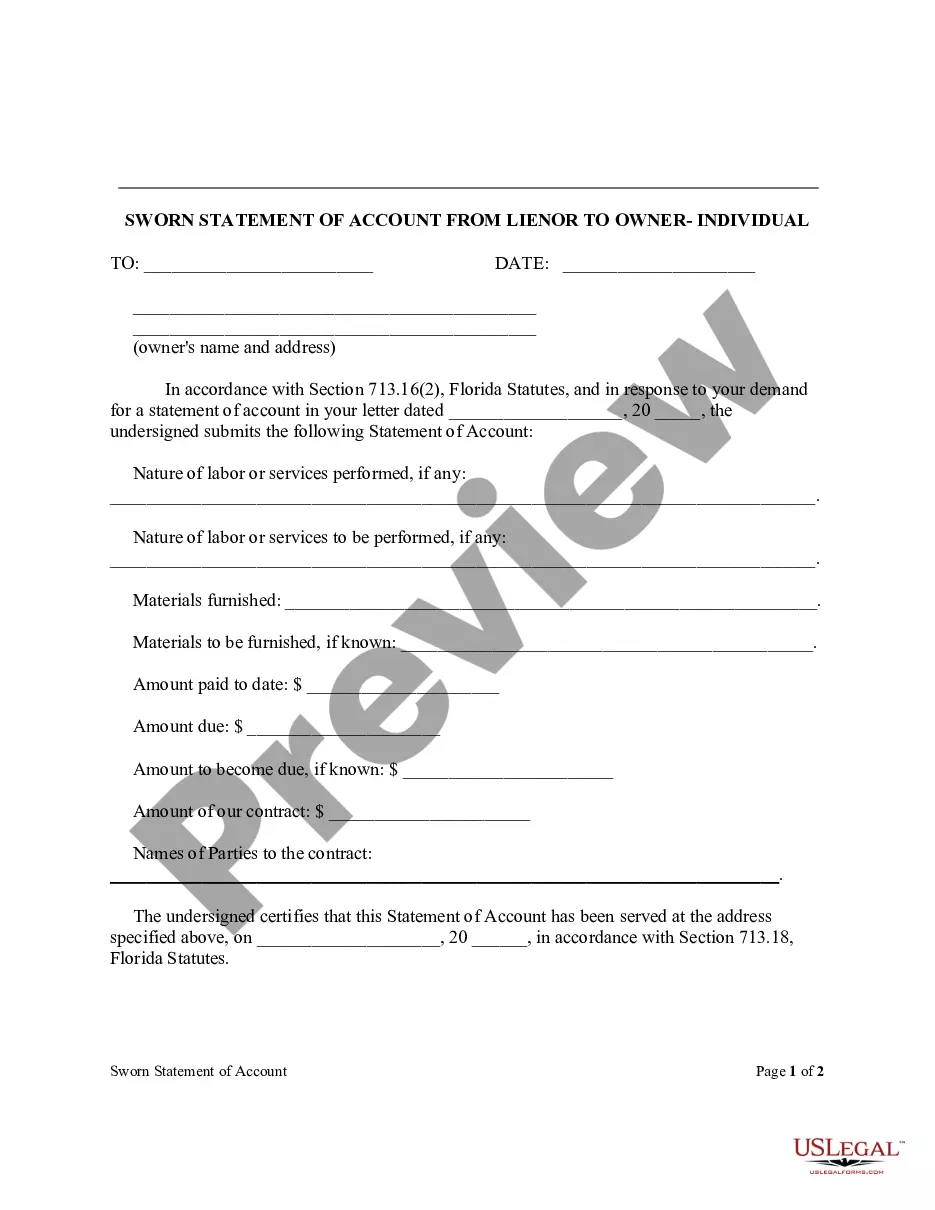

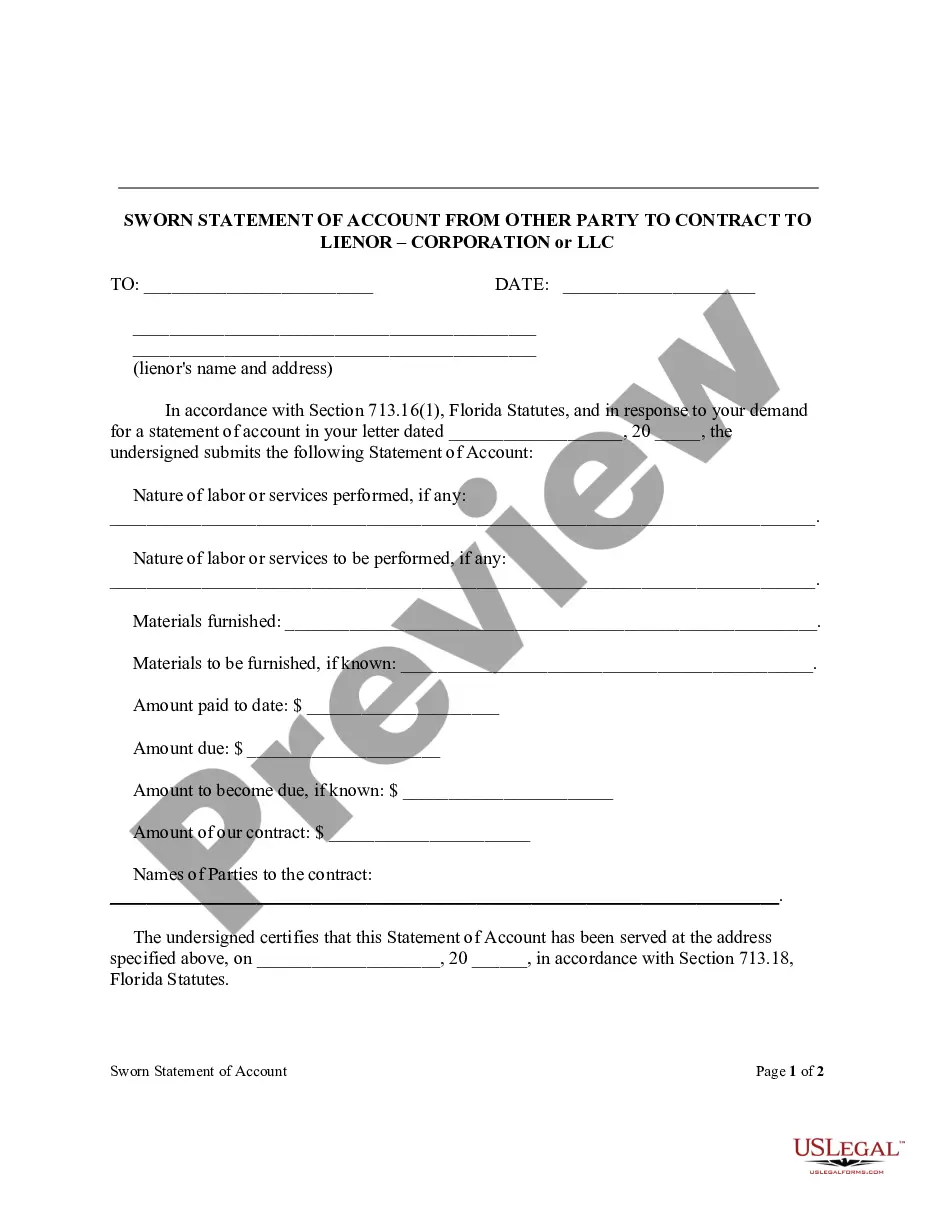

A sworn statement of account from lienor to owner is a legal document that the lienor (the party who provided labor, services, or materials to a property) sends to the property owner. This document outlines the services or materials provided, their costs, and confirms that the information is accurate to the best of the lienor's knowledge. This is crucial in the construction and real estate industries within the United States, as it supports the lienor's claims in securing payments.

Step-by-Step Guide

- Gather Required Information: Compile all pertinent information about the services or materials provided, including dates, descriptions, and costs.

- Prepare the Statement: Format the statement clearly and accurately, ensuring that all the required details are included.

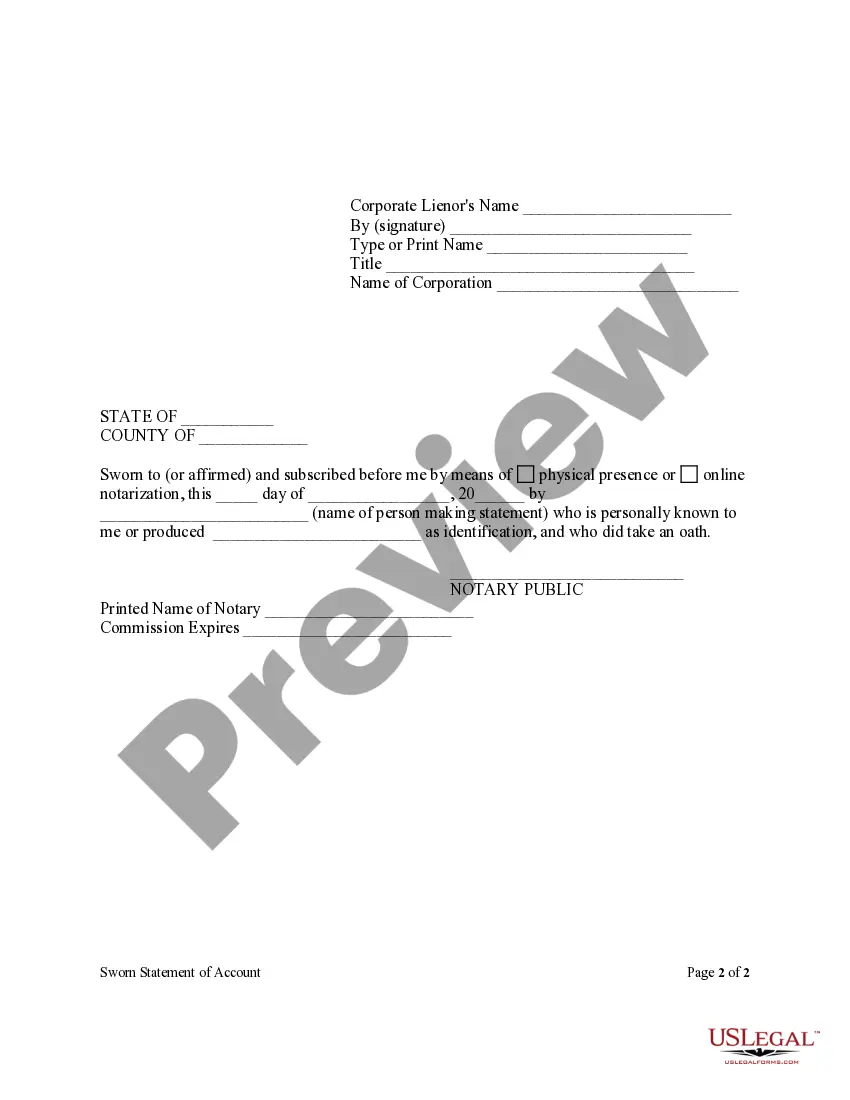

- Sign & Notarize: The lienor must sign the statement before a notary to authenticate it.

- Send to Property Owner: Deliver the signed and notarized statement to the property owner, ideally through certified mail for proof of delivery.

Risk Analysis

- Inaccurate Statements: Inaccurately stating the provided services or costs can lead to legal disputes or rejection of the claim.

- Notarization Errors: Failing to properly notarize the statement can invalidate the document, jeopardizing the lienor's ability to secure payment.

- Timing: Late submission of the sworn statement can also result in loss of lien rights under state laws.

Best Practices

- Accuracy: Ensure all information in the statement is accurate and thoroughly checked.

- Tailor to State Laws: Comply with specific state requirements for sworn statements to avoid legal issues.

- Documentation: Keep detailed records of all communications and documents sent to the property owner.

Common Mistakes & How to Avoid Them

- Lack of Detail: Provide a detailed description of all labor, services, and materials. Vague descriptions can lead to misunderstandings or disputes.

- Failure to Notify: Always send the statement promptly and use a method that provides proof of receipt, such as certified mail.

FAQ

- What is a lienor? A lienor is an individual or business that has supplied labor, services, or materials to a property and holds a lien for non-payment.

- Why is a sworn statement important? It serves as a formal declaration of the work done and the amount due, supporting the lienor's claim against the property owner.

- Can I file a lien without a sworn statement? Most states require a sworn statement as part of the lien filing process, so it is usually necessary.

How to fill out Florida Sworn Statement Of Account From Lienor To Owner - Construction - Mechanic Liens - Corporation Or LLC?

The larger quantity of documents you are required to produce - the more anxious you become.

You can find numerous Florida Sworn Statement Of Account From Lienor to Owner - Construction - Mechanic Liens - Corporation or LLC templates online, but you're uncertain which of them to trust.

Eliminate the hassle to simplify obtaining samples using US Legal Forms. Receive expertly drafted forms that are designed to fulfill state requirements.

Provide the requested information to create your account and pay for your order using your PayPal or credit card. Select a suitable document format and receive your copy. Access every document you obtain in the My documents section. Simply go there to complete a new version of your Florida Sworn Statement Of Account From Lienor to Owner - Construction - Mechanic Liens - Corporation or LLC. Even when utilizing professionally crafted templates, it's still essential to consider consulting a local attorney to double-check the completed form to ensure that your document is accurately filled in. Achieve more for less with US Legal Forms!

- If you already have a US Legal Forms subscription, Log In to your account, and you'll locate the Download button on the Florida Sworn Statement Of Account From Lienor to Owner - Construction - Mechanic Liens - Corporation or LLC’s page.

- If you haven’t used our website before, complete the sign-up process following these steps.

- Verify if the Florida Sworn Statement Of Account From Lienor to Owner - Construction - Mechanic Liens - Corporation or LLC is applicable in your state.

- Double-check your selection by reviewing the description or by utilizing the Preview mode if available for the chosen file.

- Click Buy Now to initiate the sign-up process and select a pricing plan that meets your needs.

Form popularity

FAQ

The construction lien law in Florida serves to protect subcontractors, suppliers, and contractors. It establishes a legal framework for filing liens related to unpaid work or materials. If you are involved in construction projects, understanding the Florida Sworn Statement Of Account From Lienor to Owner - Construction - Mechanic Liens - Corporation or LLC is crucial for navigating these laws effectively and ensuring that all parties receive their due compensation.

Florida has specific rules that determine how liens are filed and enforced. These rules include the requirement for providing notice to the owner, timely filing, and proper documentation. Engaging with the Florida Sworn Statement Of Account From Lienor to Owner - Construction - Mechanic Liens - Corporation or LLC ensures you understand these regulations and comply with all necessary legal procedures.

In Florida, it is possible for a lien to be placed on your house without your immediate knowledge, especially if proper notice is not given. However, the law requires that you receive notification of the lien. Understanding the Florida Sworn Statement Of Account From Lienor to Owner - Construction - Mechanic Liens - Corporation or LLC can help you stay informed and take necessary action to protect your property.

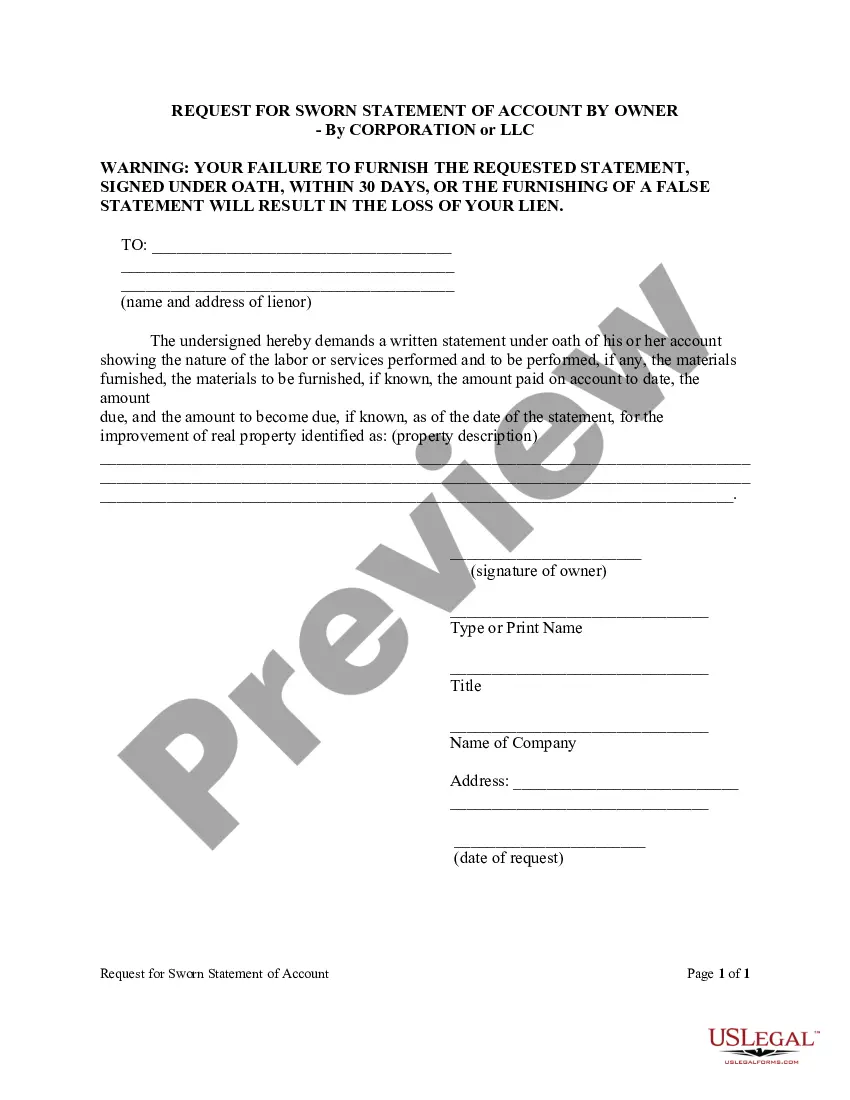

Placing a lien without prior notice is generally not permitted in Florida. The law mandates that owners must be informed before any lien is filed. This process allows the owner to understand their obligations and provides an opportunity to address any disputes, thus protecting their interests.

In Florida, you typically cannot file a lien without providing notice to the owner. The Florida Sworn Statement Of Account From Lienor to Owner - Construction - Mechanic Liens - Corporation or LLC requires that the property owner receives clear communication about the lien before it is filed. This notice helps protect the rights of the owner and ensures that they are aware of the claim against their property.

Yes, a notice of commencement is typically required to file a lien in Florida. This document informs interested parties that a project is underway and establishes a timeline for filing subsequent notices. By ensuring proper notifications are in place, you can effectively manage claims through the Florida Sworn Statement Of Account From Lienor to Owner - Construction - Mechanic Liens - Corporation or LLC. This promotes clarity and helps to facilitate smoother transactions.

The statute governing mechanic liens in Florida is found in Chapter 713 of the Florida Statutes. This section outlines the rights and responsibilities of lienors and property owners. Understanding the relevant laws helps you navigate the complexities of filing a Florida Sworn Statement Of Account From Lienor to Owner - Construction - Mechanic Liens - Corporation or LLC efficiently. Awareness of legal rights is critical for all parties involved in construction projects.

In Florida, a contractor cannot file a lien without first serving a notice to owner. This requirement ensures that property owners are informed of potential claims against their property. Failing to send this notice may prevent a contractor from successfully demanding payment through a Florida Sworn Statement Of Account From Lienor to Owner - Construction - Mechanic Liens - Corporation or LLC. Always prioritize this essential step to safeguard your rights.

A release of lien document in Florida serves to eliminate any previously filed lien against a property. When a lienor receives payment, they are required to file this document to confirm that the debt is satisfied. This protects property owners from future claims against their assets and is an important step in the Florida Sworn Statement Of Account From Lienor to Owner - Construction - Mechanic Liens - Corporation or LLC process. It promotes a clear title and reassures all parties involved.

In Florida, a contractor must file a notice to owner within 45 days of beginning work on a project. This notice is essential to establish your right to file a Florida Sworn Statement Of Account From Lienor to Owner - Construction - Mechanic Liens - Corporation or LLC later. Missing this deadline can jeopardize your ability to claim a lien. Always keep track of timelines to protect your interests.