Florida Quitclaim Deed - Trust to Trust

What this document covers

The Quitclaim Deed - Trust to Trust is a legal document that enables a trustee of one trust to transfer property to another trust. Unlike warranty deeds, which provide certain guarantees about the title, a quitclaim deed only transfers whatever interest the grantor has in the property, without any warranties. This form is particularly useful for estate planning and inter-trust transactions.

Key parts of this document

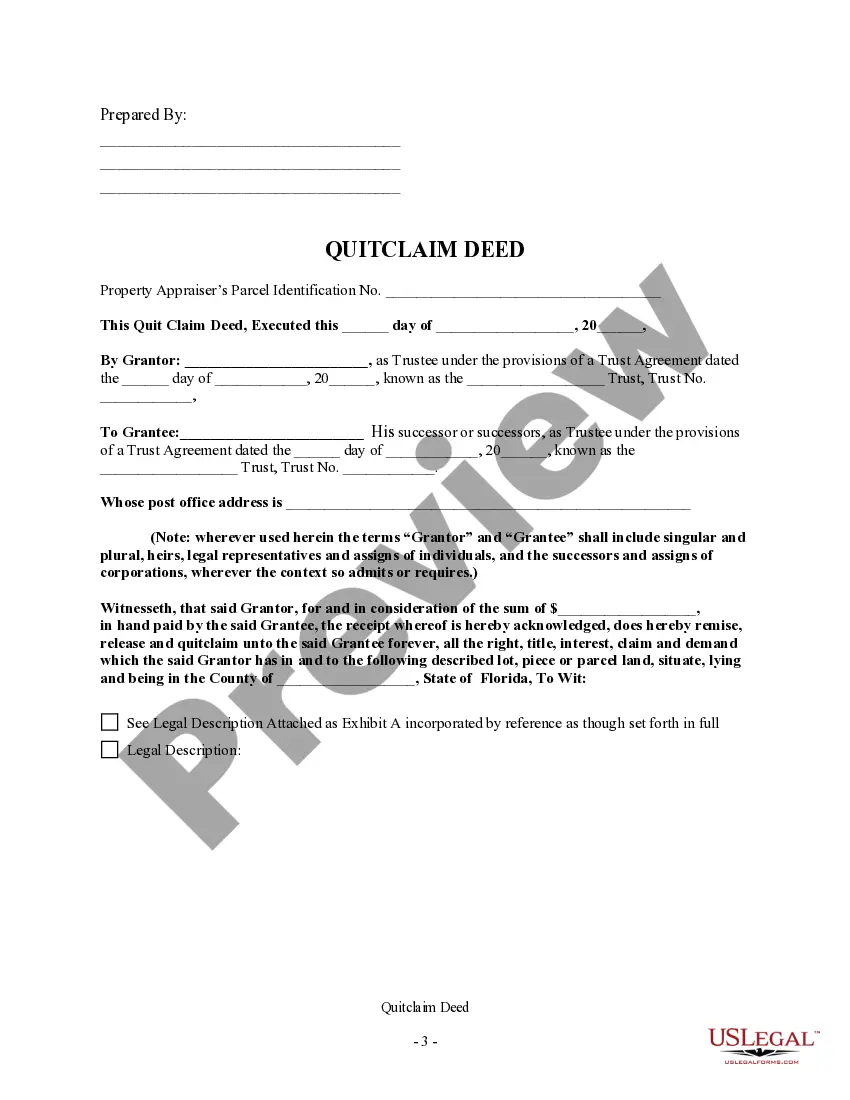

- Grantor identification: Details of the trustee who is transferring property.

- Grantee identification: Information about the receiving trust.

- Property description: A clear description of the real property being conveyed.

- Trust agreement reference: Terms of the trust under which the trustee operates.

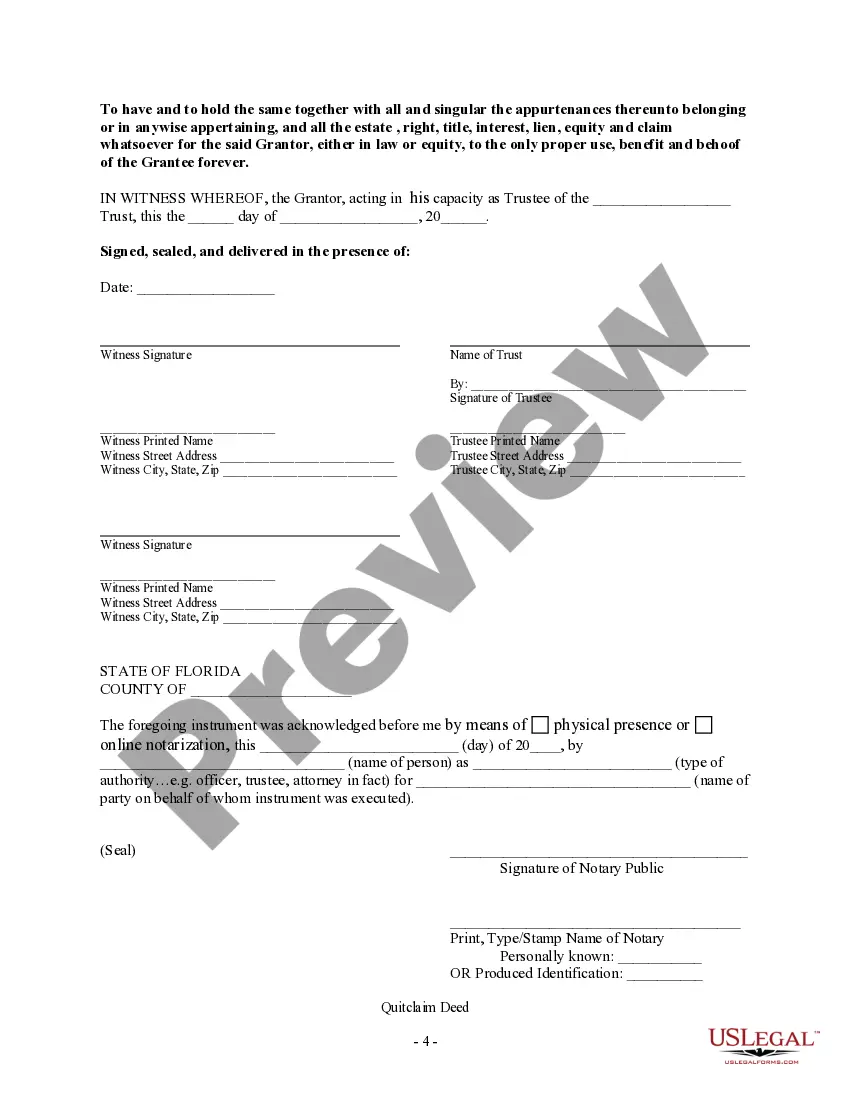

- Execution details: Space for signatures and dates to validate the transaction.

Situations where this form applies

This form is appropriate to use when a trustee wishes to transfer real property from one trust to another. This may occur during estate planning, as a part of asset management, or to consolidate properties within a single trust. It is also suitable when the property being transferred is intended to benefit another trust's beneficiaries.

Who should use this form

This form is intended for:

- Trustees looking to manage properties held in trust.

- Individuals involved in estate planning or settling an estate.

- Beneficiaries of trusts that need to transfer property to another trust.

How to prepare this document

- Identify the grantor: Fill in the name and title of the trustee transferring the property.

- Identify the grantee: Complete the name of the receiving trust.

- Enter property details: Provide a detailed description of the property being transferred.

- Reference the trust agreement: Include the date and name of the trust agreement relevant to the transaction.

- Sign and date the document: Ensure that the trustee signs the deed on the appropriate lines.

Does this form need to be notarized?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to accurately describe the property, leading to potential disputes.

- Not including the correct trust details or referencing the wrong trust agreement.

- Overlooking signatures or dates, which can invalidate the deed.

Advantages of online completion

- Convenience of downloading and printing the form at your convenience.

- Editability allows easy corrections and customization according to your needs.

- Access to professionally drafted templates ensures reliability and compliance with legal standards.

Looking for another form?

Form popularity

FAQ

To complete the quitclaim deed form, ensure that you accurately enter the names of all parties involved. Briefly describe the property, and if applicable, reference previous deeds for clarity. Next, make sure to notarize the document after signing to validate it. For guidance and templates that suit the Florida Quitclaim Deed - Trust to Trust requirement, US Legal Forms offers excellent resources.

Filling out a Florida quit claim deed involves a few straightforward steps. Start by providing the names and addresses of the grantor and grantee, then include the property's legal description and any relevant parcel identification numbers. Always check for accuracy before signing, as errors may complicate ownership transfer. For a smooth experience, consider using US Legal Forms to access templates tailored for a Florida Quitclaim Deed - Trust to Trust.

To quit claim a deed to a trust in Florida, you will first need to prepare a quit claim deed form. Make sure you list the grantor and the trustee correctly, alongside the legal description of the property. After filling out the form, you must sign it in the presence of a notary public before filing it with the county clerk. This process ensures that the Florida Quitclaim Deed - Trust to Trust transition is legally recognized.

To transfer a deed to a trust in Florida, begin by drafting a quitclaim deed that specifies the grantee as the trust. The grantor must sign the deed, and it must be notarized. After signing, file the deed with the local county clerk's office for proper recording. By using a Florida Quitclaim Deed - Trust to Trust, you can ensure that the process is executed smoothly and legally.

While putting your house in a trust can offer benefits, there are some disadvantages to consider. For instance, it may not shield the property from all creditors, and you'll incur costs related to establishing and managing the trust. Additionally, moving the house into a trust using a Florida Quitclaim Deed - Trust to Trust could trigger property tax reassessments. Carefully weigh these factors before making a decision.

Yes, a quitclaim deed can transfer property from a trust to another party or to a new trust. This type of deed allows the trustee to convey their interest in the property without guarantees. If you want to make changes to the property's ownership, using a quitclaim deed is a viable route. Always consider consulting with a legal expert to ensure the transfer complies with Florida's regulations.

One of the biggest mistakes parents make when setting up a trust fund is not clearly defining the terms and conditions of the trust. It's crucial to outline how assets should be managed and distributed to avoid confusion later. Additionally, failing to fund the trust properly can lead to complications. Using a Florida Quitclaim Deed - Trust to Trust can help ensure assets are correctly transferred into the trust.

To transfer property to a trust in Florida, you first need to create a trust document that outlines the terms of the trust. After this, you will execute a quitclaim deed that transfers ownership from you to the trust. It's essential to have this deed properly notarized and recorded. This method ensures your property is managed according to your wishes through the Florida Quitclaim Deed - Trust to Trust.

In Florida, a quitclaim deed allows the transfer of property without guaranteeing that the title is clear. This means the grantor transfers their interest in the property to the grantee without any warranties. To be valid, the deed must be signed by the grantor and must be notarized. Furthermore, it is important to record the deed with the county clerk to protect against future claims.